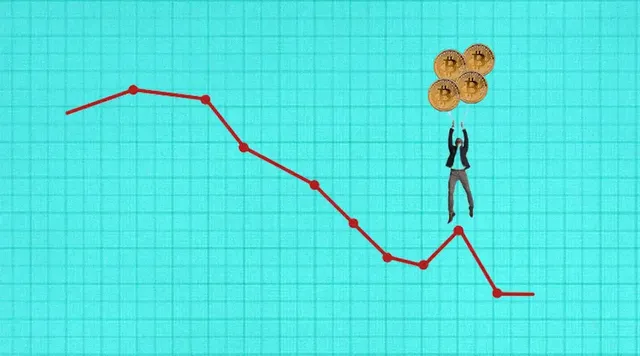

Bitcoin price recovers quickly

The recovery of the Bitcoin price has been significant and faster than previous cycles, according to analysts. The drawdown, which is the period of decline from the all-time high to the lowest point, has lasted for 755 days so far, currently around 36% off Bitcoin's all-time high of around $69,000 set in November 2021. This is shorter than the 1,178 days spent before recovery post-2013 and the 1,092 days post-2017.

Bitcoin's price has experienced a 41% increase from its lows, reaching a high of $8,616.81 in a 24-hour period. The current Bitcoin price represents a 41% increase (or, approximately $3,400 in monetary terms) from its lows on Tuesday morning. The recovery has been driven by various factors, including increased interest in Bitcoin and other cryptocurrencies, as well as the construction of infrastructure to facilitate Wall Street access to the asset class.

Despite the price recovery, retail participation remains shallow, with website traffic data and exchange reports showing lower retail demand now than in Q3 2022. This suggests that the current price increase has not been mirrored by an increase in retail participation, and the market may still have room for further growth.

Some experts, such as Anthony Scaramucci, the CEO of SkyBridge Capital, have predicted that 2023 will be Bitcoin's "recovery year" and forecasted that the Bitcoin price could reach $50,000 to $100,000 over the next two to three years if adoption is managed correctly. Similarly, Cathie Wood, the CEO of Ark Invest, has expressed confidence in the cryptocurrency market, stating that Bitcoin and Ethereum have not "skipped a beat" despite last year's price crash.

In conclusion, the recovery of the Bitcoin price has been substantial and faster than previous cycles. While retail participation remains low, the market has the potential for further growth, and some experts predict a bright future for the cryptocurrency.

The highest Bitcoin price predicted for the next year varies among different sources. According to CoinCodex, the price of Bitcoin is predicted to reach as high as $148,893 next year. On the other hand, Techopedia suggests that Bitcoin might reach a high of $98,000 in 2024, while also mentioning predictions of it potentially retesting its all-time high near $69,000. Additionally, Techopedia predicts that by 2030, Bitcoin could reach a high of $160,000, while other analysts suggest even higher price targets ranging from $427,000. These predictions are based on various factors such as market demand, infrastructure development, and regulatory decisions, and it's important to note that they are speculative in nature and subject to change based on market dynamics.

There are several factors that could affect the Bitcoin price in the next year. These include:

Supply and demand dynamics: The price of Bitcoin is influenced by the balance between the number of people buying and selling it. If demand is high and supply is low, the price will increase, and vice versa.

Infrastructure development: The construction of infrastructure to facilitate Wall Street access to the asset class could drive demand and increase the price of Bitcoin.

Regulatory decisions: Regulatory decisions can impact the acceptance of Bitcoin, leading to increased volatility and price swings. The regulatory backdrop is a critical factor that directly or indirectly influences all other factors.

Institutional adoption: Institutional adoption of Bitcoin could drive demand and increase the price of Bitcoin.

Market sentiment: Market sentiment can impact the price of Bitcoin. Positive news and sentiment can drive demand and increase the price, while negative news and sentiment can lead to a decrease in demand and a drop in price.

Macroeconomic trends: Macroeconomic trends such as inflation, interest rates, and economic growth can impact the price of Bitcoin.

Halving events: Halving events, which occur every four years, can impact the supply of Bitcoin and potentially drive up the price.

Overall, the price of Bitcoin is influenced by a complex interplay of various factors, and it is difficult to predict with certainty how these factors will impact the price in the next year.