Bitcoin ETF Applications Approval

The market has developed since 2018, when bitcoin ETF applications last hit a pinnacle. It's indistinct whether that is sufficient to see one affirmed.

There's been recharged interest in bitcoin trade exchanged assets (ETFs) with the assignment of Gary Gensler to head the Securities and Exchange Commission and the endorsement of a genuine Canadian bitcoin ETF. Regardless of whether one gets affirmed in the U.S. is as yet hazy.

ETF?

The story

The huge news a week ago was the Ontario Securities Commission endorsed North America's first bitcoin ETF in Canada. An ETF, which is basically a retail-accommodating, directed bitcoin venture vehicle that can exchange well known financier applications, has for some time been an item the business has needed. Various applications have been dismissed in the U.S., yet the endorsement of one in Canada could be an early sign that we'll before long see something comparable in the States.

Why it makes a difference

Fundamentally, the thought is a bitcoin ETF would give regular financial backers:

Bitcoin openness through existing retail exchanging applications, for example, TD Ameritrade, BUT:

These dealers would not really need to purchase bitcoin.

To put it plainly, an ETFwould let individuals put resources into bitcoin without setting up a wallet or trust in a trade that may go down when market unpredictability rises.

There are additionally the individuals who accept an ETF would help flash or proceed with a bull run, yet considering Elon Musk can basically do that on his own currently I'm not entirely certain an ETF appears as important as it did in 2018.

Breaking it down

The crypto market has developed since 2017 and 2018, when the U.S. Protections and Exchange Commission (SEC) was dismissing ETF applications left and right.

Matthew Hougan, the central venture official at Bitwise Asset Management (a firm that is tried really hard to get a bitcoin ETF affirmed), revealed to CoinDesk that the fates market attached to digital currencies has developed essentially, the fundamental spot markets are working better and the U.S. administrative design has advanced. Yet, is sufficiently that?

The principle question is whether the market has sufficiently developed to meet the prerequisites recorded under the Securities Exchange Act, the government law that supervises protections exchanging inside the U.S.

Ark Investment Management CEO Cathie Wood as of late told a crowd of people she thinks the bitcoin market may have to see $2 trillion sought after before the SEC is OK with an ETF.

Hougan isn't so certain, saying he believes bitcoin's prospects market is practically identical to hard wheat in size (hard wheat has both a fates market and ETFs, which is beyond what you can say for onions).

Gary Gensler

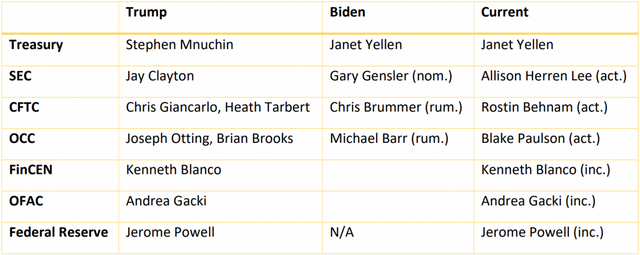

A portion of the contemplating whether to document a bitcoin ETF application includes the new organization and the designation of Gary Gensler as SEC seat. Gensler, a long-lasting crypto advocate who's maybe most popular for his work on subordinates guideline at the Commodity Futures Trading Commission after the last monetary emergency, is required to be reasonably crypto-accommodating, in any event to the level of favoring a ## ETF. All things considered, questions remain.

"It's surely too soon to say what his view will be on crypto, regardless of whether it will be a need, how that will deal with impact the market, and I believe that may even be an untimely discussion," Hougan said.

At any rate, while Gensler might be keen on crypto, it's not prone to be a need, given large numbers of different issues he'll need to address, including likely framing a reaction to the market instability seen a month ago with the GameStop stock siphon.

The better inquiry is the thing that has changed in the course of recent years.

As per Hougan, the variables that would uphold an ETF endorsement include:

Market effectiveness has expanded;

Regulatory oversight has developed;

New authority arrangements have entered the market; and

There are better review measures.

In any case, the SEC has utilized different protests in dismissing past ETF applications. The extraordinary inquiries include:

Whether the SEC's market observation questions have been replied; and

Whether the SEC's market control questions have been replied.

"The market has improved thus the inquiry you're left with is 'do we know enough' and 'has the market adequately improved' and we simply don't have the foggiest idea," Hougan said.

Canada

One sure sign for the business is a week ago's endorsement of an open-finished ETF in Canada. Honestly, it's not the main asset to exchange Canada: 3iq dispatched a bitcoin reserve a year ago. In any case, this is the main ETF that will exchange on a retail-open trade – the Toronto Stock Exchange – inside North America.

Eric Balchunas, a senior ETF examiner at Bloomberg, said on Twitter the "U.S. typically follows not long after" Canadian controllers in affirming such items, considering the endorsement a "great sign" for American candidates.

His supposition: Late September is the point at which we'll see the endorsement, and it could see $50 billion in inflows over its first year.

Here's what necessities to occur:

An organization needs to petition for an ETF by documenting a Form 19b-4. Two organizations have petitioned for an ETF as of late: VanEck and Valkyrie. Nonetheless, neither has documented a 19b-4 structure, which would commence the SEC audit measure.

When somebody documents the 19b-4 structure, notwithstanding, the SEC needs to recognize it's surveying it. This commences a 45-day survey period.

The SEC can say it needs additional time or potentially give input. The office can stretch out the audit period as long as 240 days (240 days from today would be Oct. 14).

The SEC staff would choose whether or not to affirm the application, and afterward the five magistrates would concur (or dissent, all things considered).

Sooner or later, the SEC would need to endorse or dismiss the application.

On the off chance that the application is endorsed, congrats to the backer and to the following enormous thing that everybody will get amped up for.

In the event that the application is denied, a Commissioner (or candidate) could demand a survey of the choice. This happened to nine ETF applications that were dismissed all the while in 2018. I actually have no clue about what the goal was.

Then again, the SEC likewise investigated a Bitwise application that was dismissed. The organization later pulled out that specific application.

Thus, to put it plainly, while there are positive finishes paperwork for an ETF endorsement in 2021, nothing is ensured.

SEC claims

In other, irrelevant news, a week ago Acting SEC Chair Allison Herren Lee distributed an articulation finishing the unforeseen settlement offers that could prompt the quicker goal of SEC cases. This implies that cases could delay longer for crypto organizations that get trapped in the SEC focus. (Here's seeing you: Ripple.)

The assertion said the organization's Division of Enforcement will at this point don't suggest settlements that are dependent upon whether an organization gets a waiver to go about as a Well-Known Seasoned Issuer (WKSI).

These waivers had advantages. Previously, they could be utilized as a feature of a settlement offer if the SEC was suing an organization on protections law infringement.

All in all, if the SEC Division of Enforcement is suing an organization, say a speculative digital currency related firm, for supposed infringement of the law, a settlement might have been dependent upon the firm getting WKSI status. This condition helped organizations understand what their punishments would be in a settlement, and what they could do post-suit.

Lee said this prompts a likely clash between the SEC's various divisions.

This new arrangement would seem to diminish the odds of such settlements occuring in future.

Chiefs Hester Peirce and Elad Roisman stood up against the move in a contradicting proclamation, composing that the past approach didn't prompt any primary clashes.

Organizations might be less able to seek after settlements in the event that they don't know whether they'll get waivers to keep working, they composed, cautioning that this could prompt additional time (and thusly, assets) spent seeking after cases.

It stays not yet clear what approaching seat Gary Gensler will do. Incidentally – I'll be discussing this case during a virtual board facilitated by the New York Financial Writers' Association next Tuesday at 7:00 p.m. ET. Come look at it.

Biden's standard

Truly, not a ton has occurred in the previous week. No new assignments, no affirmation hearings planned at this point. In any case, the U.S. Senate's indictment preliminary of previous President Donald Trump has wrapped up, which should give the body more opportunity to think about designations.

Changing of guard

Elsewhere:

Mastercard Will Let Merchants Accept Payments in Crypto This Year: Payments goliath Mastercard will settle exchanges in crypto and let traders acknowledge crypto installments, as per my associate Danny Nelson. This could be an indication that Mastercard doesn't foresee any administrative issues with this space. All things considered, the overlooked details are the main problem. A blog entry distributed after the article determines that this will fundamentally just apply to stablecoins, and just stablecoins with worked in customer insurances and administrative consistence. We'll check in next January to check whether it has occurred.

Deutsche Bank Quietly Plans to Offer Crypto Custody, Prime Brokerage: A decent find by associate Ian Allison showing that one more major monetary foundation's investigating how it may engage in this industry. Likewise by Ian: BNY Mellon is dispatching crypto overseer administrations.

India Grants Crypto Holders Reprieve Ahead of Likely Ban: Report: India is by all accounts pushing forward with its proposed crypto boycott. A Bloomberg report says all digital forms of money would be restricted, however financial backers would have three to a half year to finish off their positions, which is somewhat amazing? In any case, this is by all accounts pushing max throttle forward.

Crypto Use in Terrorism 'a Growing Problem,' Yellen Says: All I'll say is there's somewhat of a subject here, and it merits your consideration. More to come.

Outside crypto:

Tesla Bitcoin Bet Exposes Limits of Crypto Accounting Rules: Okay, so inside crypto, yet outside CoinDesk. In any case, incidentally, on the grounds that expenses are unusual, Tesla needs to report any possible misfortune in the estimation of the $1.5 billion in crypto it purchased a month ago, regardless of whether it hasn't really sold the bitcoin, should the property's estimation decrease before its next income report, as indicated by Bloomberg. Notwithstanding, should the bitcoin's worth increment, Tesla can't report that. This is on the grounds that U.S. charge guidelines setters (the Financial Accounting Standards Board) haven't made a particular direction around computerized monetary forms. Presumably wouldn't do any harm in the event that they did, however Bloomberg Tax reports that is not liable to happen at any point in the near future.

Canadian Woman Cited in Online Attacks Is Arrested in Toronto: half a month back I hailed a New York Times report about how a solitary individual may have distributed bogus data about various individuals throughout many years. She's currently been captured by Canadian police on badgering and criticism charges.

Special Thanks To

@booming01

@booming02

@booming03

@booming04