Steemit Crypto Academy - Season 2 Week 4 by @stream4u| Crypto Margin Trading & Crypto Leveraged Tokens Trading

Cryptocurrencies started to spread well. Thus, it started to be preferred as a financial product in many areas. Margin is attracted by traders in trading. Apart from trading, Margin also attracts the attention of traders as leveraged token.

Margin trading and leveraged tokens are similar in functioning. Margin trading prefers more experienced, more professional traders, while less experienced traders prefer leveraged tokens.

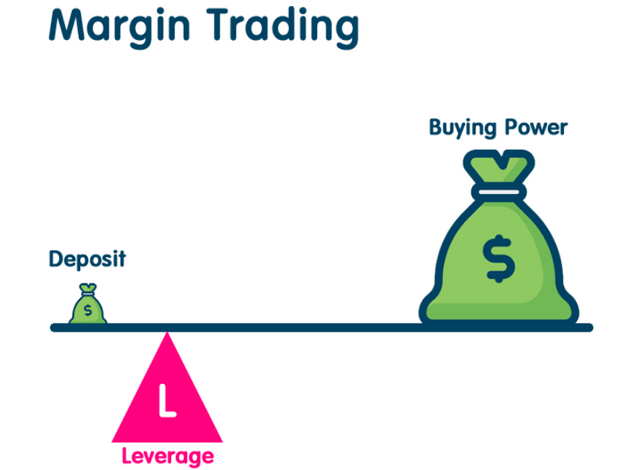

Margin Trading

Margin is one of the types of trade that allows us to trade at the floor / rate where we can choose our collateral by giving collateral to the broker. Nowadays, it is possible to trade margin on decentralized exchanges without the need for intermediaries. We can trade any cryptocurrency up to 2,3,5,10,20,25,50,100 times the collateral we provide. While the multiples / leverage is small in some stock exchanges, the leverage ratio is high in some stock exchanges. As the leverage ratio increases, the risk, ie the amount of gain / loss, increases.

Margin trading is really risky. There are big gains as well as big losses. The amount of gain or loss varies according to your leverage. Let's assume that your leverage ratio is 5. If there is a change as you expect, you will gain 5 times. If there is no change as you expect, you will experience 5 times of loss.

In margin trading, trading transactions are not made as we normally know. There are positions called long and short. In the long position, there should be an increase in the price of your preferred cryptocurrency. In the short position, there should be a decrease in the price of your preferred cryptocurrency.

For example: You have opened the long position at the rate of 5x for TRX. If there is a 5% increase in the TRX price, your earnings will be 25%. If there is a 5% drop in the TRX price, your loss will be 25%.

You opened a 3x short position for TRX. If there is a 10% drop in the TRX price, your earnings will be 30%. If the TRX price increases by 10%, your loss will be 30%.

My Margin Trading Plan

Margin trading requires good experience. After I know the market well, I start trading in margin trading.

Since margin trading is one of the most risky trading types, I trade with small amounts. I shouldn't need the amount I trade. Because even with a small fluctuation, I lose all my gains.

I try to keep my leverage ratio small. Because the higher the leverage ratio, the higher the risk. Maybe I can gain for a while as the leverage increases. If everything does not go the way I want, I may lose all my earnings.

I try not to hold my position for a long time. As long as I hold the position for a long time, I may be subject to manipulations. Corrections come periodically in crypto currencies. Corrections / increases would be substantial and I could lose all my assets.

Another benefit of not holding the position for a long time. Less commission to the broker. As the duration of the position increases, the amount we will pay to the broker increases.

Before opening a position, I examine all the factors related to crypto money that will cause price change. I look at the chart from all angles.

Exchanges providing margin trading services and margin rates

The leverage ratio is quite high in Bitmex stock exchange, the leverage ratio is up to 100x.

Deribit is one of the exchanges with a high leverage ratio. Deribit has a leverage of up to 100x.

Another exchange with a high leverage ratio is bybit. Traders can open up to 100x trades.

The leverage ratio on Binance is relatively good compared to other exchanges. We can open up to 5x trades on Binance.

Leverage up to 5x at Poloniex.

FTX exchange has up to 101x leverage. It is one of the stock markets with the highest leverage ratio.

Leveraged Token Trading

They are tokens created to make leveraged transactions leaner and simpler. Margin proceeds in the same logic as trade.

There are 4 different leveraged tokens.

Including Bear, Bull, Hedge and Half.

These names are defined differently in some exchanges. Since I use FTX exchange, I want to give an example on FTx exchange.

Bear and Bull tokens are available in 3x. Hedge tokens are in -1x. Half tokens are found in the purchase.

For example, BTCBULL, BTCBEAR, BTCHEDGE, BTCHALF tokens.

Get BTC increased by 10%. BTCBULL increases 30%. BTCBEAR drops 30%. BTCHEDGE drops 10%. BTCHALF increases by 10%.

Let BTC fall by 10%. BTCBULL drops 30%. BTCBEAR increases by 30%. BTCHEDGE increases by 10%. BTCHALF drops 10%.

My Leveraged Token Plan

Leveraged tokens are difficult to understand for a new person. After learning the operation of leveraged tokens, I start trading.

I look for reliable platforms that trade leveraged tokens. I want the platform to be reliable and I am interested in the high volume.

Leveraged tokens are very risky as in margin trading. Since the risk is high, the gain or loss is also high. I prefer Hedge or Half tokens. After learning the procedure, I start trading Bull and Bear tokens.

When trading leveraged tokens, I trade small amounts. Because it is a very risky trade.

I start trading after doing all my research before trading leveraged tokens. I examine the graphs of crypto money. I examine the upward or downward movements.

Exchanges that provide leveraged token services and leverage rates

There are exchanges that provide leveraged token services. Leveraged tokens are still in development. We will see it in many different ways in the coming years. Exchanges will give more service in this regard. Exchanges that provide leveraged token services and leverage rates.

Leveraged token trading up to 3x on the Poloniex exchange.

Leveraged token trading up to 3x on the FTX exchange.

Leverage rates on the Binance exchange range from 1.25x to 4x.

Leverage rates up to 10x on the Kucoin exchange.

Leverage rates up to 5x on the Kraken exchange.

Leverage rates up to 5x on Huobi exchange.

Price Forecast

The crypto currency I will discuss about price forecast is TRX.

TRX is my downside forecast.

TRX has caught an uptrend in recent days. I determined the support and resistance points on the chart. TRX price is $ 0.147.

TRX resistance price is $ 0.149. He's been trying for a few days to break that area. Sometimes it breaks, but then comes back again and the price goes down. TRX needs to break the $ 0.149 resistance otherwise it could drop to $ 0.138. The next price it could drop is $ 0.131.

TRX is my upward forecast.

TRX has been trying to rise in recent days, but this increase then leads to a decline. So TRX is not breaking the resistance price well. There is a resistance point at $ 0.156. If that resistance price breaks, TRX price will try to break the $ 0.170 resistance point and then the $ 0.180 resistance point.

CC:@stream4u

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

thank you very much for taking interest in this class

Grade : 6.5