Crypto Academy Season 3 Week 8 - Homework Post for @reminiscence01 | Understanding Tokens

Thank you professor @reminiscence01 for this lesson. It's good to partake in this homework task. Please read down.

1)What do you understand by Token and give an example of at least 5 tokens and identify the blockchain it is built on. ( give at least 3 different Blockchains)

A token may be described as an asset with value, built on an already existing blockchain that depends on the blockchain native coin for transactions. For example ERC-20 tokens are built on the Ethereum blockchain and uses Ether as a means of transaction fee payments. With the existence of Dapps (Decentralized Applications), most tokens are created for use in the the Dapp.

These tokens will however be used for the activation of the application features for which they were created. Some common tokens include TRC tokens of the Tron blockchain, ERC tokens of the etherium blockchain BEP tokens of binance Smartchain, NEP-5 of NAO, etc. In a nutshell tokens are used for interaction on a Dapp which are built on different blockchains.

Below are five examples of tokens and their blockchain

- Chainlink (LINK) – ERC-20 token built on the Ethereum blockchain.

- Tether (USDT) – ERC-20 token built on the Ethereum blockchain.

- Just (JST) – TRC-20 token built on the Tron blockchain.

- CAKE – BEP20 token built on the Binance smartchain.

- Safemoon – BEP20 token built on the Binance smartchain.

2)What is the difference between a token and a coin?

Difference between token and a coin

As stated earlier, a token uses the original or native coin of a blockchain to facilitate payments for its transactions. This serves as a major difference between a coin and a token. For any token that is built on any blockchain the native coin of such blockchain will be used as fee for transactions or transfer of such token.

Coins have their own independent blockchain. Examples of coins are BTC, which is the native coin of Bitcoin, and Ether, which is the native coin of Ethereum. Tokens are more like a derivative of a blockchain which are created after the execution of a project. Although in the cryptocurrency market, tokens occupy a great space because there are lots of them.

3)Explain the different categories token listed below and explain its features.

Utility tokens

Security tokens

Equity tokens

Non-fungible token (NFT)

Utility Tokens:

These are tokens that exist on an existing protocol for the purpose of making payments within the system. There is a synergistic relationship between the platform and the utility token. Utility Tokens allow people access to the products and services of a company in the future.

It is used for financing project startups, that is, when developers want to raise capital for a project, they will issue utility Tokens that could be exchanged later for the services offered by such projects. People who are interested in a project will get the token and pay an equivalent amount for the token. The token will then be allocated to the person and kept in an address controlled by the buyer with intentions of gaining access to the project services in future. Basic Attention Token (BAT) which is an ERC-20 token is an example of a utility token.

Security Tokens:

These are tokens that represent ownership of a part of a blockchain asset. Holding these tokens means that the holder has rights to decision making and voting rights just as the preference share holders of the real world. The more the value of an asset increases, the more the value of such token. For instance, the Merido platform trades tokens that represent the shares of a real estate.

Just like the traditional securities issues by companies for purchase, security tokens serve as a blockchain variation of real-world instruments/securities whereby holders own a right to share in the profits and earnings of the project as well as a right to property distribution.

Equity Tokens:

Equity tokens are a form of security tokens that allow the holders to own a percentage or a part of a company. Just as common stock or traditional stock of a company, equity Tokens enable holders to share in the profits and losses of a project as well as deciding on its future.

The major difference between stock and equity token is that equity token ownership are recorded on a blockchain for transparency instead of database as in the case of a traditional stock.

Non fungible Tokens (NFT)

Non fungible tokens are tokens that could be used to stand in for the ownership of some items such as art, estate, music, etc, which are unique in nature and cannot be interchanged. At a time, only one owner I'd recognized and there is no possibility of ownership modification. The unique properties of NFTs does not allow for their exchange for other items.

BTC for instance is a fungible item which can be interchanged as they are being defined by their value and not their unique nature. In all, tokenized art, files, collectibles, etc that cannot be interchanged are referred to as Non-fungible tokens.

4)Make your own research and write extensively on any token you listed in question one. (Must include features of the token, the aim of the project, Use cases).

Chainlink

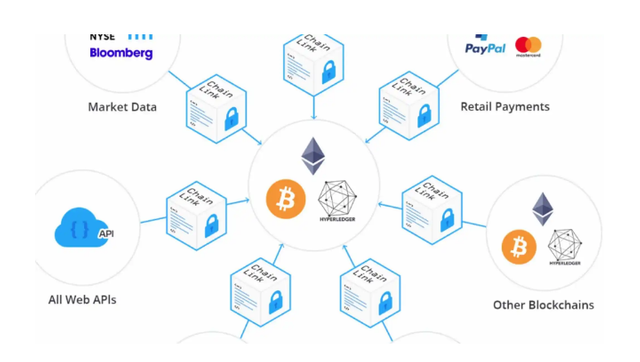

Chainlink is a decentralized project built on the Ethereum blockchain which serves as the connection between deFi Dapps, and the real world. In September 2014, the developers; Steve Ellis, Ari Juels and Sergey Nazarov came together to research about bridging the gap between real-world events and blockchains. In September 2017, the Chainlink white paper was released.

LINK is a token of the chainlink protocol. Being an ERC-20 token, LINK operates on the ethereum blockchain. Links are being distributed to the nodes as a compensation for their successful operations. LINK could be exchanged for other tokens and could also be on HODL with the potentials of price increase.

Features of the Token

LINK enables payment for smart contract transactions that take place on the Chainlink network. Acts as data payload: It has the ability to act as data payload that feeds smart contracts with information from off chain sources in order to respond appropriately to the data the token has provided.

The trade value of LINK token is used to pay all the node operators who successfuly retrieve data from smart contracts. They are also used for contract creator's required deposits made by the nodes.

The Aim of the Project

The aim of the changing project was to provide a bridge between the blockchain network and the real world and facilitate communication flow. The idea of chainlink was to allow information from our environment to be brought to the blockchain. With this, real-time information needed could be provided in a decentralized way. This makes chainlink a decentralized oracle protocol in the decentralized finance world. It solves the smart contract connectivity issue by enabling interaction outside the node network. It also addresses the centralized oracle issues.

Chainlink use cases

Chain link developments was catalyzed greatly by the partnering of Swift banking network with Chainlink. LINK has experienced a huge uptrend movement since 2018 with about 400% price increase. In 2018, LINK witnessed a huge decline but its launch on the Ethereum mainnet saw to its resurrection. Many investors have been drawn to the token and it has however witnessed the upward trend in price as it is today.

The LINK token is used as a compensation to Chainlink operators after successfully retrieving data from outside or external sources and converting them in a blockchain format for readability.

Thank you so much for your time and support. I appreciate!