Cryptocurrency Triangular Arbitrage]-Steemit Crypto Academy | S4W4 | Homework Post for @reddileep

Hello Guys, I welcome you all to my blog again as I participate in this week's Intermediate course presented by Prof @reddileep on Cryptocurrency Triangular Arbitrage.

Question 1. Define Arbitrage Trading in your own words.

Arbitrage Trading

The word Arbitrage Trading has continued to find its way in the financial space as one of the ways and strategies to engage in trading with limited or low risk. It simply implies the buy and sells activities that involve the exchange of coins from one exchange platform to another especially from where it's the price is lower to where it can be sold a little much higher.

The leverage in this scenario is the price differences observed in both exchanges which may be factors of ongoing volume trades not yet updated in the system. Therefore price differences are the may stay of Exchange Arbitrage trading.

Aside from this, Arbitrage Trading can as well be found mere swapping of coins and then back to its original state. This is given to an increased volume seen when they pass through another coin in exchange. This is the Triangular Arbitrage kind of Trading also obtainable by traders/investors.

We can also see scenarios where a user asset's price can be Hedged in the *Futures Contract. The **Funding Rate attached to this Futures Contract (sometimes comes with 2% or more) is observed to cover up for all price fluctuation risk seen in the volatile market.

All of this different scenario mentioned is accompanied by low risk with a closer guarantee of taking profits.

Question 2. Make your research and define the types of Arbitrage (Define at least 3 Arbitrage types)

1. Exchange Arbitrage

Just as the name implies, there is the involvement of two or more Exchange platforms engaged in these price discrepancies. One is expected to be observed with a lower asset price and the other with a relatively higher price.

What happens for Exchange Arbitrage Trading to take place is that a trader must have investigated these exchanges and observe their price variations between a given asset and time. Assets from Exchanges with low prices are purchase and sold in exchanges with relatively higher prices of the assets.

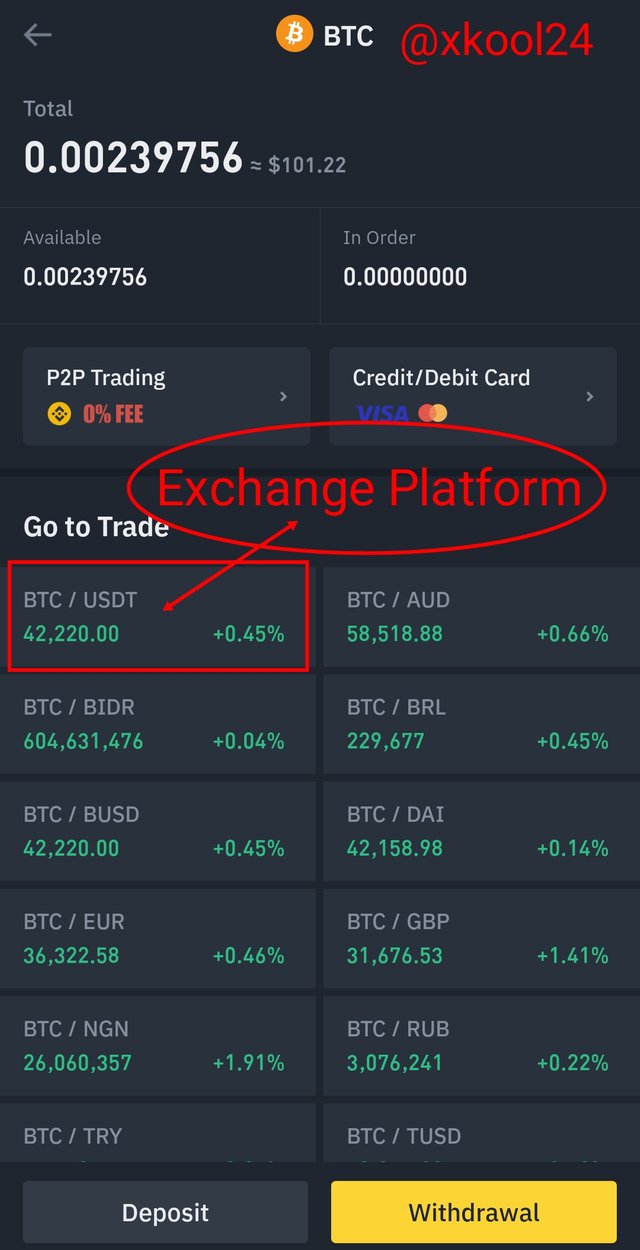

Example to illustrate the Exchange Arbitrage Trading

- Using Binance Exchange & Huobi Global Exchange

Analysis:

Binance Exchange

Asset used - BTC/USDT pair

Price value observed - $42,220.00

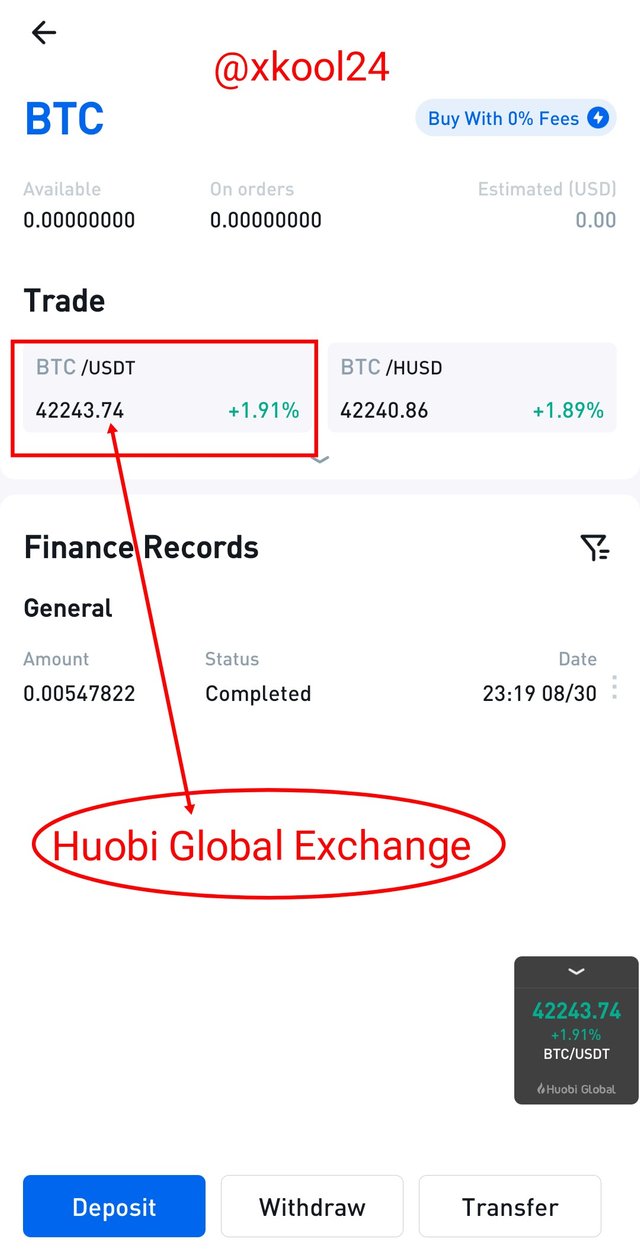

Huobi Global Exchange

Asset used - BTC/USDT pair

Price value observed - $42,243.74

Price Difference = $23.74

2. Triangular Arbitrage Trading

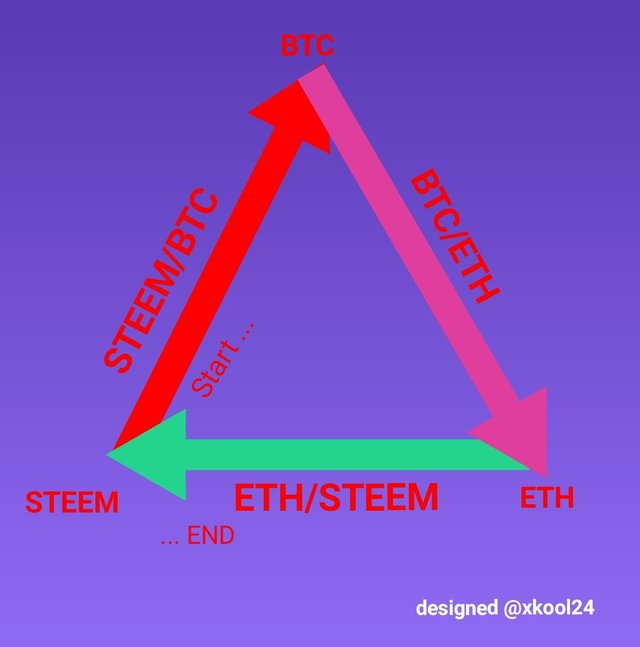

This is a scenario that allows traders/investors to leverage price differences in purchasing other coins/assets before buying back their original coin. This involves three cryptocurrency coins trades which represents the different points seen in a triangle.

Traders take advantage of price variations vis-a-vis higher volume rewarded when coins are exchanged and later to their original status.

From the diagram above we can see the illustration given. We have the start point where the Trader has the initial asset to be STEEM. He traded it for BTC and with his BTC he traded it for ETH before buying back his STEEM. This represents the triangular Arbitrage Trading which is aimed at profit-taking.

3. Funding Rate Arbitrage Trading

The Funding Rate is usually seen in scenarios where we have the Futures Contract in place. Due to the high volatility of the crypto market, traders have seen to Hedge the Prices of their Assets. The Funding Rates of 2% or more which are usually paid on these Hedged Asset prices are seen to compensate for the exposure on those assets in the market.

Investors are seen to be on the advantage when they involve in the Futures Contract with Funding Rates. The percentage rates observed here covers any anticipated exposure seen in the volatile market.

Question 3. Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your illustration)

Just as explained earlier. This is a three-point transaction that forms that of the triangle shape in its execution. This is a scenario that allows traders/investors to leverage price differences in purchasing other coins/assets before buying back their original coin. This involves three cryptocurrency coins trades which represents the different points seen in a triangle.

Traders take advantage of price variations vis-a-vis higher volume rewarded when coins are exchanged and later to their original status.

From the diagram above we can see the illustration given. We have the start point where the Trader has the initial asset to be STEEM. He traded it for BTC and with his BTC he traded it for ETH before buying back his STEEM. This represents the triangular Arbitrage Trading which is aimed at profit-taking.

Practical illustration from Binance Exchange

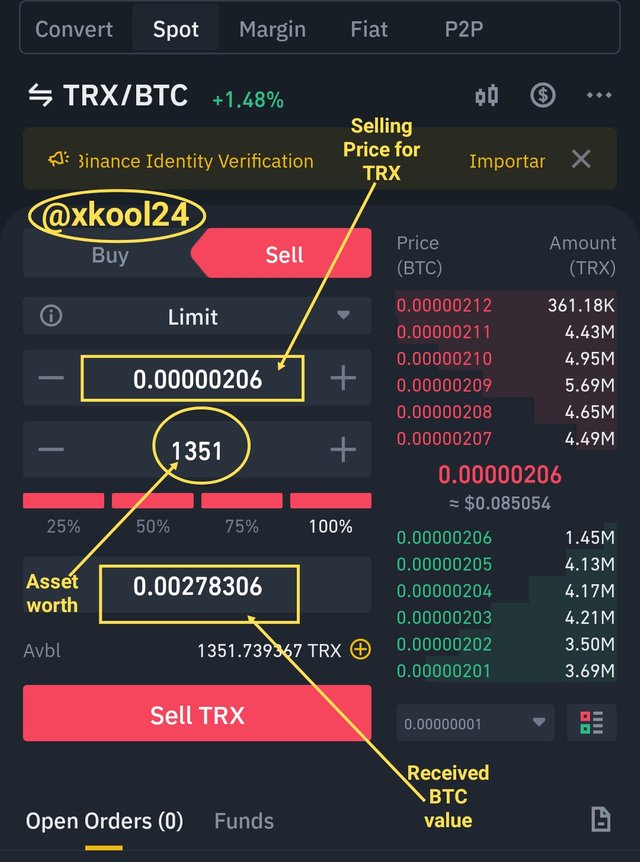

STEP 1

I have 1351 TRX worth of value in my wallet

This was sold for BTC immediately with the latest bid price.

a. Asset value - 1351 TRX

b. Selling price - 0.00000206

c. Received BTC value - 0.00278306

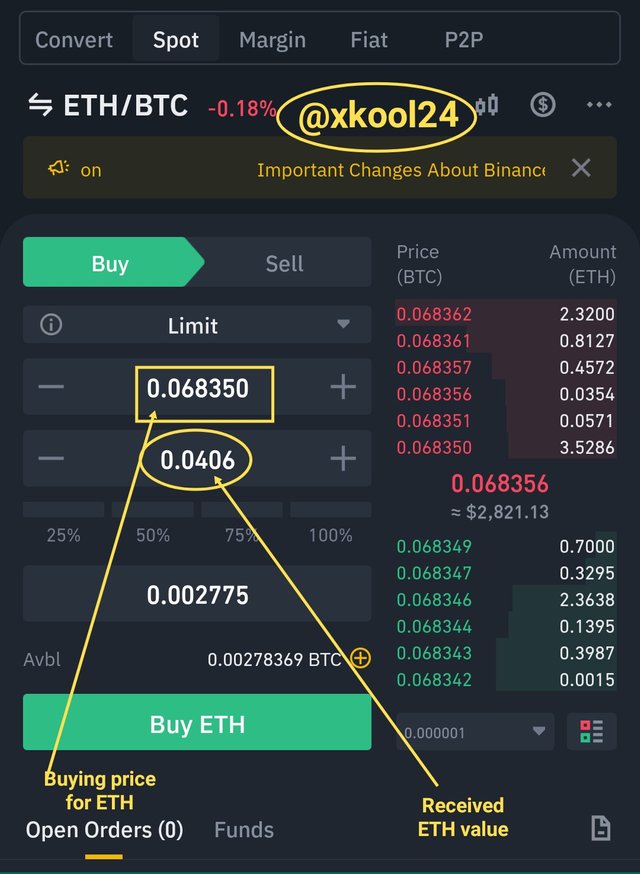

STEP 2

My purchased BTC valued was further sold for ETH

a. Asset worth in BTC value - 0.00278306

b. ETH buying price - 0.068350

c. Received ETH value - 0.0406

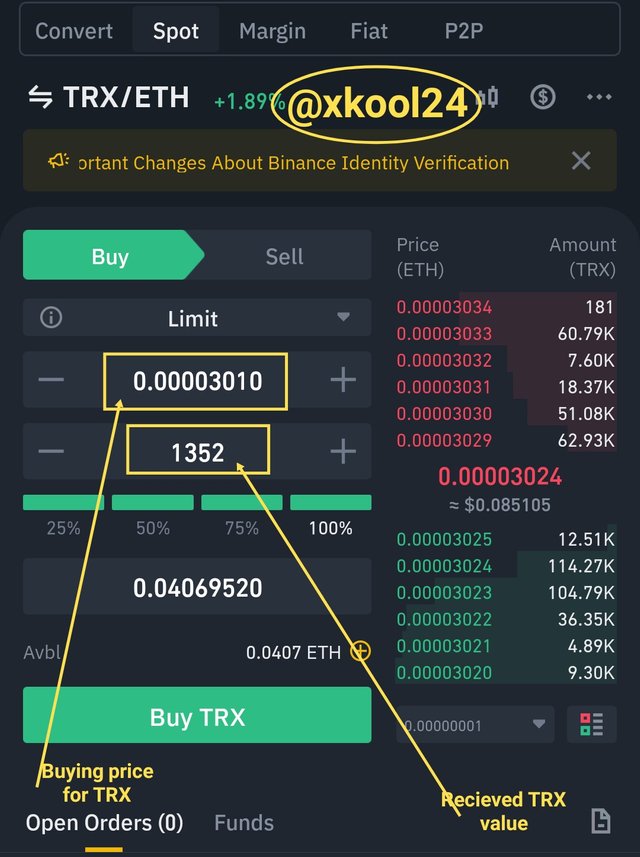

STEP 3

Now that I have purchased the ETH asset, I will now have to buy back my first asset which is TRX.

a. Asset worth in ETH value - 0.0406

b. TRX buying price - 0.00003010

c. Received TRX value - 1352 TRX

From my chart l, I was only able to make 1352 which is only 1 TRX higher than my initial asset before the trade. This simply tells us how to make profits from Triangular Arbitrage Trading.

Question 4. Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

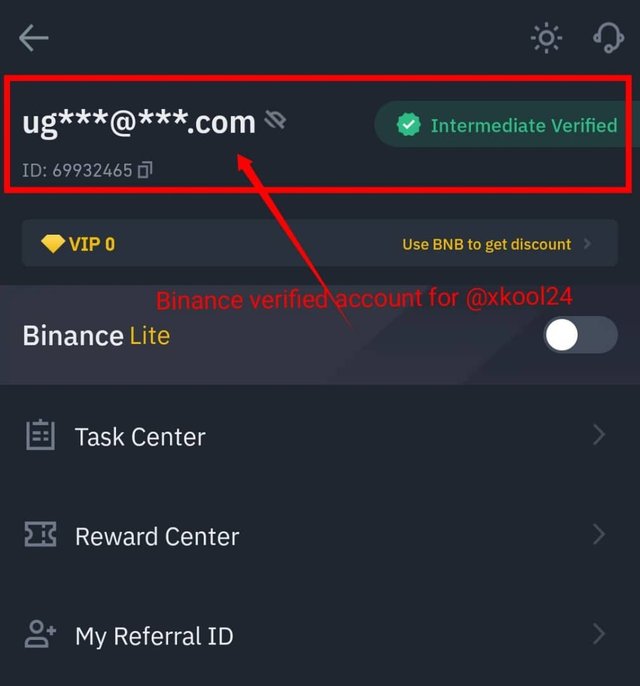

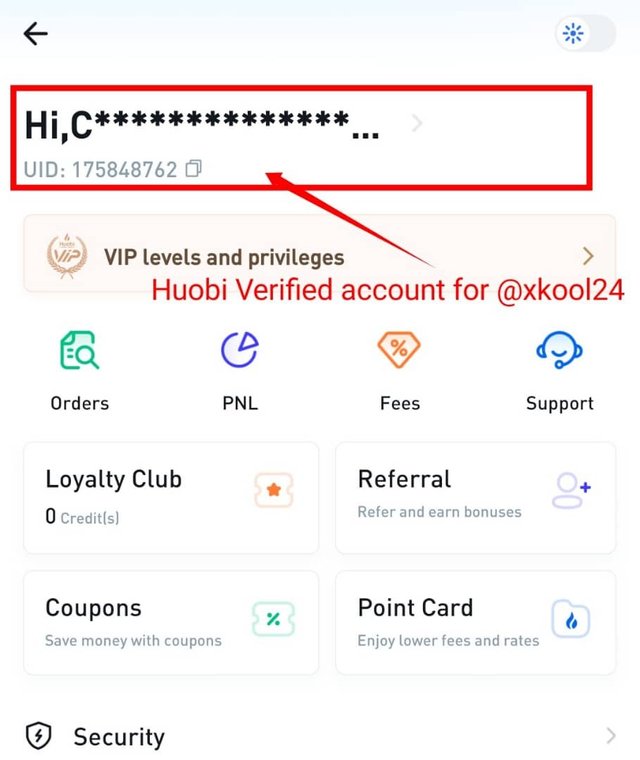

Verified Account for Binance and Huobi Exchanges

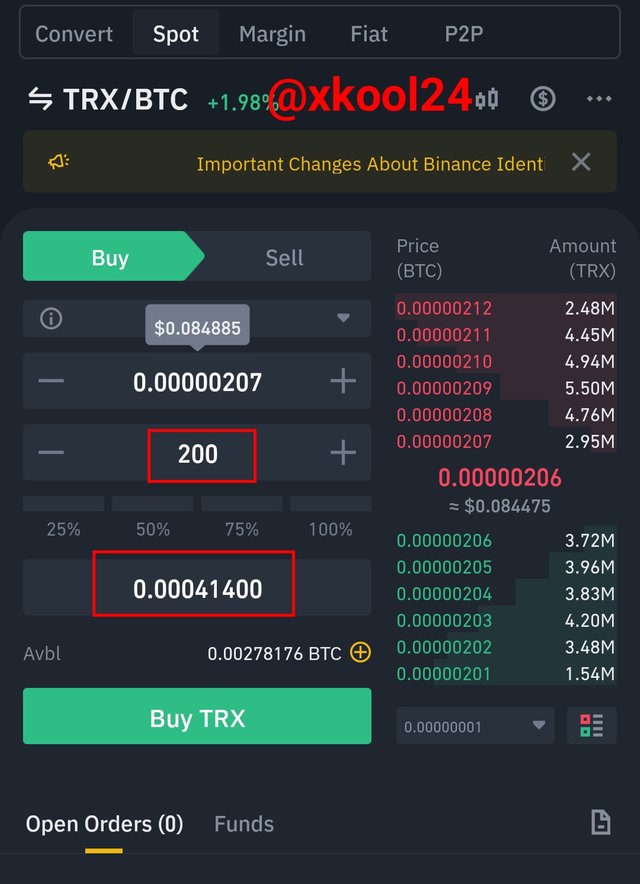

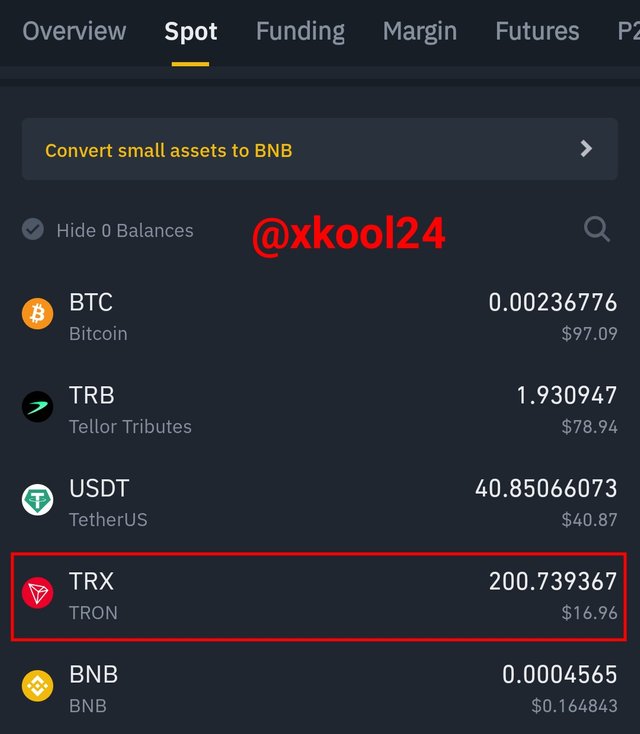

a. From Binance verified account, I'm purchasing 200trx which is worth 0.00041400 BTC and $16.96. So this was successful.

b. I will now have to transfer this to my Huobi Global exchange TRX wallet.

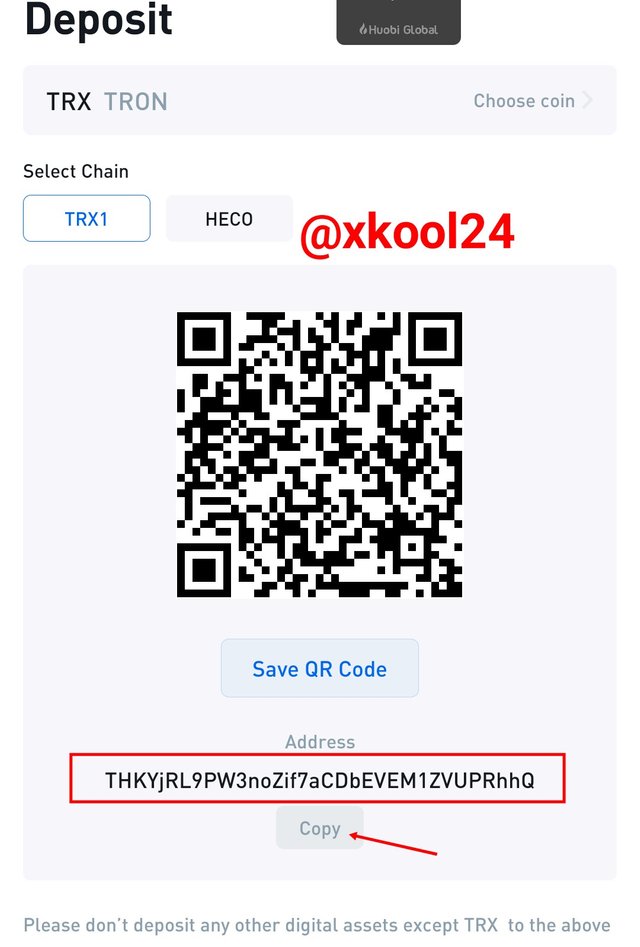

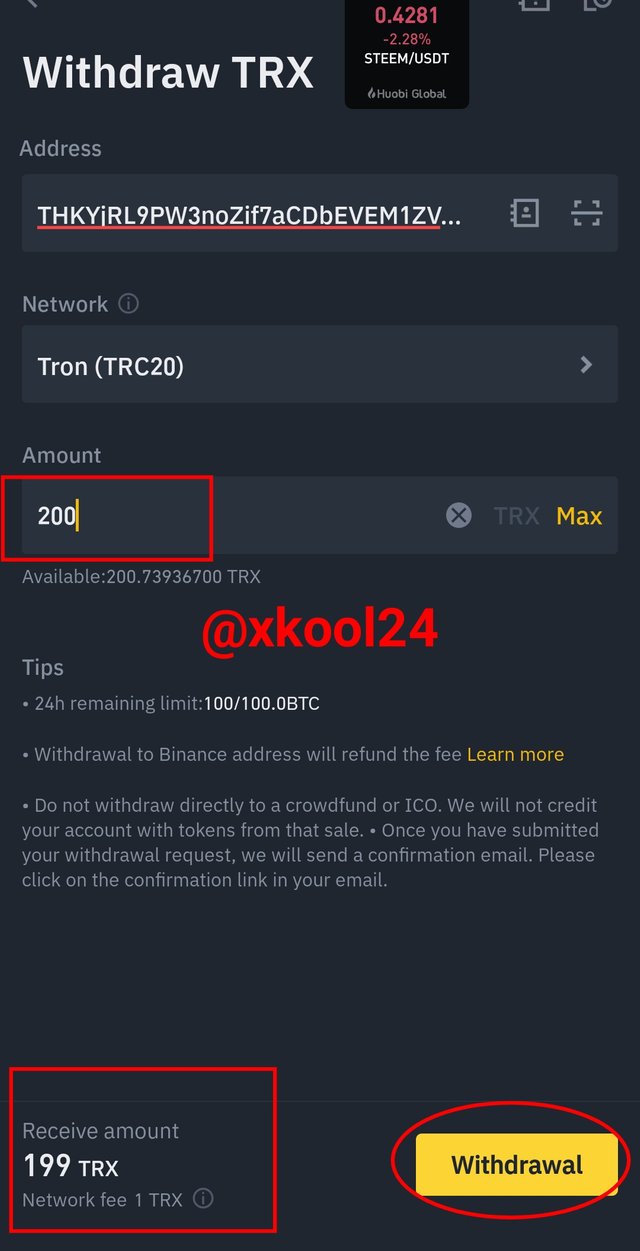

c. I have to go to my Binance account and Click on the TRX token to withdraw. This time I have to copy the TRX address from the Huobi Global exchange account

d. I have to paste the address in my Binance TRX withdrawal column

e. I will be sending the exact 200 TRX value purchased but at this time I have a Network fee of 1 TRX

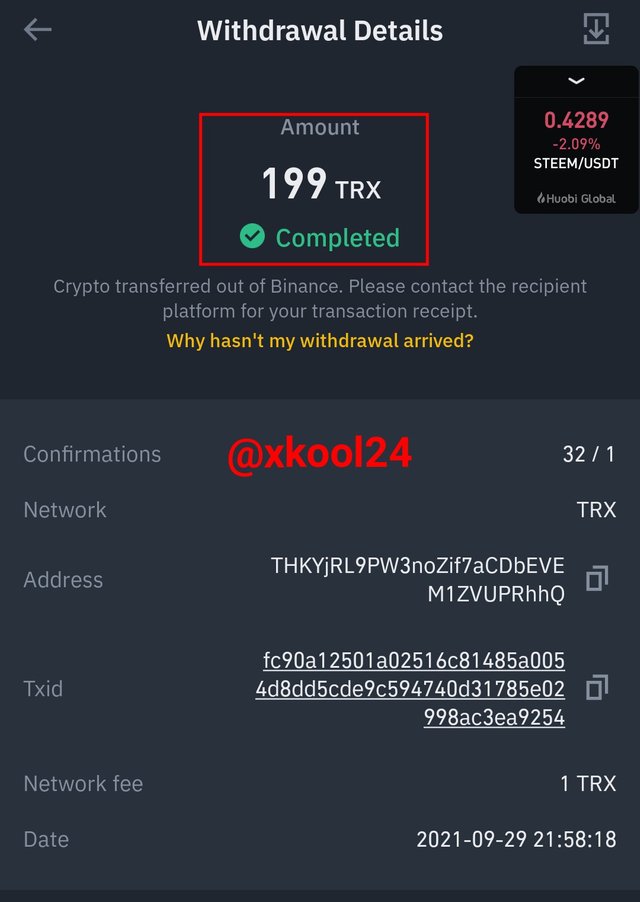

f. Then this has been sent with a confirmation receipt gotten.

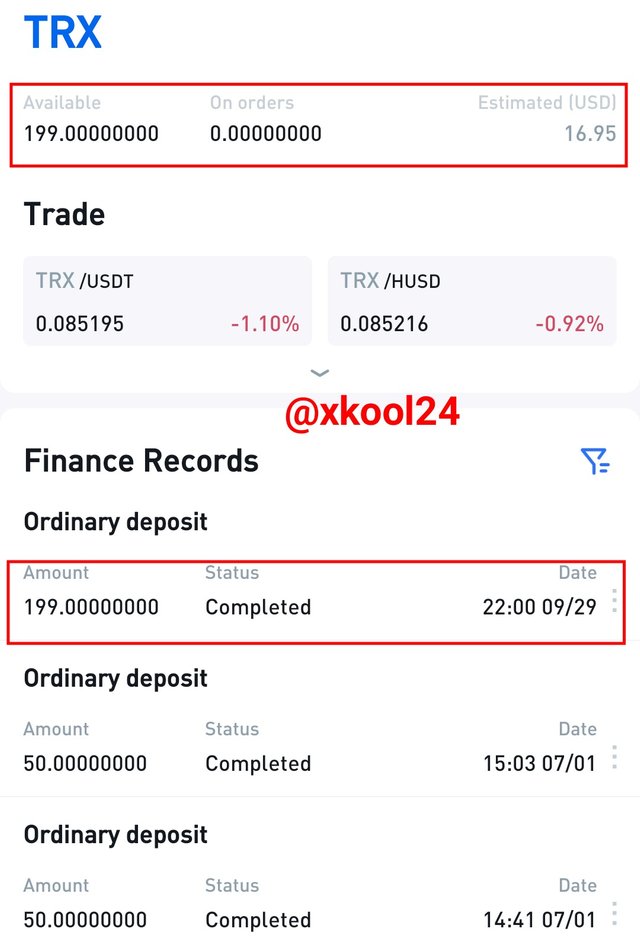

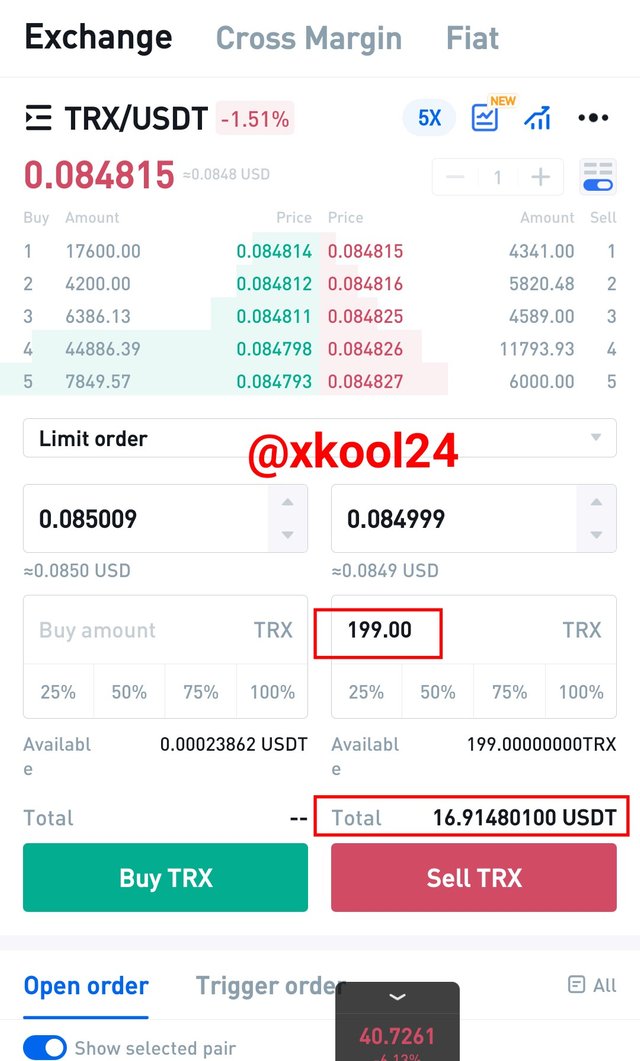

g. From the other Exchange, the price was seen going down and hence the value of 199 TRX was valued at $16.95 and before it was transacted into USDT it has also gone down to $16.91. This significantly shows that price fluctuations hurt arbitrage Trading if not executed on time.

This clearly shows that there was a decline in value purchased of $0.04 from the Binance Exchange due to the following reasons;

a. Deduction from Network Fee

b. Price fluctuations

c. Delay in Execution of process.

Question 5. Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

My practical illustration in question three above where I demonstrated 1351 TRX worth of value ($114) was a good representation of this question. See details below.

Practical illustration from Binance Exchange

STEP 1

I have 1351 TRX worth of value in my wallet

This was sold for BTC immediately with the latest bid price.

a. Asset value - 1351 TRX

b. Selling price - 0.00000206

c. Received BTC value - 0.00278306

STEP 2

My purchased BTC valued was further sold for ETH

a. Asset worth in BTC value - 0.00278306

b. ETH buying price - 0.068350

c. Received ETH value - 0.0406

STEP 3

Now that I have purchased the ETH asset, I will now have to buy back my first asset which is TRX.

a. Asset worth in ETH value - 0.0406

b. TRX buying price - 0.00003010

c. Received TRX value - 1352 TRX

From my chart l, I was only able to make 1352 which is only 1 TRX higher than my initial asset before the trade. This simply tells us how to make profits from Triangular Arbitrage Trading.

Question6. Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

| Benefits | Risks (Drawbacks) |

|---|---|

| It comes with relatively low risks vis-a-vis losses observed in Cryptocurrency trading | Risk from Execution Time. When window opportunities are not consummated before it closes, it throws investors into unforeseen negative trade. |

| Investors are sure of a guaranteed profit once the window is successfully executed | Risk form *Liquidity availability. When there is insufficient liquidity to get in and out of markets and platforms. Cases are observed in *Futures contracts with Leverage instruments. |

| Serves as Income generating revenues for investors within a short term. This is evident more in the Funding Rates arbitrage where investors engage in the Futures contract. | Risk of Price fluctuations may likely put the trader in a disadvantaged position. |

| Observed movement and exchange of assets means liquidity in the platform, hence this is also a source of liquidity in the exchanges and for those assets | High Transaction or Network Fee also affect traders profitability during Arbitrage trading |

Conclusion

Arbitrage Trading is the only trading strategy with a relatively guaranteed profit amongst all other given trading strategies because of the level of risk involved. Traders are seen reaping from mere moving their assets from Exchanges to another as well as Exchanging them with other assets and then buying back the initial asset.

Despite its guaranteed profits and low-risk perception, it is still faced with high network fees while moving from one Exchanges to another, price fluctuations before the window are successfully executed as well as execution timelines while engaging window before expiry.

Thank you, Prof, @reddileep