Crypto Academy Week 15 - Home Work Post for Professor @yousafharoonkhan - Exchange order book and its Use and How to place different orders?

Really great lectures Prof. @yousafhroonkhan. This lectures has really enlightened me on the use of order book, it was really confusing, but now am good to go. Thank you very much Prof.

Now to the assignment proper.

QUESTION 1

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

MY ANSWER

Order book is simply a book of records of buy and sell orders. So it's a book were you can have easy access to different prices people want to either sale or buy assets. So on this book, if a buyer or seller has sales to make or goods to buy, he/she goes to either section of the order book and places the order so any body requesting will easily see that and places his or her own order, to either buy or sell.

But there is a very important feature we should understand about the crypto asset order book, it has alot of difference with the local market order book. The crypto order book basically works in pairs as Explained by the professor. Such as TROY/BTC, STEEM/ETH, DOGE/USDT etc.

So if I buy TROY in Exchange of BTC, the Transaction immediately gets recorded on the buy order section of the order of book.

And similarly, a trader wants to carry out sell order, he/she sells TROY in exchange for BTC. Such record is maintained in the sell order section of the order book.

Now there are several things that makes the crypto order book different from that of the local market order book, since all transaction placed has a relationship with an order book. Below are some of the unique differences;

| Crpto Order Book | Local Market Order Book |

|---|---|

| Crypto asset pairs are needed | Just a currency is needed. |

| Features like OCO, stop loss, MacD, RSI, limit order available | Here all this features are not available. |

| Affected by price volatility | Not affected by volatility |

| Easily accessible by all traders | Not accessible by all traders Except the owner of the order book. |

| Technical Analysis, candle sticks, Ema etc. can apply | These can't apply in the local market order book. |

QUESTION 2

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

- Pairs

- Support and Resistance

- Limit Order

- market order

MY ANSWER

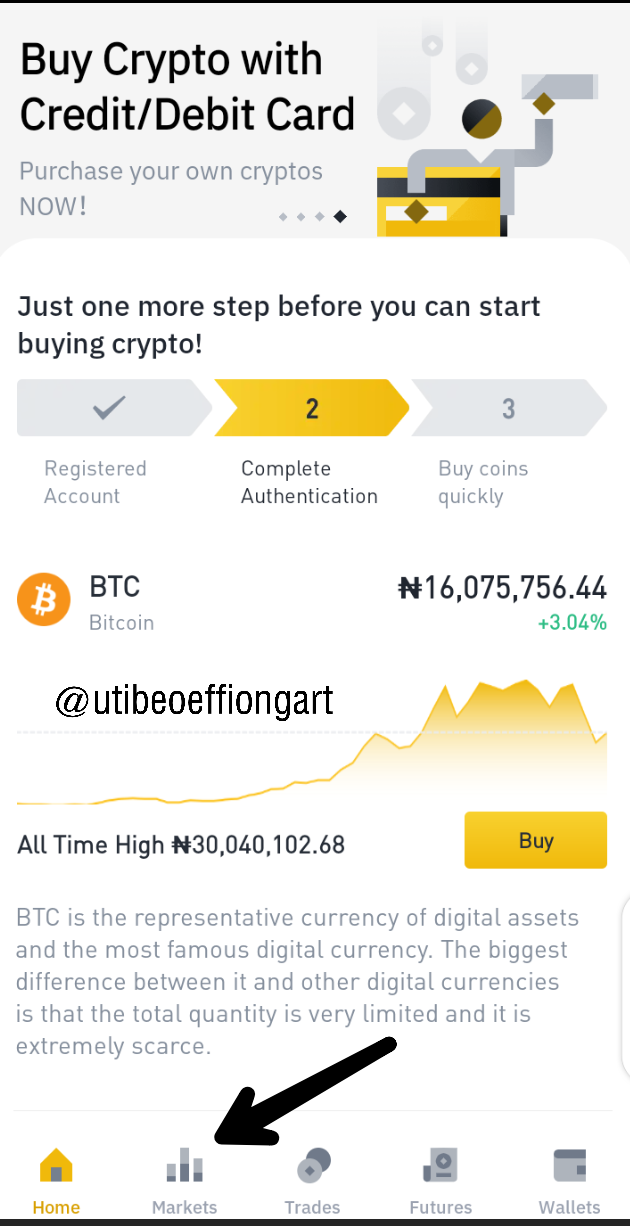

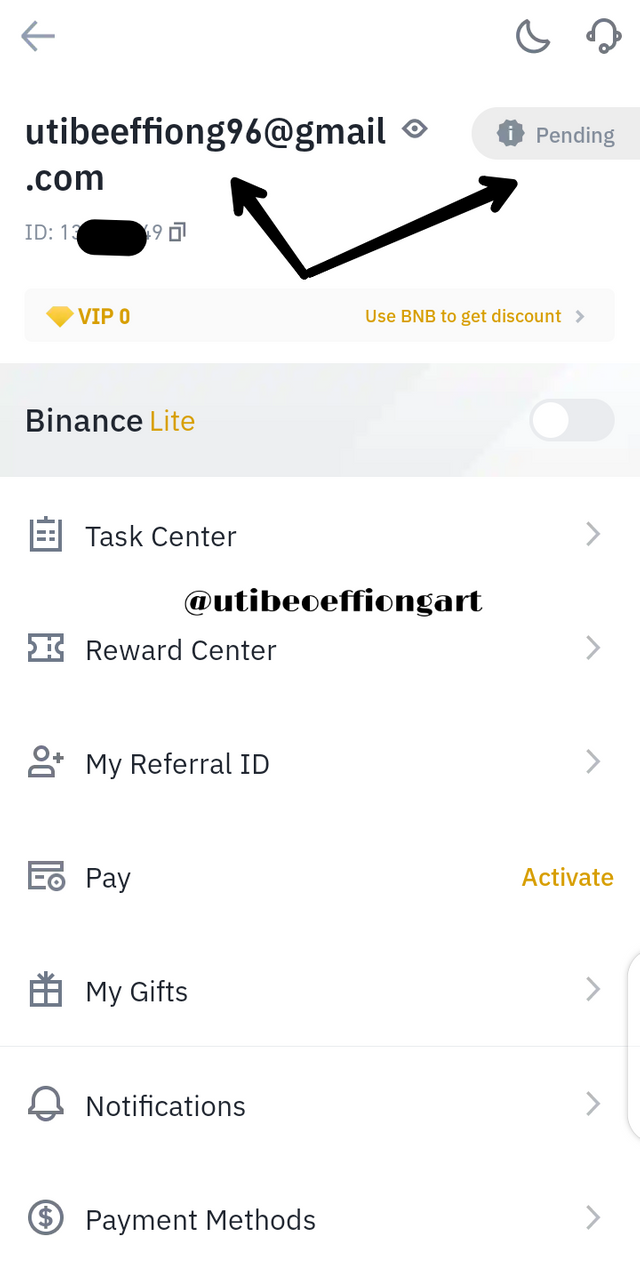

For the purpose of this question I'll be using the Binance Exchange platform. And this platform can be accessed either through the browser, or the app. I'll be using the app, my personal Binance app for this question.

first of all, download a Binance app, if you don't have one and go through the registration process.

Then on the home page of the Binance pro part of the platform

(N/B: the Binance app platform is divided into two, the lite and the pro. So to access the special features that we need, then we need to use the pro part of the Binance) choose market on the Pro section of the Binance platform as seen Below.

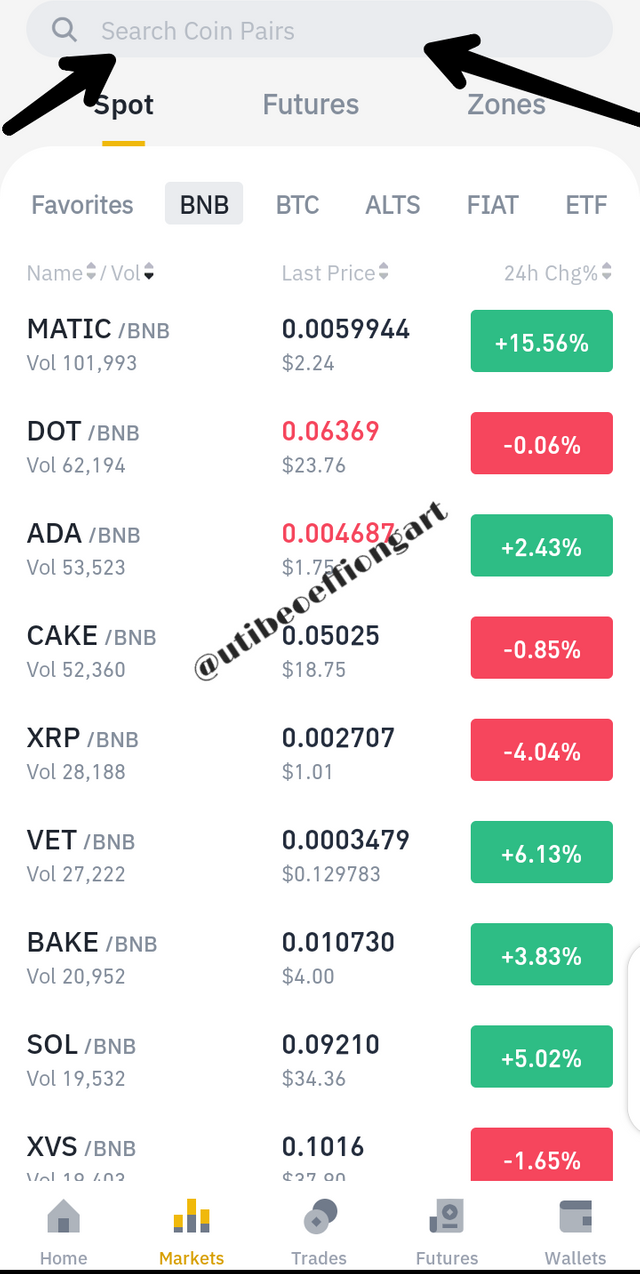

- Then proceed to search for the crypto pair you desire.

- Then proceed to fixing the asset pairs you want

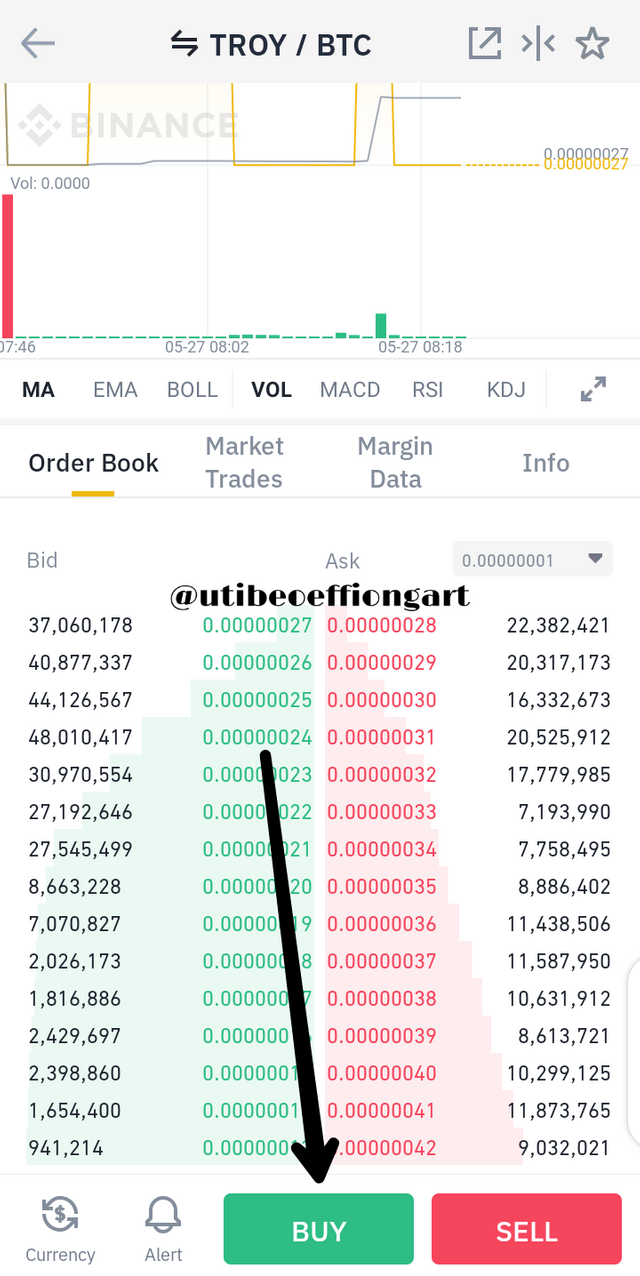

- immediately after that, the next page opens up when you have clicked on the asset. You then scroll and then focus on the Order Book.

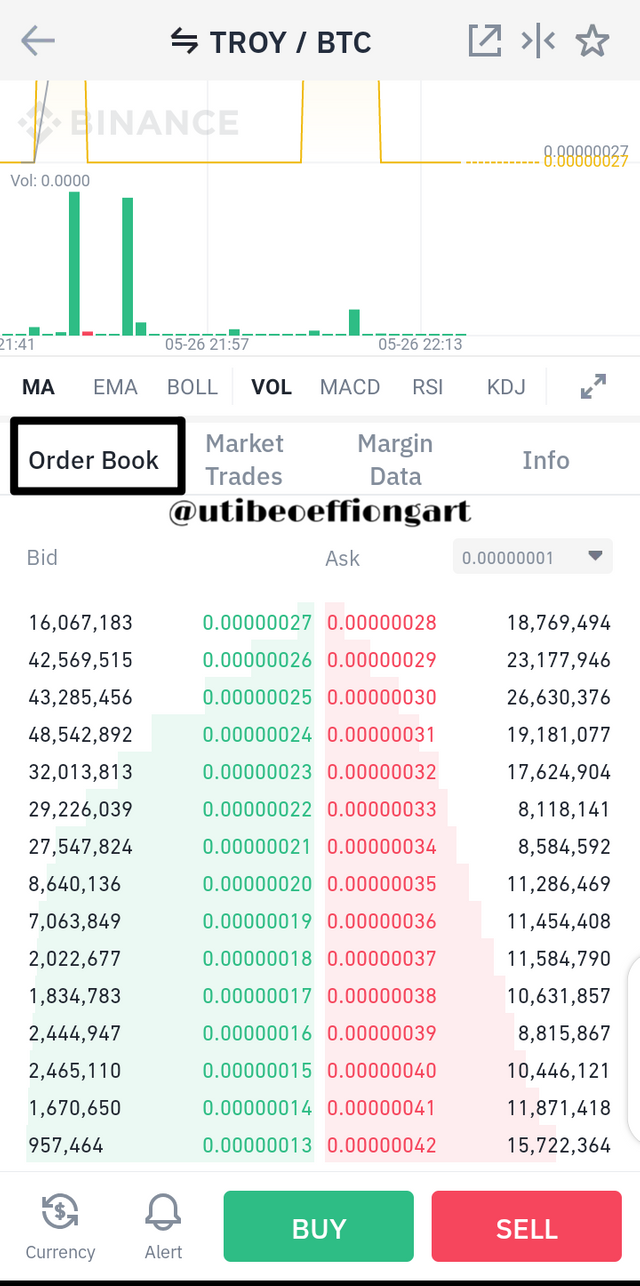

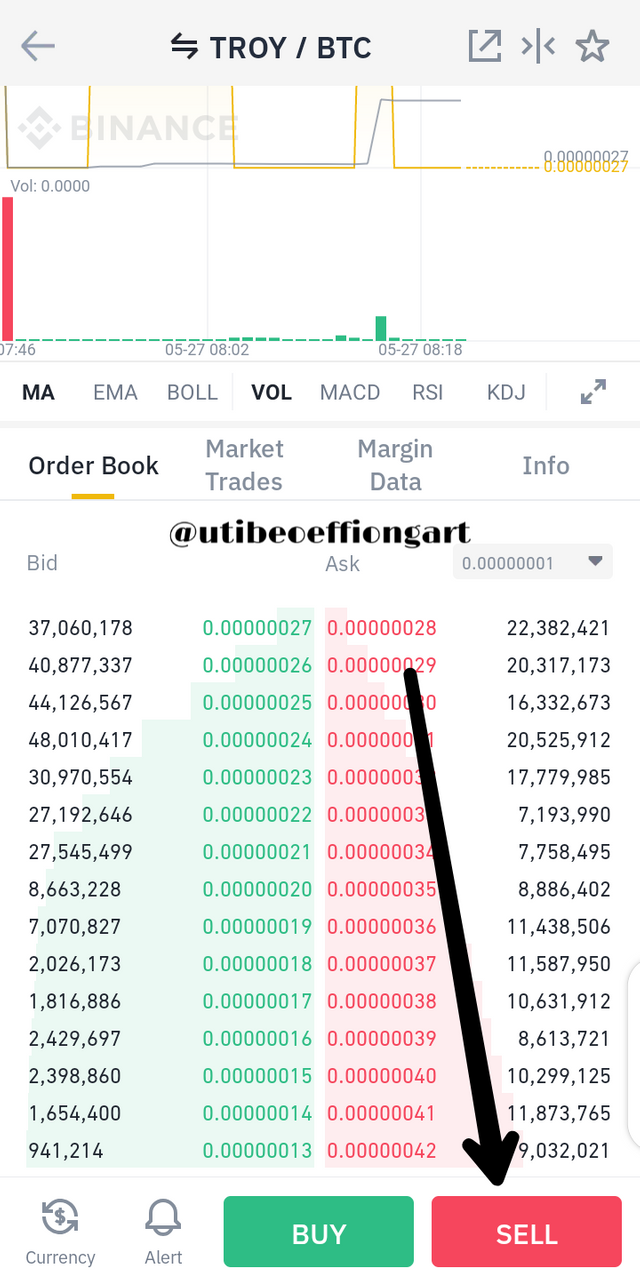

TROY/BTC asset pair of my order book

Pairs

This is simply a pair of crypto assets. Basically the crypto order book operates in pairs like stated above. So when we mean pair in Cryptocurency we mean the combination of two crypto assets, were one asset can be Exchanged for the other either by buying or selling. E.g: TROY/BTC, STEEM/ETH, DOGE/USDT.

It is worthy of note to know that this pairs can be coin to coin or coin to fiat. That is trading between coin to coin like the TROY/BTC. And it can also be coin to fiat, where a trader trades coin for fiat or fiat for coins. E.g: DOGE/USD, STEEM/USD.

Support and Resistance

Support is basically a technical analytical term used by traders to describe the buttom, lowest level or terminate of a bear run. That is, during a bear trend, a point comes were it hits and either remains there or breaks out for the bull trend when that is noticed we term that support.

At that point it needs enough energy to pull up again after it has had the stand still, and that is termed the support energy. At this point a trader can place the buying order.

AND

Resistance is also a technical analytical terminology, used to discribe the crest or highest point of a bull trend before the price begins a bear trend. At this point the price of the trade experiences it highest high and a trader can decide to sell here.

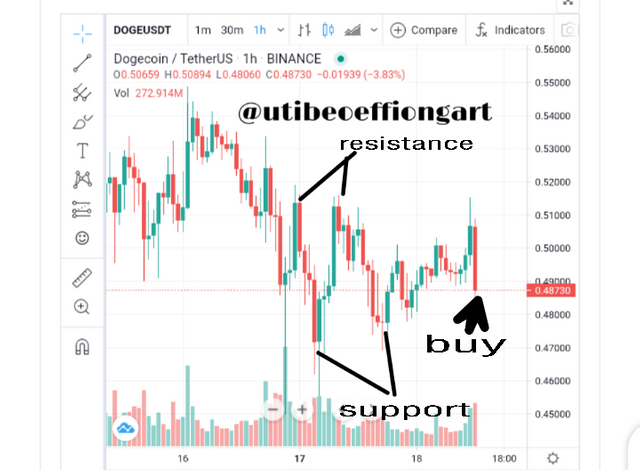

Screenshot from coingecko with DOGEUSDT

So looking at the above screen shot, at the point of the resistance arrow, the price broke out from a point as at $0.51, notice that at that point it did not waste a time at all before breaking off to the support. At that point it is good to sell except for Hodlers.

Similarly, at the first support level, $0.47, the price did not waste time before proceeding for the uptrend. So a trader can decide to either buy or Hodl. In this type of market it is good for traders to be very attentive to the technical happenings of the trade so as not to loss out.

Therefore, alot of buying and selling activities are always carried out at either the support or resistance levels respectively, and this can be monitored on the order book.

Limit Order

Now this is the type of trade order were the trader set a price for his or her order outside of what is on the order book. So a trader wanting to place a trade and is not conversant with the market price sets his own price for his asset. For example: I want to sell BTC but the price at the market is 2450Usdt, and am not comfortable with that because I want to sell mine at a rate of 3000usdt. So I'll set it at that in the sell order, but the transaction will not be carried out immediately, since the market price is not set at that. But immediately the price clocks 3000usdt then my trade will be executed immediately.

Similarly, if I want to buy BTC, and market price is set at 2450usdt and still that is too much for me, I'll set my price at 2000usdt which is comfortable for me, so immediately the market price hits my target then my buy order will be executed.

So summarily, the limit order is not a now trade because the price set is always different from the market price...

Market Order

As against the limit order. Here the trader sets his/hertrade price at the same price with that of the market. So assuming the price of BTC is 4000 USDT, and I wish to buy that, I'll enter the trade at that same price and the trade will be carried out immediately.

So the market order can be called the now trade. Were traders trade at the current market price.

QUESTION 3

Explain the important features of the order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

MY ANSWER

Before I proceed to the different features of the Binance order book, I'll love to Show my verified Binance page. But professor @yousafharoonkhan there is a little problem.. I have tried severally to verify and it keeps failing. Below is my home page showing pending, but for the purpose of this assignment I had to continue.

Features of the Order Book.

Before I proceed, it is important to understand that the major component of the order book is the buy and sell feature and it also shows some important crypto features such as the market cap, the volume etc. Immediately you log into the Binance platform and click on market, you are immediately met with the buy and sell order as seen below

Now looking at the above screenshot, you will see the red and green coloured orders of the page. That signifies the buy and sell orders. The buy order is signified by the green color and the red the sell order section of the platform. It is very important to know that the order is not static, that is you can log into the platform now, immediately you log out and log in again, the whole order changes. This shows that the order book is usually executed every now and then.

Now let's see how to execute out the buy and sell order with screenshot below..

Buy Order.

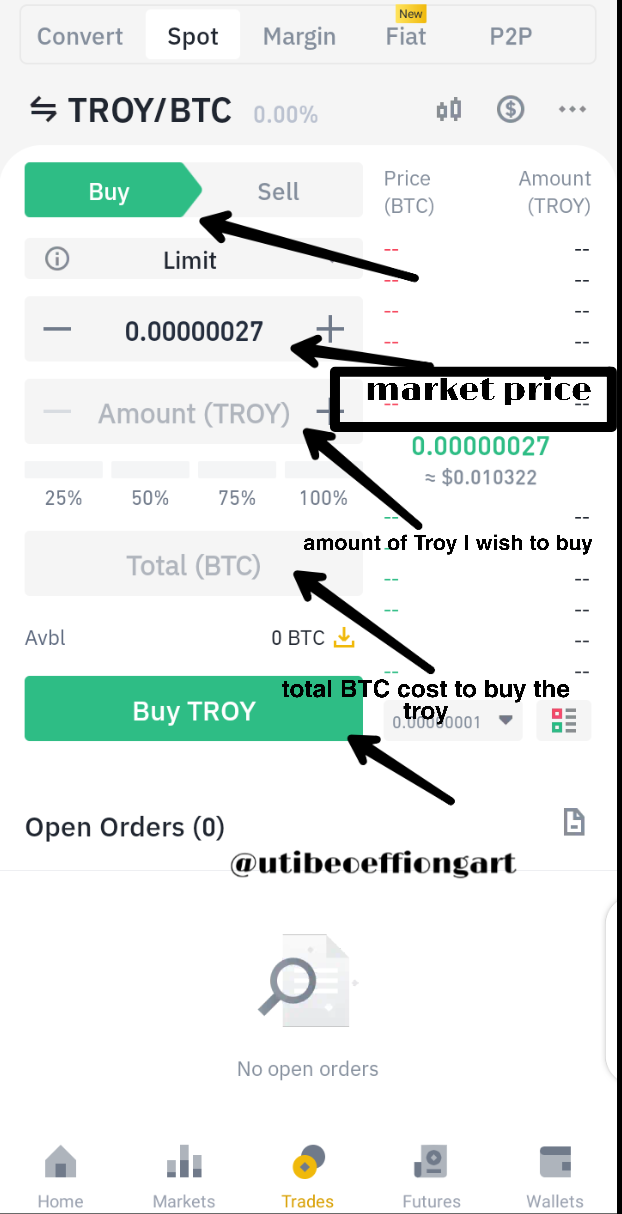

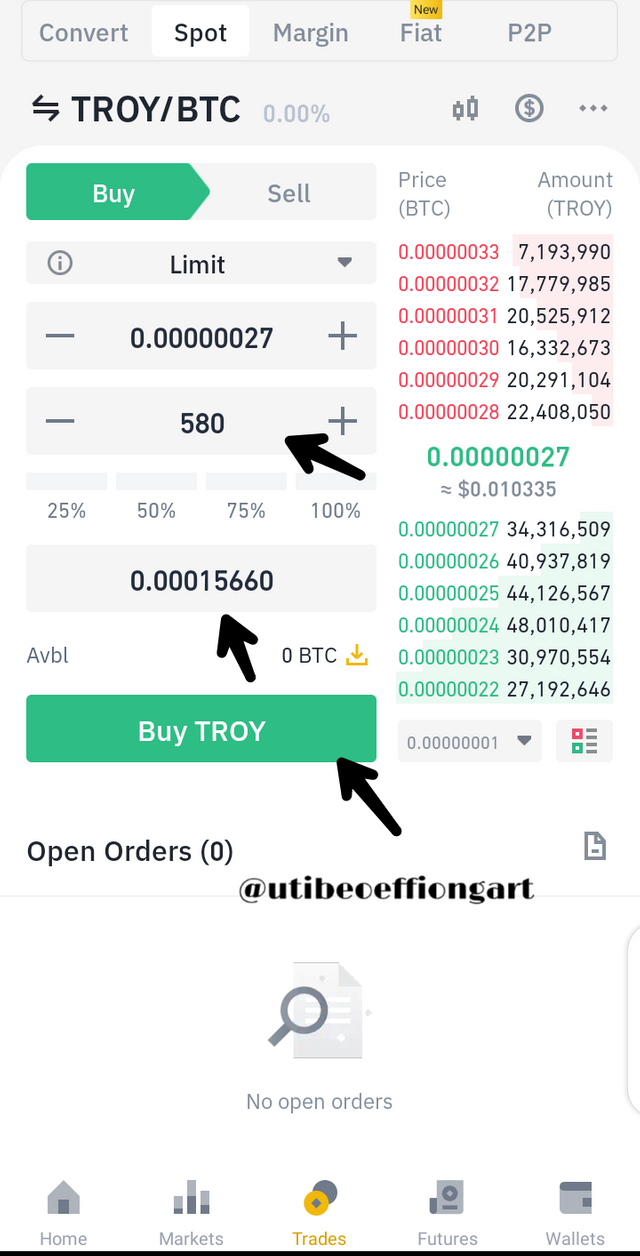

As the name implies to buy means to purchase. So relating that with the crypto currency exchange or order. This means purchasing a Coin. Now purchasing this coin must be done in pairs, that is buying what you want with you have. So assuming am running a TROY/BTC Transaction, that means I have enough BTC to make the TROY purchase.

- so first of all click on buy and the page below will open.

- immediately the page appears you then fill in the page.

- Not that the first is the market price which should remain, then you fill in the amount of Troy you wish to purchase and immediately the total amount of BTC needed for this purchase will show up then you simply click on buy. This I have done below.

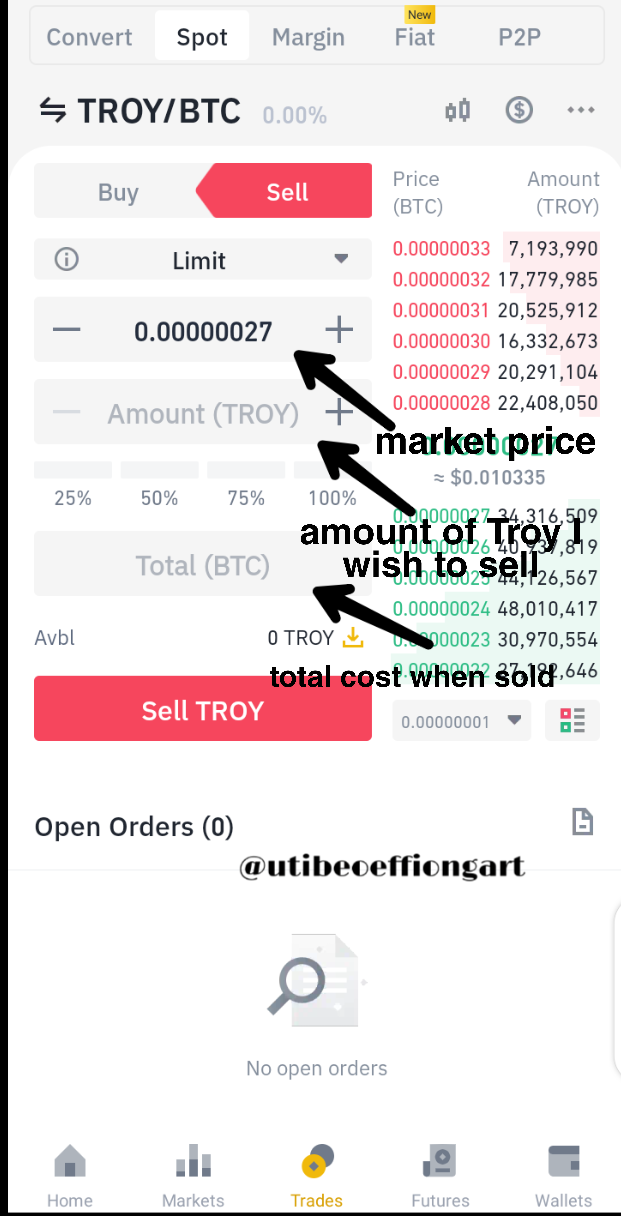

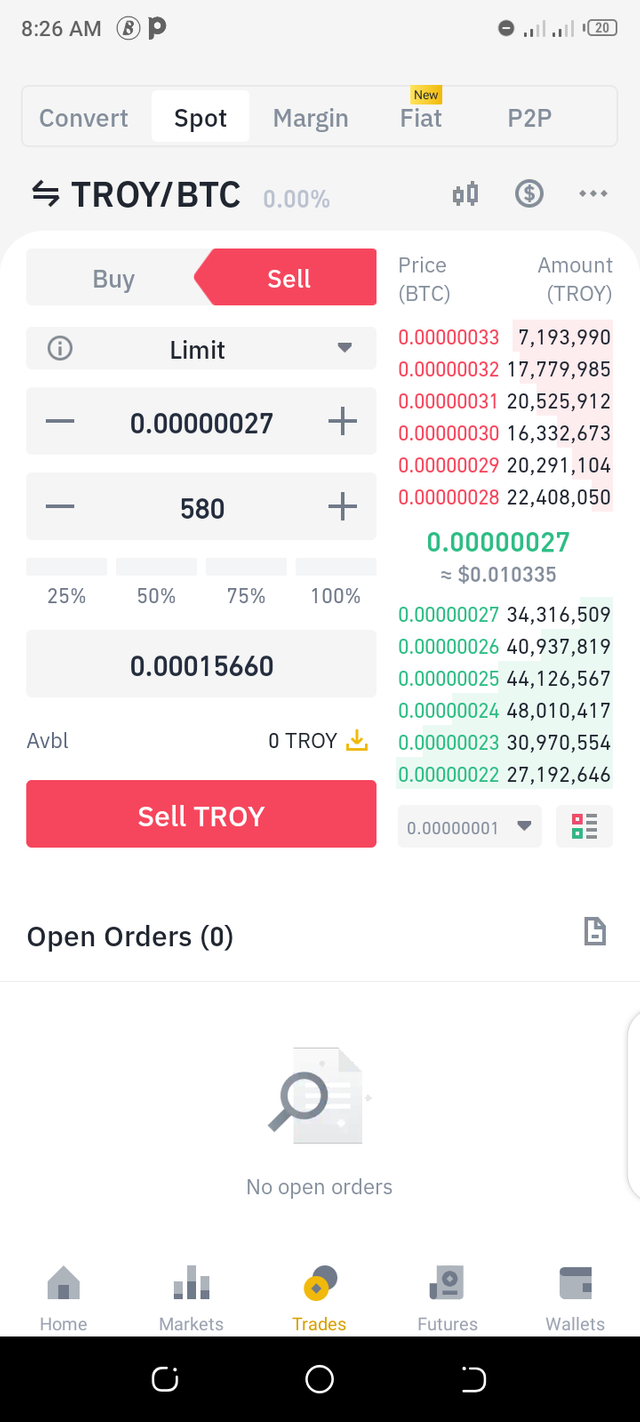

Sell Order.

As the name implies, this means I want to make sales. So this is carries out when a trader in possession of some coins wishes to exchange or sale it to either get other coins or fiat in return. So assuming a trader in possession of Troy and wishes to sale them to get BTC in return.

- Simply click on the sell section of the order book.

- Then immediately the page below will come up, where the first box is the market price that is not editable except you want to set it as order limit, so you then input the amount of Troy you wish to sell them the amount of BTC reward will appear automatically, then you proceed to selling.

- I'll then input my specified amount in the respective spaces and proceed.

QUESTION 4

How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

MY ANSWER

Stop-limit trade

Before we proceeding to the screenshot of the stop-limit trade it is very important than we have a good understanding of the terene. Now the stop m-limit trade is imbibed by trader to avert losses before it comes on, it gives traders full control of the trade. There are two important features of the the stop-limit trade which is the Stop price and the limit.

Stop Price: this price is the beginning of the required price for the trade.

limit price : this is a lower price of the stop price, at this price the trade is considered executable. That means at this point the trade will be carried out.

How Stop-limit trade is carried out.

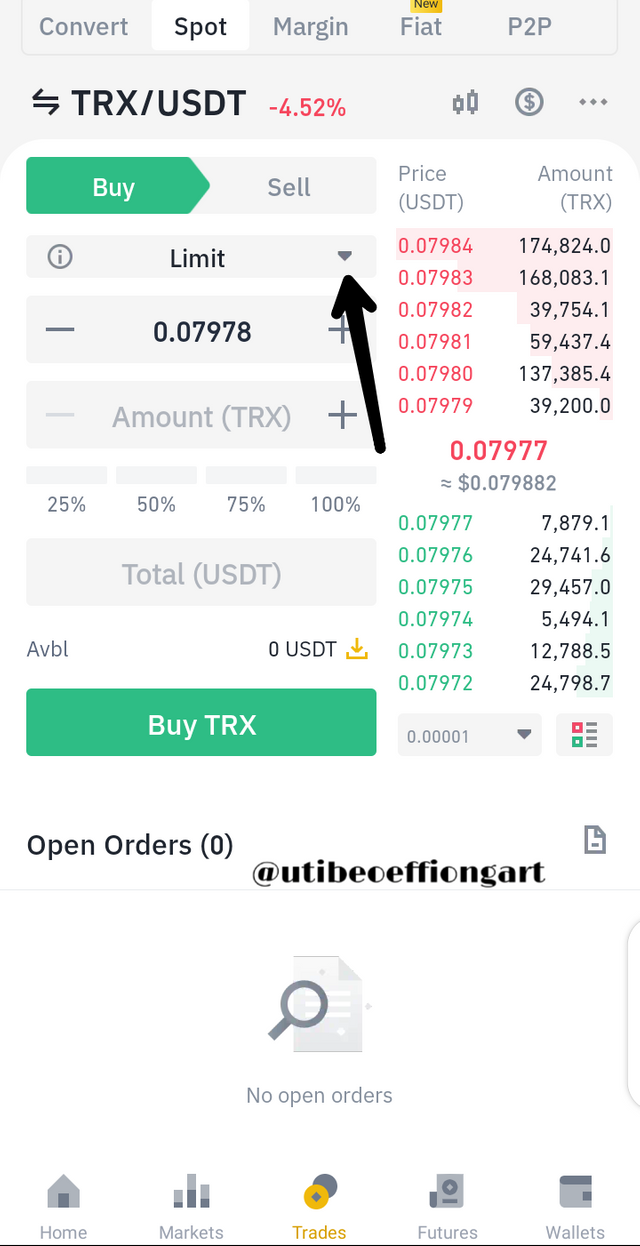

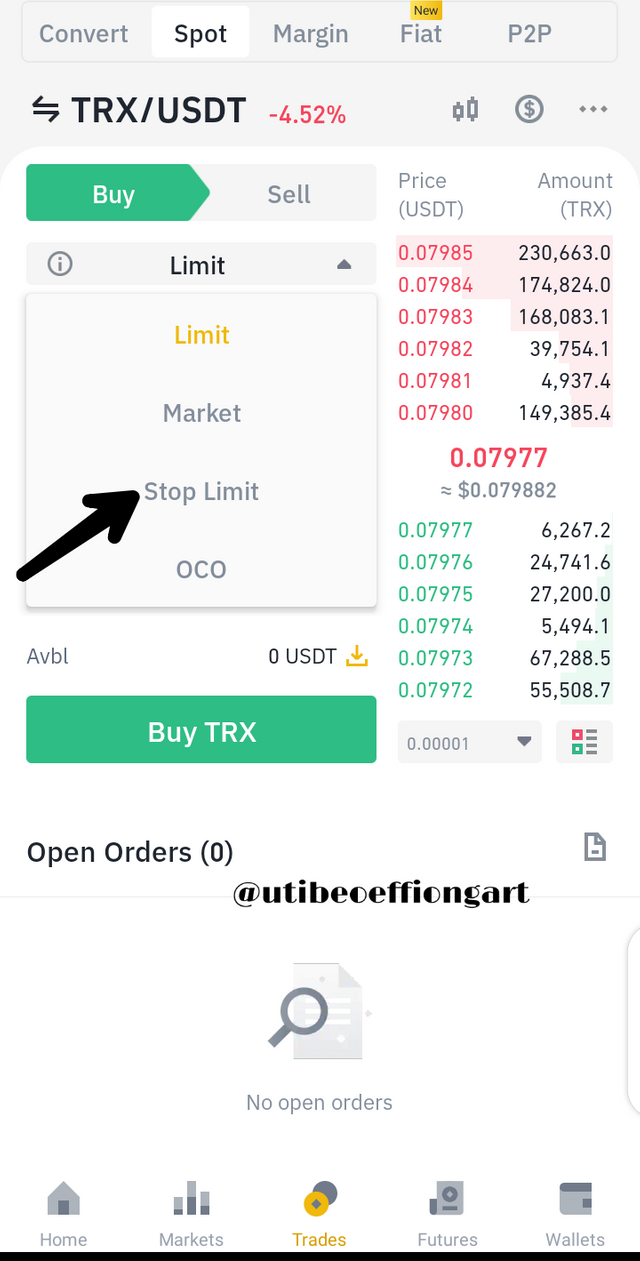

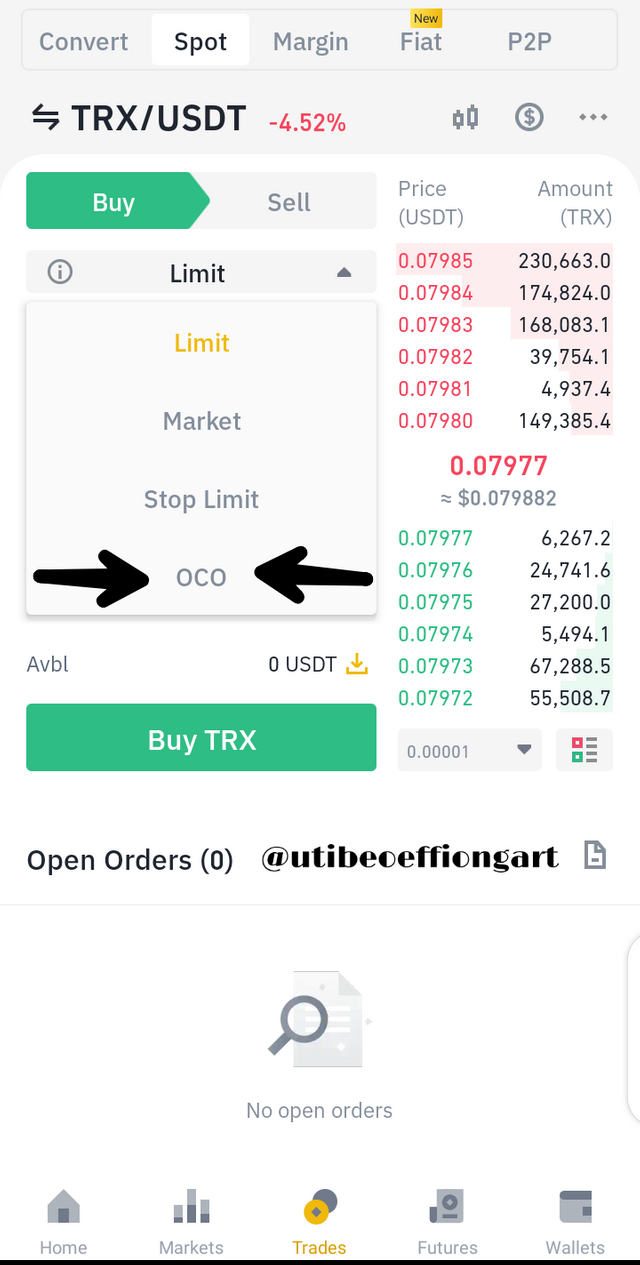

- Just as we Carried out the buy order and sell orders. On the home screen of your Binance page, you click on the market and the order book page will come up, select your pair, which in this case we choose, TRX/USDT and then click on the limit and click on the stop-Limit on the drop down box. Below is a screenshot to show.

- Then select Stop-limit as shown below

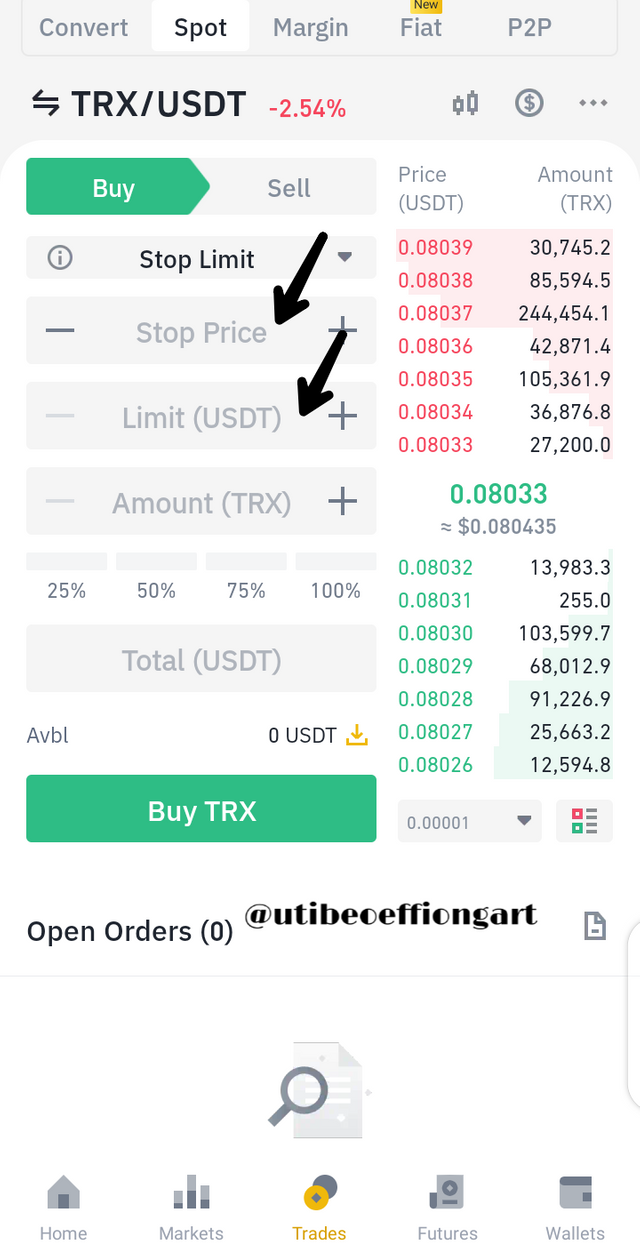

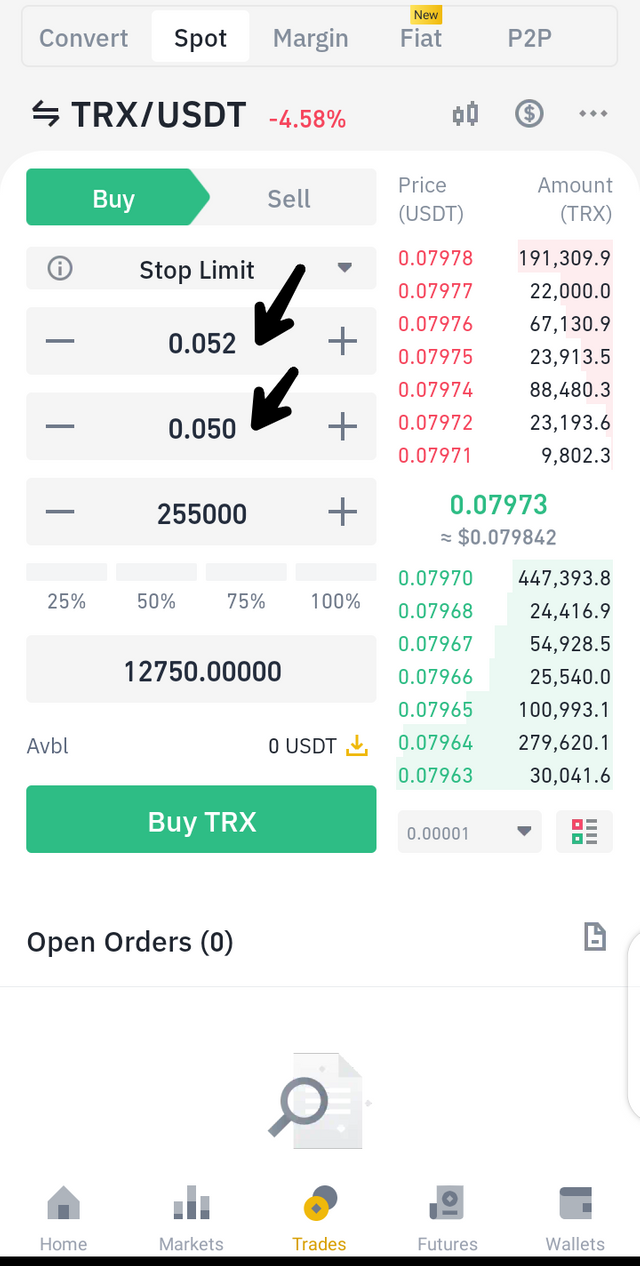

- Then place your buy stop-limit

Notice that I set my Stop price at 0.052usdt and limit price at 0.050usdt, so immediately the market price tends towards my stop price it will be executed at the limit price for my TRX to be purchased.

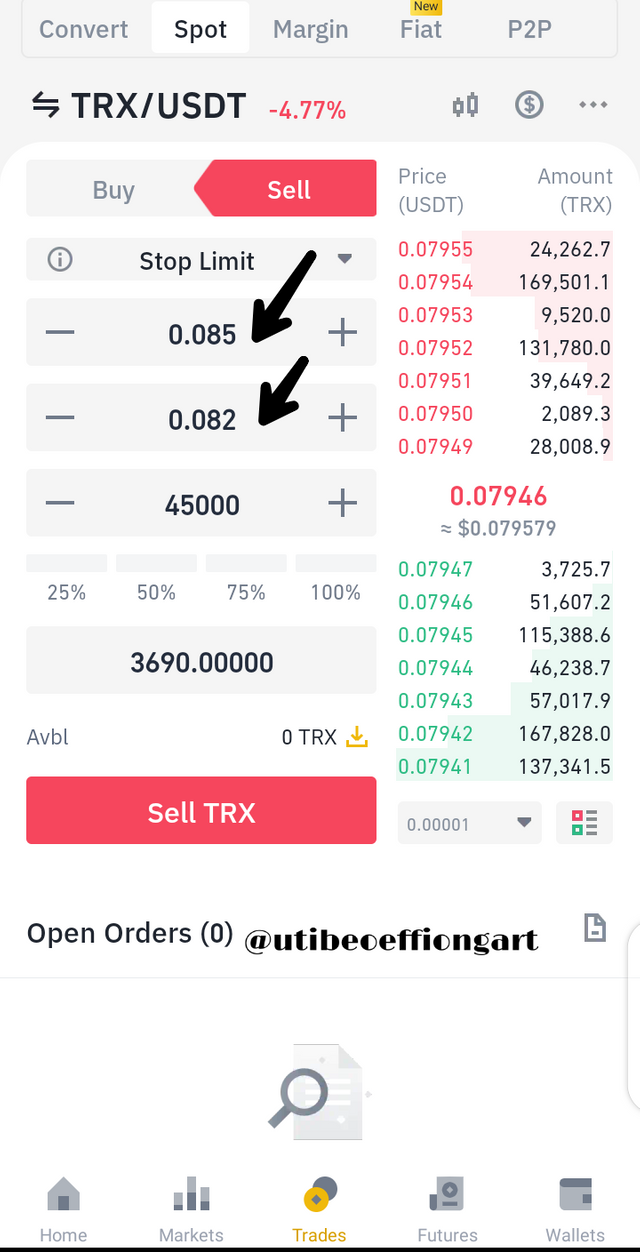

Then also place your Sell Stop-limit order.

- Here I set my Stop price at 0.085 and limit price at 0.082 which when the market price will favor me, my TRX will be sold.

How to place OCO buy and sell order.

OCO means One-cancels-the-other.

The OCO is basically the combination of the limit order and stop-limit order. Whereby if one takes place before the other, then the first cancels the other. Meaning of limit order is executed first then the stop-limit is automatically cancelled. This is very useful for traders to avert much losses. They are not directly affected by high Volatile market price.

Buy OCO order.

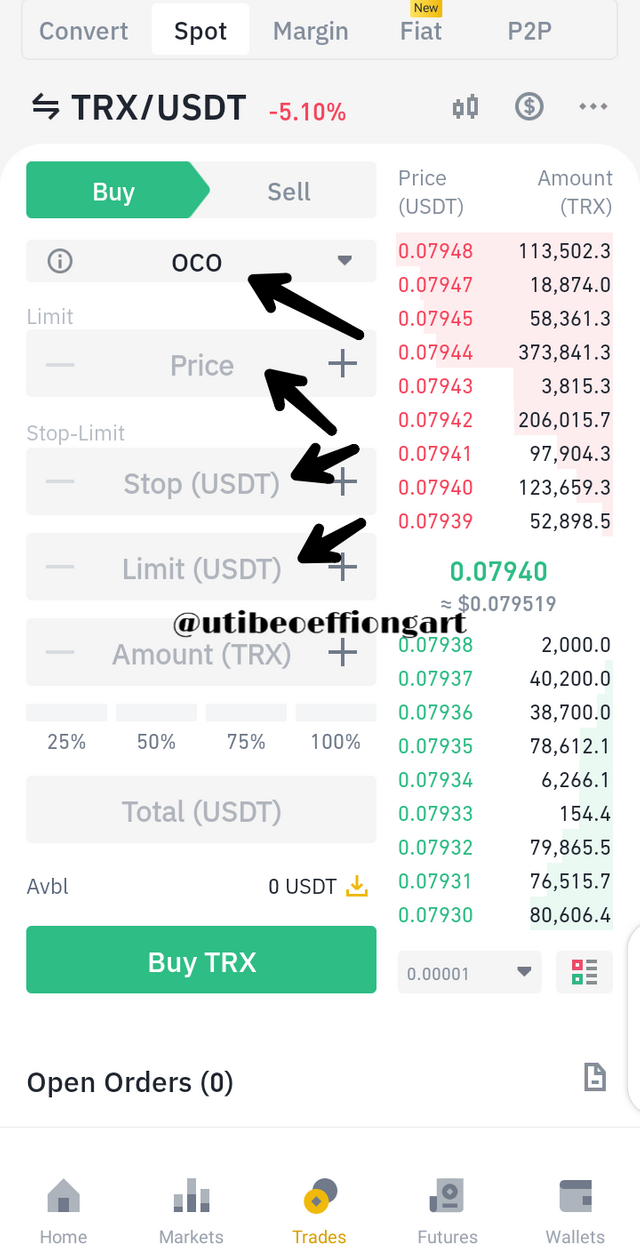

- The same process of logging into your Binance, chosing market and chosing your pairs and then changing the limit button to OCO. Let's see below.

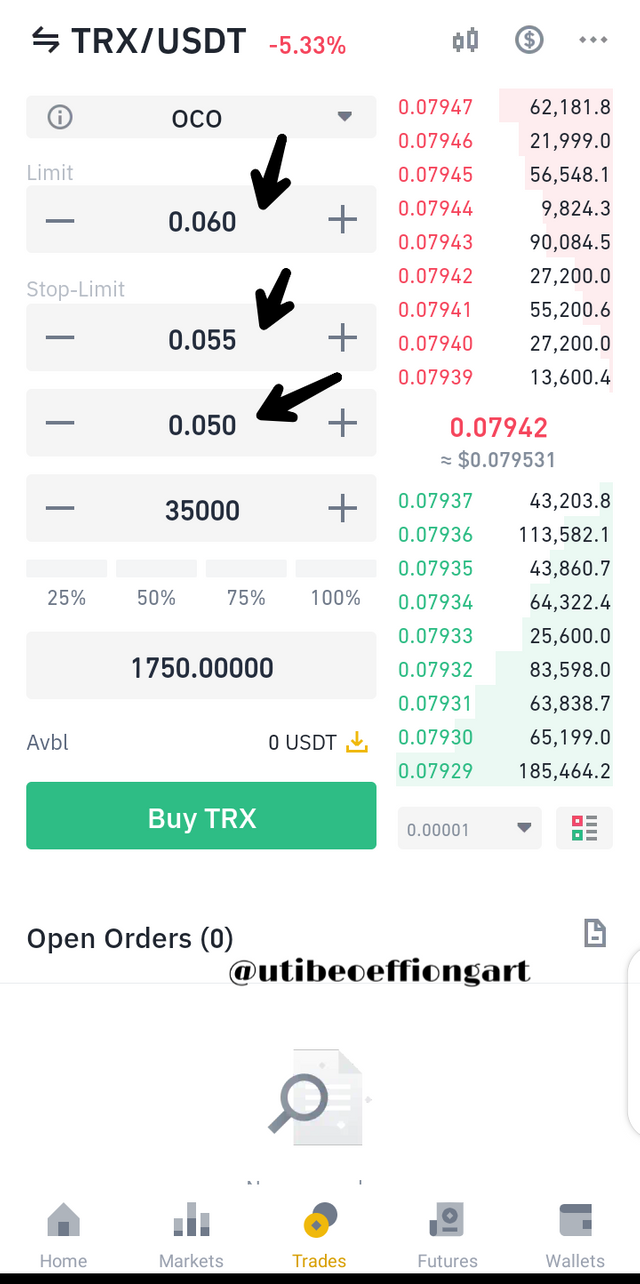

- and then fix in my prices for each of the boxes

- Now I set my limit order at 0.060 and my stop price at 0.055 and the limit price at 0.50.

Now if the market price gets to 0.060 it will trigger the limit price and it will be executed, and automatically cancelled the Stop-limit order. And vice versa.

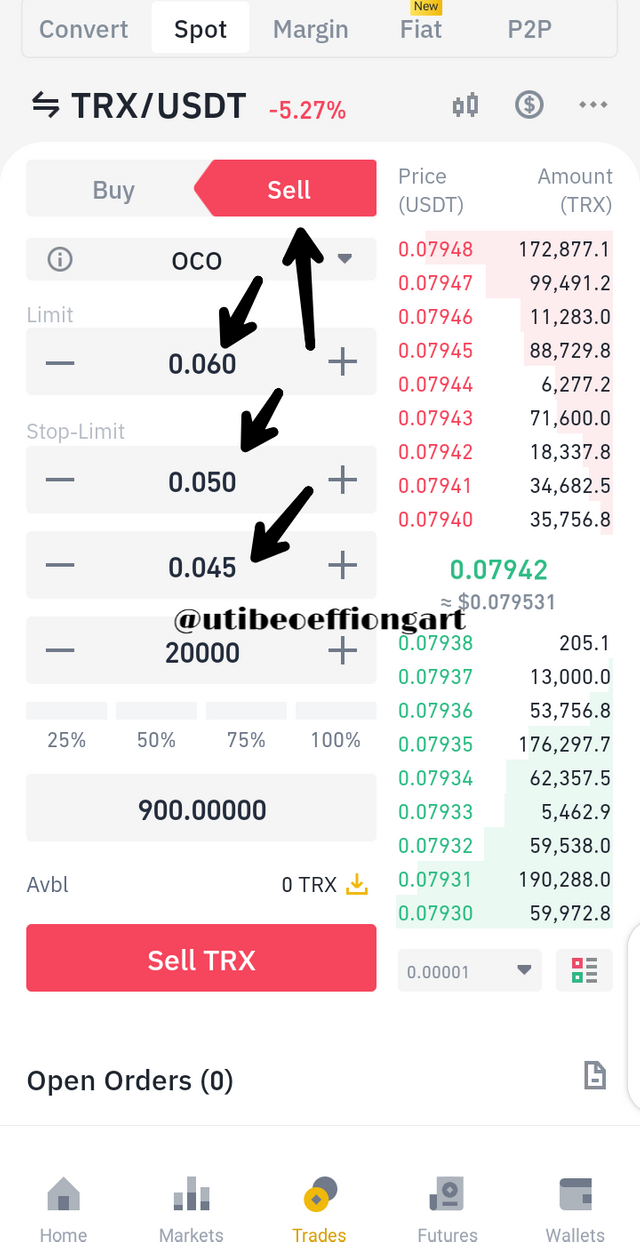

Sell OCO Order.

- Here I set my limit price at 0.060usdt and the stop-limit price at 0.050 and 0.045usdt respectively.

So at this point, if the market price goes up to 0.060usdt then immediately my trade will be executed and the TRX will be sold in exchange of the USDT and the stop-limit order will cancelled. But if it goes down to the stop-limit order first, then the trade will be executed here and the limit order will be cancelled.

QUESTION 5

How order book help in trading to gain profit and protect from loss? share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

MY ANSWER

Now this lectures has really exposed us to the different features of the order book and just by going through we have seen the different ways we can utilize the order to avert loss and gain more profit.

Now contrary to the real trade, were u have to be predicting the chart and all, the order book can take that stress off you.

Now assuming as I was watching the market bullish and bearish trend and all of a sudden the market price begins to get to rise to a high level, now rushing to the other book and using the normal market order, you can either place your sell or buy asset at a very instantly and you automatically make your profit.

And then assuming you don't have the luxury of time to be studying the uptrend and downtrend of your chart, so you can execute your trade instantly. Then you can just go to the order book and study the support and resistant records of the book. With that knowledge you can set your stop-limit order. Where your trade either buy or sell will be executed immediately the price tends towards the direction of the price set. And note, since you are the one setting the price for buy or sell if the asset, it is very difficult for the trader to make losses. The problem here is the trade might not get executed due to the market price not reaching this limits. But if it does, then trader is Sure to make profit.

Now another feature of the order book is that will really help a trader avert losses is the OCO. Here the trader combines the limit order and stop limit order. This is very best for traders trading with very volatile assets. Here the first the market favours gets to be executed first. Here the trader avert the problem of the trade not either being executed or making huge loss.

Now it is important to note that, likewise the chat , just looking at the progresses of the order book, you can derive your support and resistance. That's looking at the book and the part were the volume is so muchly on the increase, this shows that the market was on a resistant level and a lot of traders wished to sell off thier assets and vice versa. So the order book by meer observation and study can help you carry out some technical analysis and placing your order accordingly or help in the future prediction of the market price.

Conclusion

The order book from the study has proven to be very useful for traders if they understand the technical know how of the book. It is worthy of note that a proper understanding of the order book and it derivatives and different features can help remove losses and increase profitability of crypto currency trading.

Thank you

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7

Thanks prof..

Have benefited alot..

Correction noted!!