Trading Cryptocurrencies - Crypto Academy / S4W6 - Homework Post for @reminiscence01

Homework Task for @reminiscence01

Hi everyone, I couldn't do my homework in crypto academy because of my lectures at university, but now I'm here. I hope, I can prepare good assignments and give enough understandable information.

Subject:

1). Explain the following stating its advantages and disadvantages:

-Spot trading

-Margin trading

-Futures trading

2). a) Explain the different types of orders in trading.

b) How can a trader manage risk using an OCO order? (technical example needed).

3). Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

4). Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i) Why you chose the crypto asset

ii) Why you chose the indicator and how it suits your trading style.

iii) Indicate the exit orders. (Screenshots required).

HOMEWORK

1- Explain the following stating its advantages and disadvantages:

- Spot trading

- Margin trading

- Futures trading

Spot Trading

Spot trading is the most basic form of investment in the cryptocurrency universe. Spot trading means buying many cryptocurrencies such as Bitcoin, Ethereum, STEEM, and SBD, waiting for them to appreciate, and selling after they are valued. We are free to trade in US dollars or many other currencies at any time according to market trends or our trading strategies.

The token we buy with spot trading belongs to us and we can hold it until we sell it in our crypto wallet or on cryptocurrency markets like Binance, Gate.io and Kucoin. We can hold our crypto assets for years if we want to. We can use spot trading to buy any cryptocurrencies that we think will appreciate in the future. In spot trading, since the asset belongs to us, we can use it however we want. I want to list three benefits of spot trading:

- Cryptocurrency belongs to us.

- We are free to receive Bitcoin or other crypto assets.

- We can use crypto assets as payment for a good or service we buy.

I don't see a downside of Limit Order.

Margin Trading

Margin trading is a method of buying and selling assets using funds provided by a third party. Margin accounts allow users to access larger amounts of principal and make it possible to leverage them. Margin trading allows users to earn more profit from successful trades.

In margin trading, the user has to put up a certain percentage of the total value he bids. This initial investment is called margin and is linked to the concept of leverage. That is, margin accounts are used to create leveraged trading, and leverage defines the margin ratio of borrowed funds. For example, for a transaction worth 100,000 USDT with 10:1 leverage, a capital investment of 10,000 USDT is required. While margin trading increases the profit rate, so does the loss lost when things go wrong. I want to list three benefits of spot trading:

- Serious investments can be made with a small portion of the capital.

- If profit is made after investment, we can make huge profits in proportion to our capital.

- We can trade in positions that we cannot come to with physical trade.

The only downside to margin trading is that when we lose, all our capital is lost.

Futures Trading

Futures trading is an agreement to buy or sell an asset at a certain price in the future. With this process, businesses and industries can be protected from future price fluctuations. Futures trading is very risky for those who are new to crypto trading, but it is a very useful method for those who know the cryptocurrency market well and can do strong analysis. In addition to being useful, the risk ratio is high as it is a predictive system.

Margin Orderi can be considered a kind of gamble, so we may lose capital.

2- a) Explain the different types of orders in trading. b) How can a trader manage risk using an OCO order? (technical example needed)

a) Explain the different types of orders in trading.

In cryptocurrency trading, a user or trader can trade however they want. There are different order types for these trades. These order types are as follows.

Market Order

Market Order is the fastest and easiest way to place an order because after entering the amount of money you want to spend, you can instantly buy any cryptocurrency asset by pressing the buy/sell button. When you buy with Market Order, the exchange you buy from will buy-sell at the best price for you. People who make this transaction are called Market Takers. This type of order is usually made by people who are new to the world of crypto money or people who need to take action urgently.

Pending Order

Pending Order enables the trade to take place when the price reaches the level determined by the user in the market. People who use pending orders are generally those who do technical analysis, constantly follow the developments about the assets they trade, and consciously use the assets and exchanges they trade. There is more than one type of pending order. These variants are: Limit Order, Stop-Limit Order and OCO Order. Let's see these order types in order:

1- Limit Order:

Limit Order is a transaction that users make by setting a price and entering the value of the asset to be bought or sold. So, for example, we want to buy 10 USD worth of STEEM and the instant price of STEEM is 0.5892 USD. We, on the other hand, would like to purchase STEEM for 0.5500 USD. We must write the price we want in the necessary places on the purchase screen. This order will be executed when STEEM's price drops to our desired price (0.5500). Likewise, in selling transactions, the transaction will take place when the price of STEEM reaches the price we set. (STEEM is just an example, this order type applies to all crypto assets.)

2- Stop-Limit Order:

Thanks to the Stop-Limit Order, we have a chance to avoid a big loss. This order has both a stop price and a limit price. The stop-limit order triggers the limit order when the stop price is reached. The stop price of the **stop-limit **order can be above or below the current price. When the current price rises or falls to the determined price, the stop-limit order is triggeredand the transaction is realized by turning into a limit order. The limit price can change above or below the stop price for both buy and sell orders.

3- OCO Order:

It is possible to avoid many risks in the market by using Oco Order. In this order, we can say that two limit orders are placed at the same time. One of these orders is Limit Order and the other is Stop-Limit Order. However, there is a situation like this; when one order is fulfilled, the other order is cancelled. Likewise, when an order is canceled, the other order is also cancelled. So, let's say we made an OCO Order at night and slept and the Limit Order in this order was executed, the Stop-Limit Order will be cancelled. Likewise, Stop-Limit Order has been executed, Limit Order will be cancelled. In this way, when there is a decrease in the market, we will not suffer much loss and when there is an increase in the market, the rate of profit we will earn will increase.

Exit Order

Exit Order is divided into two, one is Stop Loss Order and the other is Take Profit Order.

1- Stoploss Order:

In Stoploss Order, a warning order is given before an asset that has been invested in the long term reaches a certain price. Stoploss Order helps us protect our capital during market crashes. The Stoploss Order is a somewhat risky order and therefore dangerous to use without proper research.

2- Take Profit Order:

Take Profit Order is used to exit a position when the price of an asset is in our favor. In other words, when we make a profit for us, it allows us to keep that profit. Thanks to this operation, the profit is automatically reserved.

b) How can a trader manage risk using an OCO order? (technical example needed).

Using OCO Order is a task that anyone who has used cryptocurrency exchanges for a short time can easily do. Because, if you know Stop-Limit Order and Limit Order, you know OCO. As I explained in the previous question; In the Stop-Limit Order section, we enter the lower price as we normally use the Stop-Limit Order, and in the Limit Order section, we enter the upper price as we use when using the Limit Order in the normal time.

In this case, if the cryptocurrency we are trading drops to the Stop-Limit Order price that we set, we will sell the amount of the asset we set and the Limit Order will be canceled, so if the decline continues, we will be saved with little loss. On the other hand, if the cryptocurrency we are trading rises to the Limit Order price we set, we will buy the amount of the asset we set and the Stop-Limit Order will be cancelled. In this way, while the rise continues, the amount of units we have will increase and the rate of profit will increase. We can apply these procedures for Buy or Sell.

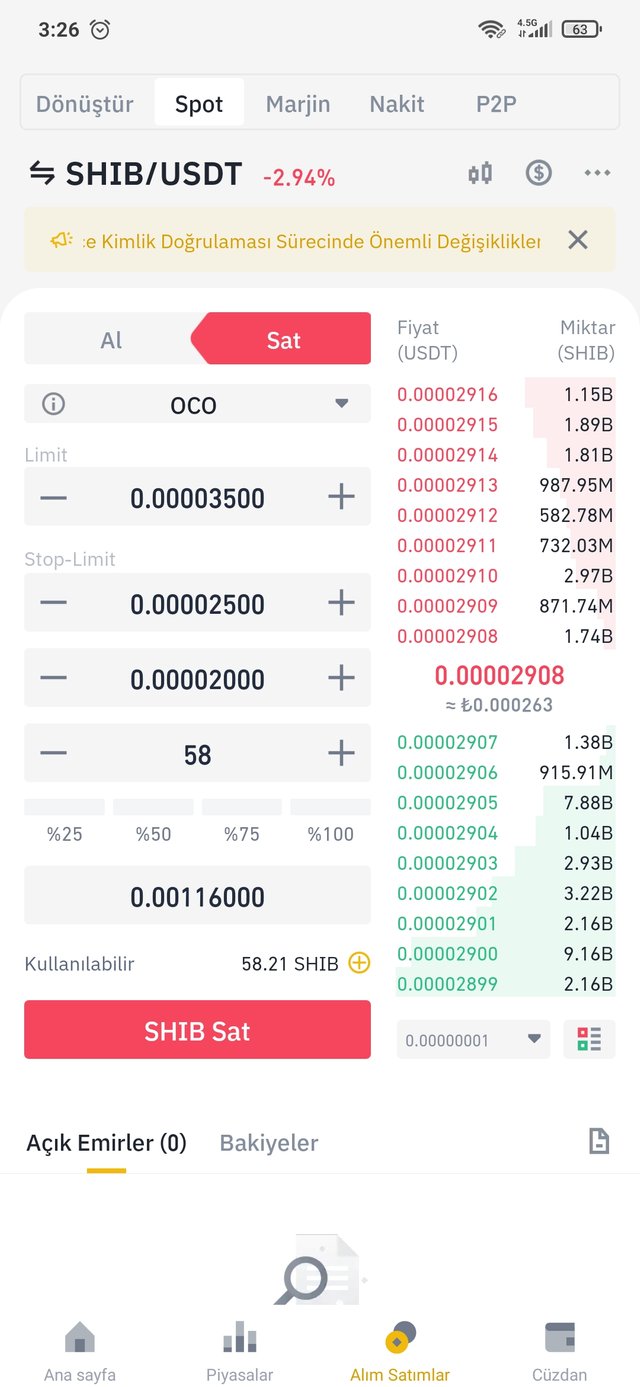

As seen in the screenshot, I entered a Limit Order to sell SHIB at 0.00003500 USDT. On the other hand, I set a Stop-Limit price from the Stop-Limit section. If the SHIB price becomes 0.00003500, the Limit Order will be executed and the Stop-Limit Order will be cancelled. If SHIB price is 0.00002500 Stop-Limit Order will be executed and up to 0.00002000 Stop-Limit Order will be executed and Limit Order will be cancelled.

3 - a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

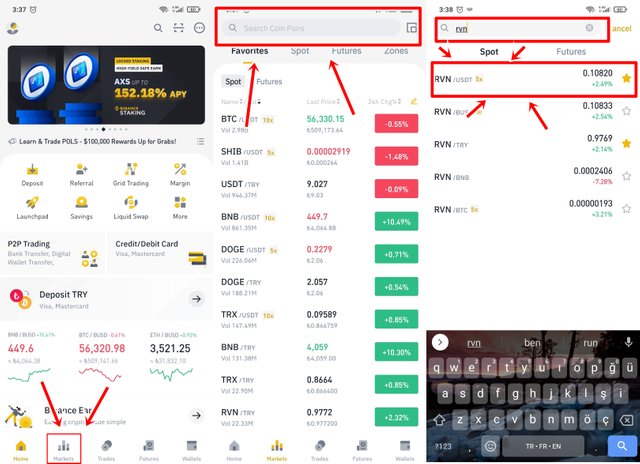

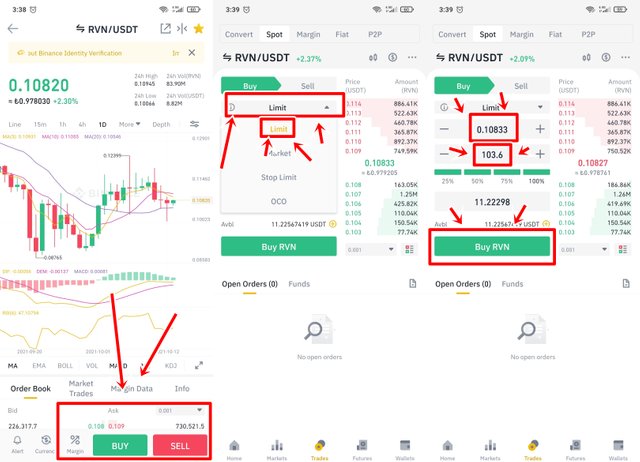

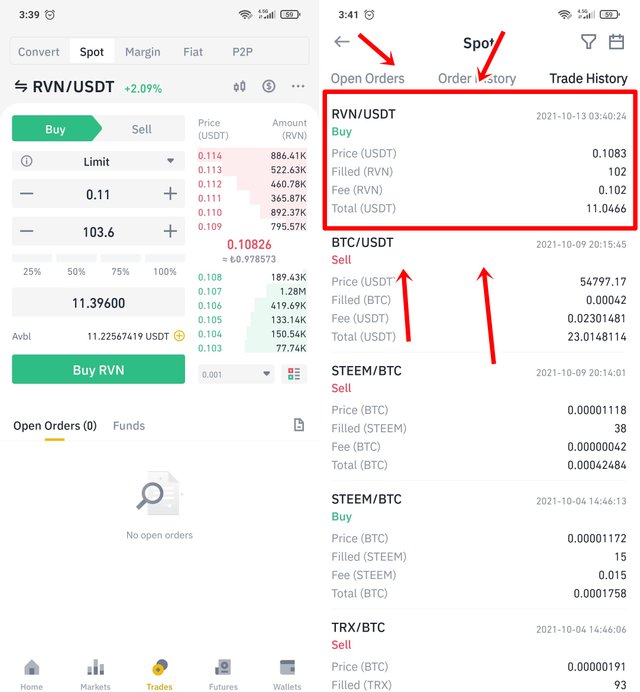

In this question, I will explain with https://www.binance.com/. The first thing we need to do is open a **Binance account **or log in to our account. Then we click on the Markets section at the bottom of the screen. On this page, we choose a crypto asset that we want from the top section. From the page that opens, we click on the Buy or Sell button according to the operation we want to do. We select Limit Order from the page that opens and then enter the amount and price we want to buy and click the Buy button. Since I set the price without changing the market price much, my transaction was carried out quickly. You can follow the processes in order from the screenshots below.

4 - Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

- i) Why you chose the crypto asset

- ii) Why you chose the indicator and how it suits your trading style.

- iii) Indicate the exit orders. (Screenshots required).

Why you chose the crypto asset?

I chose the STEEM/BTC pair because we currently use the Steemit platform and are interested in STEEM. I also learned that STEEM will be used in the BSC network, working with a new blockchain recently, and my trust in STEEM, which I have already trusted, has increased even more. That's why I chose to use the STEEM/BTC pair.

Why you chose the indicator and how it suits your trading style?

I chose to use the indicator named Ichimoku Cloud because I made a lot of profit thanks to this indicator before. I used to trade a lot 5 or 6 months ago and I used this indicator the most because it is very easy and convenient to use.

In this chart above, I will briefly explain which order I should place with the Ichimoku Cloud.

Sign 1: Here is a sell signal as prices cut Kijun-Sen down.

Sign 2: Here is a sell signal as prices remain below the cloud.

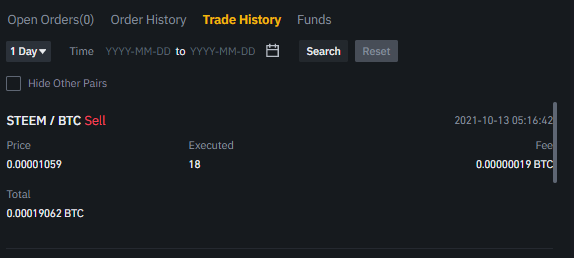

The Ichimoku Cloud signals almost clearly with such simple signs. This is how I've always won. I sold STEEMs because there are 2 sell signals in the chart above. (Since I could not open a demo account, I traded from my own account on Binance.)

If prices are below the cloud on the Ichimoku Cloud, it is a sell signal, and at the same time, if prices cross the Kijun-Sen downwards, it is also a sell signal. Based on these, I made a Sell Limit Order and I trust my transaction.

Conclusion

As a result;

- **Each Order type **has separate features, but some Order types can contain each other.

- New entrants to the crypto asset market can use Limit Order or Market Order.

- Margin and Futures Trading are more suitable for people who know this business really well.

- With Margin Trading, big profits can be obtained with small capital, but the risks are also high.

- Although Futures Trading requires guessing after analysis, it still looks like a game of chance.

- We can make technical analysis and profit by using the necessary indicators that are suitable for us.

References

CC: @reminiscence01