The Bid Ask Spread (Part II)- Steemit Crypto Academy- S4W3- Homework Post for @awesononso

Thank you professor @awesononso , this course is very educative!

1. Define the Order Book and explain its components with Screenshots from Binance.

Order book is a list of trades, either manual or electronic, that an exchange uses to keep interest of market in a definite security or financial tool. Shares are commonly listed in an order book price level and by volume.

Order book is real time updated because it’s a necessary indicator of the market abyss. The trades amount at any given time and this is the reason why they are called a ‘continuous book’ at times.

Order books can also know the buyers and sellers that's behind each self-standing exchange. So, some partakers decide to work in dark pools, which are batches of trades that are hidden away from the order book. This makes it hard to know if the positions are taken being by a person or institutions.

Component of order book

- Buyer's side and seller's side

- Bid and ask

- Prices

- Total

- Visual demonstration

Buyer's side and seller's side: order book stand as market recorder, so it include buyer's side and seller's side; the two partakers in a market

Bid and ask: some order book use bid and ask instead of using seller's side and buyer's side. Buyers “bid” for a specific number of shares at a thoroughly explained price, while sellers “ask” for a certain price for their shares

Prices: Order book records the interest value of both Bid and ask. The number in anyone of them columns would represent the amount they bid or ask for and at what price.

Total: The sum columns are the pile up amounts of the specific asset that's sold from different prices.

Visual demonstration: with Visual demonstration, reader can easily understand the overall market demand and supply.

2. Who are Market Makers and Market Takers?

Market Maker is a person that cite their own price in a market. Market Makers don't need to have their orders filled at the market price that's present because they specify their choice price level to the exchange. They are the ones that buy at the Bidding price and later sell at the Ask price.

Market Takers are the ones take take market order without hesitation. They actually take the market the way it is without argue on the price. In order words, they do not wrangle. So, they buy at the Ask price and Sell later at the Bidding price.

3. What is a Market Order and a Limit order?

Market order is a type of order that is filled instantly and at the current market price.

Market order is an order to purchase or sell a stock at the best available price. Market order usually guarantee an execution, but it does not guarantee a thoroughly explained price. Market orders are optimal when the number one goal is to perform the trade instantly.

Limit Order is an order that is placed for a specific amount of an asset to be bought or to be sold at a certain price. Once it's placed, they would be arranged on the order book until it's filled.

Limit order is an order to buy or sell an asset at a particular price or a good price.

Limit order is to Make trade when the price is right

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

You explained that the Limit orders initiated by the market makers gives liquidity for an asset. Many Limit orders mean many standby orders at any price. So It means that there would be a market ready for the Market Takers and Market orders can be filled easier and more thoroughly. So, market takers would come in with their market orders and matched to the limit orders. Once they matched, market takers take the price of the market makers and both orders would be filled.

In a simple statement, market makers provide s liquidity, so, market takers takes the liquidity.

The two order types are Limit order and Market Order

5. Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

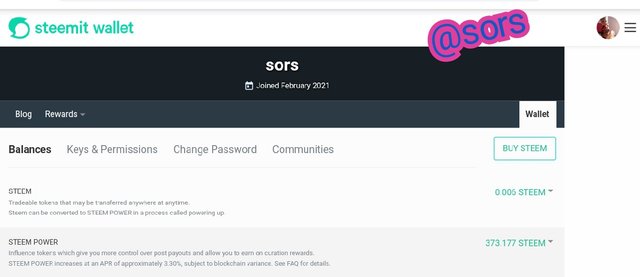

Here are rye steps by steps on how I placed the order

1

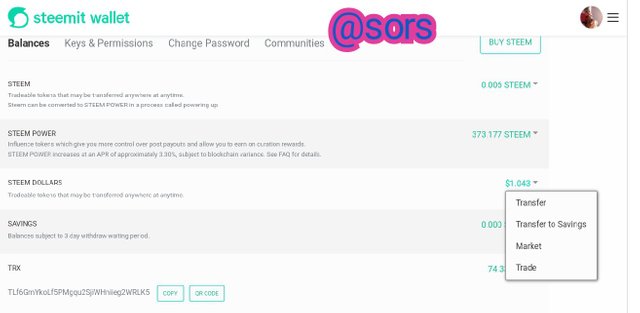

2

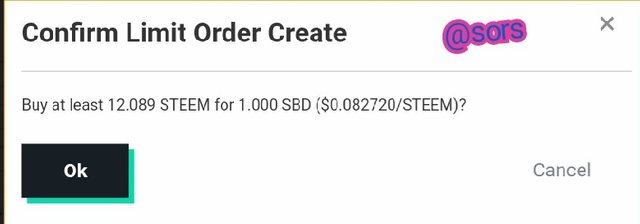

3

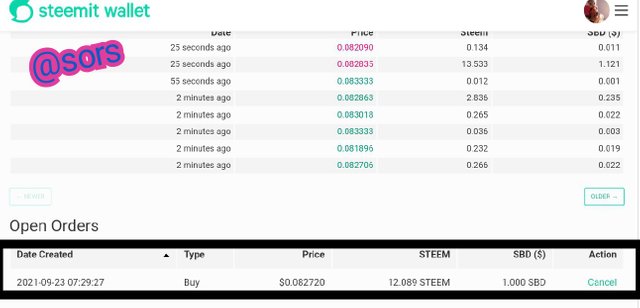

4

5

Was it instant

Yes it was instant because I accept the lowest ask and I have enough balance on the order I placed, SBD price is higher than the steem I want to trade it with. After trade, it gave me 12.05 steem

Changing the lowest ask

When I changed the lowest ask, the price of sbd I would trade it with increase, which means the price us already fixed there, it can't be changed

The exchange stand as a market maker and I stand as the market taker

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

On the binance mobile App home page, go to trade, then click on it

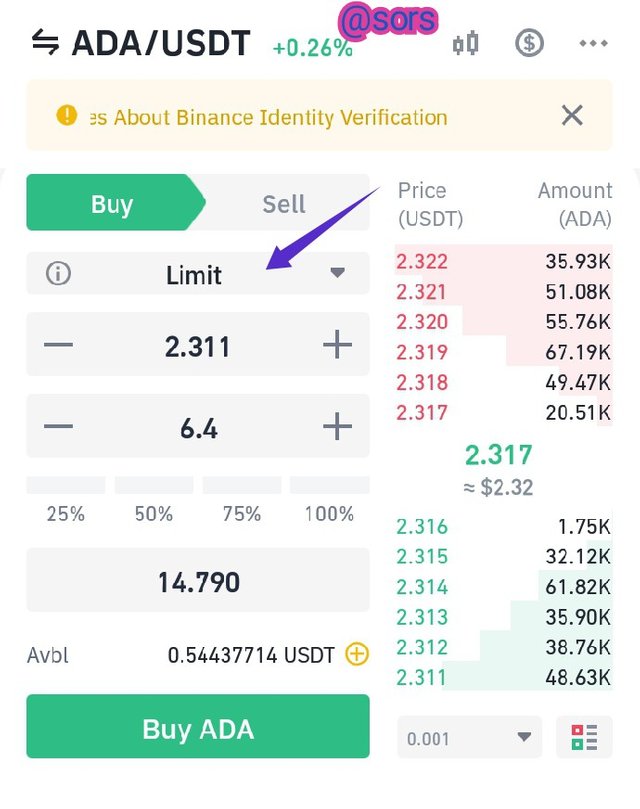

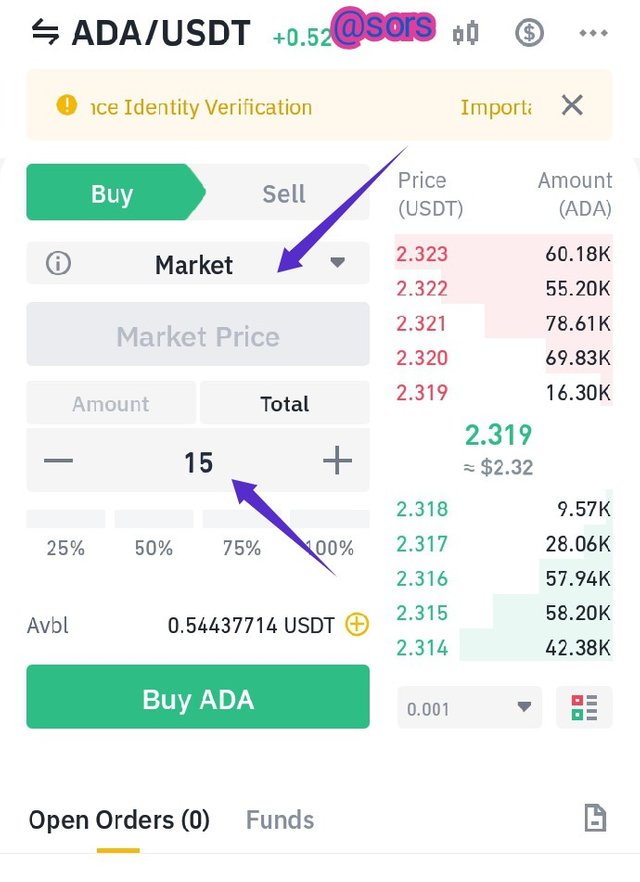

After that, you'll see where your last trade is, if that's not the trade you want, you'll search for the trade you want for yourself. In the below screenshot, I want to make TRX/USDT trade; Buy limit. So I clicked at the place the arrow is to choose Buy limit

But I can't buy due to low balance on my walket

7. Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

But I can't buy because I didn't have enough USDT so I can't know the impact of my order in the market but any order would surely make change in the market

8. Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price

To calculate the Bid-Ask: (Lowest ask - highest ask and answer)x100

Lowest Bid is 2.391

Highest Bid is 2.369

(2.391-2.396)x100

-0.005x100

= -237.209

Bid-Ask = -237.209

B

The highest bid is 2.396

The Lowest bid is 2.391

The mid-market value is (Highest Bid = Lowest Bid)/2

(2.396=2.391)/2

4.787/2

= 3.5915

Mid-market price = 3.5915

Conclusion

Professional traders apply the Order book in their trading but new traders may not know what it means. Limit order, marker takers, market traders works in different ways, they have each of their roles in the market so they have to be considered as too in trading

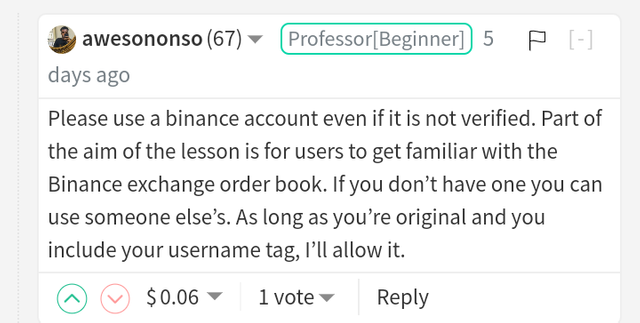

NB

You said in the comment section of the course post to use Binance, because part of the course is to get familiar with Binance exchange order, that's why I did number 7 and 8 so as to prove that I'm familiar with Binance exchange order

Thanks for stopping by

Hello @sors,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You mostly paraphrased the lesson and other sources too. You really should try to be as original as possible when you write.

You did not perform questions 6 and 7 and so the presentation is incomplete.

Thanks again as we anticipate your participation in the next class.