Risk Management in Crypto Trading - Crypto Academy / S5W7- Homework Post for @reminiscence01

What do you understand by "Risk Management"? What is the importance of risk management in Crypto Trading?.

Trading comprises the use of technical analysis, fundamental analysis, and risk management strategies in executing a trade for a better and profitable cumulative trading outcome.

So with the following bases, I would be talking more about risk management, this is so because risk management is the core foundation of every trade, let's continue!

RISK MANAGEMENT

Risk management is considerable procedures and techniques put in place when trading, which enables traders to maintain losses at a minimal rate by keeping a favorable risk-reward ratio.

The strategies put in place by risk management hinder traders from losing all their capital.

Risk management is applied by both new and professional traders, this is because it is the basic and the foundation of trading. Trading without a guide and control is like driving a car without break. We can tell how risky it is to drive without a break, one can lose his life.

The same thing applies to risk management in trading, a trader has a high tendency to lose all his capital without the strategic application of risk management.

Risk Management helps traders to set up their stop-loss, take-profit, and risk/reward ratio in other to avoid much, or rather the loss of capital which is as a result of poor or no risk management strategy.

Now, understanding the concept of risk management, we would be looking into the importance of risk management in cryptocurrency trading.

IMPORTANCE OF RISK MANAGEMENT

Risk management is important in trading in the sense that it helps traders minimize their losses in trading and also maximize their chances of making a profit.

As I said earlier but in a different sentence, risk management is the key in carrying out a trade. Every trader makes losses in trading sometimes, but the rate of losses made is minimized and controlled with risk management.

- Risk management can also mean conserving your capital. It helps traders in examining their trade size, setting their take-profit, stop losses, and applying a favorable risk-reward ratio.

- Risk management aids traders in positioning a rational-sized trade that is in consideration of their account fund(capital).

Explain the following Risk Management tools and give an illustrative example of each of them.

a) 1% Rule.

b) Risk-reward ratio.

c) Stoploss and take profit.

Risk management comprises three significant tools which traders observe in other to make an effective and potential risk management strategy. These tools comprise the 1% rule, risk-reward ratio, stop-loss, and take profit. I would be explaining and analyzing the following tools of risk management.

All successful traders make use of risk management, so they don’t risk much on a particular trade.

They can risk at most 1-3% of their trading capital on each position opened, this saves them from losing all their capital and as well from blowing up their account when they encounter any loss.

As I said earlier, making a loss in a trade is not bad, that is a norm, but how detrimental the loss could be is minimized with the 1% rule, which is risk management.

Taking for instance; I have a $500 account in trading, I would risk just 2% with 2 opened positions.

i.e $10 × 2 = $20

Assuming I make 4 losses at a straight,

:- $20 × 4= -$80,

My capital balance would be

= $500-80 = $420.

From the above instance given, we would see that even as I have undergone 4 losses at a straight, I still have a reasonable trading capital which I can use in making up my losses by taking another chance in the market.

But if I had risk like 10% of my capital with 2 opened positions, losing 4 trades in a row, it will set my trading capital to -$400.

If I should decide to enter back the market quickly, in other to recover my losses I might end up losing all my capital. Trading is all about controlling your emotions and sticking to your risk management strategy properly.

Now we can see that the 1% rule can help save our trading capital even on the worst trading days. So I would advise that we make sure to risk just a fraction of our capital on each position opened.

The risk-reward ratio is another tool that makes up a risk management strategy. Due to crypto market fluctuation/volatility and poor risk management trades could go in profit and the next one would take the profit made.

risk-reward ratio involves knowing and marking the stop-loss and take-profit positions. It is advisable to put your risk-reward in a ratio of 1:2 on any opened position.

What do I mean by this? In an open position, we are advised to make sure that our take profit is twice our stop-loss.

Let's take for instance, assuming we are risking (stop-loss) $10 on an opened position, our take profit target should be at $20.

Opening trade with a 1:1 ratio is unprofitable and a bad way of trading in the cryptocurrency market, this is what most novice traders do.

The crypto market is always open on a 24/7 hr basis for all traders, so it is unnecessary to chase the market at all times. In trading, it is advisable to have self-control over your emotions, as emotions could lead a trader into making a lot of regrettable mistakes.

Any trade setup of risk-reward ratio at 1:1 is not worth the risk.

Having a good risk-reward ratio increases the trader's winning ratio which keeps the trader in profit even when they encounter losses.

Take profit and Stop-loss are the two ways in which a trader exits the market automatically. This is “automatical” because the trader does not need to manually close the trade, but the market automatically, on its own due to the settings (sort of instruction) implemented on the trade closes or exits the trade.

When we talk about Stop-loss, it is an exit order in the market that closes an opened trade but at loss, and this is when the market drives against the trader's prediction.

Furthermore, the take profit position is also an exit order in the market that closes an opened trade but at profit, and this is when the market works in favor of the trader's prediction.

A trader should bear in mind that the market has every tendency to go against their prediction and as well in favor of their prediction. And this is because of the highly volatile nature of the crypto market. That is why traders set up their trades with the implementation of take-profit and stop-loss so that the market does not come down to their entry point or enter a negative trade after it must have delivered a positive trade- for take profit.

Also, the stop-loss is applied to protect the traders' capital in case the market goes against their prediction, to minimize their loss %.

Traders should understand that the stop loss should also be in consonance with how much they are keen to risk from the opened position and that their take profit is twice their stop-loss.

Adjustment of opened position in trade(trading lot size) is advisable to give room for the placed trade to play out.

There are Strategic places where a trader can place the stop-loss and take profit in the market, the include; the support area, the resistance area, market structures, moving averages, trend lines, and channels.

These targets can also be set with the use of technical indicators like the Average true range( ATR).

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required).

a) Trend Reversal using Market Structure.

b) Trend Continuation using Market Structure.

TRADING CRITERIA:

firstly, I analyzed the market in other to study and understand the market structure.

Then I ensured that the price failed to create a new high. I waited for the price to reverse back down in other to break the previous low formed, which ascertains the break of market structure.

After the break, I waited for the price to retest the broken low in other to form a resistance. After the retest as we can see in the image below, I waited for the formation of the bearish engulfing candle.

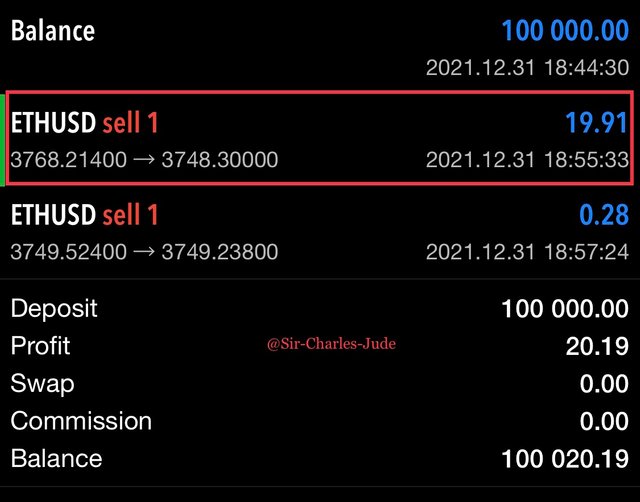

Here, we would realize that I entered the trade late, it should have been at the bearish candle that retested the broken structure. This was due to my network & phone issue. nevertheless, I still executed my trade by entering (selling) the market at the price of $3768.21.

I placed my stop-loss directly above the break of structure, which was at $3786.0. And my take profit at $3748.324 as we can see in the image below.

1% RULE:

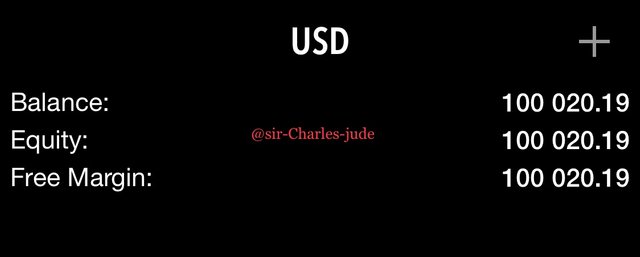

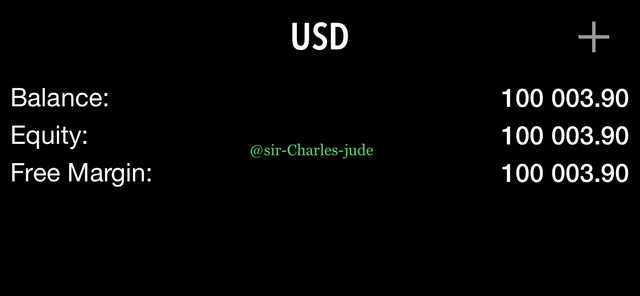

Okay, following my account analysis which I started with a demo account of $100,000, I observed the 1% rule by the following.

I risked 1% with 1 opened position.

I.e 100/1x100,000

= $1000

= $1000x1 = $1000

:- $100,000-$1000

= $99,000

Risking 1% of my capital, I still have $99,000 which could give me another chance in the market if anything goes wrong.

RISK-REWARD RATIO

My risk-reward ratio was 1:2, therefore I placed my stop-loss at $3786.0 and $3748.324 respectively.

So, concerning the above trade, after my analysis and trade execution, I realized a profit of $19.91

TRADING CRITERIA:

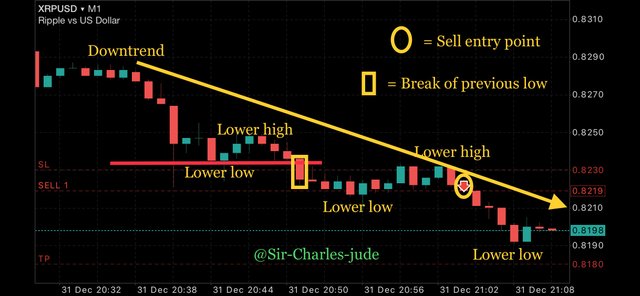

I analyzed the market in other to determine the market trend whether it was an uptrend, creating higher highs and higher lows, or a downtrend creating lower highs and lower lows.

I realized it was a downtrend, therefore I waited for the price to retrace, forming a lower high point which is lower than the previous lower high as illustrated below.

Then I took a sell trade at price $0.8219 as the price retraced back down with a bearish engulfing candlestick.

1% RULE:

I risked 1% of my capital with 1 opened position.

I.e 100/1x100,000

= $1000

= $1000x1 = $1000

:- $100,000-$1000

= $99,000

Risking 1% of my capital, I still have $99,000 which I can use to enter the next market if anything goes wrong.

RISK-REWARD RATIO:

My risk-reward ratio was 1:2, therefore I placed my stop-loss at $0.8230 and my take profit at $0.8180

So, concerning the above trade, after my analysis and trade execution, I made a profit of $3.90

Risk management is vital to trading, for proper risk management yields a positive result. Even at the worst time of trading where the market goes against the analysis of the trader, the trader is still protected and covered from making a loss which could be detrimental to the account.

Risk management helps minimize the rate or loss % ascertained in a trade. It is advisable to set good risk management in other to feel confident and courageous when entering the market.

About the market structure analysis, it is not even advisable to use a single indicator and a standalone in analyzing the market, talk more of using the market structure.

It is advisable to make use of at least two technical indicators with the market structure analysis for real-time trading in other to build your confidence in the market and as well affirm a positive result.

Thank you and Happy new year 🎄

Cc:-

Hello @sir-charles-jude , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Hello @sir-charles-jude the minimum requirement to participate in club5050 is 150 Steem. You failed to meet the minimum requirement.

What if i power up now so I can meet the requirement, can it still be marked?

I have the available steem. If I power it up now, will the post be marked? @reminiscence01

@reminiscence01 I have powered up. I now meet the requirements

Alright.