Steemit Crypto Academy Contest / S5W6 - My cryptocurrency portfolio.

Background Image Edited on Canvas

Hi, steemians,

I welcome you all to my entry number 7 in this last week's engagement challenge for season 5. As we all know every participant in the engagement challenge is expected to enter the engagement once a day for the rest 7 days beginning from Monday to Sunday. I have made one entry each day of the week and that is what made this entry the last for the week.

I welcome you all to my entry number 7 in this last week's engagement challenge for season 5. As we all know every participant in the engagement challenge is expected to enter the engagement once a day for the rest 7 days beginning from Monday to Sunday. I have made one entry each day of the week and that is what made this entry the last for the week.

There are always quite interesting contests in this season's engagement challenge and this last week is not left out. The topic we are looking at this week is titled My cryptocurrency portfolio. Every crypto trader has a portfolio and on this day I will be sharing with you my crypto portfolio and my understanding of the said term. I will do this by attempting the questions given below. Let's get started.

Every crypto asset is stored in a wallet. This simply means that all crypto traders have a wallet where they store their assets. Wallets are placeholders for crypto assets and they can hold as many crypto assets as possible depending on the exchange where you have these wallets.

In very simple terms, we can see a cryptocurrency portfolio as the list of all the crypto asset one has in his/her wallet within a given period. So the asset stored in our wallets makes up our portfolio. These assets may be those we bought with the mindset of holding them for a long period or the ones we bought to trade them once we have a little push-up in the price to maximize profit.

Our crypto portfolio talks about all we have as crypto assets be it the asset we are holding at the moment or the asset we are staking at the period. All we have in the wallet make up our portfolio. At the time of carrying out this task, I dashed into my Binance exchange wallet and discovered my portfolio has been grouped into 3 categories I.e earn, spot and funding.

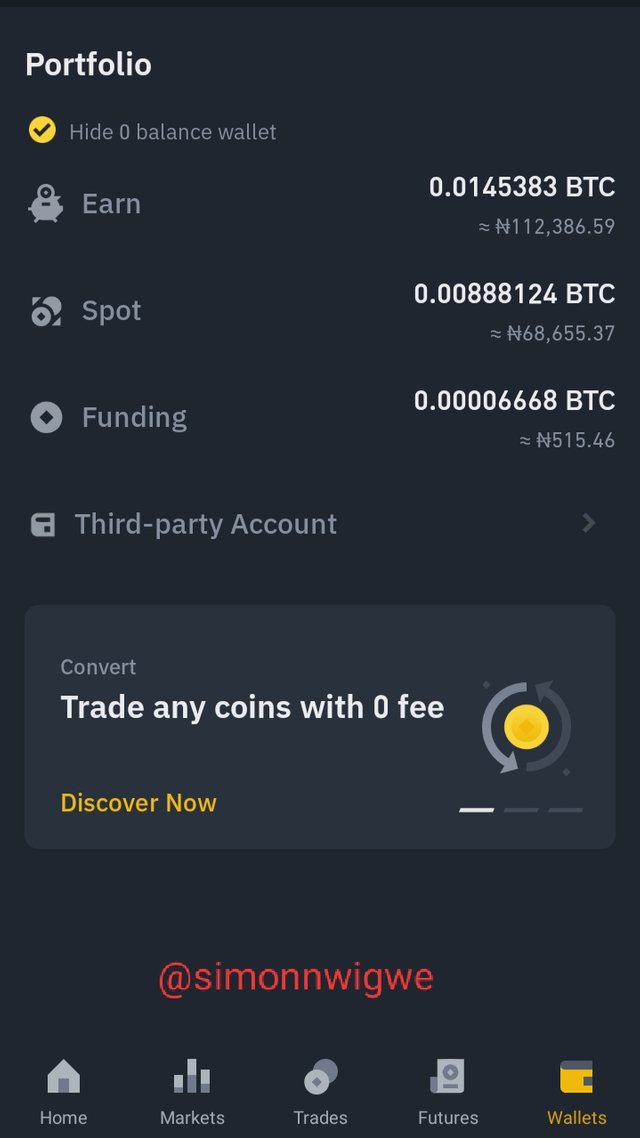

My portfolio on Binance

The sum of all my staked assets is seen on the earning part of my portfolio, whereas the asset I'm holding at the moment without staking is seen at the spot part of the wallet. Lastly, the funding part contains the asset I can withdraw at any time. The screenshot above shows what I have just mentioned. A few lists of the asset that makes up the amount in my portfolio is also seen above.

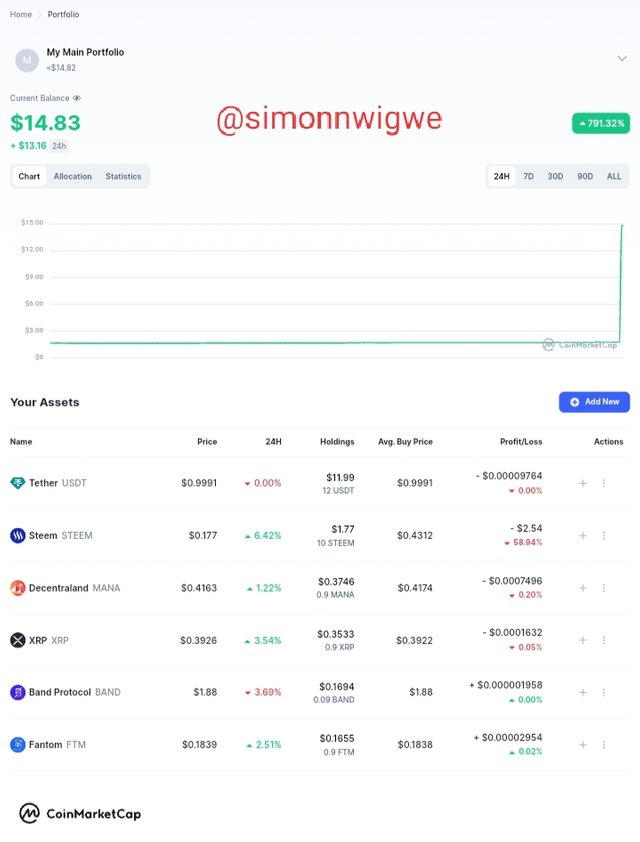

My portfolio on coinmarketcap

Apart from seeing your asset in an exchange, platforms like the coinmarkertcap also have a unique feature where traders can monitor their entire asset from different exchanges. All you need is to create an account and add the tokens you wish to monitor and the number of tokens you have. You will see the price movement and then you can know if you are making a profit or a loss at any point in time. The above image is my portfolio on coinmarketcap.

The word diversified portfolio simply means that the crypto investor spread his or her investment on different crypto assets I.e such an investor has different types of crypto assets in his or her possession either holding them or even staking or trading them. The simple explanation for this is that such a trader does not concentrate on just a particular asset but he focuses on as many assets as possible.

This is a very good way to manage risk in the crypto world because should in case one of your assets goes bankrupt just like in the case of Luna, you can still bounce back since you didn't put everything on Luna alone. So diversifying their portfolio keeps investors safer in the crypto space.

A concentrated portfolio is the direct opposite of a diversified portfolio. As I have explained above, in a diversified portfolio, a trader gets himself involved in different crypto assets whereas, in a concentrated portfolio, traders only focus on one or two crypto assets. Many traders hold only one or two assets and don't have the knowledge of having more assets and that is why a lot of money was lost during the Luna crash.

A friend of mine invested only in Luna, and within a few periods, he saw his investment of over a million crumbling. It is not always advisable to focus on a concentrated portfolio since you can not predict what next will happen in the crypto space. When the market of such a coin is going bearish, you don't have any other coin that will encourage you since you only focus on one.

With that being said, I prefer the diversified portfolio over the concentrated portfolio. In a diversified portfolio, traders can have more returns since they have invested in multiple crypto projects and also, and the risk of losing everything within a blink of an eye is also eliminated.

Yes, I have some crypto assets in Hodl. Holding in cryptocurrency refers to a situation where a trader buys or invests in an asset for a longer period. The crypto investor here studies particular crypto and then sees the potential of the asset in the future and then buys and holds it until the said price of the asset appreciates to his or her satisfaction before the assets can be traded.

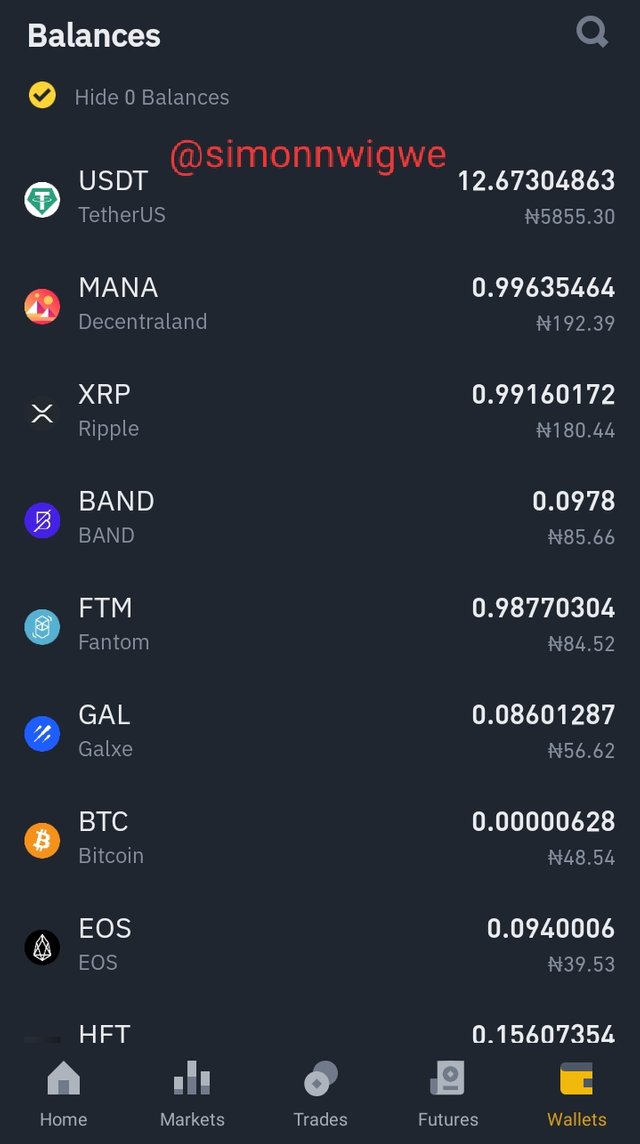

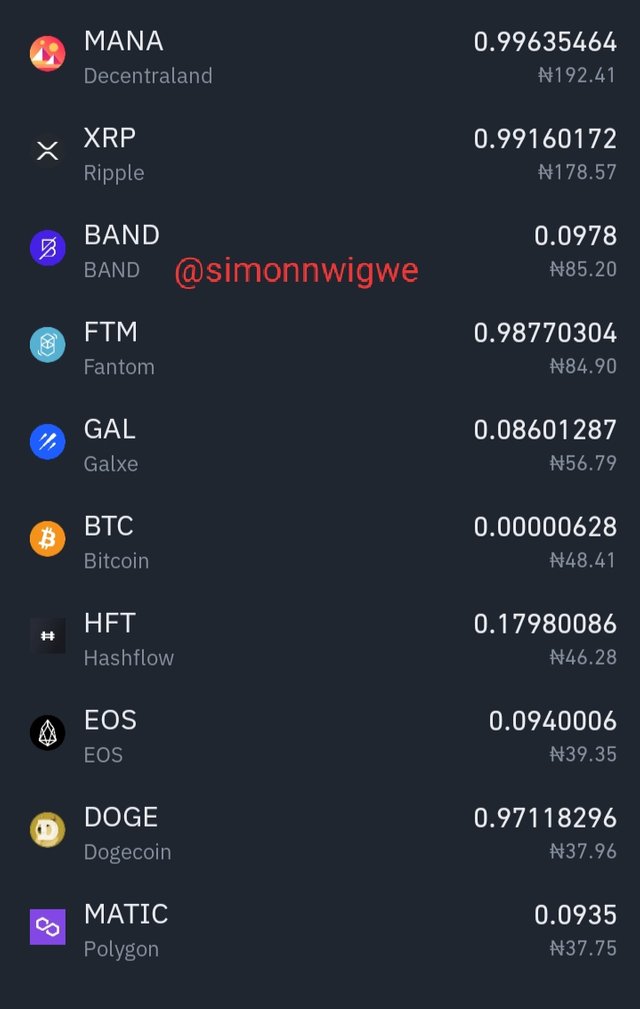

Crypto assets in Hodl on my Binance wallet

From the above screenshot, the asset seen is all the asset that is currently on hold in my portfolio. Most of the coins seen above like Galxe, Hashflow etc, are few coins I believe will the prices will appreciate in the nearest future so I intend to hold them till that time comes.

Yes, I have some crypto assets in staking here in my portfolio. The word staking refers to the process of locking an asset for a particular period and then in turn you earn some percentage interest for doing that. The essence of staking an asset is to add liquidity to the pool. It is important to mention here that during this period of staking, these assets can not be used.

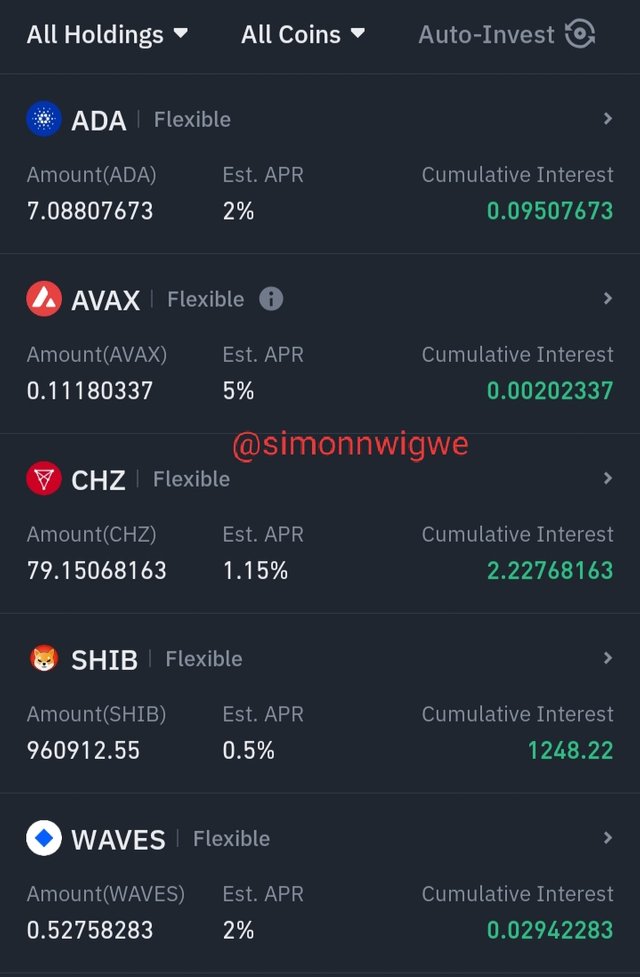

My staked asset in my Binance wallet

From the screenshot above, you can see the list of all the assets I have been able to stake and their cumulative interest as well. Once the period of staking elapses, the asset and the cumulative interest will return to the holding in my wallet.

Based on the explanations given above, you will agree with me that holding a coin does not increase the number of assets you have in your wallet, you only wait for the price to appreciate. Secondly, holding a coin and earning profits takes a longer time but staking a coin gives you instant interest. With the whole of these points listed above, I want to say I prefer staking to hodl.

Staking helps to put your asset to work for you while you sleep. Holding does not add anything to your portfolio but staking adds cumulative interest. In Binance launchpad, you can even earn a new token by staking a few tokens during the IEO process. I have been able to earn a few new coins by staking some of my crypto assets as well. So I prefer staking to holding.

A cryptocurrency portfolio helps all crypto users to know the amount and the types of assets that are currently in their wallets. They can decide to monitor the movement of these assets using tools like the coinmarketcap. Staking and holding are two dimensions of our portfolios, one may decide to hold a certain asset with the belief that the price will appreciate with time. In staking, you lock your asset and earn cumulative interest and sometimes, when you participate in launchpad you can earn new tokens as well.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

You have share a really nice post with is boss. Many investors prefer to hold their assets over staking, because by holding onto a cryptocurrency, you give it a chance to increase in value over time. It's important to know when to sell cryptocurrency, but you should also understand that this can be risky because the price of the coin might go down instead of up.

Thanks for sharing friend, and goodluck in this contest. #steem-on.

I will appreciate if you equally engage on Mine

You did great explanation about crypto portfolio, you have a list of coin with Hodl and in stakes. I'm a beginner and don't understand to invest in many coins, I choose only those are familiar to me (me as 4-5 crypto coins)

You are right appearantly staking is better than Hodl, but my choice will always Hodl over staking.

You made a great contest entry, best of luck for the contest.

I appreciate your efforts

Well written