Crypto Academy / Season 3 - week 8 / Homework Submission post for Professor @yohan2on / Risk Management in Trading / by @shahzadprincejee .

Hi to all my steemian friends . Hope you will all well by the grace of Allah Almighty . I am also fine . It's my pleasure to participate in this homework task . I am grateful to professor @yohan2on for this an amazing lecture . It is the great opportunity to gain knowledge from the crypto class . As we know that we have learnt a lot of things from the crypto classes by sharing the expert professors . They provided the lectures and enhance our skills . Now i will explain the interesting topic of "Risk Management" .

1.Define the following Trading terminologies;

Buy Stop

The buy stop orders can be serve a lot of purpose in the trading . The buy stop order can be used to protect to against the unlimited losses in the trading . It is an order to purchase the security when it reached the specified stop prices . It can be applied to the derivatives , forex and many of others tradable assets . It is often reffered to as a stop loss orders . It is commonly thought that the many of investors apply this strategy to protect against the potentially unlimited losses of short position . It can help to the traders/investors to limit the existing loss and cover up the profits on the stocks . Now we will see an image to simple understanding about the buy stop .

Source

Sell Stop

This order is placed when the market price is currently on the sell . We can consider it to the opposite of the buy stop . The sell stop will be dictate to the third party (broker) to gain a security . When the prices will be reached at this level then the deal will be completed instantly as in the trading strategy . Sell stop order is changed and trends of the existing market price . Now we will see the image to understand the sell stop order.

Buy limits

Buy limits control prices but can result in missed chances in fast-moving market situations . A buy limit order on the particular price to purchase the coin at the below specific price , it is also called the present market price . It helps to the traders to select that how much they want to pay . People said that they will buy a coin at the lower prices than the current rate . It is totally different from the current market prices . Limit buy orders are most beneficial in the unstable markets.

Sell limit

Exactly the sell limit is opposite to the buy limit . It will execute at limit price or higher . It helps to us for specify the price . When the stock's price will reach to the stop price then it will be execute to next market price . It allows to trader that he set at the specific price . When the price will get their destination then it will sell automatically . The order will only trigger if the price will reach to that level. It's important to use to purchase an asset at cheaper price than the current market price . To use this strategy , we can make our trading easier . Now we will see image in below page .

Trailing Stop

Trailing stop order modifies the typical stop order . It can be set at the defined percentage from the current prices of the markets. Now we will talk about the long position and the short position . First of all, we will explain the long position . In the long position , a trader places the trailing stop order below the current market prices . On the other hand , for the long position a trader places the trailing stop order above the current market prices . It is designed to lock in profit and moves the trade favorably . It only moves if the price moves favorably . When it had moved to lock in profit and reducing the losses one time then it will not move back in the other different directions .

Margin Call

When we trade with our assets , normally in the market or with a broker we can get benefits from our position . Margin call happens when the value of the investor's margin account comes under the broker's required amount of assets . A margin call refers to broker's demand . A margin account contain securities purchased with borrowed money . Margin call occurs when the margin account run low on the assets because of a losing trade . Margin call is the indication that the value of securities clutch in the margin account has reduced . Brokers can force to trader for selling the assets . Now we will see image below .

Practically demonstrate your understanding of risk management in trading.

Risk Management is process to assessing and controling threats to losses at the same time . As we know that the every trade is not the profitable . From this impact, we can win and lose . These threats , or risks , including financial uncertainty , strategy management errors , incidents and natural disasters . Every business and organization faces the risks of unexpected threats . It can cause the permanent closing of the company .

Importance

By applying a risk management plan and by examine many of potential threats or incidents before they happen , a corporation can save money and protect future . From the management risk , we should be create a secure management ecosystem for the customers and staff of any organization . It protects all involved people and assets from the potential risks and natural disasters . It increases the stability of the business operations .

Risk Avoidance

The completer annhilition of all risks are rarely possible . Sometimes the companies are able to decrease the amount damage certain risks. Sometimes , a result of risks are shared or divided among many of plans participants or business organization. The all risks can be shared with vendors and business partners . As we know that the trading is the full of risks .

Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management. (screenshots needed)

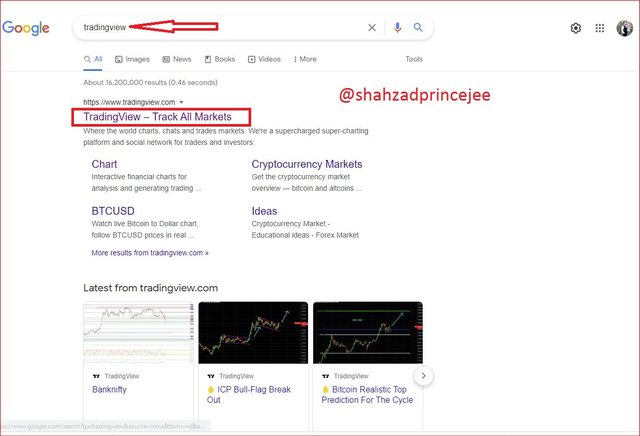

First of all , we open the Chrome browser and search "Tradingview" on the search box . As we can see in the below image .

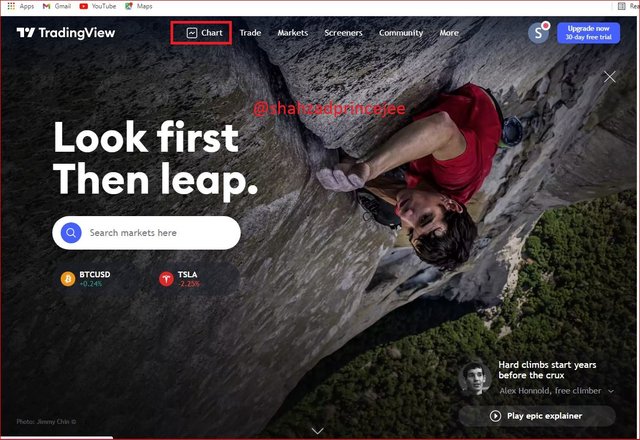

Now we click on the firstly website to go on the tradingview page and click on the option of the "Chart".

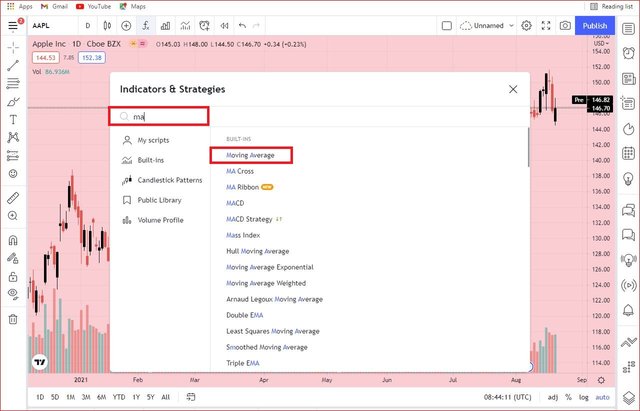

After clicking on the option of indicator and search the "moving average " and click the double on the moving averages .

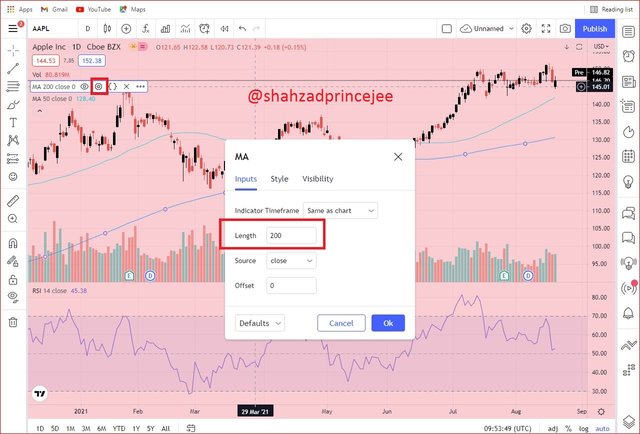

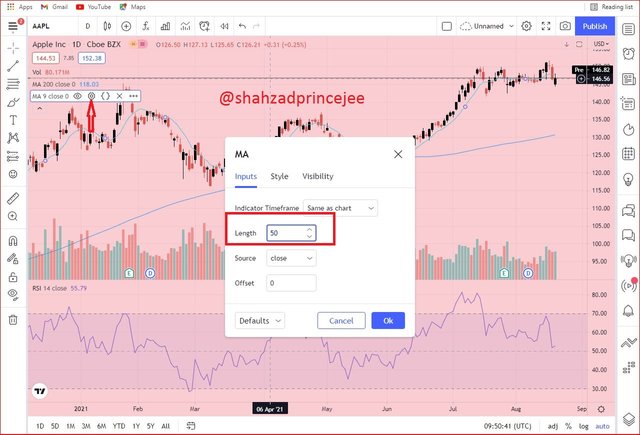

Now we will set the length of both moving averages 200 for the long and 50 for the short term .

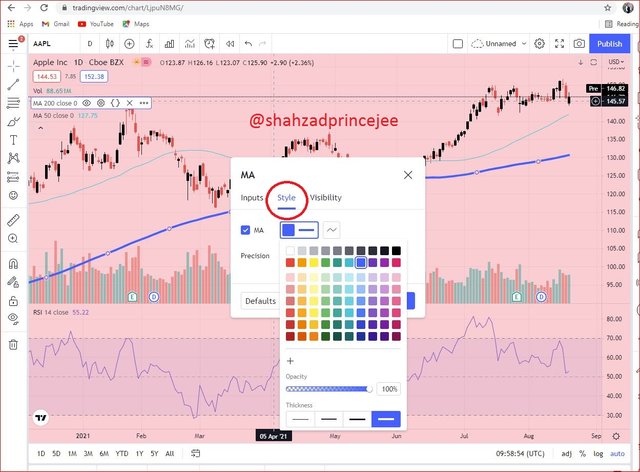

Now we will change the style to differenciate between them .

And now we can see the indicator is shown in below image .

I hope you will be understand the all steps easily .

Conclusion

Finally , i have completed this assignment easily . I learnt a lot of knowledge which i did not know before this lecture . I am also want to become a trader so that it was really very amazing lecture . Especially i taught about the Risk management and how can we avoid from this unusual act . Margin call was the new for me . From the above techniques we control the losses . I knew about the trailing stop strategy . In fact , it was really very interesting lecture for me and many other beginners .

Thank You

Best Regards

.jpg)

.jpg)

.jpg)

Good work brother

Thank you so much

Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week 8

Remarks

question no 2, you explained very much short,

need detail explanation about it that is related to risk management topic

thank you very much for taking participate in this class

Thank you so much professor for review my post