Yield Farming - Yearn Finance - Crypto Academy S5W3 - Homework Post for @imagen

Hello steemians,

Today's topic is Yield Farming - Yearn Finance. Here is my homework presentation based on the questions given

1.) Describe the differences between Staking and Yield Farming.

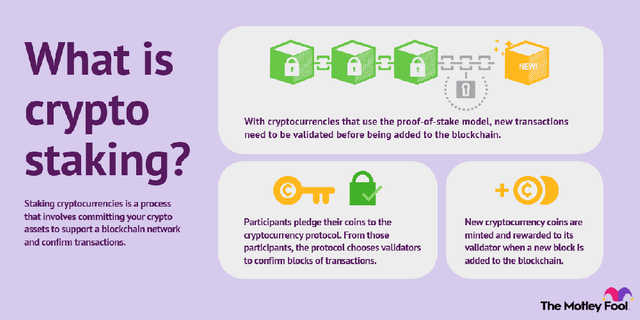

Staking

Staking is a consensus algorithm that enables users to mine specific cryptocurrencies based on the user’s power of stake. Staking simply means locking up your crypto asset to allow you to validate blocks in other to receive rewards for the block validation.

Considering cryptocurrencies that use the proof of stake (PoS) mechanism, staking is the means by which new blocks are mined and, in return, earn rewards. Cryptocurrencies that use the PoS mechanism allow investors based on their holdings to validate blocks. Thus the higher the investor's holdings, the faster the ability to validate blocks and vise versa.

Yield Farming

Yield farming is the process of earning passive income on your crypto asset with a Defi(Decentralized finance) system for adding liquidity to the system. It’s termed one of the simplest methods to earn crypto.

As said, earned rewards result from investors lending their crypto assets to the system to increase its liquidy pool. This crypto-asset lent would generate passive income for adding more liquidity. Investors who yield farms are called liquidity providers.

Liquidity providers tend to lock their crypto-asset with the platform for some time, and in return, receive rewards for their contributions to expanding the liquidity pool. The rewards earned uses an APY mechanism to distribute dividends on individuals' holdings.

2.) Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options). Show screenshots.

To explore the platform and indicate its functions

- Use the link below to visit the yearn finance webpage. yearn.finance

- Below are features of the yearn platform.

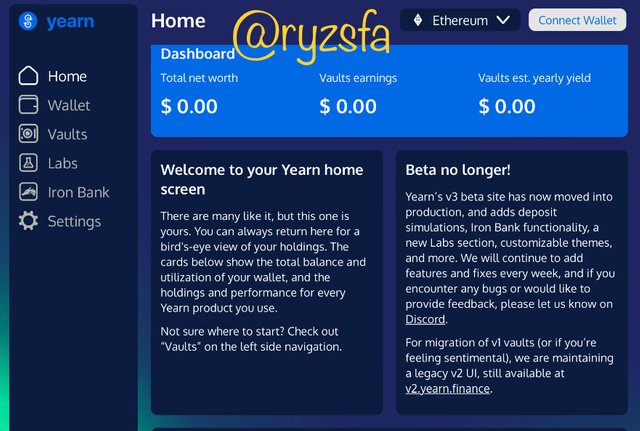

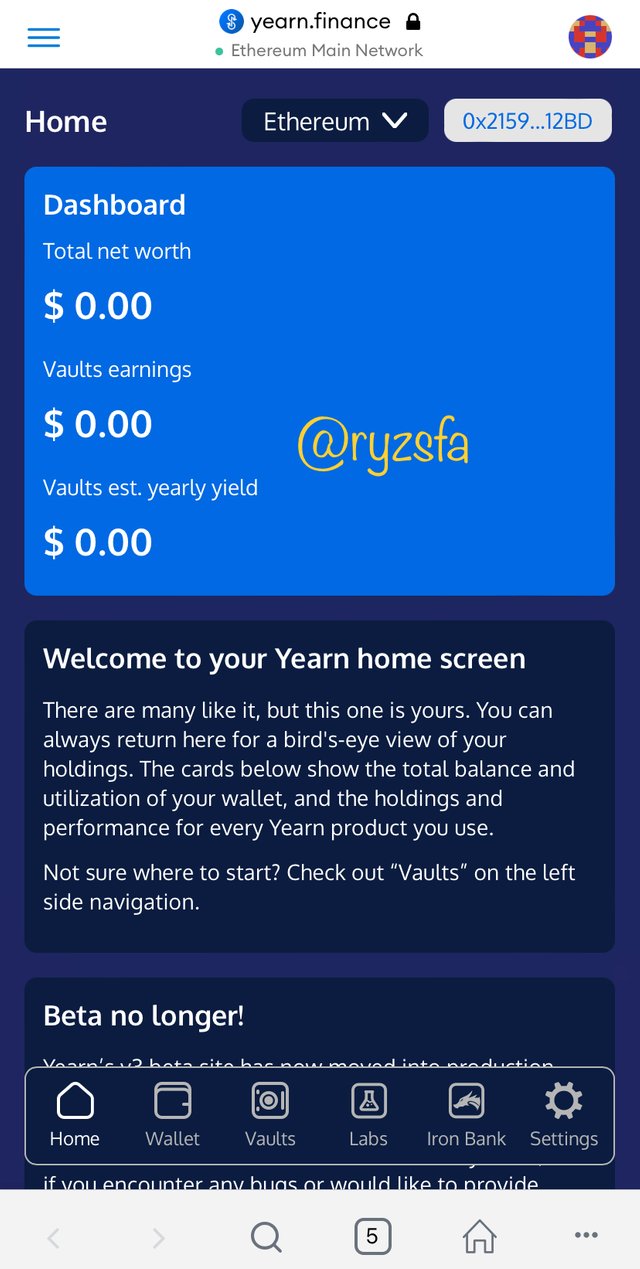

Home

This is the initial view upon opening the platform, and it's where the total earnings on the platform are displayed. Comprising is the total net worth, the vault earnings, and vault estimated yearly yield, all available in the dashboard.

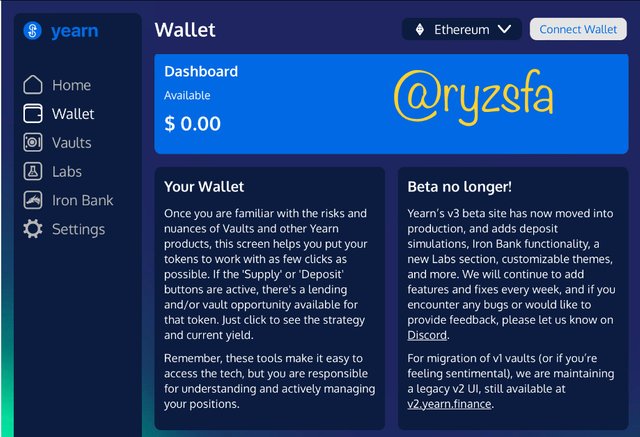

Wallet

It is where your available assets in your yearn account are stored.

Vaults

This feature offers liquidity pools where assets can be staked to receive rewards. The liquidity pools available are arranged in descending order of APY percentage.

Labs

This feature provides information on the latest opportunities available on the platform.

Iron Bank

This feature allows users to gain by borrowing from the pool and again supply to the pool.

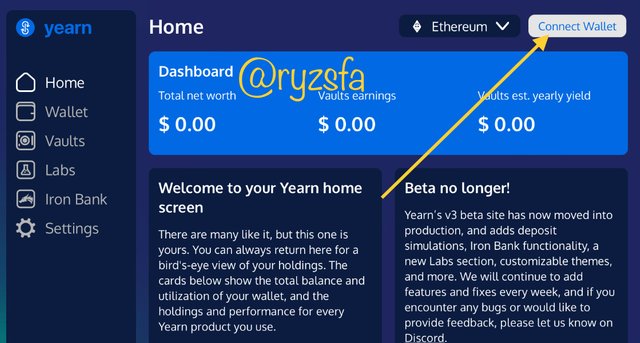

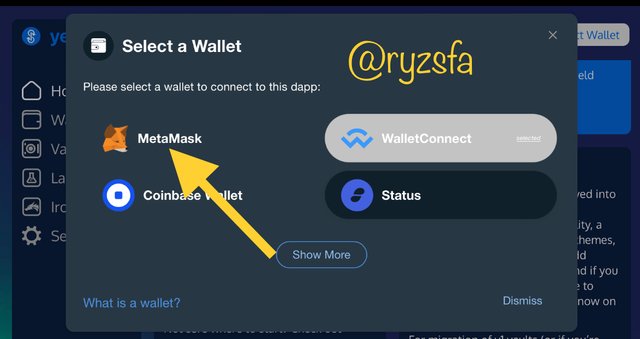

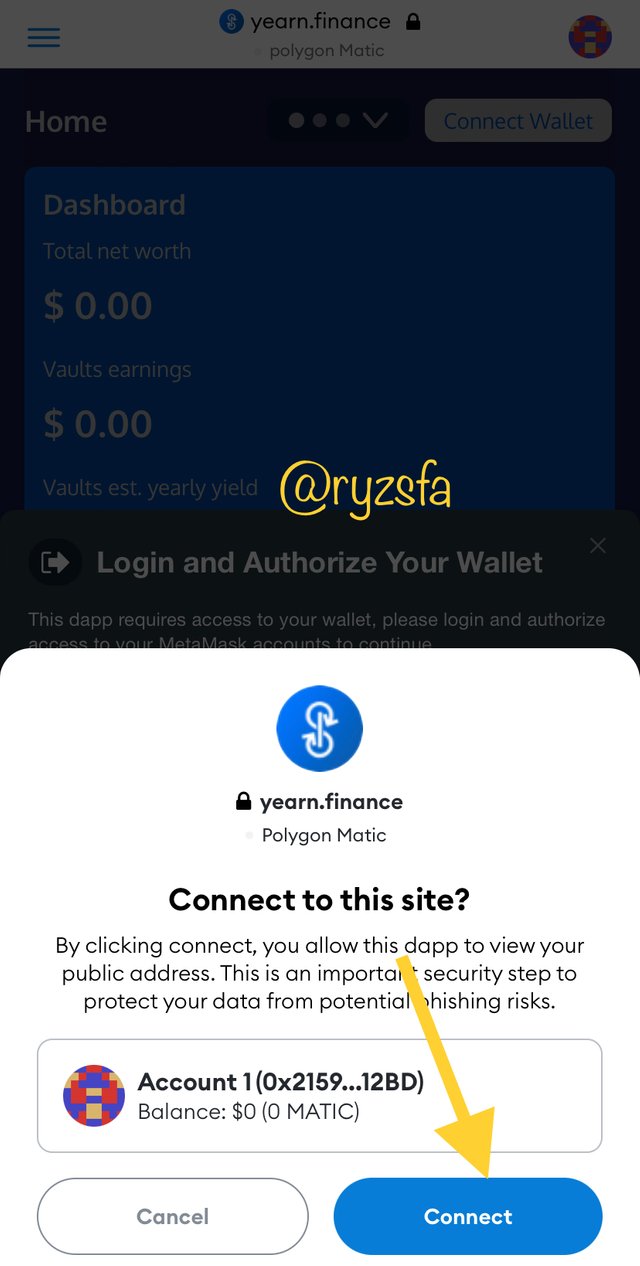

Connecting Yearn To a Wallet

At the top right of the page, we can connect wallet. Click on it.

- Here, I will like to connect my wallet with my Metamask. So you click Metamask from the pop-up.

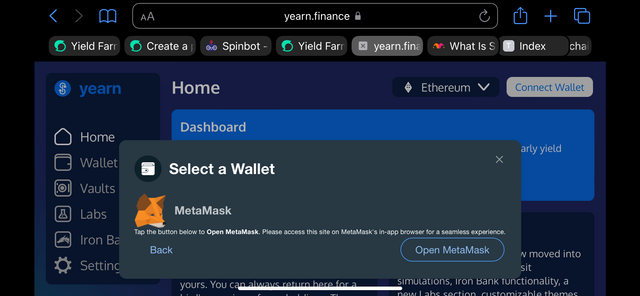

- Click open Metamask afterward.

- click connect.

- We now have our wallet successfully connected.

3.) What is collateralization in Yield Farming? What is the function?

Let's first understand collateral; collateral is an item from a borrower used to secure a contract with a lender. Collaterals are consumed by a lender when the borrower fails to fulfill the agreement approved with the lender.

For instance, a borrower intends to get a loan; the lender would require collateral (an asset) to serve as a replacement if the borrower fails to pay back the borrowed money. This ensures that the lender does not lose his money during contract failure.

Concerning yield farming, Collateralization takes place too; every borrower has to leave up collateral in order to acquire a loan. Basically, the collateral is mostly higher than the borrower's amount. Fundamentally, Collateralization is the means of using expensive items to secure a loan.

4.) At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

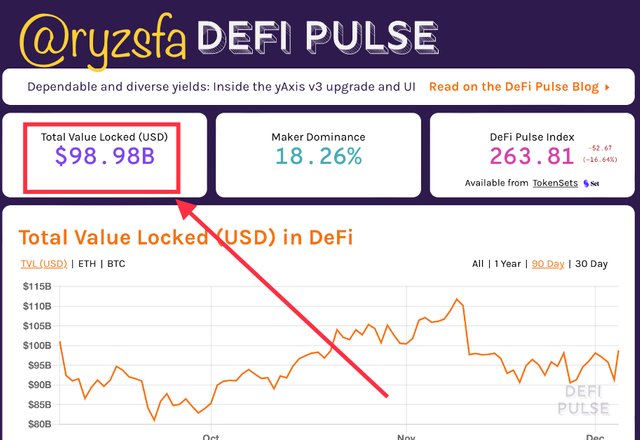

Visit https://defipulse.com/ to find out said in the question above.

Below is the TVL of the DeFi ecosystem during my assignment.

- Down moving below the page is TVL of the Yearn Finance Protocol

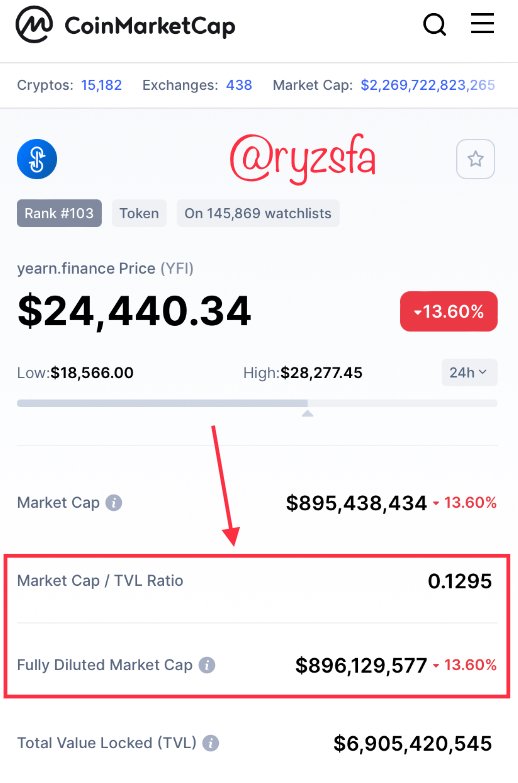

- Let visit our CoinMarketCap to explore the Market Cap / TVL ratio of the YFI token.

- Market Cap / TVL ratio of the YFI token = 0.1295.

From the above screenshot, it’s clear that the YFI token is undervalued since the Market Cap / TVL ratio of the YFI token is less than 1.

5.) If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

Here is BTCUSD Chart from August 1st to date

- BTC rose above at a percentage of 24.66% from a price of 39289.66 to 49054.01

Percentage Yield is (24.66/100)*500 = $123.3

Total yield on BTC is $500 + $123.3 = $623.3

Here is YFIUSD Chart from August 1st to date

- YFI price falls at a percentage of 43.10% at a price of 31426.32 to 24450.96

Percentage Yield is (43.1/100)* 500 = $215.5

Total yield on YFI is $500 - $215.4 = $284.5

Therefore

The amount left after investment period is = $623.3 + $284.5 = $907.8

Net loss = $1000 - $907.8 = $92.2

Returns on investment = ($- 92.2/$1000)*100 = - 9.22%

6.) In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

Smart-contract somehow is a risk to yield farming because it could lead to loss of assets. DeFi systems are inclined to code errors due to their nature. When the system experiences any code error would cause a change in nodes which can lead to massive loss of the liquidity pool.

Gross depreciation on the asset. When the assets lent to the borrower happens to depreciate at a high percentage, it becomes very difficult for the borrower to pay at that rate.

Collateral loosing its value over time. During a contract between a lender and a borrower, the collateral used to secure the loan tends to fall over time causing the lender to loose asset when the borrower fail to pay back the borrowed amount. This is because the collateral has lost its value.

Conclusion

I will say yield farming is a very simple and efficient way to earn crypto just by being a liquidity provider. Although it is pretty risky to practice yield farming, however, very productive too. Unlike staking, risks are lesser as well as the income earned on stakes.

I will like to acknowledge professor @imagen for this was a very key topic which was very well explained. Thanks for the humble service for I have understood the lecture very well.