Crypto Academy Week 15 |Homework Post for Professor @yousafharoonkhan |Exchange order book and its Use and How to place different orders

So here my answer for your question and I will explanation as my thought.

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples

My answer

Order Book is a queue list of selling prices and buying prices available in the market at that time. Every person who will sell him will record the type of commodity and the number of commodities offered at the desired price level. Likewise, buyers who wish to buy will record the type of commodity, how many commodities they want. Commodity note, the quantity and price level is what is called a book order.

Order books can occur in conventional / traditional markets or for crypto markets. At the traditinal market, for example, a trader brings a cow and wants to sell it for 25 million rupiah. This trader directly records the cattle price list. You came again, a trader who also wanted to sell a cow for 20 million, so he immediately listed the offer that was given. At the same time, a prospective buyer wanted to buy a cow for 15 million. It immediately lists the desired price for today's purchase. Then came another buyer who wanted to buy a cow for 20 million rupiah. So he also immediately wrote down the price of the cow he wanted to buy.

In this order book, of course, the ones who successfully make transactions are traders and buyers who find the same price, which is 20 million. The trader will get 20 milion in fiat money. It is different with Crypto exchange because trader and buyer can make transaction in pair. For example Bitcoin can trade by other coin such USDT,

In the cryptocurrency market this also happens. Traders who want to sell assets will record the type of amount and price they want. Buyers do the same. it records the type, quantity and price level desired. We can see how many different types of cryptos are offered at varying price levels. Likewise, the demand for the type of commodity, the quantity and the desired price level varies widely.

There is a difference between the order book in the traditional market and the cryptocurrency market

| NO | Traditional market | Cryptocurrency Market |

|---|---|---|

| 1 | It changes daily | Can change every second |

| 2 | local territory | Not limited by country |

| 3 | Can only be accessed on a limited basis | Can be accessed by anyone connected to the internet |

| 4 | Manual recording | Absolute computerization |

| 5 | Traders must bring their commodities | Not carrying but clearly recorded |

| 6 | Only single currency/ money | Doing in pairs |

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.

My answer

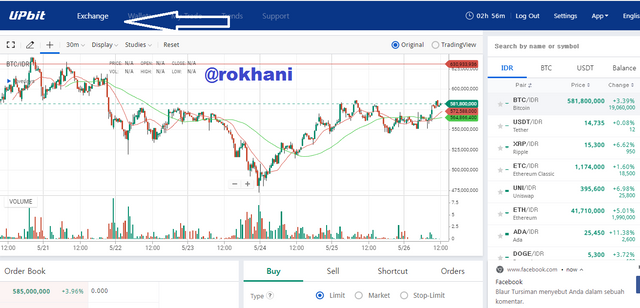

To know the order book practically, we have to open the exchange that is used. I use Upbit Exchange. After loggin, we can see what the following screen shoot looks like.

when I click on the exchange like I give an arrow it will show that so many coins are being traded at a certain price level.

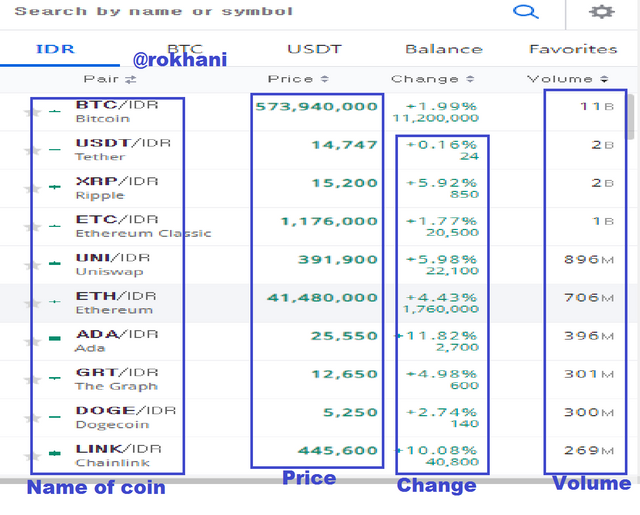

I marked the names, prices, changes during the 24 hours and volume of assets/ coins as in the following screen shoot

Pair

Now, let's try to see a certain coin from the Upbit fit order book.

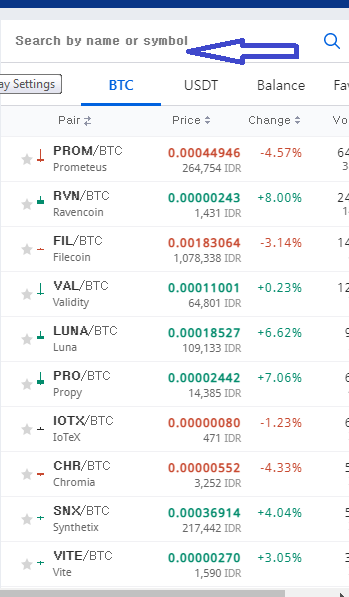

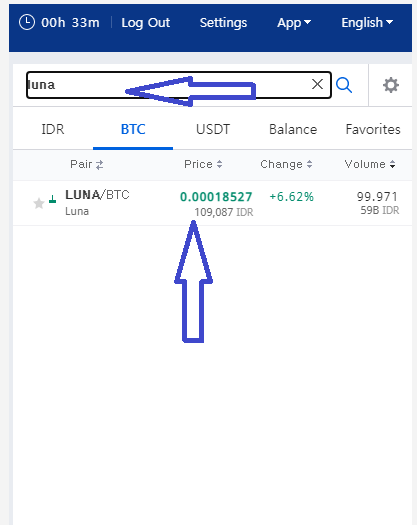

We need to find the name of the coin we want to see. In the search option we type the name of the coin.

Prof. @yousafharoonkhan, you can see in the picture below I am looking for Luna coins.

And when we find the coin, I click on it so we can see the price of the Luna coin paired with bitcoin and Rupiah. Because my wallet only has bitcoin deposits, I have to pair it with bitcoins. After that we can see the following screen shoot. This trade we ca call pair in cryptocurrency trading

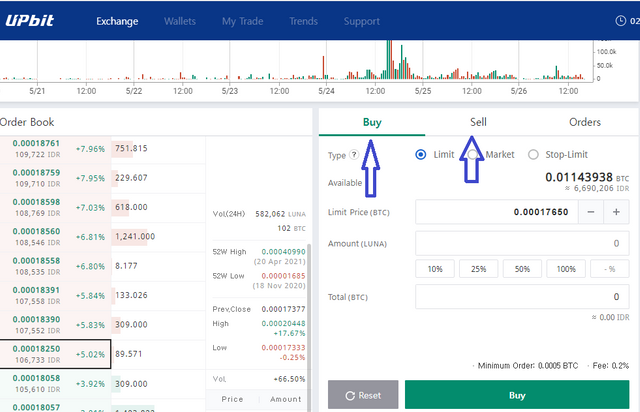

After we click the coin we can decide trade it, buy or sell the asset of Luna as shown inmy screen shoot

As you explained in the previous lecture, each exchange may have various service features and may differ from one another. On the Upbit exchange the trades are placed only in My Trade. Meanwhile, on the Exchange on Upbit we determine whether to sell or buy directly.

see the custom buy or sell button that we want to do.

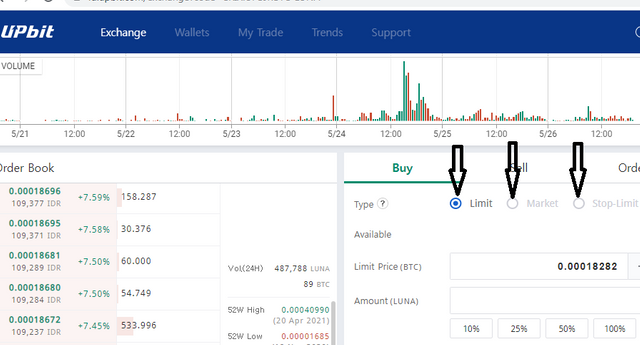

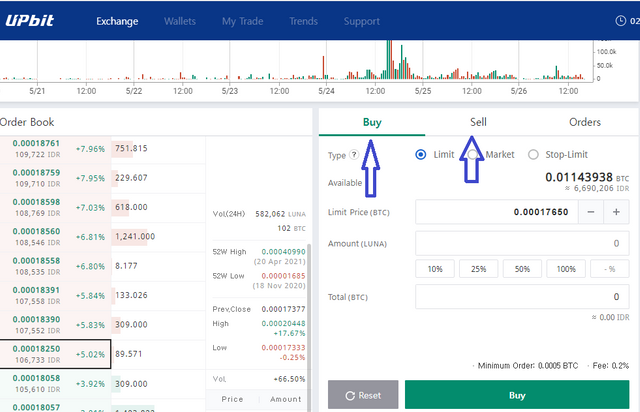

Order Limit

I will try to explain this with an example. Suppose the current price of one Luna coin is 0.000185 BTC, but if I want to buy a coin that is priced at 0.000183 BTC then I can buy that coin via a limit order. But my order will only be filled when the price of this coin will be 0.000183 BTC. To place an order with a limit order, place this coin in pairs with Luna and BTC. We just need to enter the price of 0.00183 BTC, which is what I want. We also write down the number of coins Luna wants us to buy.

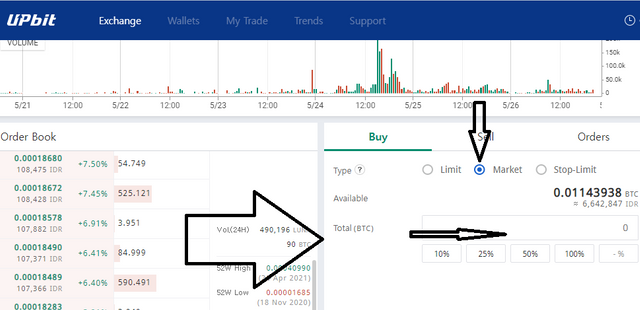

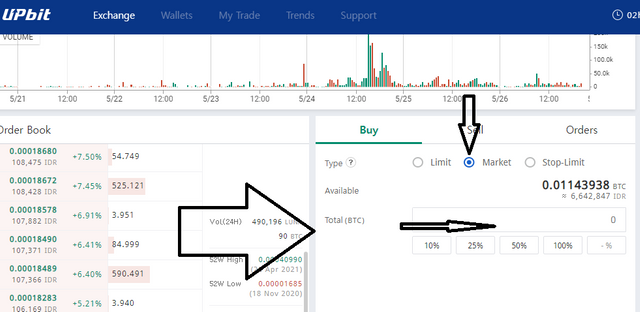

Market Order

Market orders are different from limit orders. When we trade a Market order, we have to buy and sell according to the current market price. We cannot adjust the price according to what we want, such as when ordering coins with a limit order. itself as we did with the limit order. When we click on the Market order we have to pay according to the current price. The commodity that we want to buy or sell will be adjusted to the market price when the transaction is made.

Support and Resistance

Question no 3 :

Explain the important main features of the order book

My answer

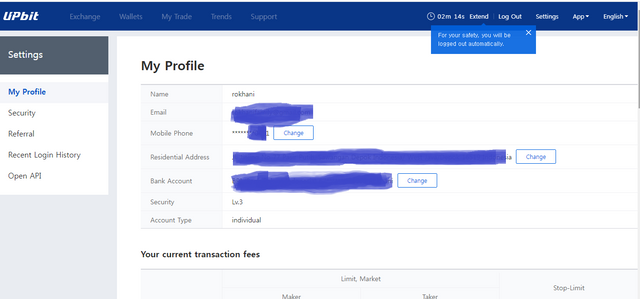

Before I answer this question I want to appear my account in Upbit that verified

As you see i use Upbit for trade in cryptocurrency. Thank a lot for #steemexclusive, #steem, all Steemian and of couce for you @yousafharoonkhan. without Steem and Steemit i don't have account in exchange.

In Upbit there are two main features, namely buying and selling.

Now when we click sell / buy it will appear

as in the following screen shoot.

Upbit will also display the Order Book. How you can see a screenshot of the order book in the image above. we have to understand both. We must understand what the Buy and Sell features are for.

The order book has two basic components, one is Sell and the other is Buy.

Buy Order Book

We can look at the order book with a certain crypto currency pair, we will see a green Buy button. This means the price at which different traders or buyers want to buy. This means he will bid a price on the coin. In the screenshot, all buy orders can be seen alternately. If a buyer orders to buy coins, the records will be recorded here.

We can see how many coins there are and the price level offered. we just have to decide on the amount and price what can be agreed upon or according to our wishes.

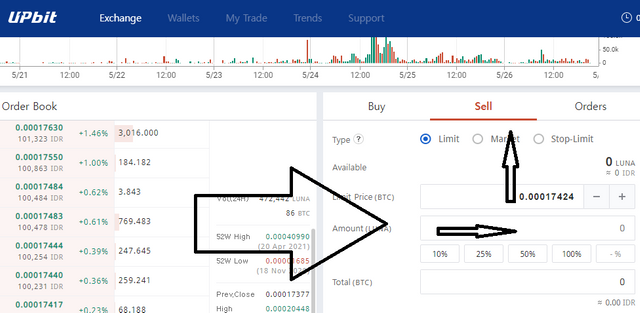

Sell Order Book

The Buy Order Book informs us of the buyer's order, the type of quantity and the price level of the coins you want. The Sell Order book also gives us information about the current price offered in a particular coin pair. Selling orders refers to the seller at what price. Crypto wants to sell and the price at which sellers want to sell coins is called a sell order. We can see the details of the average selling price and the total orders in the sell order. As you can clearly see in the screenshot.

In the Sell Order Book above we can see the price of Luna coins

Question no 4 :

How to place Buy and Sell orders in Stop-limit trade and OCO?

My answer

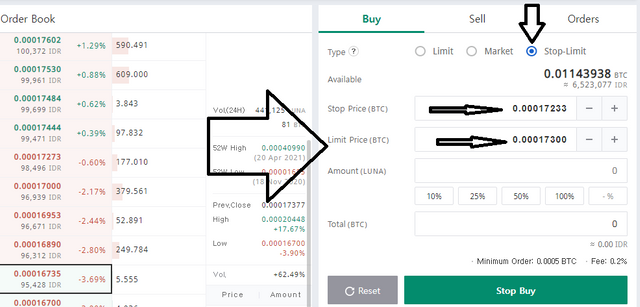

The stop limit order is closely related to two important things, namely the stop price and the limit price. the sale and purchase of assets here can reduce the risk to the seller or buyer.

There are two price points that are used as benchmarks, namely the stop price and the limit price.

Stop price is the initial price specified for trading.

The limit price is the price that is outside the trading target.

In the screen shoot above we can see that the stop price is 0.0017233 BTC while the limit price is 0.00017300 BTC. If the market price moves at 0.00017233 BTC the order will be filled as long as the price does not exceed 0.00017300 BTC.

Question no 5 :

How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer

My answer

As far as I know, one of the functions of the Order Book is to help us see how many buy or sell orders on the crypto asset market.

That way, we can see how many demands want Luna or want to let Luna go. We can also see if there are members who want to buy or sell crypto assets in large quantities. This opportunity can be used to make a profit by looking at the opportunities that exist.

Conclusion

Order Book is a series of orders that can be seen on the exchange in relation to the type, quantity and price level for both sales and purchases. The function of the order book is to help us see how many buy or sell orders are on the crypto asset market.

By looking at the buy and sell features we can see how many assets are being sold at the right price. we can buy or sell with a limit order, market order or stop limit order.

That is the task that I submit today.

Best regard from Indonesia

@rokhani

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

question is short you did not explain all points ,more detailed answers are needed so that the answer to the question is clear.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

How an order book can help a trader make a profit , you did not explain well, your answer was very much short , need more detail to explore this question۔

You have not specified the OCO order correctly, you only explained one there was sell and buy and if you look at the screenshot it is incomplete and you have not specified your order in the text format, . stop limit order also did not cover

question one look rewrite but its ok

it is necessary to answer every question according to given points, you did not cover all points in given homeowrk

Thank you very much for participating in this class. I hope you have benefited from this class.

grade ;4.5

You give nice Explanation on comparing With Traditional order book and Crypto Order book.

Nice presentation from you. Take care.

#affable #india