Homework Task Week7 for Professor @besticofinder| Cryptocurrency Investment|

Kyber Protocol Vs Orion Protocol

Kyber Protocol concept

Due to the setbacks and limitations in the centralized exchanges which includes insecurity and loss of users funds. Decentralized exchanges have been developed to fill in these gaps by providing a trusted platform that allows users to have full control of there access and secured transactions. Despite achieving these goals, Decentralized exchanges still have their issues which are low liquidity available for users to carry out transactions and also the high cost of trading fees. The Kyber Network provides users with liquidity from various sources while still maintaining a low transaction fee.

This single network turns up to provide a single endpoint for Dapps and other users to perform transactions seamlessly on multiple tokens. The Kyber protocol provides entities with the possibilities for liquidity providers to contribute liquidity in a wide range. This includes end-users, DEX and other decentralized protocols. Similarly, end-users and cryptocurrency wallets, smart contracts are provided the access to perform instant and trustees transactions at the best rate available from the liquidity sources.

Features of Kyber Protocol

- The Kyber protocol aggregates liquidity from various sources into one liquidity pool, which makes it easy for users to find the best rates seamlessly from these sources.

- Kyber Protocol allows different types of liquidity and allows token swap across decentralised exchanges without any risk or high fees.

- Kyber Network facilitates token swap between users and liquidity providers. This allows for instant settlement of trades. Unlike the centralized exchanges where orders are queued in the order book. In Kyber Network, orders and settlements occur in a single blockchain.

Kyber Network Purpose

The purpose of Kyber Network is to fill in the gap of low liquidity and high trading fees in Decentralized exchanges by aggregating liquidity from different sources to enable seamless transactions of token swap instantly at a reduced cost.

Kyber Network Social Reach

Kyber network still maintains a great actives community which can be seen from its official Twitter page with more than 145,000 followers and 7500 followers on Facebook. Similarly, Kyber Network users are more engaged in the Telegram page with over 7000 users with an average of 600 online users engaged in the project's discussion and development. Similarly, the Kyber network still maintains a great community in Reddit and Discord. These communities backing up Kyber Network is supportive and a good sign for constant development of the project.

Kyber Network Team

Kyber Network was founded by Loi Luu, Yaron Velner, and Victor Tran. Luu was the co-founder of SmartPool; a decentralized mining pool project. Similarly, the Kyber network attracted the interest of Ethereum founder Vitalik Buterin is one of its advisors. Furthermore, the Kyber Network has a team of advisors who are well-grounded and knowledgable in cryptocurrency technology. Loi Luu remains the CEO of Kyber Network and oversees its operation and development. These teams put together are working on the goal of Kyber Network. Further contact details of the team member can be found on the LinkedIn part of Kyber Network Kyber LinkedIn

Kyber Network Crystal (KNC)

This is the digital currency and the backbone of the Kyber Network which facilitates the economic, governance and treasury functionalities across the Network. Networks without KNC won't be recognised or supported by the project or community. This shows the influence KNC has on the Kyber Network. The main usage of KNC includes:

- Economic Facilitation: KNC is used as a payment for the transactions in the Network. This can be a transaction fee incorporated into their spreads for instant liquidity to execute trades. Similarly, KNC is leverage as a staking mechanism to act as a barrier to safeguard the Network and maintain its integrity.

- Governance token: KNC serves as a governance token for the Network across all chains. Similarly, KNC offers individuals the voting power to make decisions on the Network.

Orion Protocol Concept

.jpeg)

Source

The Orion Protocol is quite similar to Kyber Network. Orion Protocol is also designed to aggregate and provide the liquidity of several Dapps in a single and non-custodial gateway for users to access. Orion Protocol was founded in 2018 and launched in 2020 by Alexey Koloskov and Kal Ali to eliminate the potholes encountered in Dapps which includes insecurity of funds, low liquidity and better return of investment.

Orion Protocol Purpose

Orion Protocol aims at harnessing the entire liquidity of centralized and decentralisation exchanges and making it accessible through a single decentralized platform for users to access. Similarly, Orion aims at solving the major issues of liquidity in performing transactions on Dapps. Furthermore, Orion aims at offering users the opportunity to get the best returns out of their investments while also reducing the risks associated with centralised exchanges.

Features of Orion Protocol

- Orion Protocol collects liquidity offered in multiple exchanges and showcasing it in a single universal API making it easy for users to carry out transactions seamlessly.

- Orion Protocol offers portfolio management to users which allows them to monitor and keep track of their activities across exchanges.

- Orion provides a marketplace for Apps for users to easily access and trade.

- Orion Protocol allow users to stake ORN tokens through a staking model known as Delegated Proof of Broker. This model involves two parties, the broker and the non-broker. The non-broker delegates ORN token to their broker of choice to benefit from the broker's revenue share. Similarly, brokers increase their chances of facilitating trades by staking more ORN tokens.

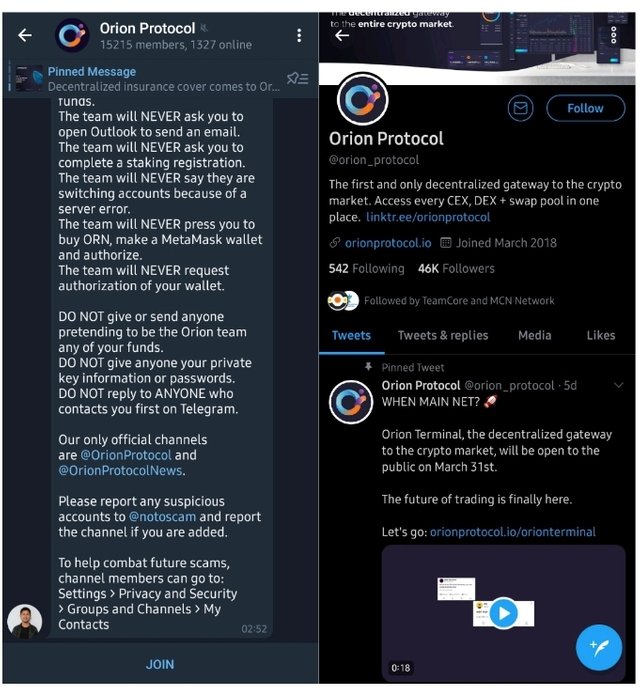

Orion Social Reach

The Orion Protocol social reach can be seen in its active Telegram group chat of more than 15000 users with 1000+ online discussing the progress of the project. Similarly, the project has reached a good audience on Twitter with more than 40,000 followers.

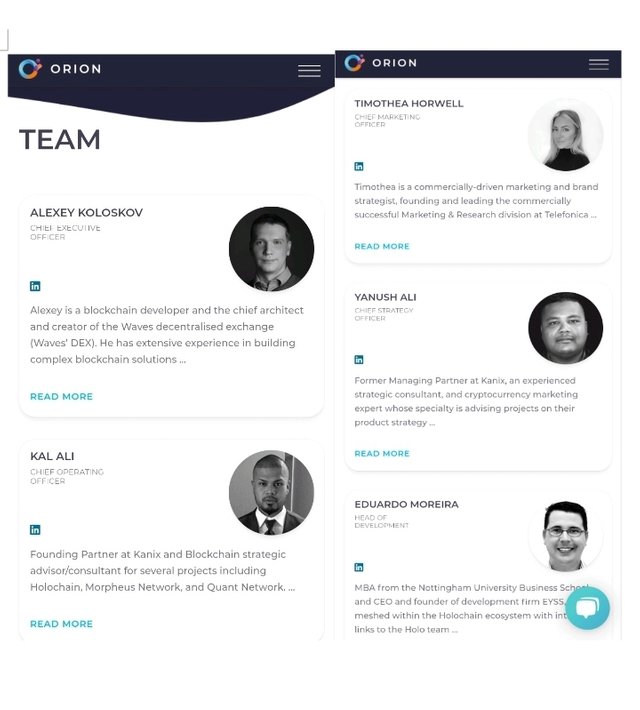

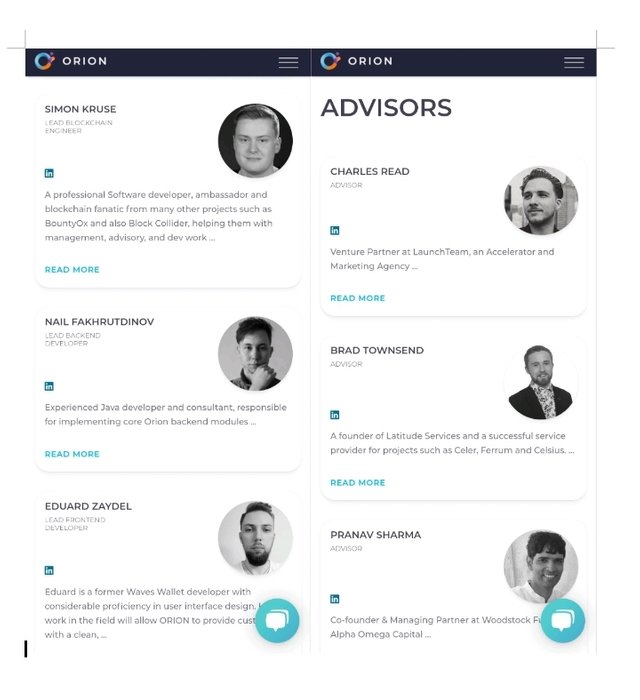

Orion Protocol Team

Orion was founded by Alexey Koloskov and Kai Ali. Alexey is a blockchain developer and the chief architect and creator of Waves decentralised exchange. He has vast knowledge and experience in building complex blockchain solutions. Karl is a founding Partner at Kanix and Blockchain strategic advisor/ consultant for several projects including Holochain, Morpheus Network, and Quant Network. Karl oversees the overall business development of all Orion's operations. Information about other team members of Orion Protocol can be found on their website Orion Team member.

Orion Token (ORN)

Orion token is an ERC-20 token built on Ethereum platform which is used as a native token in Orion Protocol. Orion Protocol revolves around Orion tokens and users are offered lower transaction fees when they pay with ORN. Brokers Orion Protocol decentralisation exchange must stake ORN tokens to execute trades. Similarly, users of Orion decentralised exchange enjoy the benefits from brokers revenue shares when they stake ORN tokens. Furthermore, users who hold ORN token are eligible for advanced features of Orion Protocol like margin trading and futures trading.

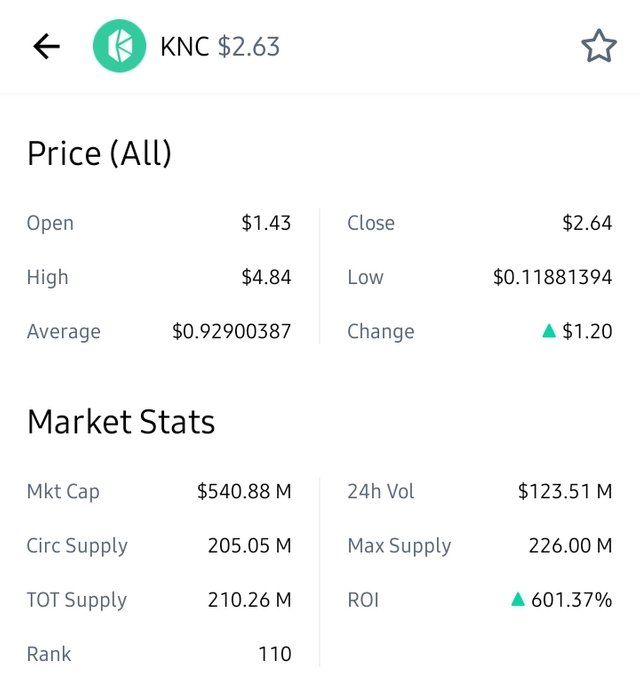

Technical Information of Kyber Network Crystal

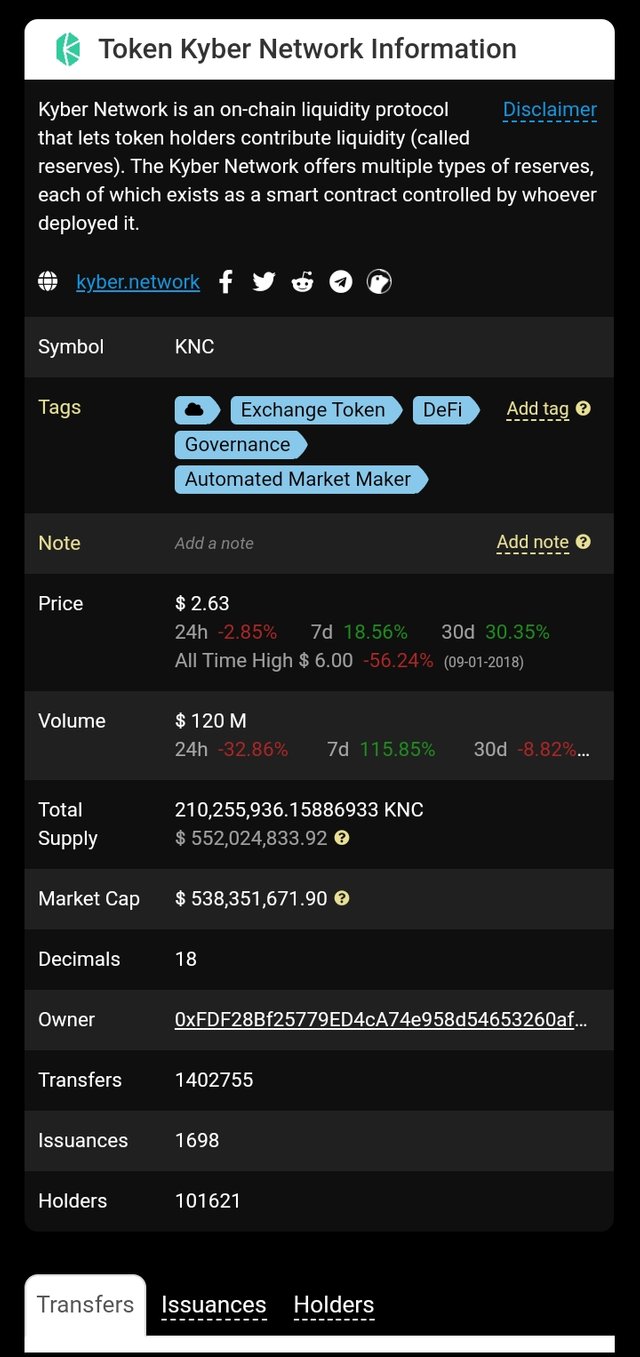

KNC is currently trading at $2.63 at the time of this writing with a market capital of $540.88 million and a circulating supply of 205.05 million. The market capital of any asset is a function of the token current price and the circulating supply of the cryptocurrency. Similarly, KNC has reached an all-time high of $4.84 and an all-time low of $0.1188. The return of investment since its launch is 601.37% showing positive development in the price of the token.

Similarly, The maximum supply of KNC is 220 million with a trading 24hr volume of $123.5 million.

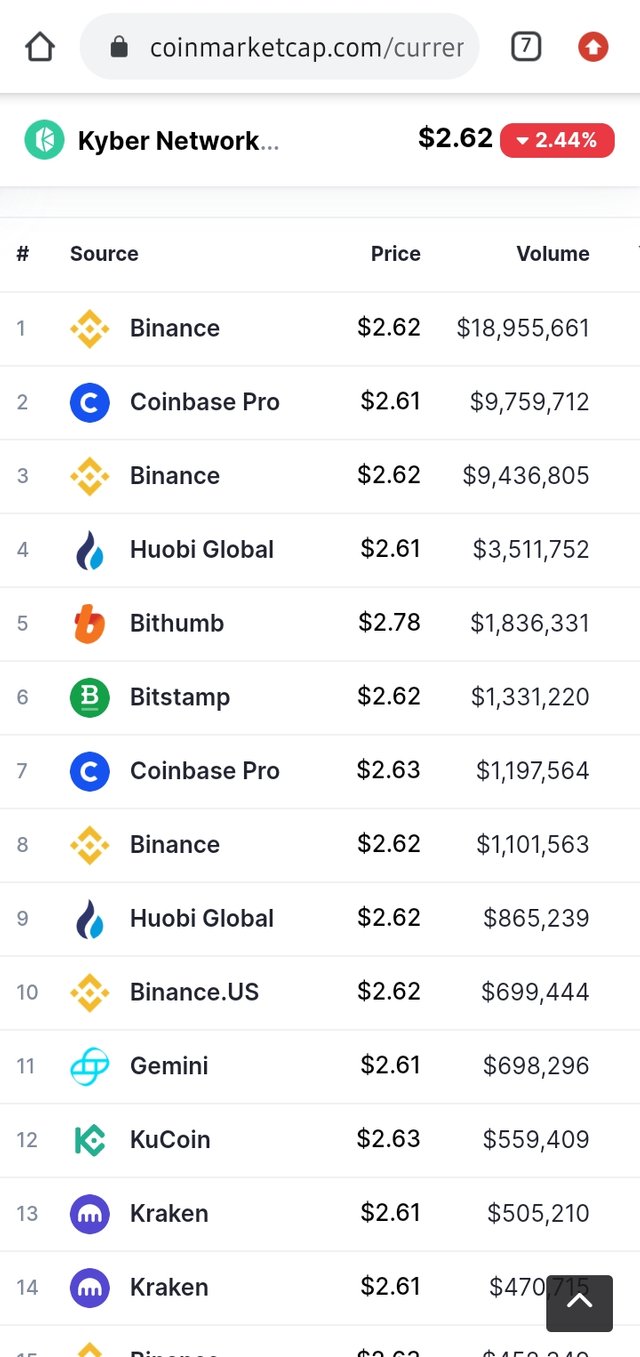

KNC is trading in major exchanges with Binance and Coinbase having the highest 24hr volume of $18 million and $9million. This high trading volume means the liquidity of the asset is high and can be easily traded in major exchanges. Below are some of the major exchanges that you can trade KNC.

Contract address of Kyber Network Crystal: 0xdd974d5c2e2928dea5f71b9825b8b646686bd200

From the picture below, there are 101,621 addresses holding KNC token. Further information about the token can found on etherscan using the link KNC etherscan

Technical Information of Orion Token (ORN)

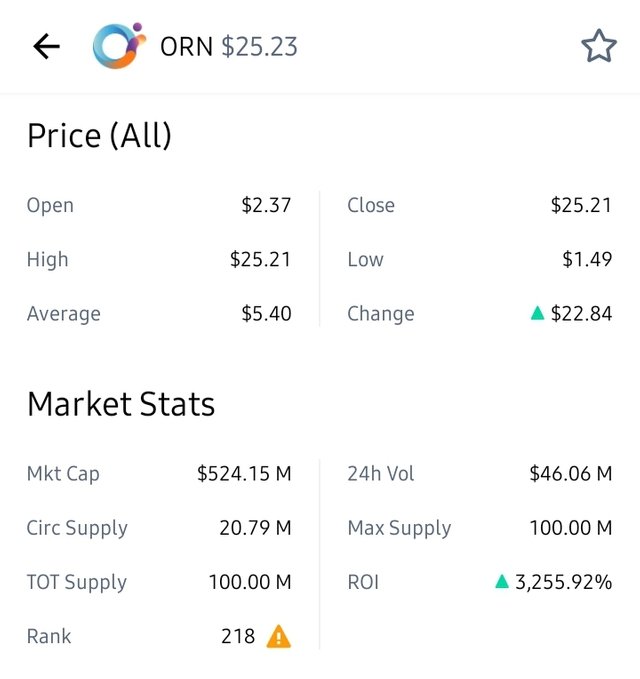

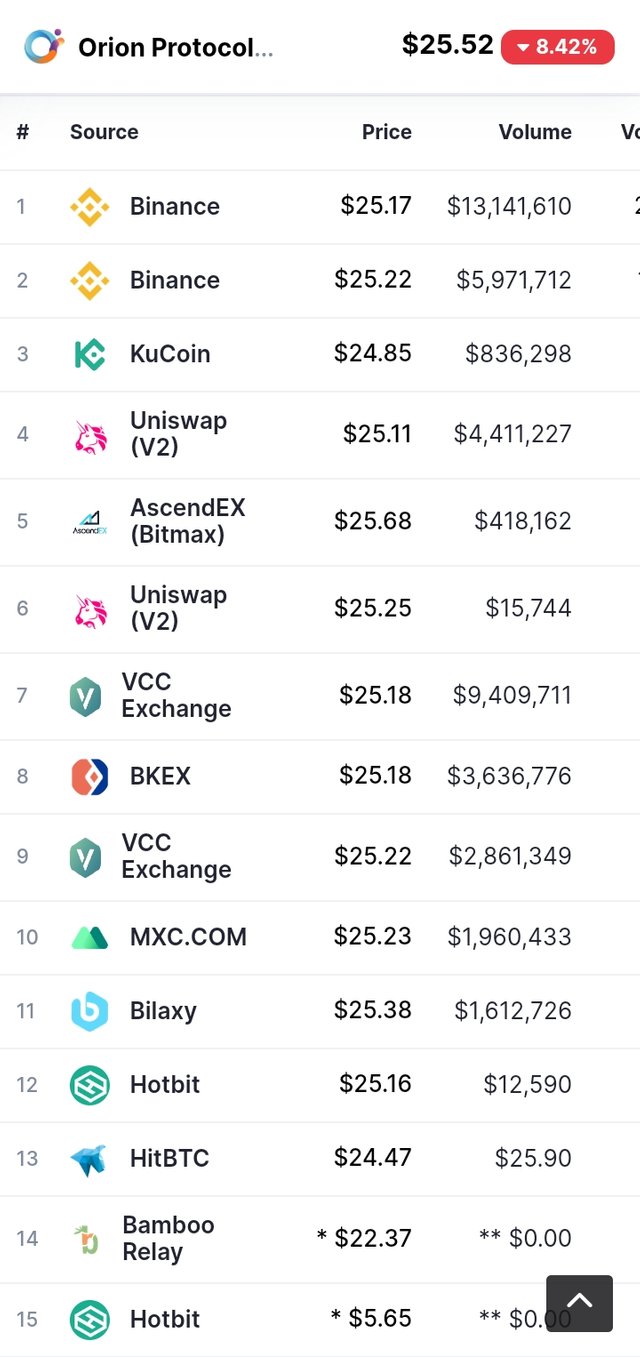

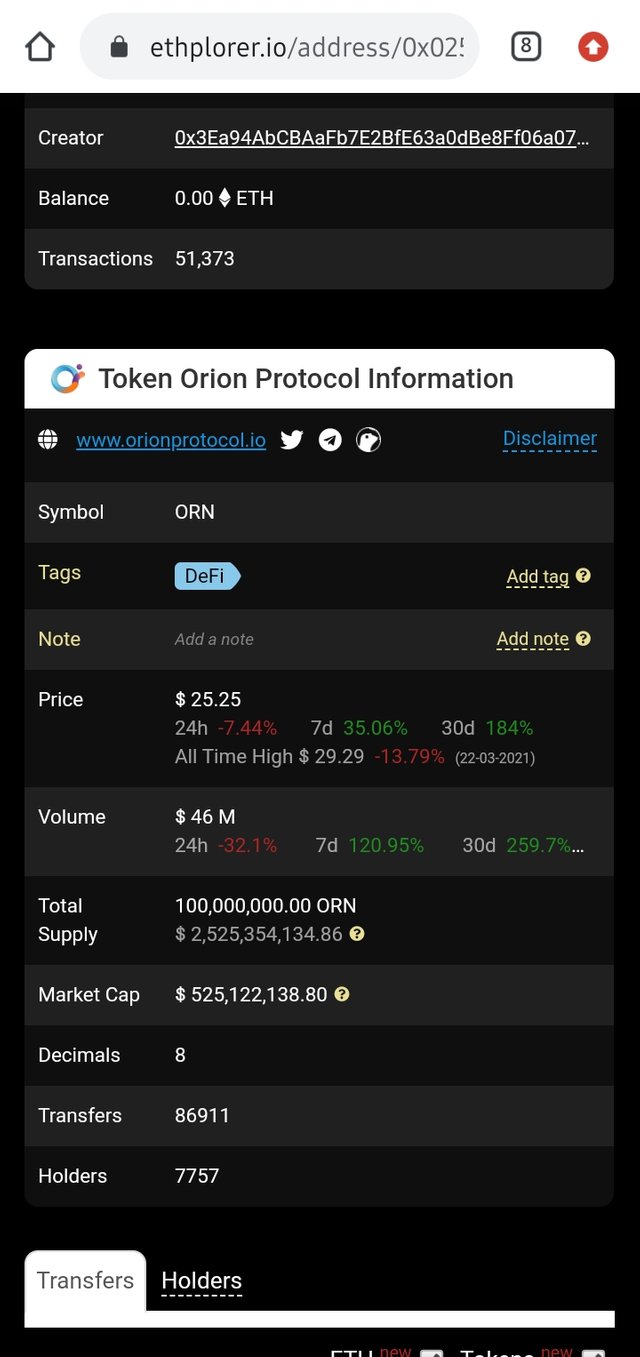

Orion token is currently trading at $25.23 at the time of this writing with a market capital of $524.5million and a circulating supply of 20.79 million. Similarly, ORN has a maximum supply of 100 million and a 24hr volume of $46.06 million. The currency has reached an all-time high of $25.21 and an all-time low of $1.49. The ROI of ORN since after its launch is 3,255%. This shows that there is a constant development in the project. Orion token is trading at the major exchanges in the cryptocurrency industry and it can be shown in the picture below.

Contract address of Orion Network Crystal : 0x0258F474786DdFd37ABCE6df6BBb1Dd5dfC4434a

From the picture below, we can see that there are 7,757 holders of Orion Network Crystal. This information can be found on etherscan using the link ORN Etherscan

My decision on the best Currency

From the overview of both cryptocurrencies, both are competitive and have similar goals of providing liquidity for DApps and reducing transactions fees. But from my point of view, I will choose Orion as the best currency. Though Kyber is higher than Orion in the Market capital by $16 million, Orion seems to show great development within the short timeframe of its invention with an ROI of 3,257%. Similarly, Orion provides a staking program for both brokers and users within its protocol using the Orion token as a base currency, this idea will help to boost the currency and increase its Market capital in the future. Also, the low circulating of Orion is an advantage for the token to boost its price when the demand increases in the future. I believe Orion protocol is at its development stage and the company has a lot of potentials to be the best liquidity providers for DApps.

Thank you Professor @besticofinder for this wonderful lesson.

Special regards:

Cc:@besticonfinder

Cc:@steemcurator01

Cc:@steemcurator02

Cc:@trafalgar

Twitter Promotion