Steemit Crypto Academy Week 7// Stable Coins (2) //Homework submitted to @yohan2on

Good day Prof. @yohan2on, nice lecture this week.

Introduction

Stable coins just as we defined in the last class are coins pegged to the value of a fiat currency, an example can be the US dollars.For the purpose of this lecture and the home work Task, I will enlighten us alittle on True USD (TUSD).

What is True USD

TUSD was introduced in 2018 as a fully collaterised ERC-20 token, the first crypto asset to be built on the Trust Token platform, it is legally protected and very transparent in nature. Tusd is used like other stable coin to tackle the problem of volatility in cryptocurrency for this reason, it is pegged to the value of US dollar at the ratio of 1:1.

The trustToken platform is a platform to create fait currency-backed tokens that can easily be traded all around the world.

TUSD by design is supposed to be a simple, transparent and reliable stablecoin and for this reason does not have any special bank or special code/alogaritm controlling it but rather Tusd holdings are distributed to various banks account held by trusted companies. They companies have agreed to publish daily collaterised holdings and monthly holding respectively.

How it works

TUSD can be traded by those who have completed their Kyc requirements using their provided application.

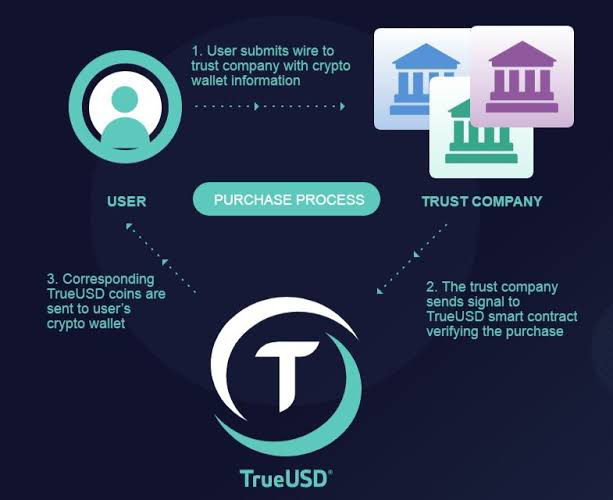

The key to proper functioning of every TrustToken tokenized asset is the third-party escrow accounts. source

Once the kYC/AML is verified, a user can transfer USD into the TrueUSD's trust partner's account. As soon as the USD funds are checked and verified by escrow, API sends a message to the TrueUSD's smart contracts which in turn issue equivalent amount on a 1:1 ratio. Tokens can then be distributed from the wallet. Incase all Trueusd was not spent, it's redeemable by a reversal process of sending it back to the the smart contracts address which inturn notify the third party company, not too long a fiat USD equivalent is issued back to the user at a stipulated fee.

Benefit of the TUSD stablecoin

1)Fully Collaterised

TUSD is fully backed and collaterised by fait USD which is held by the escrow account company reserve.

2)Close monitoring

Account attestation and publications are conducted by the escrow company for everyone to see.

3)Has legal Protection

The holding company conducts legal attestation which comes with strong legal protection.

4)Funds are redeemable

As long as you have completed your KYC, you are eligible to redeem unused TUSD by collecting a USD equivalent.

5)Trust worthy fund management

TUSD has gained trust be virtue if it's build up. USD can be exchange directly to the escrow account.

Conclusion

TUSD seems to be a trust worthy stable coin, though has a disadvantage of centralization and may not function effectively. There are many other stablecoins of its class but it is built to ensure a safe and secure platform for its users. TUSD can be bought from exchanges incase you wish to trade.

Futhermore, All stable coins are created with the same principle just like tether, Usdc. The difference between them is that TUSD and USDC are more open in their activities, declaration of holdings, account and they comply to regulations.

Thank you.

Hi @promo-nigeria

Thanks for attending the 7th -Crypto course on stable coins and for your effort in doing the given homework task.

Feedback

This is good work. Well done with your research on TUSD

Homework task

8