How to Trade Cryptocurrencies Profitably Using TD Sequential-Steemit Crypto Academy | S4W8 | Homework Post for @reddileep

Hello everyone...

It feels good to be among those taking part in this week's lecture with professor @reddileep. I must confess that this has been the most complex thing I have learnt in all of this season.

Thankfully, I finally have a good grasp of the TD sequential indicator and have utilized that knowledge to solve the homework task below.

Q1: Define Thomas Denmark (TD) Sequential Indicator in your own words

The TD sequential indicator is a technical indicator in the category of oscillators. It serves to deliver signals to traders, informing them of a coming price reversal. It also keep traders at a vantage edge where they can take early positions to ride market trends.

Given its two major components which are: the TD set-up and the TD countdown, the TD indicator helps traders make profitable trading decisions across different time-frames and market situations.

For instance, the indicator delivers signals that are applicable in both ranging and trending market situations. Furthermore, the TD indicator is characterized as a counter-trend strategy that is very useful at spotting market tops and bottoms, as well as support and resistance zones.

Unlike other price oscillators that are given to subjective interpretations in the financial market, TD sequential indicator is an objective system, built with its own risk management mechanism.

The two components of the TD indicator - the Set-up and the Countdown, play crucial roles in defining the market momentum and trend exhaustion points, respectively. With the information from these components, traders are better positioned to make profitable trading decisions in the market.

The TD set-up sets the pace for the TD Countdown to play out. In other words, for a TD countdown to be adequately applied, it must first be preceded by a TD set-up.

The TD set-up works better in a range-bound market as it helps to define price ceilings and floors (support and resistance zones). Using the TD set-up, traders can take optimal long/short position when the market is in a range-bound situation.

On the other hand, the TD countdown occurs immediately after a TD set-up is completed. In an unofficial description, a TD countdown could be referred to as countdown to the next cycle after a successful set-up has been completed.

For instance, in the case of a TD "sell" set-up. As soon as the "sell" set-up is completed and a "sell" signal is triggered, if the market obeys this signal, the TD sequential indicator begins another Countdown leading up to when the current cycle will terminate.

Q2- Explain the Psychology behind TD Sequential. (Screenshots required)

The TD sequential works in a pattern of candlesticks, numbers, and Signals.

In any market situation, for the TD sequential to apply, there must be:

- A bearish/bullish flip

- A TD set-up

- Possible set-up interruptions

- Set-up Completion

- Signal

- The TD countdown

The general psychology behind this indicator is that if a flip occurs, and a set-up of nine consecutive candlesticks are printed in favour of the particular flip. Once a set-up is completed without obvious interruptions, a signal is triggered which indicates an exhaustion of the current trend and possible reversal; then the Countdown begins.

Putting this in context, let's illustrate using a typical situation in the market.

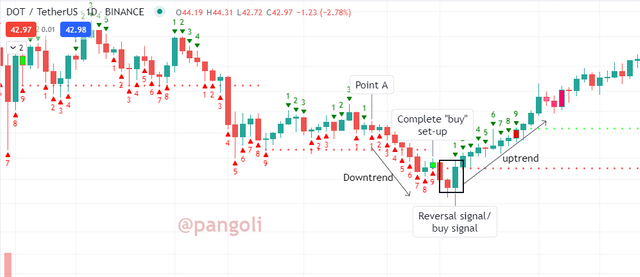

Image source

From the chart (DOT/USDT daily) above, we can see the candlesticks flip at "Point A" into a downtrend. A complete TD "buy" set-up follows after this switch as indicated by the numbers on the subsequent candlesticks.

The set-up is complete because each consecutive candlestick closes lower than the previous four candlesticks in a uniform sequence.

At the point where the 9th candlestick in the TD set-up is completed without interruptions, it indicates that the current market trends is due for a reversal. Hence, long positions can be opened before the countdown to the next "sell" signal begins.

Image source

In addition, an interruption of the TD set-up would imply that the current market dynamics have changed, and the market trend might be headed in a different direction. Interruptions occur when the set-up sequence does not maintain a uniform consistency from 1 to 9.

Q3: Explain the TD Setup during a bullish and a bearish market. (Screenshots required)

As we have already put it in the definition, TD indicators help to reveal turning points in the market so that traders can enter and exit trades profitably.

Having said that, it would be common knowledge to "sell" and take profits when the market is in a bullish momentum and prices are high, or "buy" when the market is in a bearish momentum and prices are low. This is what the TD set-up helps us do.

The TD set-up in a Bullish Market

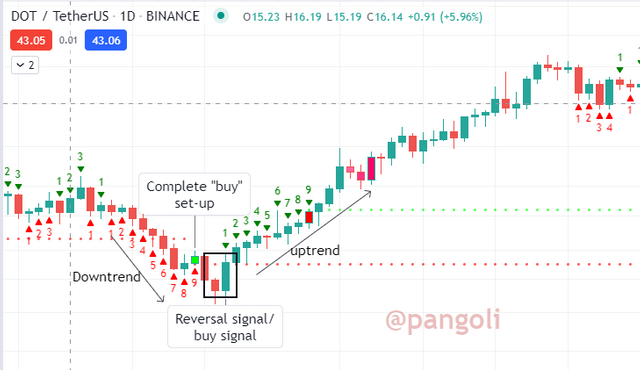

Image source

From the character of the TD indicator, we can already tell that a bullish market will definitely go with the TD "sell" set-up. This point is oftentimes misunderstood by traders to imply the opposite.

In a bullish market situation, we will be looking for the next signal to "sell." So, the target is to find a TD "sell" set-up that will complete the 9 candlesticks cycle without interruptions.

As it can be observed on the chart above, the bullish price flip was followed by a complete TD "sell" set-up. All 9 candlesticks have their close above the previous four candlesticks.

Once the set-up is completed as shown above, a "sell" signal is triggered and the countdown to the next "buy" signal begins.

The TD set-up during a Bearish Market

Image source

This is the exact opposite of the previous illustration. In this case, we are looking for a TD "buy" set-up.

As it can be observed on the charts, for an ideal set-up to occur, there is a bearish price flip, and the candlesticks continue in a downward momentum. Once the TD "buy" set-up is completed by consecutive candlesticks that close lower than four candles earlier, it is said to be a "buy" signal.

With proper signal confirmation, traders can open long positions ahead of the next "sell" countdown.

Q4: Graphically explain how to identify a trend reversal using TD Sequential Indicator in a chart. (Screenshots required)

The TD Sequential indicator is very useful in spotting trend reversals. In the following illustrations, I will explain how this indicator can be used to identify potential Upward or Downward trend reversals.

Upward Trend Reversal

Image source

For this kind of reversal to occur, there must first be a situation where the market is trending downwards. Using the TD terminology, we can say here that we are on the lookout for a TD "buy" set-up.

The first signs leading up to when this reversal occurs is usually a bearish momentum marked by a candle closing below the close of the previous candlesticks.

This candle becomes the first sequence in the TD "buy" set-up and is labelled "1." One there are successive candles that close below the close of the previous four candles, and a consistent succession of 8 to 9 candlesticks is formed. The TD set-up is said to be complete, and it indicates an exhaustion of the current trend.

Beyond this point, the market is due for a reversal and we can see it play out in the subsequent price action.

Downward trend reversal

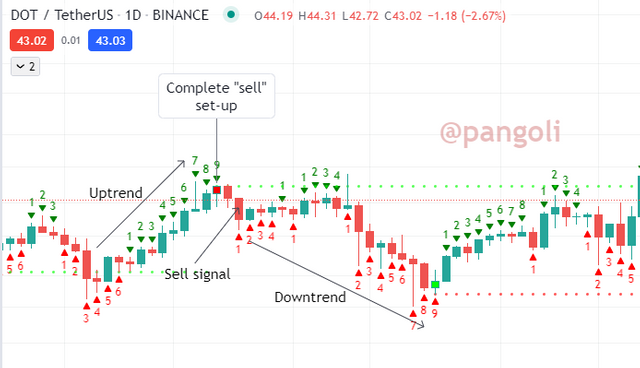

Image source

For a downward reversal to occur, the market must be trending upwards initially. We can also say here that we are on the lookout for a TD "sell" set-up.

Just like the first instance, some of the first signs leading up to when this reversal occurs is usually a bullish momentum marked by a candle closing above the close of the previous candlesticks.

This candle becomes the first sequence in the TD "sell" set-up and is labelled "1." Once successive candles that close above the close of the previous four candles emerge, and a consistent succession of 8 to 9 candlesticks is formed. The TD set-up is said to be complete, and it indicates an exhaustion of the current trend.

Beyond the point of set-up completion, the market is due for a reversal and we can see it play out in the subsequent price action.

Q5: Combine TD Sequential Indicator and make a real purchase of a coin at a point in which TD 9 or 8 count occurs. Then sell it before the next resistance line

For my analysis, I will be pairing the TD sequential indicator with the Relative Strength Index (RSI) indicator.

Image source

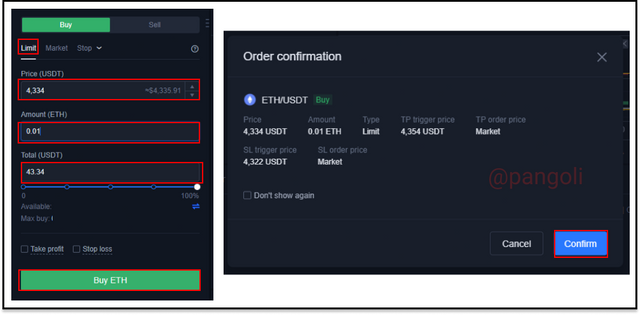

From the ETH/USDT chart above, it can be observed that the market is currently trending downwards and a TD "buy" set-up is completed up to the sequence number 9. The RSI indicator is already approaching the oversold region. These are all indications that the market will soon reverse in the opposite direction.

Furthermore, price action is heading towards the resistance. I will wait for the a further confirmation signal from price action around the resistance zone before proceeding to place my trade on an exchange platform.

Image source

The "signal" is confirmed as a reversal pattern appears around the support line, followed by a bullish candlestick.

Image source

I proceeded to define my entry point, as well as my exit orders before going over to an exchange platform to take my trade.

Image source

On the exchange platform, I set my order-type to limit order since is yet to get to my entry point. Then, I filled out the other requirements and clicked on "Buy ETH".

Image source

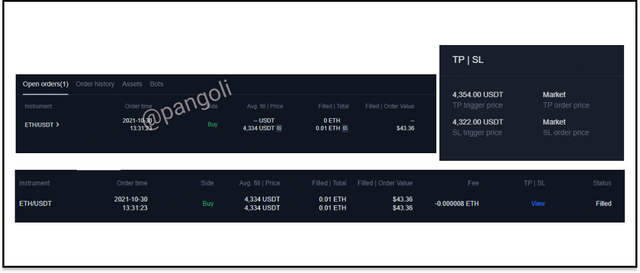

My order is opened and my exit orders are specified accordingly as shown on the screenshots above. Also my filled order details are also displayed alongside the open order.

Conclusion

In conclusion, trading can be a very profitable activity if approached with the right knowledge and strategy.

Interestingly, having a good grasp of high-level technical indicators like the TD sequential indicator can be a huge break for traders in the financial market.

Understanding and utilizing technical indicators like the TD sequential indicator can help traders gain better entry points and exit points in the market. Thus, reducing their risk of making unnecessary losses.

Thanks for reading...

Cc:-

@reddileep

#club5050 😀