Trading Cryptocurrencies - Crypto Academy / S4W6- Homework Post for @reminiscence01.

Image self created on Canva

Explain the following stating its advantages and disadvantages: Spot Trading, Margin Trading and Future Trading.

Spot trading: Spot trading is a type of trading where traders exchange real assets (cryptocurrencies). This involves the buying and selling of assets at at a definite price known as the spot price. A place where such trading occur is known as a Spot market. In a spot market, the assets bought are delivered instantly and the buyer takes full custody of the asset.

Advantages; In spot trading, traders gain full custody of their asset and thus can put it to any form of use. Most traders uses this assets as a form of investment. They buy at a low value and hold till such assets increases in value and then they sell.

Disadvantages: the Spot market is subjected to variations due to fluctuations in the Values of cryptocurrencies. This pose a great risk to fledgling cryptocurrency investors which might be entering the market in the Bulls.

Secondly. In spot trading, you can only trade or invest what you have, unlike the Margin trading.Margin trading:Margin trading is a type of trading whereby investors have the opportunity to trade on loan. They trade beyond what they own as assets. This done to maximize their profit when trading. In margin trading, the trader stake the less fund he has as collateral to acquire larger loan fund known as Leverage to enter a trade. This type of trading poses a risk of losing ones fund totally as the staked collateral would be liquidated if the target is not reached.

Advantages:In margin trading, the potential profit of trading is amplified. That is, traders earn more money by investing more usiny acquired loan.

Secondly, the trader has the opportunity to diversify his investment in such a way that he can open multiple positions for different assets rather than having all his capital positioned to one investment.

Disadvantages:Margin trading poses a high risk of loss. If things go bad the trader can lose his staked capital in a very short timeFutures trading: Future trading is a type of trading that does not involve buying the real asset. I the future market, asset derivative are bought in form of future contract rather than the real underlying assets. Future trading is kind of a bet whereby you go long or buy future contract when you predict the price of such asset will increase or otherwise go short or sell assets when you predict the price will go down. In future trading, predictions are speculated about price of interested asset at a particular time. In this case, one agrees to buy or sell an asset at a predicted price at a particular future price. One significant feature of the future market is the issuance of leverage to its traders. A trader can choose to borrow capital to open a bigger position in the market.

Advantages: Leverage offered by the future market enables trader to maximize their profit return as well as diversify in multiple trades.

Disadvantages: Future trading pose a very high risk of investment when using leverage. Trader can easily lose their capital due change in value of assets. Due to high risk involved in future trading, beginners are advised not to attempt trading in future until a considerable knowledge is gained. Also, the future market does not support owning the real asset and thus, the trader is not in custody of asset.

Explain the different types of orders in trading.

The various order under the Spot trading includes Limit, Market, Stop loss and OCO.

- Limit Order: This is the default type of order in spot trading. Limit order allows trader to dictate the price at which they want to buy or sell a particular coin. The exchange platform works by matching buy and sell orders and as such, a limit order is a pending order that is triggered when such price is hit. For example if the current market price of IDEX/USDT is 0.4 one can decide to buy at a lower price of 0.2 as a limit order. This order would only be executed if the price drops down to 0.2.

- Market Order:Market order is appropriate for traders who wants to buy or sell a token immediately without pending their order. In this case, the trader would have to go by the current market price. Using Binance, the market price is automatically fixed to your order. For example, if the current market price IDEX/USDT is 0.4. The trader can only buy at the price at that particular time.

- Stop Loss:This type of order has two price features: Stop Price and Limit Price. The Limit price is the price at which a trader wish to buy or sell an asset while the Stop price is the price that is set to trigger the order. When the stop price is reached, an order to sell or buy an asset at the limit price is placed in the order book. Buy orders are expected to have limit price slightly lower than the Stop price while Sell orders are expected to have limit price slightly higher than the Stop price.

- OCO: This if fully known as one cancel the other. In this type of order, there are two orders that are placed simultaneously: Limit order and Stop-Limit order. However, only one of these can be executed. If any of the two is partially or fully fulfilled the other is cancelled.

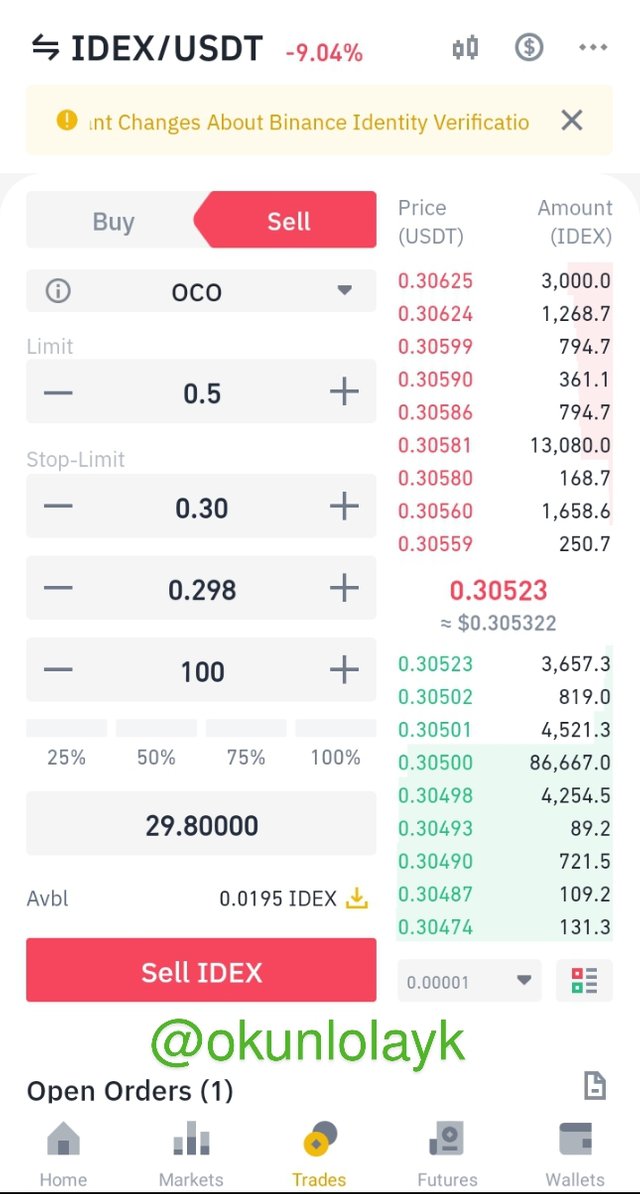

How can a trader manage risk using an OCO order? (technical example needed).

Technically, OCO is used by traders to stop loss during trading. Using the limit order the trader determine what price he wishes to buy or sell an asset. On the other hand he reduces his loss by placing Stop limit order which puts him in a good position even if things goes against his prediction.

When selling for example, I wish to sell IDEX for USDT. The current market price is at 0.308 and my target is at a resisitance of 0.5: However, I set my limit price 0.5 and went ahead to the Stop-limit order and put in 0.30 as the stop price and 0.298 as the limit price.

The implication of this is that if things go well as predicted, I have a chance of selling my asset as desired at 0.5. If the table turn otherwise, I have a Stop-limit order to reduces my loss by placing an order at 0.30 to sell at 0.298.

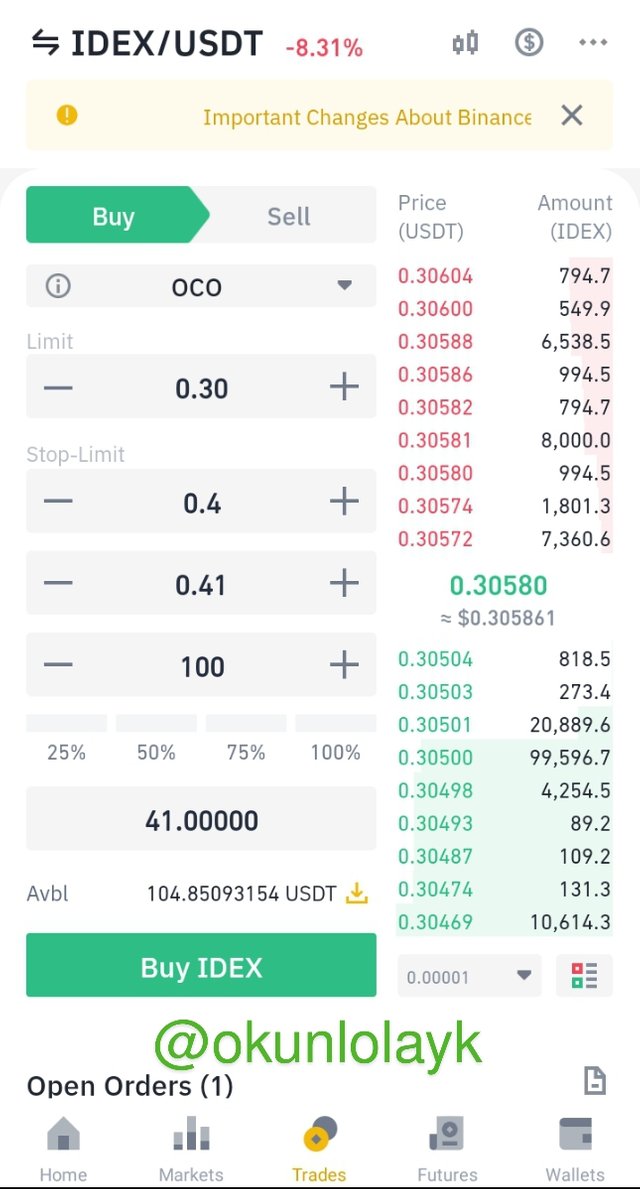

A similar scenerio happens when buying as well;

I wish to buy IDEX when it falls to it support of 0.30. Hence, I placed in the limit order 0.30 and then on the Stop-Limit order I placed 0.4 as the stop price which would trigger a limit price sell of 0.41. The implication here is that if things go as predicted, I will have my IDEX bought at the support price 0.3: If things go otherwise I wouldn't miss out of buying IDEX which now aims at higher price.

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

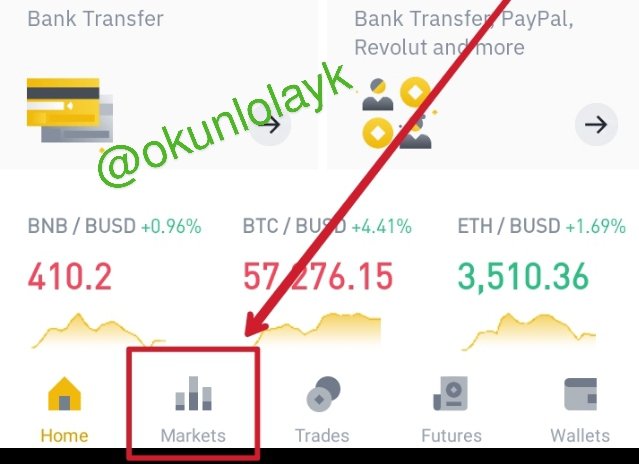

To open an order, log on to the exchange platform. Here I'm using Binance mobile Application.

Step 1: On the home page, tap on market;

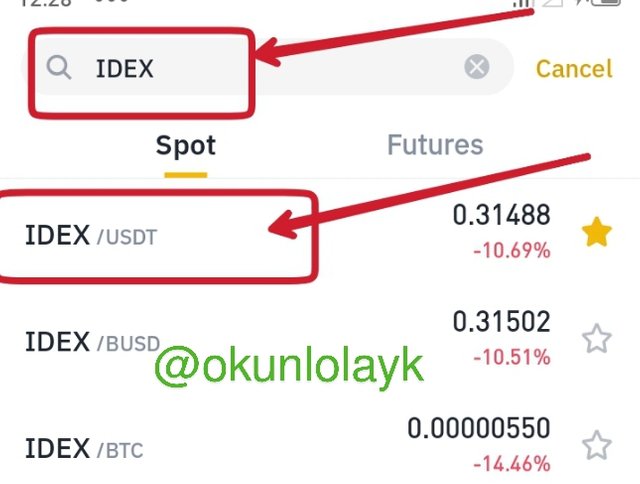

Step 2: fill the desired coin you wish to buy or sell in the search box to easily locate it. Here I searched for IDEX and it provided a list of options of pairs of the coin. From this list, I selected IDEX/USDT; which means I intend to buy or sell IDEX in exchange for USDT.

STEP 3: Click on the Buy or Sell button below the chart displayed and this redirect to the site of trade.

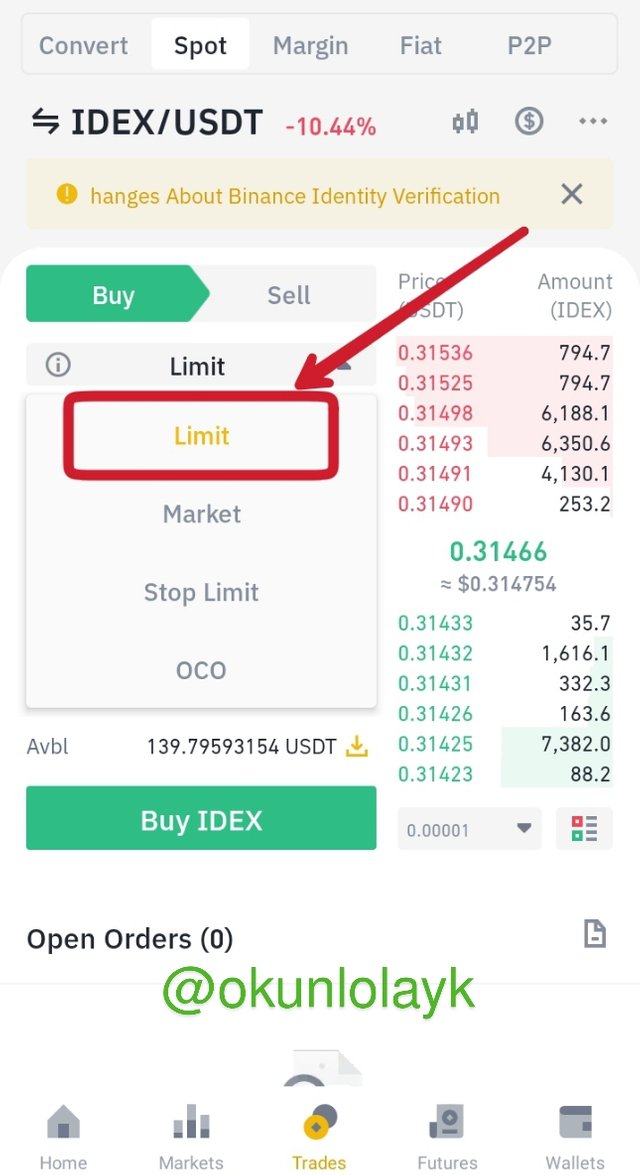

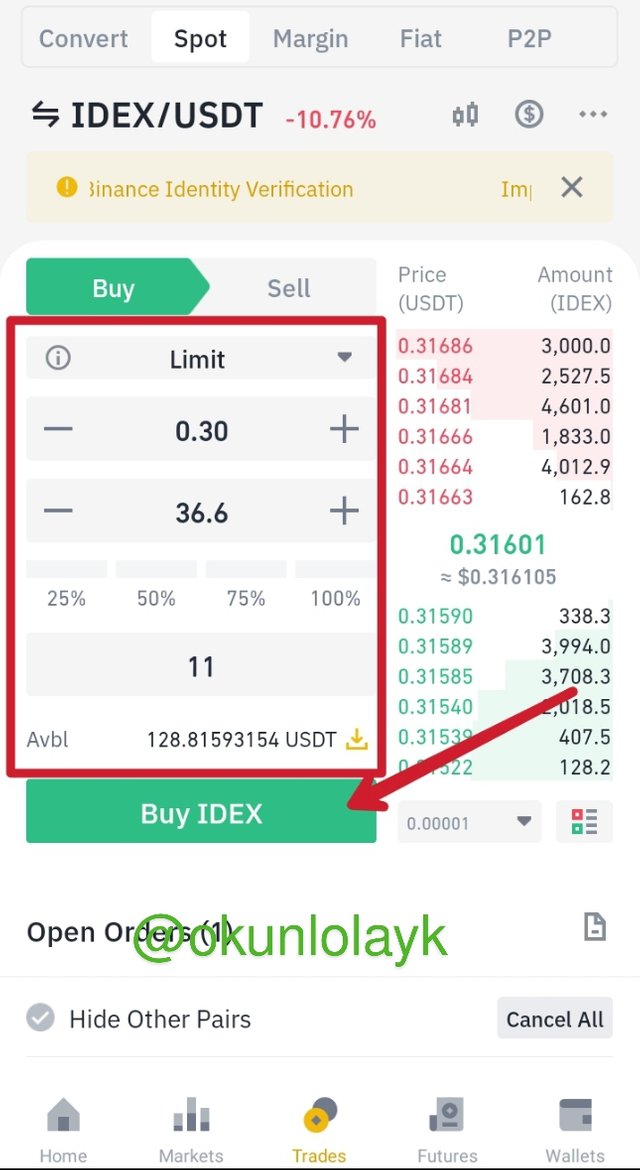

Step 4: On the trading site, we can see the spot market price and the behavior of the market. Here click on the drop-down option which shows the variety of spot trading. Select Limit. When using limit, one is given the opportunity to determine what price he wishes to buy or sell the asset. Here, I considered buying at a lower price than the current market price. The current market price is at $0.31 but I wish to buy at $0.30. This means my order goes pending and it will be triggered when the market price reaches the limit price that I set.

Step 5: After filling the necessary values, click on "Buy IDEX"

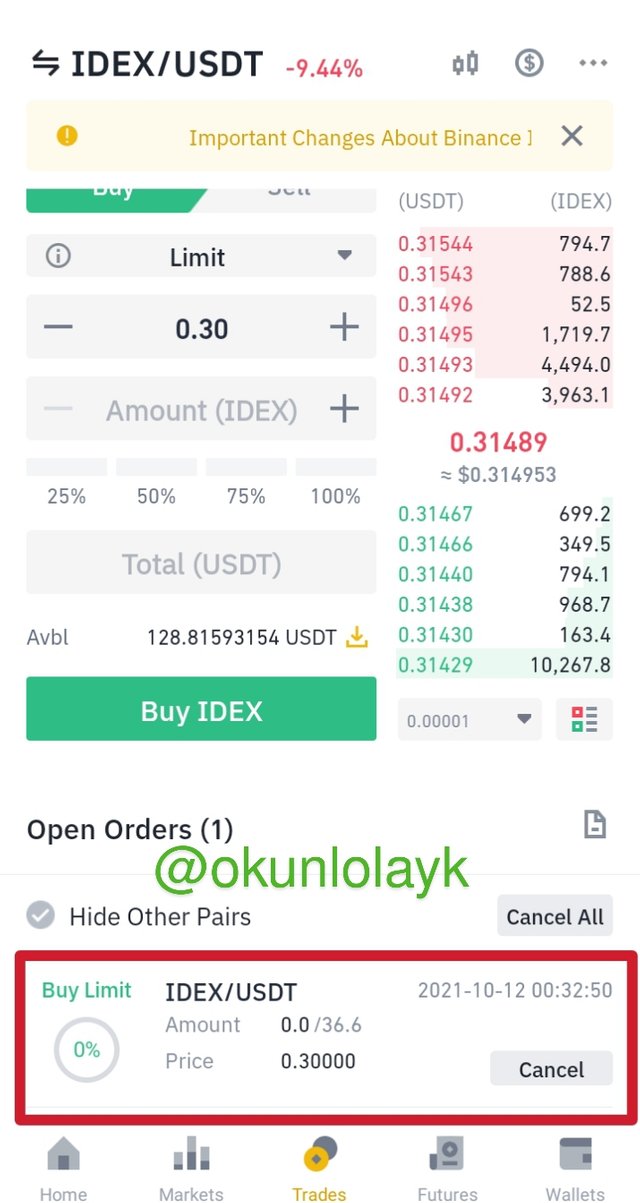

The transaction is approved and a pending Limit order has been placed.

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset.

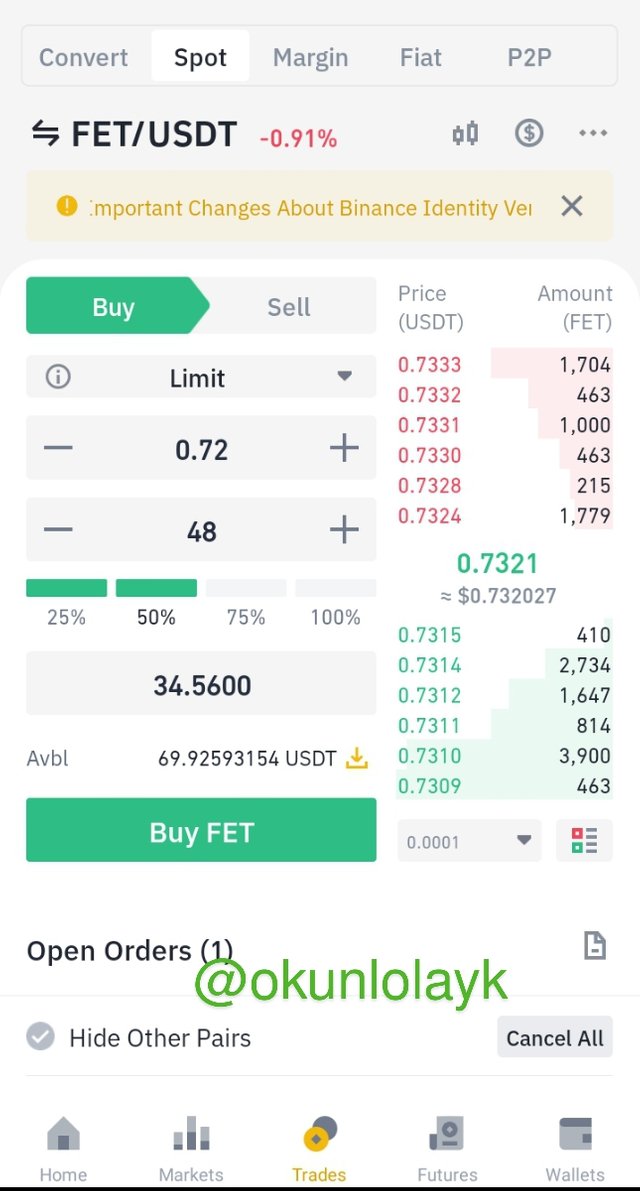

Being a swing trader in search for the a crypto asset that can provide a return in few days. I decided to choose the FET which is considered to be very close to a support at the time of writing. Assets are bought at support expected to bounce to an uptrend. I used the Moving Average (MA) indicator to check the market trend. The FET/USDT experience a consecutive UP-DOWN trend in an average of 5 days.

The MA indicator help to show the average price behavior over a number of time range and the crossing of lines has a significant indication.

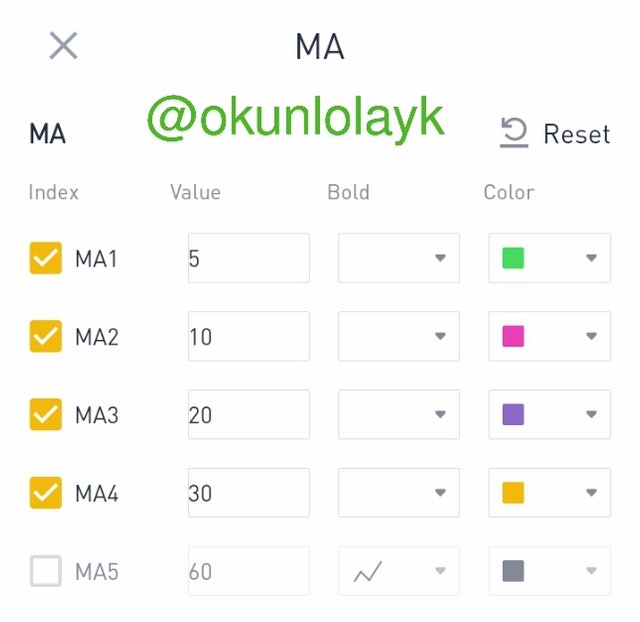

In my demo display here on binance mobile app, the setting of the MA is set across three different timeline the first which is 5 days is indicated green; 10 days indicated pink; 20 days indicated purple and 30 days indicated Yellow.

While displayed on the candlestick chart it could be observed that the green and pink line crossed below the purple and yellow lines.

This is indicated a recent bear in the market.

Being at a support level, it is reasonable to purchase the asset and then hope it grows towards the target resistance.

Considering the FET/USDT market, I'll open a buy trade at limit price of 0.72 USDT at the support and hope to have an upgrowth towards the resistance 0.83 which would serve as the exit point in less than 5days.

Conclusion

Trading is about knowing what you want from the market and knowing how you can strategically get it. Knowing what type of trader you are as well as having the required knowledge are paramount in making trade decisions. The volatility of cryptocurrencies presents an opportunity of potential profit or loss.

Cc: @reminiscence01

Best Regards!!

Hello @okunlolayk , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Thanks for the assessment and feedback professor... Looking forward to writing a better content next time.