Crypto Academy Week 6 Homework Post for [@yohan2on] by @ns-porosh

Assalamu Alaikum🤲

Hello..!!

My Dear Friends

This is @ns-porosh from Bangladesh 🇧🇩

How are you all? I hope you are well by the grace of God I am well with your prayers and mercy God's grace.At first of all thank you to the @yohan2on. Your lesson provides a lot of information on homework tasks.

Homework Task 5

Homework task: Write about any one of the following stable coins;

- Tether(USDT)

- Steem backed dollar(SBD)

- DAI

Stable Coin

Since the dawn of the internet, there has been a demand to take a fiat, make it digital, and reduce its permissions. Entrepreneurs or institutions tried the idea of creating a digit dollar and initiated the journey by launching BitUSD.A stablecoin is a digital asset that remains stable in value against a pegged external traditional asset class. It reduces the price volatility by backing its value against a conventional asset, such as a combination of currencies, a single fiat currency, or other valuable assets. Stablecoins aim to create a stable and reliable environment to increase cryptocurrencies' adoption and negate digital assets' speculative nature. They offer the best of both worlds — security and decentralization of cryptocurrencies, with fiat currencies' stability.

The first Stablecoin: BitUSD

Launched in the early days of cryptocurrencies, in 2014, BitUSD was the first stablecoin issued as a token on the BitShare blockchain. The pioneering stablecoin was the brainchild of two prominent figures in the blockchain industry, Charles Hoskinson and Dan Larimer. The token was backed by the core token of BitShares, BTS, and was collateralized by a range of other cryptos - all locked in a smart contract to act as collateral.

What is Tether?

Source

The history of Tether begins with the Realcoin project. Realcoin entered the market via its whitepaper in July 2014. The whitepaper caused a huge stir amongst the community for several reasons. Aside from its revolutionary technical aspects, the paper’s publishers are some of the most reputable names in the market.

Tether (USDT) is the world’s most popular stablecoin. As such, it serves multiple purposes in the market making it a core cryptocurrency in many investor strategies. While it may be impossible to envision a crypto market without Tether, this hasn’t always been the case. The Tether project overcame much controversy to make it to the top spot.Nowadays, Tether helps to provide liquidity and a hedge against market volatility. It’s able to accomplish this task because it is what’s known as a Stablecoin.

How Tether works

Tether’s official website has a hidden surprise in its “legal” section:

Once you have Tethers, you can trade them, keep them, or use them to pay persons that will accept your Tethers. However, Tethers are not money and are not monetary instruments. They are also not stored value or currency. There is no contractual right or other right or legal claim against us to redeem or exchange your Tethers for money. We do not guarantee any right of redemption or exchange of Tethers by us for money. There is no guarantee against losses when you buy, trade, sell, or redeem Tethers.

Major features of Tether

1.Stability: It is claimed by Tether that users can have the benefit of digital, a blockchain based transaction without being evaporated of most cryptocurrency.

2.Transparency:Tether has claimed its transparency as a fiat reserved account, which is systematically audited to verify that its reserve accounts can actually back up the value of Tethers.

3.Minimal transaction fees: When you make the transaction between two Tether accounts, it doesn’t have any transaction fees.

Advantages of Tether

A tether can be used in order to transfer ordinary money to contractors much cheaper and faster, as the speed of Tether is same as any other cryptocurrency.

Both purchase and re-selling option is provided by Tether. So that you can buy USDT from the exchanges and can also re-sell them.

Once Tether is integrated with the exchange platforms, the performance is highly enhanced.

It can easily integrate with the online cryptocurrency wallets; This is the most important feature of USDT.

Disadvantages of Tether

You have to pay extra to use Tether so if you are not paying and get caught, then they will charge the fees for you.

A big disadvantage of Tether is of using your cell phone as an Internet connection provider, as the connection speed will be same as that of the phone. So, when large files are transferring over a Tethered cell phone, it could take more time and in case if some user disallows the tethering and connecting a device to your phone could destroy your contract.

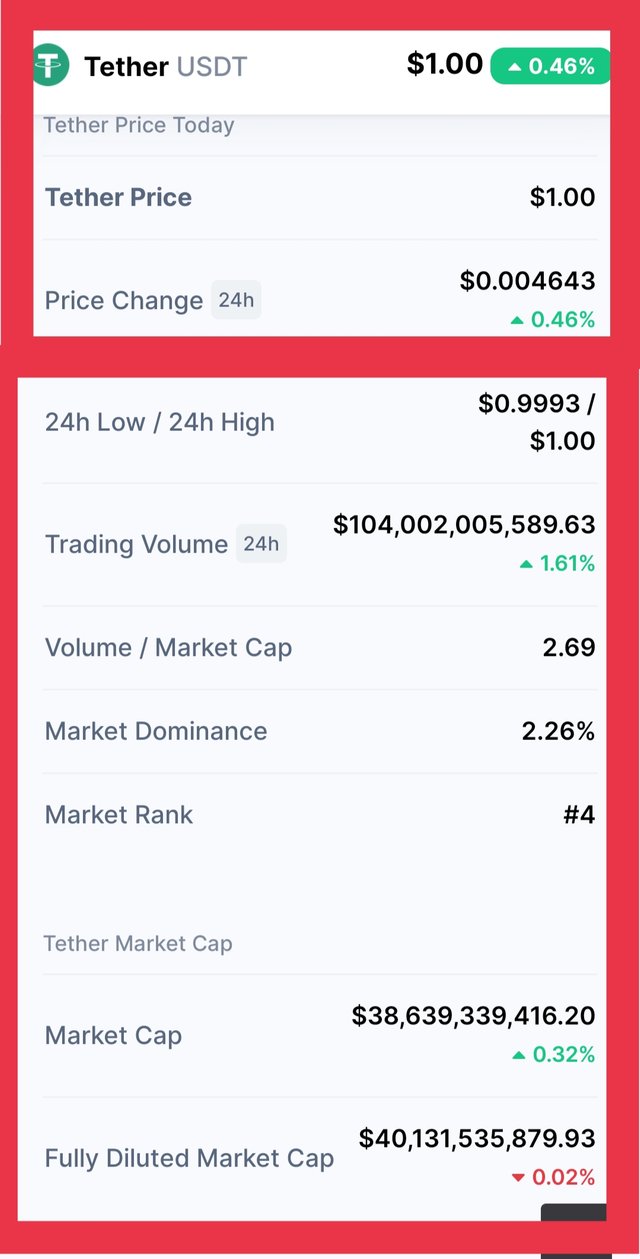

Today's Tether Price/Value and 24h Market Vol./24h high/low

Screenshot Source

Tether Chart

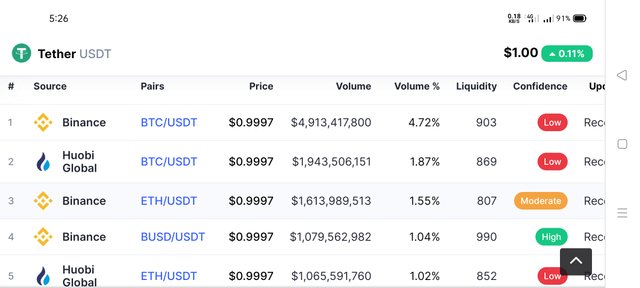

Tether Markets

Thank you @yohan2on for this beautiful lesson. I hope I was able to meet the requirements of this homework work.

Thanks a lot for your visit.🤝 See you again.

Hi @ns-porosh

Thanks for attending the 6th Crypto course and for your effort in doing the given homework task.

Unfortunately, you have plagiarized content in your article. Your article is 97% copy and pasted work from other sources.

Plagiarism is not tolerated on steemit

Homework task

0

Sorry sir @yohan2on (72) next time will not be like that.Please forgive me sir.I made this mistake because I am a new member of this community sir.

@ns-porosh - that is nonsense - you are clearly not a new member of the community as you have already posted several times.

cc @yohan2on @rex-sumon @tarpan @toufiq777

Sir @steemcurator02 (53) Sorry sir I made a mistake sir forgive me. Please forgive me sir. I will never make this mistake again.

@steemcurator02 (53)Sir, I am making your request. Sir, forgive me. Please sir, I will never make this mistake again.