Introduction to cryptocurrency trading : Homework | Task 01 | Professor @besticofinder

Hello steemians,

(The origins of the images mentioned here are as below)

I hope you all are well. This is the first time I've published an article in this community. In my first article I thought of completing homework - task 01 recommended by professor @besticofinder. I thought that task was an easy one so I decided to complete it first. Before that I checked it out on the internet. I present here briefly and simply what I learned.

Introduction to Cryptocurrency Trading

Homework - Task 1

Make an article with short explanations of the following fundamental trading terms: Altcoins, Stable coin, trading pair, Bagholder, HODL, Sats, Bear/Bearish, Bull/Bullish, FUD, etc. You need to do your own research on each term and provide a small explanation.

Altcoins

Altcoins are cryptocurrencies that use a technology called blockchain, an alternative to bitcoin. This makes it easy to transact with peers. altcoin is built on the success of bitcoin and its rules are slightly different from bitcoin. Users can transact here using a private key. The performance of altcoin is similar to the performance of bitcoin. The transactions that take place here cannot be changed or rejected later.

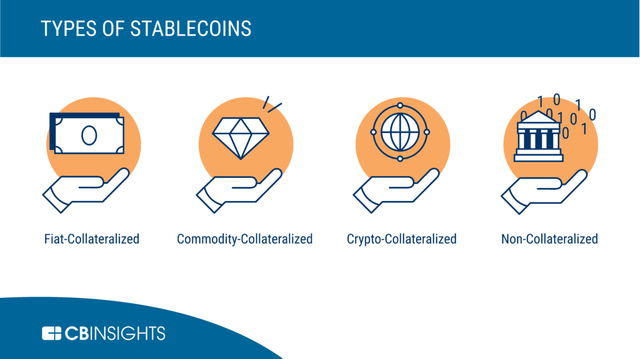

Stable coins

Stable coins are cryptocurrencies designed to minimize the volatility of the price of a fixed coin relative to an asset or fixed assets. Some stablecoins are backed up and some are not backed up. Fiat is known as a stable coin backed by coins that can be redeemed for money and commodities, and an algorithm is called a backed stable coin. One of the major advantages of a stablecoins is that they reduce financial risk.

Trading Pair

A trading pair is a function of two different currencies that can be traded with each other. When buying or selling any cryptocurrencies it is often exchanged for local currency. For example, if we intend to buy or sell SBD with the US dollar, its trading pair is SBD to USD. This can be done in the same way with other cryptocurrencies. And also money can have many trading pairs related to each other.

HODL and Bagholder

HODL is an insult to the cryptocurrencies (other cryptocurrencies, including bitcoin) in the cryptocurrencies community. This is a more lucrative activity than selling. A person who keeps cryptocurrencies in this way is called a hodler. The word HIDL has a clear meaning, meaning "Hold On for Dear Life". That means waiting for the love life.

A Bagholder is a shareholder who holds shares in a non-value company. Another definition of bagholders is that the fraudulent person who is stuck in property ownership is called a bagholder if he buys a worthless property with the intention of selling it at a higher price. It can be directed to the holder of any financial instrument that becomes useless, such as the coins of a defaulted company's bond or failed cryptocurrencies. The word bagholder is derived from the expression "shareholder bag holder".

FUD

The acronym FUD consign "Fear, Uncertainty and Doubt". In 1975, the acronym FUD appeared in marketing and sales as well as in public relations. FUD is usually a strategy of influencing cognition by spreading negative and suspicious or false information and appealing to fear. During this decade (1970), general information relevant to the software, hardware, and technology industries was generally used to describe misinformation in the computer hardware industry.

Bearish and Bullish

I thought could get a better understanding of it by presenting comparative facts about bullish and bearish. Therefore, I present those facts as follows.

• Investors call a person bullish if they believe that stocks or other security will increase. People who believe stocks will fall are called bearish.

• A bullish investor believes that the price of one or more securities will rise. This can apply to any scale on the market.

• Sometimes a bullish investor believes that the market as a whole should rise.

• bearish traders believe that a market will depreciate very quickly and try to profit from its decline. This is in stark contrast to the confidence of bullish investors. They will buy a market in the belief that doing so will bring a profit.

• Normally the market price will fall. For this reason, a market that experiences a continuous decline in prices is called a bear market.

The End

Thanks for reading

References01

References02

References03

References04

References05

References06

Regards

Cc :-

@steemcurator01

@steemcurator02

#cryptocurrencies #steemexclusive #trading #crypto #srilanka #steemit #besticofinder #crypto-academy

A++

Congrats!

Thank you.