Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread | @nachomolina2

This is my entry to Cryptoacademy: Steemit Crypto Academy Update [ September 6th, 2021 #2 ] - Season 4 : Week 1 Courses. Homework Post for @awesononso: Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread. I invite all Steemit.com users to join. @juanmolina @betzaelcorvo @corinadiaz @zmoreno

1. Adequately explain the supply and demand differential.

Speaking in stock market terms, the supply-demand spread consists of the difference in value that exists between the bid price and the ask price of an asset.

This condition applies to any market and on any product or commodity it uses for trading.

In the cryptocurrency market, prices are defined by "limit orders" placed by both buyers and sellers. The price differential is represented by the difference between these limit orders.

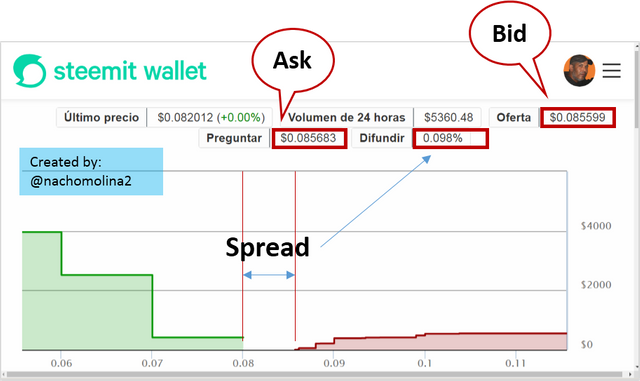

Image created by the author, Steemit logo

Image created by the author, Steemit logoIn such a sense, we have that the highest price that the buyer is willing to pay in a negotiation is called Bid Price while the lowest price that the seller is willing to sell such a product is called Ask Price.

Finally, the subtraction of these two Bid-Ask "limit order" values, represents the differential known as "Spread" or Price Spread, which can be used as a strategic value to determine the liquidity of an asset in the market.

Liquidity is understood as the property of a financial asset to operate quickly in a market and execute orders easily, since there are enough buyers and sellers willing to negotiate, this indicates that the asset is solid in terms of fundamental value, has financial backing and therefore can be a reliable project.

"On the other hand, the Spread can be calculated based on the same asset, between a pair of exchange or between two periods of maturity of a quotation. And it expresses the operational volume for a given moment and how "liquid" the market can be. The lower the spread the higher the liquidity and the higher the spread the lower the liquidity will be."

2. Why is the bid-ask spread important in a market?

According to my own opinion, the calculation of the bid-ask spread is used to have an immediate notion of the current state of the market that transits an asset with which you want to trade, taking into account the liquidity as a fundamental data that can serve to select a reliable project in which to invest.

It is important because it can serve as a guide for successful trading, since according to market liquidity a trader will be able to execute his orders quickly and therefore counteract the effects of market volatility on the price, thus reducing financial risk.

For example, for a scalper or intraday trader the spread is very useful since it gives a signal of the supply-demand balance and therefore of the market movement. Let's remember that "short" traders make profits in volatile markets, hence the bid-ask spread offers first class information on market profitability according to the sensitivity of each trader.

My Steemit wallet

The above screenshot shows in detail the STEEM Spread in the market for a given time. As you can notice it has a fairly wide bid-ask spread which indicates that the market is illiquid, as there are not enough open limit orders that can balance the bid-ask.

"Taking into account the reduction or widening of the margin or spread, you will have a pretty clear idea of the feasibility of the project in which you want to invest or if on the contrary it will bring problems to execute the orders."

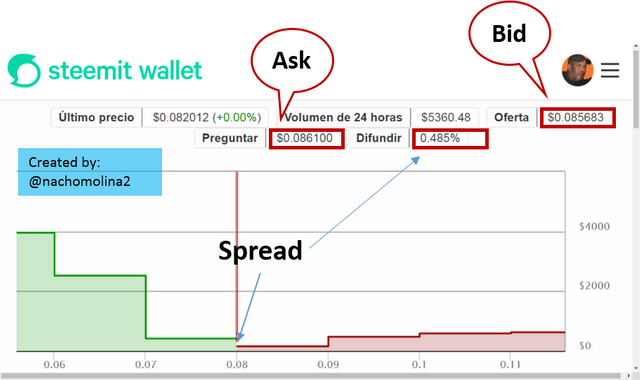

My Steemit wallet

The above screenshot corresponds to another STEEM market moment where you can see in detail the bid-ask spread with a very small gap indicating high liquidity and probably a large operational volume of limit orders. For this moment STEEM may be an ideal project to invest in as there are willing buyers and sellers to trade.

In general, the bid-ask spread is important because it reduces operational risk by allowing evidence of a project's reliability. The market movement attributes a greater possibility of obtaining short-term profits thanks to liquidity and it is precisely the information offered by this price differential, an element that contributes to the fundamental analysis of a cryptoasset. It can favor both sellers and buyers as it is oriented to the best price offer (bid-ask) for trading the asset at a given time.

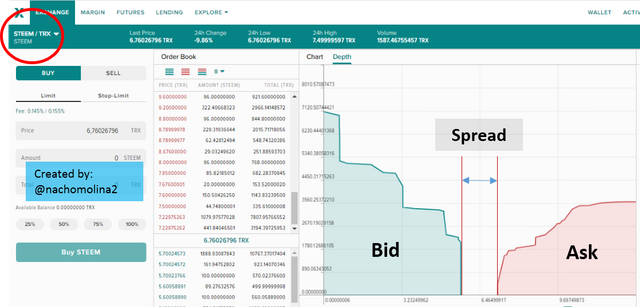

Poloniex

The above screenshot comes from poloniex.com in this case for the STEEM/TRX swap pair, you can see a wide Bid-Ask Spread gap which indicates low market liquidity where perhaps limit orders are not executed quickly therefore investing at this time is considered a risk.

3. If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the bid-ask spread.

b.) Calculate the Bid-Ask spread in percent.

Response:

a) The Bid price = $ 5.0

The Ask price = $ 5.20

- Bid-Ask Spread = Ask price - Bid price

$ 5.20 - $ 5.0 = $ 0.20

b) %Spread = (Spread/Ask price) x 100

- %Spread = (0.20 / 5.20) x 100

0.0385 x 100 = 3.85 %

4. If Crypto "Y" has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Response:

a) The Bid price = $ 8.40

The Ask price = $ 8.80

- Bid-Ask Spread = Ask price - Bid price

$ 8.80 - $ 8.40 = $ 0.40

b) %Spread = (Spread/Ask price) x 100

- %Spread = (0.40 / 8.80) x 100

0.0455 x 100 = 4.55 %

5. In a statement, which of the above assets has the highest liquidity and why

The asset with the highest liquidity is: "X", with a %Spread = 3.85 %.

Because the lower the spread the more liquid the market will be. This indicates that there is a balance between the limit orders created by buyers and sellers, which is manifested by a boom in buying and selling attributing dynamics to the market represented by speculative traders interested in buying at the Bid price reached and in the same way others agree to sell at the Ask price that is established for the moment.

This creates a financial effect where orders are processed easily because there is interest in trading with this crypto "X", putting a lot of capital at stake which increases the stock market liquidity and reliability of the project.

It should be noted that the difference between ask price and bid price of asset "X" (5.20-5.0=0.2), is smaller than the ask-bid price difference of asset "Y" (8.80-8.40=0.40); this particularity is what defines the lower "%Spread" (3.85 %), for asset "X" indicating that it has a higher number of open limit orders and a large operational volume, which translates into liquidity.

6. Explain the slippage.

Slippage is a complex situation that occurs in the framework of an exchange when a type of order is placed called: "Market Order".

In this type of trading the trader does not set the price at which he wishes to trade the asset, as in the case of a "limit order", but accepts an existing order with a previously established price.

This implies that from the moment the order is created until the moment it is executed, the price could vary at a different value than expected.

By the time of cancellation of a market order the price could have increased or decreased, in either case that difference from the expected value is what is known as slippage.

7. Explain positive slippage and negative slippage with illustrations of prices for each.

Positive slippage:

In this type of slippage the strike price is more favorable than the expected price. Therefore the trader will benefit in some way whether he has gone long or short.

For a buy order the price is executed at a lower amount than expected, i.e. the buyer ends up buying cheaper than expected.

Example 1.

The market order was placed on the exchange for the "buy" of an asset "A" for $ 50 and after a time interval ended up being executed for $ 48. We speak of a positive slippage of:

- $ 50 - $ 48 = 2 $

"The buyer would have had a profit of $ 2 for the trade thanks to the slippage".

For a "sell order " the price is executed at a higher amount than expected, i.e. the seller ends up selling more expensively than he expected.

Example 2.

The market order was placed on the exchange for the sale of an asset "B" for $ 20 and after a time interval ended up being executed for $ 21:

- $ 21 - $ 20 = 1 $

"The seller would have had a profit of $ 1 for the negotiation thanks to the slippage."

Negative slippage:

In this type of slippage the execution price is unfavorable with respect to the expected price. Therefore the trader will be affected in some way whether he has gone to buy or sell.

For a buy order the price is executed at a higher amount than expected, i.e. the buyer ends up buying more expensive than expected.

Example 3.

The market order was placed on the exchange for the purchase of an asset "C" for $ 50 and after a time interval ended up being executed for $ 50.82. We are talking about a negative slippage of:

- $ 50.82 - $ 50 = 0.82 $

"The buyer would have bought the asset $0.82 higher than expected, due to the slippage."

For a sell order the price is executed at a lower amount than expected, i.e., the seller ends up selling cheaper than expected.

Example 4.

The market order was placed on the exchange for the sale of an asset "D" for $20 and after a time interval ended up being executed for $19.40. We are talking about a negative slippage of:

- $ 20 - $ 19.40 = 0.60 $

"The seller would have sold the asset 0.60 $ lower than expected, due to the slippage."

Conclusion

In this assignment the issues related to the bid-ask spread, liquidity and slippage have been discussed, these aspects are determinant to opt for the selection of a reliable project and to have operational success.

Taking into account that a trader according to his nature on negotiations will choose to participate in an exchange by placing limit orders or market orders, in this sense, it would be of great help to manage the bid-ask spreads with certain ability to be clear about the market liquidity for a particular asset.

Likewise, if it is a "market order", you should keep in mind that your investment would be subject to possible price slippage even more so when orders are not executed quickly due to the supply-demand imbalance.

In either case, it is concluded that the liquidity of an asset should be studied thoroughly and preliminarily before investing, in order to have an idea of the fundamental financial status of the project and to be able to carry out low-risk operations.

Image created by the author, Steemit logo

Cc: -

@steemitblog

@steemcurator01

@steemcurator02

@awesononso

@lenonmc21

Original content

2021

Twitter:

https://twitter.com/addverso/status/1436525497362657280?s=20

Hello @nachomolina2,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You have done well on the topic with good explanations and illustrations but some instances needed to be a little clearer.

There are a couple of points still missing especially on the explanation of slippage.

Thanks again as we anticipate your participation in the next class.

Gracias professor @awesononso!