Crypto Academy Week 10: Homework Post for Crypto professor @fendit | make your cryptocurrencies work for you

INTRODUCTION

good day sir @fendit I went through your article about savings, launch pool and others it is a really nice article thank you for that and here is my assignment sir based on what I've learnt from you and my research.

My aversion to risk

Most people actually like averting risk while some love the risk but what is an investment without risk, the fun in investing is the fact that it's risky.

I guess the fact that I'm new to crypto trading made me to be have a conservative tolerance to Risk cause I don't really understand the market so well yet and I can't just be putting a whole lot of money into what I dont understand, the most interesting thing about the conservative tolerance to Risk is that I'll be going for investments that gives a guaranteed profit cause who would want his profit to be guaranteed?

Unlike an aggressive Risker who risk very high in order to get a profit which isn't guaranteed cause he can go into a loss. But the interesting part of been an an aggressive Risker is that when you are making profit it's going to be very high cause you are risking high unlike the type of Risker that I am I don't care about the amount of interest I'm making as long as my interest is guaranteed.

There are actually a lot of products on binance that you can risk like the Bitcoin (BTC)Ethereum (ETH) Binance Coin(BNB) Litecoin (LTC) Ripple(XRP) Polkadot(DOT) Stellar (XLM) but i love risking my Tron coin cause it's has a low volatility and cause it's cheap a Tron coin is worth less than $0.15 as at now.

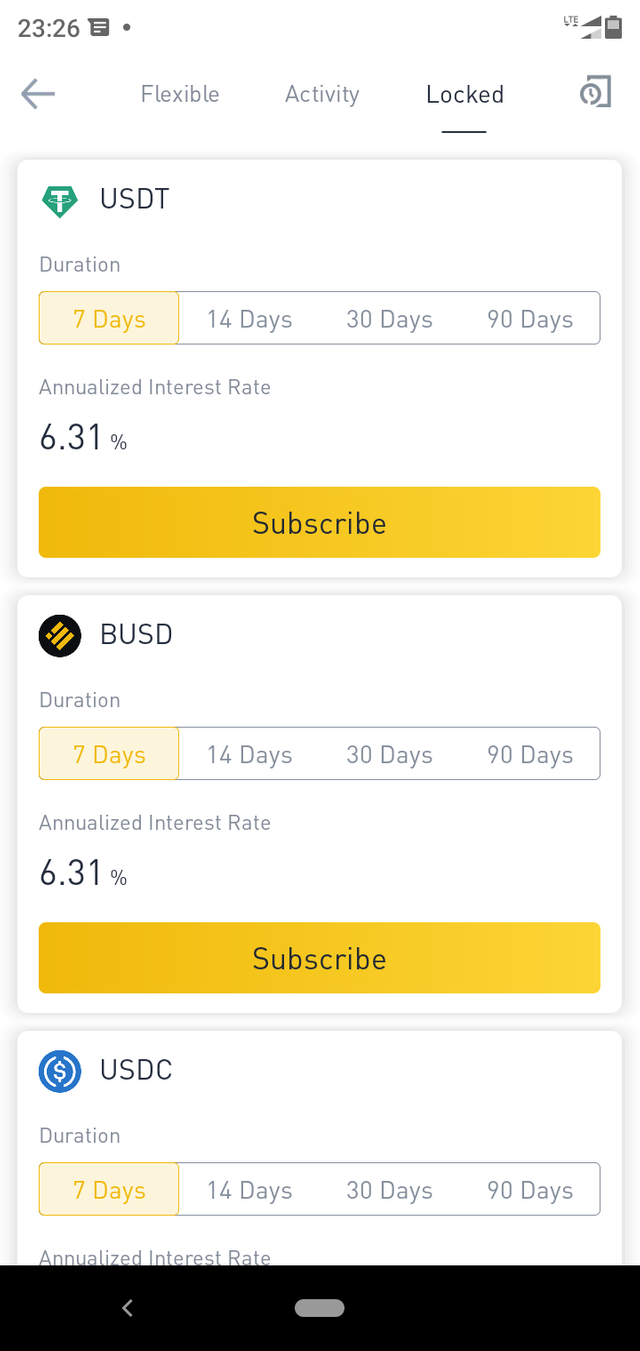

Fixed savings

Under this type of savings the amount of coin or product you stake cannot be accessed by you again until the period or duration you choose which could either be a week, month, 2 months or even a year depending on you but note that the higher time you save with the higher your profit for example Mr A and Mr B invested $500 in a coin but Mr A's duration was just a week while Mr B's duration is a year if the period of their savings is over Mr B will definitely come out richer than Mr A cause his profit will be much more than that of Mr b. The fixed savings is also known as the locked savings

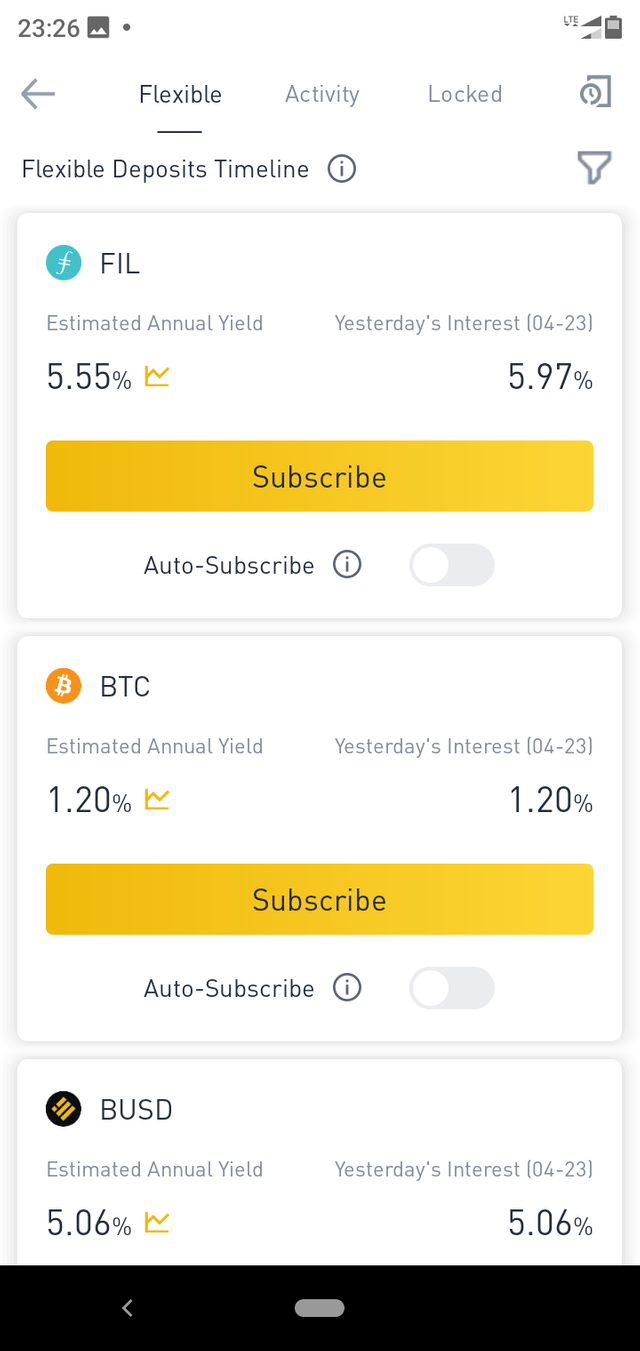

Flexible saving

Unlike fixed savings that's you can't have access to your coin or product after saving them, the flexible saving is the exact opposite, like the name flexible which means it can be changed, you have the ability to opt-out of an investment even though the period or duration you Inserted in the investment isn't complete another amazing fact about the flexible savings is that you said and I quote "THIS IS A GREAT CHOICE FOR YOU IF YOUR RISK TOLERANCE IS LOW" so for a person like me who has a conservative tolerance to Risk I'd prefer the flexible savings.

High risk products

Someone like me wouldn't want to get my hands in there just yet cause I'm that conservative type for someone to trade this products he or she must have a high tolerance to risk which i dont have. These are products that can reduce greatly in value if price volatility is low and increase greatly in value if the price volatility is high.

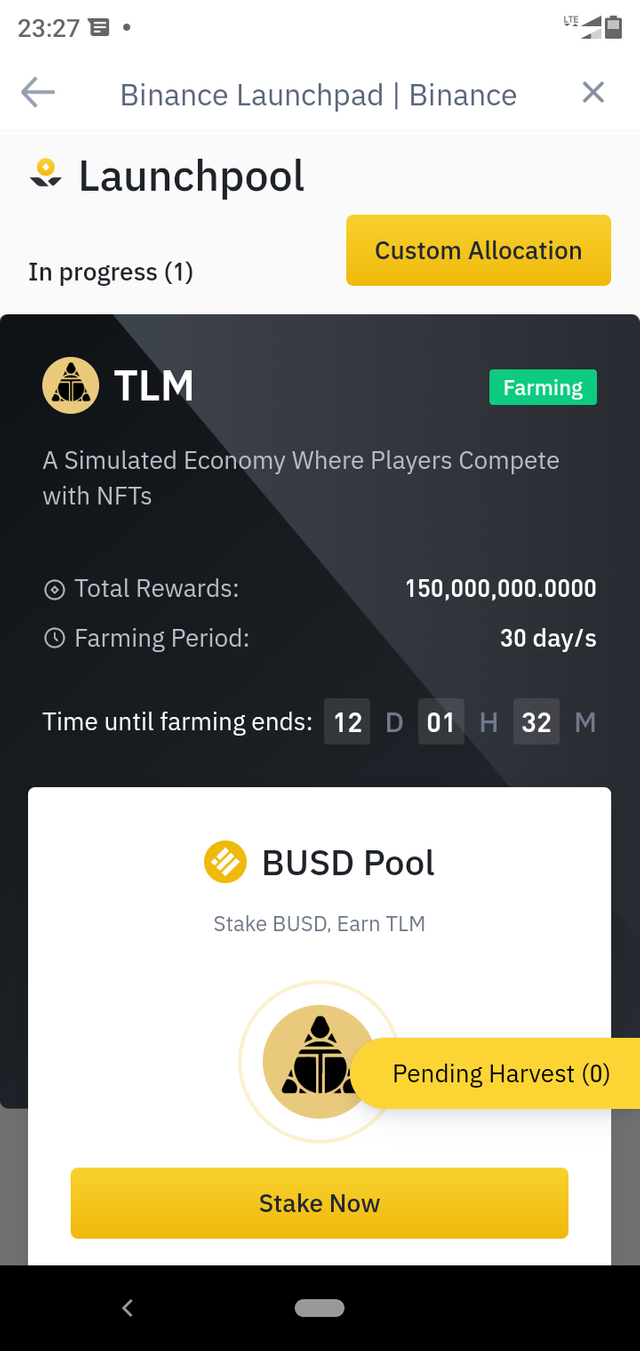

Launch pool

It's a way of investing on the binance platform or any other trading platform that has the token launch, they'll inform about about a new projects so you'll be able to stake your Coin to earn another different coin for free which means the higher the amount of your coin you stake the higher the amount of the free coming you going to get but before staking your coming you have to look at their offers like the APY(annual percentage yield) and go fo the one that suites your taste and the launch pool is like a fixed savings cause you don not have access to your coin again until the time of farming is over i.e the duration for the staking

Step by step on how to make a flexible savings

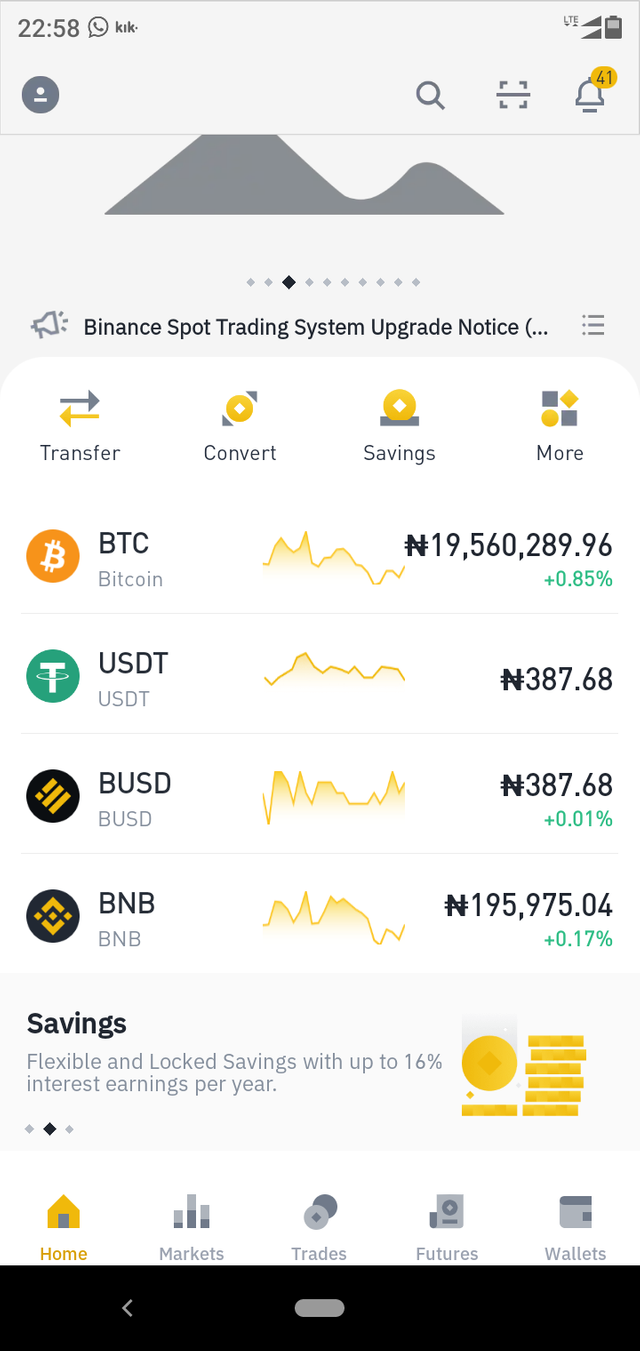

I'll be doing a live flexible saving so all the picture are from my trade

The first step is that you'll go to the hope page and click on savings

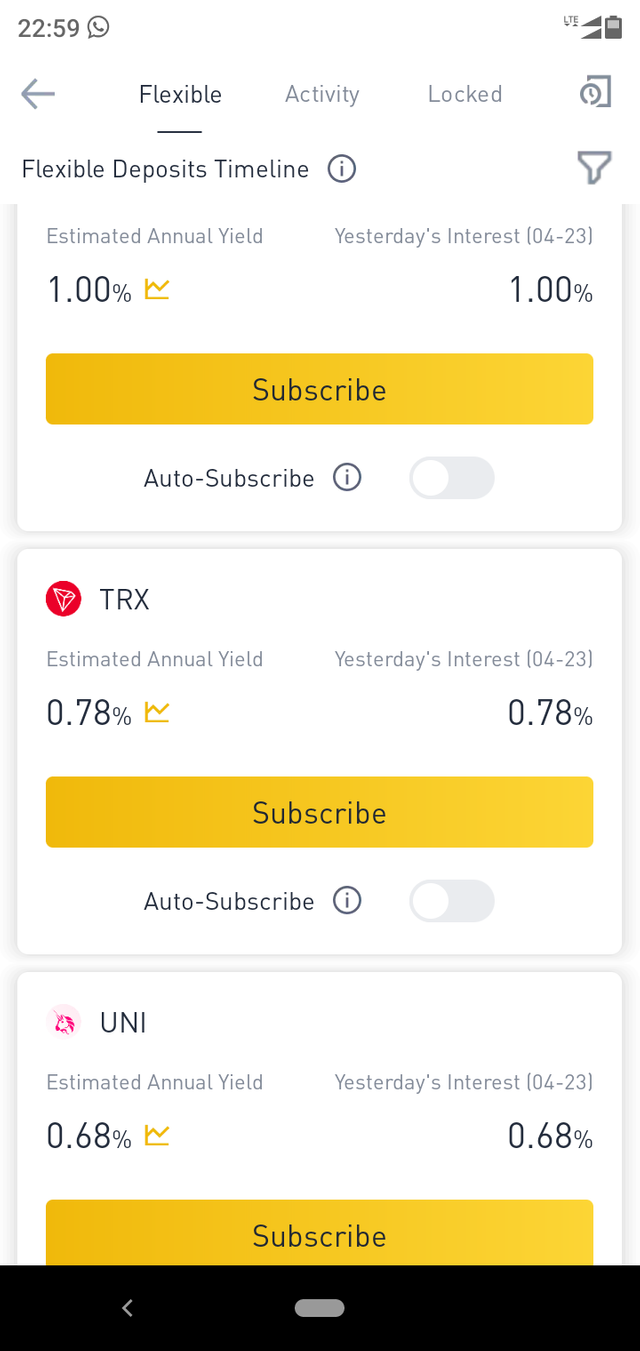

You find the Coin you want to save and mind you, you can always change the type of savings you want to engage it it's just at the top of the page where you'll see flexible, activity and locked i.e fixed savings

I want to save the TRX (Tron) so I clicked on subscribe

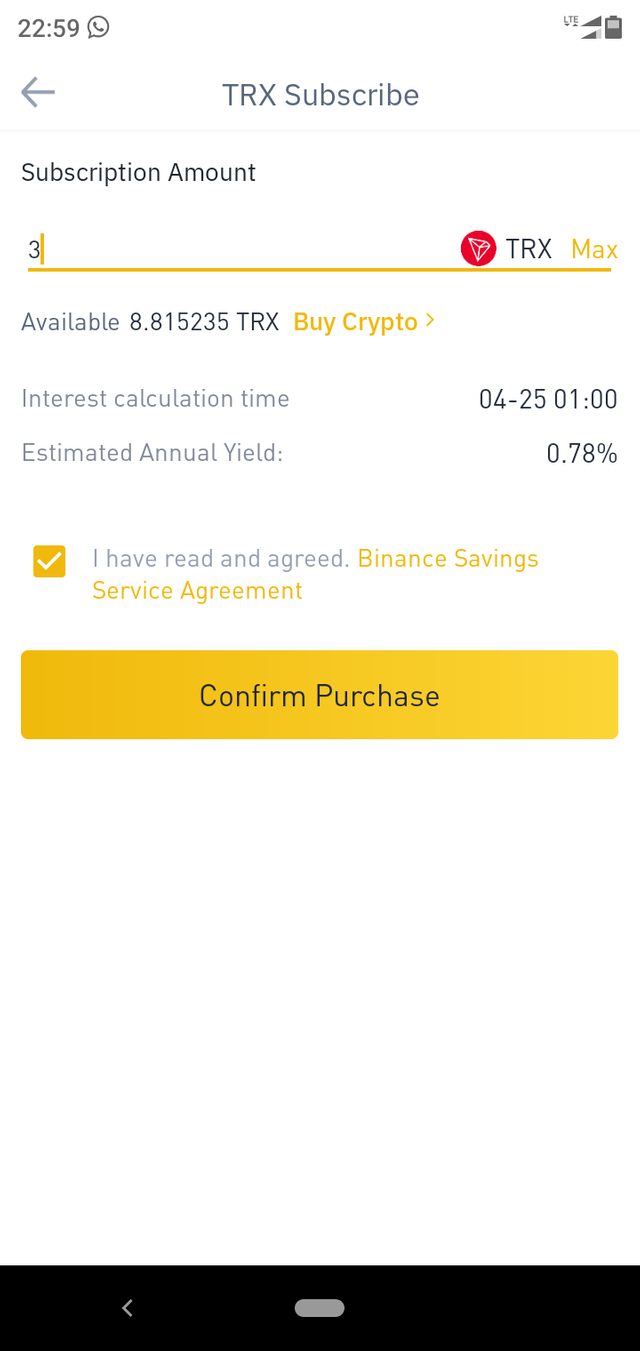

You input the amount of the coin the you want to save as for me I saved 3 TRX, accept the terms and conditions and then click on the confirm purchase botton

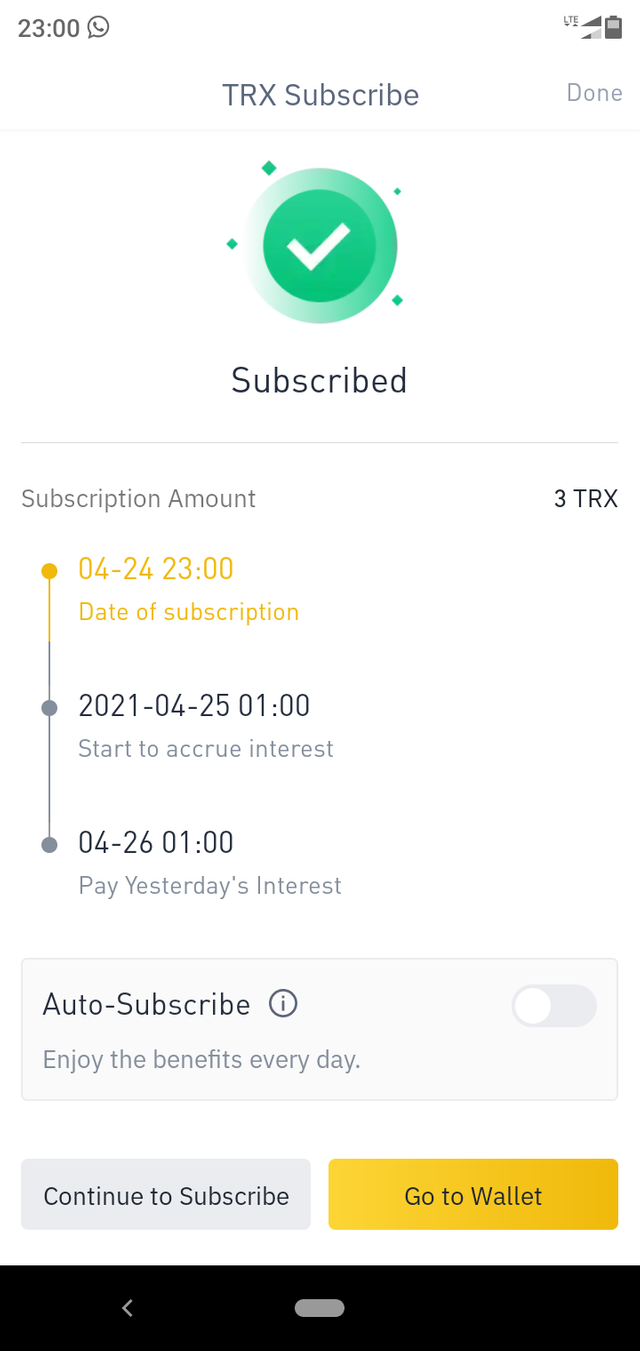

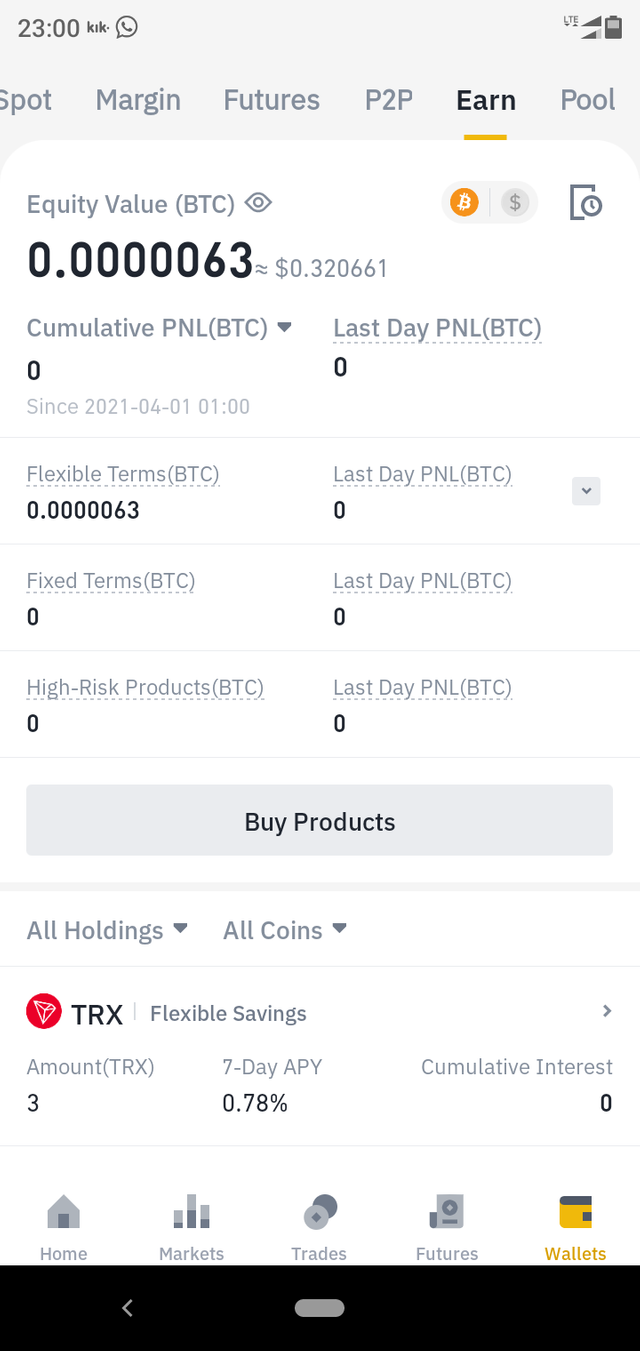

Then You'll be subscribed to the flexible savings, click on go to wallet and it will automatically direct you to the earn page where you can check your savings and earning

the end

NOTE: all picture are screenshots from my mobile binance app

Cc @fendit

Cc @steemcurator02

Cc @ateemexclusive

Thank you for being part of my lecture and completing the task!

My comments:

It was good, but try to explain everything in a more detailed way for next time. Also, giving your insights on this topic can also be a good idea and it's always nice to share your experience.

Those are not products, they are coins.

Also, try to focus on markdowns next time, they can make your post look a lot better and that's also important when it comes to overall score.

Overall score:

4/10