Steemit Crypto Academy-Explain Spot Trading and Margin Trading,Advantage and Disadvantage Homework Task 3 by @besticofinder

Hello Steemit Crypto Academy Community

Thank you very much to @besticofinder for giving homework to us beginners, this time I will answer questions about spot trading and spot margin.

I edited this image through the Picsart application

1. Describe Spot Trading and Margin Trading

Spot trading

Different from peer-to-peer trading, spot trading is more concerned with and focuses on the spot price or the current market price. Traders usually seek to profit from volatile market movements. In this regard, prices in the market tend to be more fixed and less variable because they follow market prices. This is because spot trading is carried out on the same day when the trading position is determined.

If peer-to-peer trading must have a partner to make trading transactions, the spot trading scheme usually uses the principle of buy low sell high in certain cryptocurrency exchanges and does not involve other opponents when making transactions. Later, traders will buy cryptocurrencies when the price of cryptocurrencies on the market is low, and sell them when the market prices are high.

Here, traders will directly trade crypto assets in real market conditions, so that price movements can be seen immediately and will greatly affect the profits that will be obtained.

Margin trading

This trading has the same buy low sell high mechanism as spot trading, but what distinguishes it is the choice of capital or margin used. This margin system is to borrow capital at a certain value on a cryptocurrency exchange. The available margin also varies depending on the platform provider. Usually the smallest value starts from 5X, 10X, 20X, up to the largest 100X margin.

The use of this margin is nothing but done to make it easier for users to open trading positions at a certain price with more buying / selling capital than their original capital, and of course to increase the profit from trading.

Keep in mind, even though it has the potential for large trading profits, the risk it has will also be higher according to the selected margin. What's more, usually this service provider will charge certain fees according to the margin used to its users.

That's the basic difference from peer-to-peer, spot, and margin trading in the crypto currency space in terms of price and also the transaction process in it. The differences between the three can determine the methods and strategies of traders in dealing with price movements and cryptocurrency market conditions.

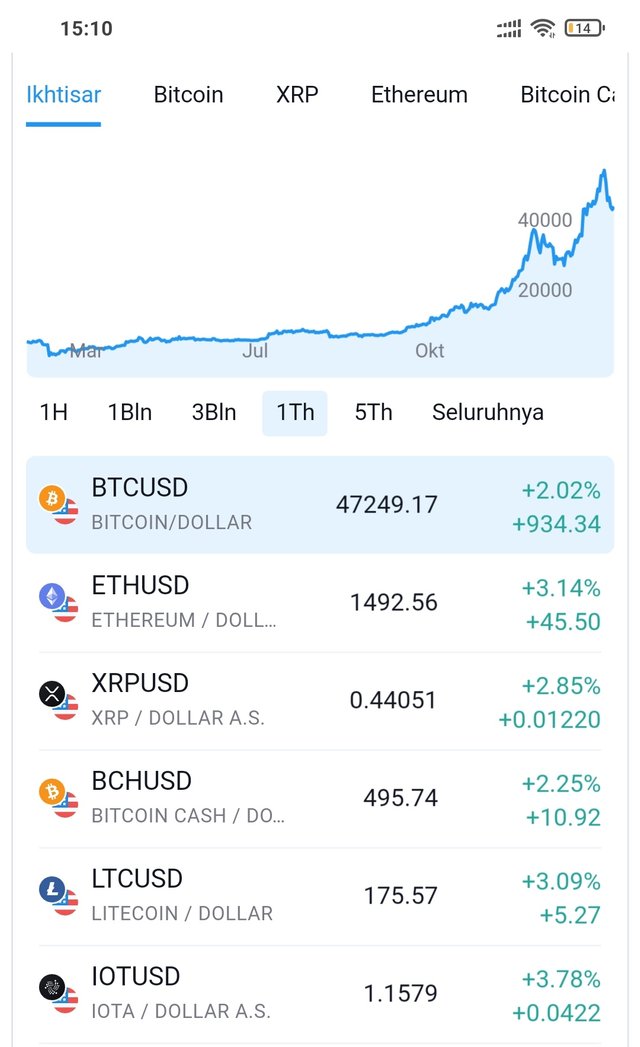

this image from my phone screenshot

2.Advantages and disadvantages of Spot Trading and Margin Trading

Spot trading advantages

First, trading is more flexible than the futures market. Transactions on the spot market can proceed for lower volumes. In addition, the parties involved can hold the item until they find a better deal.

Second, deliveries are short-lived and require only a few. Therefore, the investor can immediately get the purchased item after paying a certain amount of cash. It reduces uncertainty and the possibility of counterpart delivery failure.

Third, the spot market usually requires less capital. In contrast, in the futures market, the minimum investment is usually significant.

Fourth, prices are more transparent. You may use yesterday's price to make a transaction now.

Advantages on margin trading

1.Leverage is a fairly simple and affordable tool that allows you to earn more and has very clear and understandable advantages:

2.Increased purchasing power. By borrowing money, you can control a much larger position in the market. Formally, with 1 BTC, you can borrow another 200 BTC and trade as if you had 200 BTC. However, if something goes wrong, you will lose 1 BTC instead of 200 BTC.

3.A good combination with high market volatility. The digital asset market is very volatile. The dynamics don't allow you to wait long for an increase in trading capital - those who bought assets last week are probably much richer than their followers. Under such circumstances, getting huge capital right here and now is priceless.

4.Ability to make a profit during a market downturn. Leveraged trading is possible both on rising and falling. You can make a profit even if the asset value decreases.

5.Easy access. Gaining leverage in the cryptocurrency market is usually several times more than in other markets. You can get access to margin trading regardless of where you come from, what you do, or what kind of education you have.

Example of margin gain / loss:

If, for example, the margin is 0.1 BTC but the trade value on the basis of that margin is 1 BTC, a 5% movement in the market (in both directions) is interpreted as a gain or loss of 0.05 BTC (50% of the value of the margin).

This is all about my Homework Assignment given by @besticofinder

Hello @besticofinder

If there is a need for correction, please let me know.

Thanks

Cc: -

@steemitblog

@steemcurator01

@steemcurator02

@besticofinder