{Steemit Crypto Academy - Season 2, Week 6} Elliott Wave Theory:Homework done by @mojubare

Introduction

Elliott wave theory made us understand that market prices move in waves which can be disintegrated into fractal with the help of the Dow Theory. Founded by Raph Nelson Elliott, the theory has been of great importance to traders and investors alike.

In this post, I will be writing to answer the questions in the assignment given by @fendit in the class "Elliott Wave Theory".

What's the application of Elliott wave theory?

Elliott wave theory is a technical analysis wave where charts are being studied and monitored for future predictions of financial market prices ranging from stocks, indexes, cryptocurrencies, etc. The theory makes it clear that the market movement is determined by participation, market mass, and volume. it says that the market does not move as a result of the latest news but rather as a pattern.

Trading results can be finalized mostly when Eliott wave theory is applied by a trader while trading on a particular financial asset. Elliot wave theory gives the trader an insight into how the trading outcome will be otherwise saving the losses that are to be incurred when trading. Traders also have the ability to monitor and know when to break a particular trade or put it on hold when they noticed there is a high probability of loss.

Elliott wave theory proves that price movement move in waves that goes up and down in a repetitive pattern. The waves are created by the trader’s interest in the trading lane. The theory discovers that there is consistency in the rise and fall of trading mass psychology.

What are impulse and corrective waves? How can you easily spot the different waves?

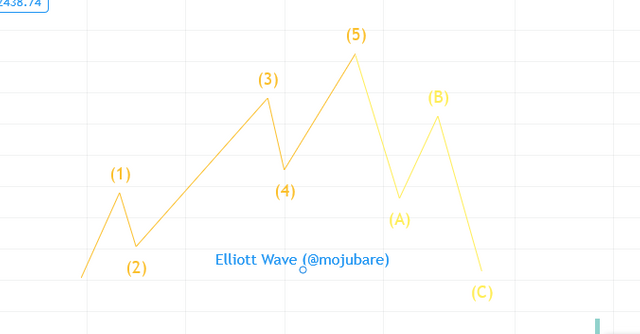

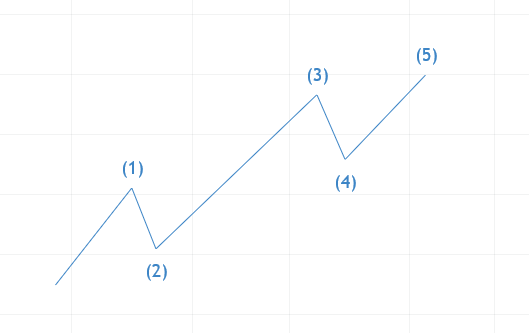

Impulse waves

With impulse wave, there are five strong waves that follow the market trend making the trend a larger wave. In a bullish market, the impulse wave will give a bullish increase and in a bear market, the impulse wave will increase the trend to its 5th wave.

The waves are labelled in a way that shows how important they are which are wave 1,3 and 5 which are strong impulse waves, followed by wave 2 and 4 that are correction waves within the impulse wave.

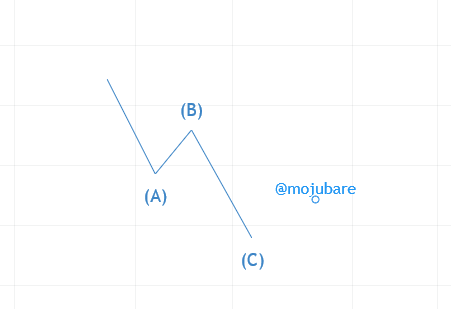

Corrective waves

This wave never overcomes the level of impulse wave but retraces part of the previous wave trend. They never break each other origin and there is a smooth flow within both waves giving the trader the ability to be able to understand how the trading waves moves. Wave 2 never overthrows 1 and wave 4 never goes above the origin of wave 3. Asides from the waves in the impulse wave, the corrective wave A,B, and C changes the trend of the market where the origin of the reversal starts from wave 5.

The corrective wave A, B, and C can come in three different forms;

- Zig-zag where B is shorter than A and C (5-3-5)

- Flat where the waves are of the same size (3-3-5)

- Triangle which shows a gradual reduction in price labeling from A, B, C, D, and E (3-3-3-3-3)

What are your thought on this theory? Why?

The first thing is that Elliott wave theory is not fully proven and it is still a theory, you cannot depend on it alone to get a good result. Using the Elliott wave theory with Fibonacci, MACD, and RSI will give a more accurate result. With that said, it is very painful that the Elliot wave seam to be very appealing to the eyes of traders and while the previous history can be very true, future predictions are very difficult with it.

When used correctly, it can be used to mitigate losses while trading as well as get a good entry point while trading.

Choose a coin chart in which you were able to spot all impulse and correct waves and explain in detail what you see. Screenshots are required and make sure you name which cryptocurrency you're analyzing

To answer this question, I will be using the ETH /USDT pair.

The Elliot wave is drawn from the period of 3rd of May to the 17th of May 2021 with a 4hr timeframe chart. The price begins to rise forming the wave 1, and it dropped on the 4th of may to form wave 2.

Wave 3 is the longest and started from the 4th of May to the 10th of May followed by a drop to form Wave 4 and then an impulse to wave 5 on the 12th of May.

The reversal or corrective wave started on the 12th of May and Wave A was reached on the 13th of May.

Wave B is shorter than wave A and Wave C which shows it is a zig-zag corrective wave. It was reached on the 14th of May.

The final wave C is reached on the 17th of May 2021.

Conclusion

Just like any other type of technical analysis, it is important to know that while using the Elliott wave theory, it is not a 100% certified analysis so traders should not force their own preferred count instead of the right count. Always remember to stop loss.