Steemit Crypto Academy Season 2: Homework Task Week2 for @kouba01//Submitted by @meymeyshops//21/04/2021

To my Professor @kouba01

Steemit Crypto Academy.

INTRODUCTION

Having read through and understood the lecture, I hereby present my entry to the best of my ability and in my own words. Thus:

What is a cryptocurrency CFD?

The abbreviation CFD stands for Contract for Difference. It is a trade entered on agreement between the investor and the broker providing the offer for investment. Here the investor do not own the asset but he speculates that the price of a certain asset will increase within a time frame. So he may choose a long position during which if the asset price increases to the direction he opens the trade, he will maximize the profit otherwise if it turns the opposite way, he also maximize losses as much as the units he entered the trade with. Simply put, the investor agrees to exchange the profit or loss of CFD trade from the time of opening the trade to the time of closing it.

Key Notes on CFD:

- There is room for anticipation of up and down price movement.

- There is provision for leverage, meaning that you can open a trade worth $4000 and only deposits 5% of the full amount which is only $200.

- There is a specified price quotes of the asset in trade: this means that the opening price (selling price) for a short term bid and the long term bid (Buying price) are specified.

- Again the actual current market price differs from CFD trading, while the selling price is a bit lower than the current market price, the buying price is also a bit higher than the current price.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

The following self-searching questions should enable one examine himself before venturing into CFDs trading, these include:

- Am I a sophisticated investor who is ready and able to bear the extreme market risk underlying CFDs trading? The reason for this is due to high volatility of cryptocurrencies, there is often a chameleon behaviour of prices in cryptocurrency markets.

- Do I have the ability to locate new market (brokers/exchange) that can provide such trade without owning crypto asset?

- Am I aware that in case of a hack of such new market, any transaction already made can never be reversed and there's no authority to help resolve such problem?

- Am able to manage stress arising from trading in a stress-filled environment?

If the answers to the above self-examining questions are in the affirmative, then one can decide to enter CFD trading otherwise the person should back out.

Are CFDs risky financial products?

The answer is Yes. From my study, there are many potential risks associated with CFDs, few among them are listed below:

- Holding Cost: This is a daily cost for holding either a short-term or long-term position. If a position is hold longer than usual, that spells high holding cost for the investor especially as the price change without warning. Even any profit ever accrued can be mopped away by a holding cost. The investor is expected to be constantly funding his account to cover holding cost.

- Complexity of CFDs trading: There might occur some system blunders and the investor account could be closed out.

- The broker or exchange providing the CFDs may not manage the account in favour of the investor since he also want to maximize his own profits and this can cause losses for the investor.

- The swift changes in prices without stopping at any price point can result in great loss.

Do all brokers offer cryptocurrency CFDs?

Not all brokers are into CFDs trading but the few ones among those providers are presented herein under:

- Plus-500 - A platform listed in the London Stock Exchange with the largest range of cryptocurrencies.

- IC Market - The best of Meta Trader 5 for crypto currencies.

- eToro, a top social cryptocurrency trading platform

- Ava Trade - Good at CFDs spread.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

I followed the procedure taught me by my Prof.

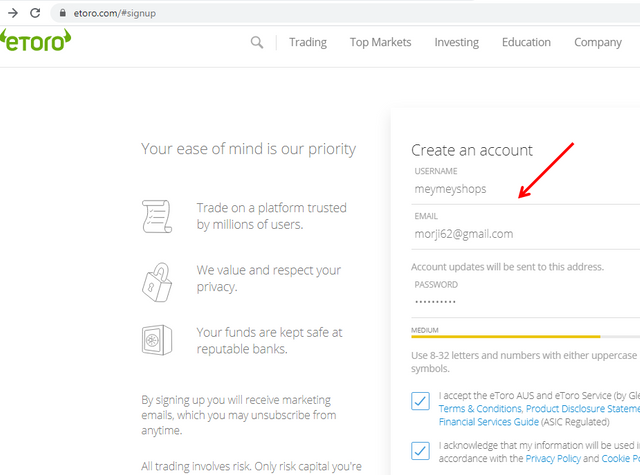

- I created account with eToro with my username, email and password.

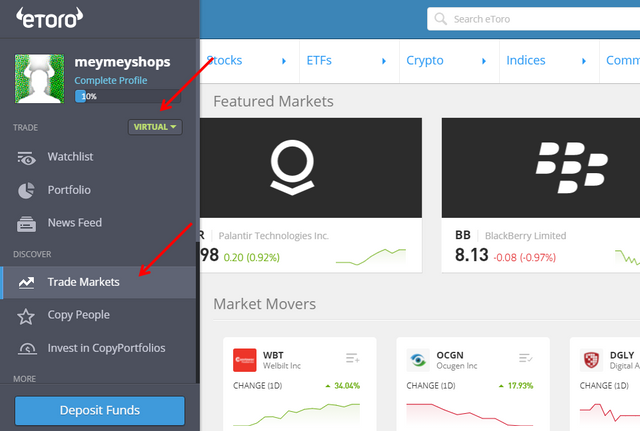

- I login with the said username and since it's a demo account, I went straight to virtual account.

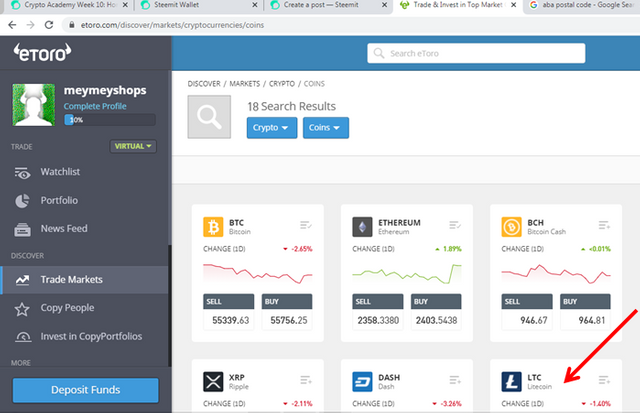

- On the dashboard, I select crypto and then move down to select my desired asset which is LTC (Lite coin)

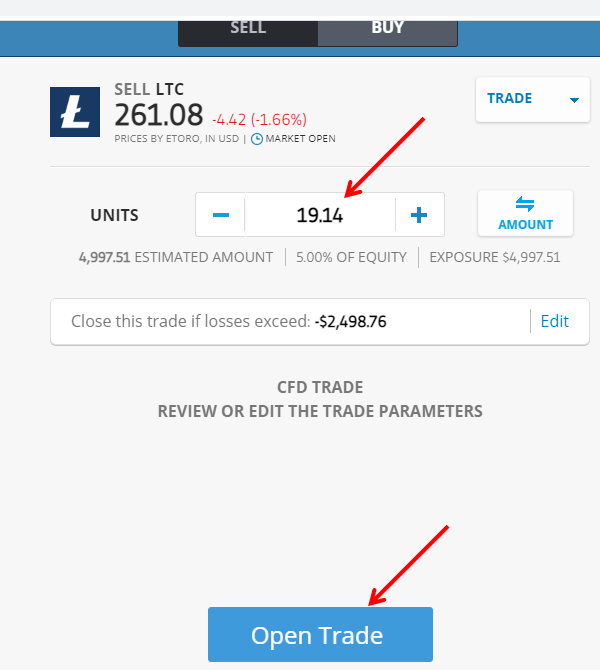

- Having done that, I move on to click on Trade and enter the units of assets to trade as can be seen on the board.

I also clicked on the Open Trade Button

- Then my chat looks like this, it has started to trade:

CONCLUSION

From the foregoing, CFDs (Contract For Different) trading is not for all investors except those refined ones who have the agility to withstand risk pressure associated with the market. Also those whose financial status can not be shaking by unforeseen circumstances embedded in CFDs trading.

I sincerely appreciates the extent of this lecture and the academy at large for how well the training is moving. I look forward to your corrections and appraisal.

My warmest regards.

Hi @meymeyshops

Thanks for your participation in the Steemit Crypto Academy

Feedback

Good work. Well done with your research study on Cryptocurrency CFDs.

Homework task

7

Thank you greatly @yohan2on. You are great.

Hi my Prof @yohan2on greetings, my Prof @kouba01 greetings.

This work is already 5 days without curation. Please kindly do something with many thanks.

Hi my Prof @yohan2on greetings, my Prof @kouba01 greetings.

This work is already 5 days without curation. Please kindly do something with many thanks.