Steemit Crypto Academy | Season 2: Week7 || Exchange order book and its Use and How to place different orders? by @laser145

.png)

.png)

Question no 1 :

What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

The conventional order book refers to keeping a record of printed or written orders these orders are classified into buying and selling orders that the buyers and sellers themselves place prices at their convenience this can be understood as the meaning of conventional order book.

The cryptographic order book is a little bit different the records are stored digitally in pairs for example ADA/USDT an example is that the investor buys USDT with ADA then his record will be kept as purchase orders in the order book, in orders under ADA/ USDT purchase order then it is like the previous step.

another example a trader buys SHIB with BNB then the record will be kept in the order book in a specific section.

If a trader sells BNB and gets SHIB then the record will be stored under Sell orders in the order book.

We talked a little longer and deeper about the order book is not something that is only in Digital trading these books have always been used and will be used by the local markets but it differs from the Digital cryptocurrency order books by having different characteristics which I will name below.

There is no price volatility in the traditional local markets, so there is not much room for price negotiation.

In traditional markets you do not see trading pairs systems and it is a single currency to negotiate the purchase and sale.

In traditional markets everything is centralized, and the books are only shown to the owner, the buyers do not have access to them.

Stop loss and stop limit orders are not a function in traditional markets, but they are in cryptocurrencies.

It is impossible to perform a technical analysis in traditional markets because they only work by the day's supply with a fixed price at the national level imposed by some government law.

.png)

Question no 2 :

Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

Pairs

Support and Resistance

Limit Order

market order

.png)

Well in the following section I will make a very easy to understand but quite extensive and complete guide we will detail how to find the pairs for this I will use Binance Exchange to demonstrate how it is done.

Step 1:

Open the browser and start the Binance section.Step 2:

Select Marketsstep3:

select the exchange you want I selected Fiat Markets because I have usdtstep4:

select the currency you are going to trade in my case I chose SHIB/USDT

binance

.png)

Once you have selected the pair, click on it and continue.

binance

.png)

Here you can see the sale and purchase orders.

Click on "More".

binance

.png)

You will get a window where the Book Order will be displayed

binance

.png)

Trading pair:

They are two assets that are on the Exchange to be traded for example the SHIB/USDT pair are pairs that are in constant movement of buying and selling within the exchanger is a crypto pair and we can buy or sell it in any asset that is available we can buy SHIB with USDT or exchange USDT for SHIB at the price that suits us.

.png)

Supports and Resistances:

The resistance is always given by the highest point of its maximum in uptrends that will make our stop point in a conventional trading operation is the price where we all expect the price to stop either to make a range and follow the trend or make a range and change trend this we can not know immediately if not over time we will see the behavior of the upward range or range fall to the next support.

Support: this is defined as the floor or shock absorber of a fall or downtrend at this point we all hope that the price of a fall stops to make a range and this like the range in the resistances makes a movement that indicates its future whether bullish or bearish what we do know about the support is that once were resistances and once they were broken and new highs were reached important now are very important supports depending on the volume of purchase at that time before.

Example of a resistance and a support in a x-charts

BINANCE FLM/USDT

In the resistances we can see stops in uptrends this means that buyers at that point no longer see apetesible prices and will wait for a fall to buy and accumulate others to make trading and different operations usually those who bought in support usually sell at this point to see no more buyers so earn some profit and wait for a fall more to buy in supports never buy in resistances always waiting for a setback to buy as they looked below.

Depending on the volatility of the market we have in mind that the supports are usually limits in downtrends where buyers see very appetizing those prices to buy more and thus sell at resistances so the history are very important to determine the previous supports the future resistances and thus determine a good analysis of the market.

Limit order:

It is the price that the buyer or seller is convenient for them to sell never a buyer will sell below the price or a buyer buys at super high prices always buys below the current price just like the seller will always sell above the current price. for that there is the limit order for example I want to sell 1FLM at 1$ but the market is at 0. 53$ then I place an order to sell 1 FLM at 1$ when the value of the currency reaches 1$ then I will have my profit, if I am a buyer and I want to buy FLM but that price of 0.53$ I don't like then I place a Limit Order at 0.35$ when the price value tries to go down to the previous resistance and touches the value of 0.35$ this buy will be activated and will accept it so the order will be filled.

Market order:

It is an order that consumes waiting time to be executed, once you make the order to buy or sell this automatically executed at the price of the moment is not necessary to wait prices to activate the purchase or sale, an example the market price is at $ 0.52 if I activate a purchase of $ 50 automatically activate the purchase will give me the equivalent of coins to the value of $ 0.52 at that time there is a seller who wants to sell at that price and we buy at that price so the instant market order is fulfilled.

.png)

Explain the important future of the order book with the help of a screenshot. In the meantime, a screenshot of the verified profile of your Exchange account should appear (the answer should be written in your own words)

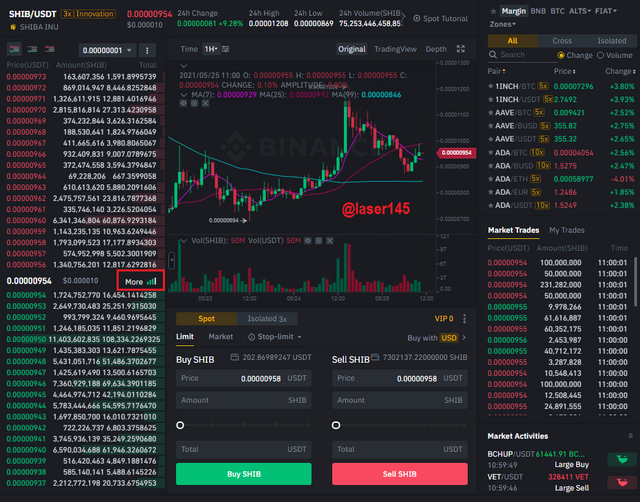

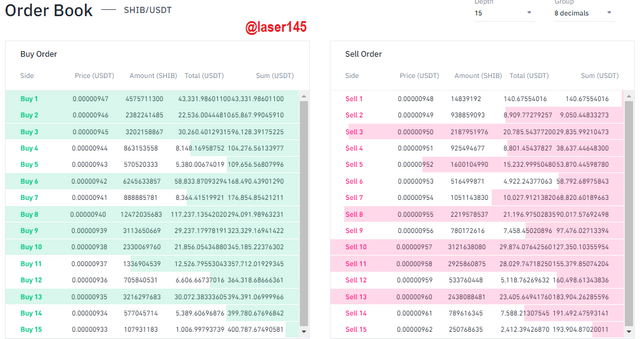

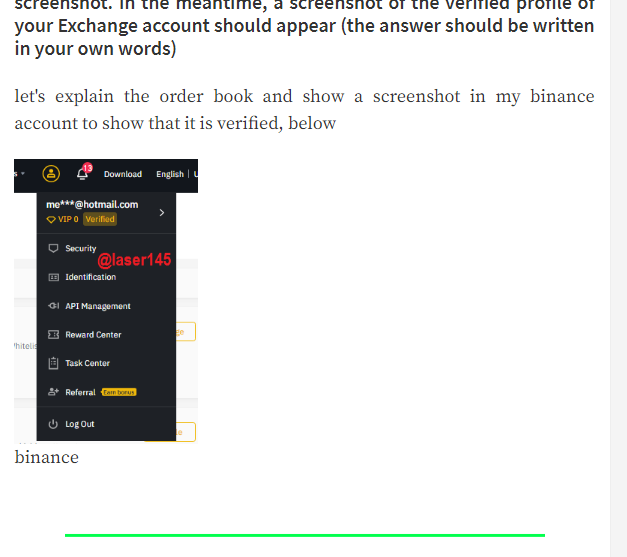

let's explain the order book and show a screenshot in my binance account to show that it is verified, below

binance

.png)

Order book features

The most fundamental order book features of cryptocurrency trading is trading in pairs as discussed above, the coin order book keeps a record of buying and selling pairs along with other more fundamental details such as the record of supply market capitalization prices volume etc. below we will demonstrate how the order book and its binance functions.

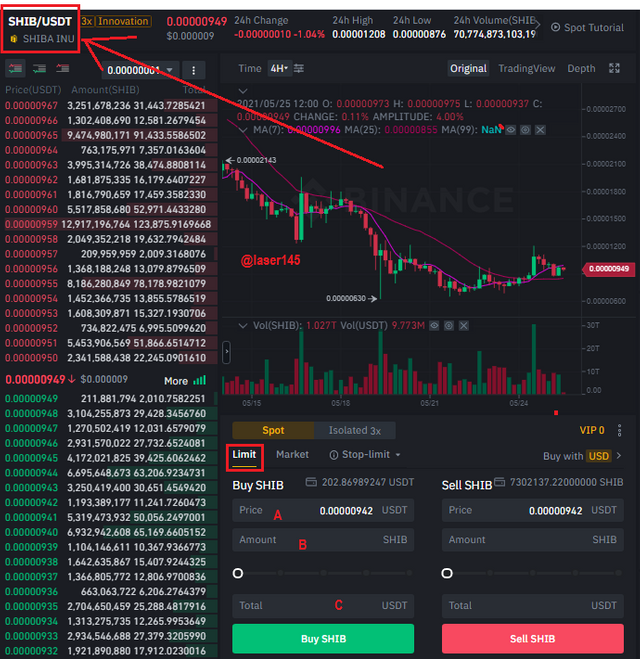

binance.

We are looking at a picture of SHIB/USDT where we see in the green part are the buys and the red part are the sells in the order book we can see the sellers interest and the buyers interest it is a very closed level and it works with buy and sell interest of the currency pair SHIB/USDT the trade interacts based on this. it is its own nature and volatility of the market.

.png)

Purchase Order

It is when you want to buy a cryptocurrency that you need for a specific purpose in exchange for another cryptocurrency or Fiat that we have for that we select a pair of cryptocurrencies the one we have in the wallet and the one we are going to buy an example if I have USDT and I see that there is an opportunity to buy in SHIB I look for the pair SHIB/USDT and place a purchase order in this case I will give USDT and they will give me SHIB.

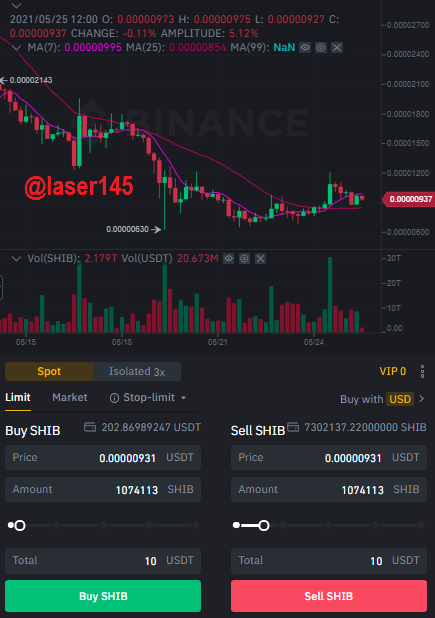

We go by pairs Example SHIB inu/ USDT pair

We select limit

A=

This is the price at which we will choose to buy in this case is 0.00000942B=

Amount of coins to buyC=

Total amount of USDT we are going to buy e.g. 100$.We place the order and click on BUY SHIB and ready the order will be activated when the price touches 0.00000942 and we will have in our SHIB valance, and the USDT will be exchanged.

For the sale is the same but in the opposite direction, you place the price you want to sell in A.

Enter the amount of coins in B that you want to sell or exchange for USDT and click on SELL SHIB.

Then when the price reaches the price set in A the sale will be activated and you will have the USDT.

Binance

.png)

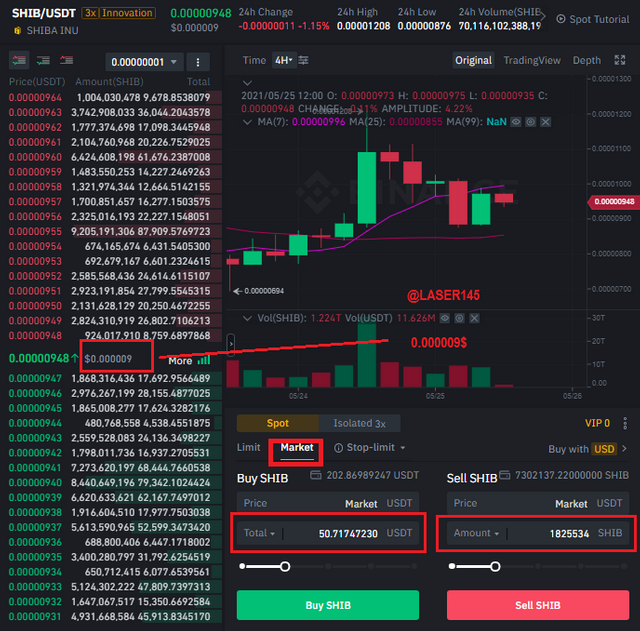

EXCHANGE MARKET SHIB/USDT EXCHANGE

To buy in market is simply to buy at the current market price this means that you can buy at the current price without waiting a certain time for the order to be accepted there are constantly buyers and sellers in the cryptocurrency markets usually you will always find someone who is selling at the price you need at the moment for this is used the exchange market.

If you need to sell just select "MARKET".

You will have to place the % of the capital to invest or directly place the capital at the right price you need to exchange.

Then click on BUY SHIB and the market will be created.

In the same way we will do for the sale in market

We select the amount of coins that we are going to exchange for usdt then we place the exact value we see the current price and click on sell shib this will sell us the tokens and in this way we will have the usdt instantly.

Binance

.png)

How to place buy and sell orders in Stop-Limit and OCO operations? explain through screenshots with verified trading account you can use any verified trading account (the answer must be written in your own words).

When we do a technical analysis our strategy tells us that we have to follow some patterns so that our operations in trading are successful usually we go to the stop loss to perform this procedure I will make a guide quite extensive and complete of what you want.

the stop losses are always placed in resistances and in supports of important volume entries and of previous supports or resistances as we will see it acontinuacion.

.png)

Limit Order:

Here we will determine the value of buying and selling at our convenience, for example if we want to buy cheaply in supports to sell more expensive later in some resistance according to trends and values in currencies we will use this very important tool.

A= Choose the value at which we want to buy.

B= Select the amount of currencies we want to buy.

C= We look at the value of the coins that we are going to receive or that we are going to sell in the case of selling or buying.

Binance

.png)

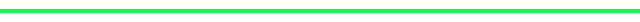

OCO Order

Select the OCO Order

A=

We select the sell stop limit usually at a resistance or at the price that suits us.B=

Here we select the stop loss if the price goes below our support the price will shoot up and we will sellC=

Is a security price for example if I have an order in B of 0.50$ and the price goes down so fast it does not give time to sell then the C: takes that order and executes it being able to sell it is like more security to the market usually I would put it a little below B example 0.499$ or 0.498D=

Is the amount of token that we are going to sell in this operation.E=

Is the amount of USDT we will receive if term "A" is fulfilled.

Binance

.png)

How does the order book help in trading to make profits and protect against losses? share the technical point of view, which helps to explore the answer (the answer should be written in your own words that show your experience and understanding).

Through a good technical analysis and applying all the strategies that we have been learning in the continuous course we can determine entry and exit points of a market the order book is a tool that will help us to achieve the objectives set out in our analysis and our strategy which means that we will put into practice everything we saw earlier to achieve the success of our operation. I want to give an example of how it can help us

if we see the stop limit helps us to sell at a certain price usually these sales are executed in the resistances also for its part we can reduce losses by placing the stop loss so if the price falls below our support we know that will seek the next support for that part we can sell and buy in that next support. so reduce losses, remember no one loses if you do not sell. if we are talking about hold or buy tokens. we just have to wait for the price to rise again to achieve our goal.

we also have the OCO orders this order combines 2 types, usually a sell order to our benefit and another sell order but to protect us from the bear market. example if we buy an asset at a price X and we want to sell it at a price Y then we take it in a support we create the OCO order and if the price reaches the price X it will be activated and sell getting profit. But if on the contrary the price deviates and goes down over the price X then the order would be triggered protecting us from a volatile market and bearish trend then we would take the price at the next support by another technical analysis.

.png)

Conclusion:

Each one through studies and fundamental and sentimental technical analysis and through our own market strategy we will create buy and sell orders to operate the market looking at the upward or downward trends would be the same as in both we can make money, however there are negative possibilities not in all we are going to win, therefore we must follow a strategy that helps us to maximize our capital taking an average of losses and gains and that the gains are higher than the losses that would be a good strategy to follow without violating nuinguna established pattern, I hope this task is very high conocmiento for all try to be as clean and complete as possible so that everyone who reads this task is to learn something new and add so conocmiento for your trading career that we all want so much. thank you very much to the teacher

@yousafharoonkhan and a big hello to the teacher @yohan2on.

.png)

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

thank you very much for taking participate in this class

Grade : 7.5

hi, @yousafharoonkhan hello if you show it here it is xD

yeah i got it, but i did not reduce in grade, at the time of grading,, thank for bringing in my notice welcome

Thank you professor I will work harder for the next assignment, getting stronger and stronger in the academy.