Crypto Academy Week 4 Homework Post for [@yohan2on] | Introduction to Decentralized Finance (DeFi)(100% powered up)

Hello steemians,

In this article, written as part of week four to answer homework questions posed by stylish professor @yohan2on, you will find important information and an explanation of decentralized finance in digital currencies, which is the most recent development of digital currencies in this large and promising market that is developing day after day and the last thing reached by these wonderful markets is decentralized finance, which transfers the digital currency market from speculative and project markets to markets approaching real life. Complete the article to learn about decentralized financing.Good reading!!

What is DeFi?

DeFi is an umbrella term for all current financial products, but with the use of blockchain technology and decentralization of these services.

The idea of decentralized finance is to use cryptocurrencies, and to provide financial services using smart contracts.

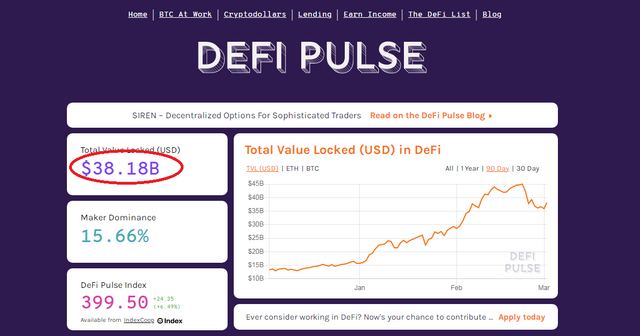

With a quick glance at the "DeFi Pulse" platform, we can see how much money is locked into smart contracts currently.

At the time of writing this article, there are more than $ 38.18 billion, significantly higher than what was recorded earlier in 2020.

What are the decentralized applications and services?

Applications that can be used to access decentralized finance services include:

- Open Lending Protocols.

- Decentralized issuance platforms.

- Decentralized forecasting markets.

- Trading platforms and open markets.

- Stable currencies backed by decentralized assets.

Maker [MKR] :

What is Maker?

Maker (MKR) is the governance token of MakerDAO and the Maker Protocol - a decentralized organization and a software platform, respectively, both based on the Ethereum blockchain - that allows users to issue and manage DAI stablecoins.

MKR tokens act as a sort of voting action for the organization that manages the DAI; although they do not pay dividends to their holders, they give the holders voting rights on the development of the Maker protocol and their value should appreciate depending on the success of the DAI itself.

The Maker Ecosystem is one of the first projects in the decentralized finance (DeFi) scene: the industry looking to build decentralized financial products in addition to blockchains based on smart contracts, such as Ethereum.

How does Maker work?

Instead of using the dollar to guarantee the value of DAIs, Maker uses Ethers (and by November other cryptos). Since the dollar value of ETH is constantly fluctuating, Maker must constantly make adjustments to ensure that the value of his stable token is properly hedged. Maker achieves this through its smart contracts. When the system needs more Ethers, it automatically liquidates MKR tokens in the market (which dilutes their value), and vice versa.

Compound :

What is Compound?

Compound is a major player in decentralized finance, present in the Ethereum ecosystem. The principle is quite simple: allow users to lend their Ethereum funds against interest. But the simplicity for the end user, its features and its numerous integrations make Compound one of the market leaders.

Before being an interface, Compound is above all a public protocol. It is therefore through various interfaces that end users can access the services offered by Compound. These interfaces are multiple, starting of course with the Compound application itself. But there are others, like Zerion or InstaDapp for example.

How does Compound works?

Compound is not a peer-to-peer loan protocol, meaning that two users do not directly interact with each other to take out a loan. Rather, it works through a system of pooling funds made available by users. These pools have different parameters depending on the type of token that is made available on them. These parameters are in particular the different interests of the loans of these funds, which are determined algorithmically.

How to use Compound?

Let's practice now, and let's try to borrow some Dai. There are several possibilities, since different interfaces exist in Compound. I'm only going to be using one with you, but I've also covered using Silver recently, which is another way to access Compound, in addition to other features. I chose the Compound app, which requires the use of Coinbase Wallet, Ledger, or Metamask account.

Once connected by the method of your choice, you will have access to the Compound application. But before you can borrow funds on the protocol, you will need to activate the token you want to borrow. To do so, you must supply the protocol with this or these types of tokens that you want. One transaction is enough and it is very easy to carry out.

Then you can let yourself be guided by the application which is very easy to use. You have access to important market parameters, such as the liquidity of the latter as well as the rate of use of available funds. These are obviously the stable corners that are used the most by consumers. Please just pay attention to the different guarantee rates, some tokens require more than others. And again: research everything you use, from logging in to transactions to ensure the integrity of your funds.

Uniswap :

What is Uniswap?

Uniswap is therefore a protocol open to all Ethereum users to allow token swaps. Based on smart-contracts, Uniswap's main objective is to guarantee maximum liquidity for these users. As such, and we will see it more particularly in the part on the operation of swaps, Uniswap allows the exchange via a pair (BAT / ETH for example), but can also carry out several exchanges to carry out swaps with the maximum liquidity. . Indeed, knowing that each swap has funds from the token as well as funds in ethers, it is possible to directly convert specific tokens to ether and carry out a second exchange. This therefore allows for example to swap two ERC20 tokens between them.

Using Uniswap

Uniswap has above all a superb interface to use the protocol. You will find tutorials and explanations there to make the best use of the features offered by the project. But Uniswap is above all a protocol based on smart-contracts and that is why you do not need to use the interface of the latter. You can very well interact directly with the contracts, use another interface or even develop your own. In addition, the source code of the Uniswap interface is completely open source. So you can use it to host it on your server or modify it in your own way.

But it is also possible to partially or completely integrate Uniswap with a third-party application. For example, Ethereum mobile wallets can use the protocol to easily allow their users to exchange their tokens without having to worry about liquidity and at a lower cost.

Synthetix:

What is Synthetix?

Synthetix is an Ethereum network-based protocol for decentralized asset management. Its main feature is the Synthetix.exhange exchange platform, a decentralized platform for buying and selling tokenized assets (Synths).

Concretely, with a simple internet connection, one can therefore participate in the foreign exchange markets (FOREX), be exposed to the price of precious metals such as gold or silver, and even participate in the DeFi madness via an index created for the opportunity, the sDeFi.

Synthetix differs from traditional finance by the absence of any intermediary. In practice, this means that you no longer need a broker or open a securities account in your bank to start trading in these markets.

How does Synthetix Network work?

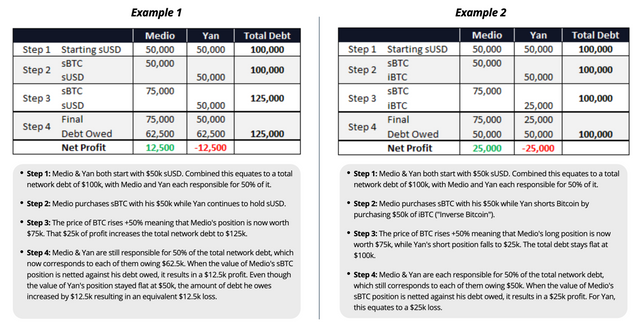

The main Synthetix token serves as collateral. It therefore guarantees the value of synthetic assets generated from them. Say I have 1,000 SNXs, which are worth $ 1 each. Synthetix allows me to issue sUSD, Synthetix's stable token, my SYNs must guarantee 750% of the value of these tokens (crash protection). In doing so I have to freeze my Synthetixes. They become available again when I have refunded the sUSD I received after placing my SNX as collateral.

What can be done with sUSD? Buy Ether, or any other crypto that has a pair with sUSD. Or use the synthetic asset exchange https://synthetix.exchange/ which offers infinite liquidity on a variety of synthetic assets such as sBTC, (synthetic euro), synthetic commodities, etc.

BzX :

What is Bitcoin Zero BzX?

Bitcoin Zero is a Fork between BTC, HXX and LTC to allow it to be more focused on privacy with also a masternode capability. You should also know that he also has a certain level of anonymity, indeed he is almost anonymous.

Features of Bitcoin Zero

Its Zerocoin protocol is activated while combining the different attributes of cryptocurrencies, thereby reducing or eliminating the privacy concerns that are generally associated with the use of Bitcoin.

This project also uses the Dark Gravity Wave to allow it to have a safer but also faster operation. The goal is to be able to create a whole blockchain ecosystem to allow more useful applications.

- Reduces privacy concerns with a zero-defect and ZeroCoin implementation.

- Its nodes have equal control and power.

- It is fast: block of 2.5 minutes.

In order to surpass the wait for the wallets to sync, the blockchain for this project remains available for download.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

@yohan2on

Hello @kouba01

Thanks for attending the 4th week Crypto lecture and for the great effort in doing the homework task.

Feedback

I must admit that you have done excellent work. Thanks for the in-depth explanations of all the highlighted Defi applications(Maker, Compound, Synthetix, bZx , Uniswap)

Have you ever used the compound application in borrowing some funds? Anyway, it's great that you incorporated in that great brief step by step tutorial on how to borrow funds from the compound DeFi application.

Homework task completed

10

Thank you very much for your nice feedback that I liked it and that will encourage me to give the best of myself, on using the compound app, to be honest I haven't tested it but I did watched a video on youtube summarizing the process and i took some notes to present it to steemians. This new educational context has allowed us to research concepts and applications that we neglect before their usefulness and function, thank you for the whole team and dear professors.

Twitter promotion

You have been curated by @yohan2on, a country representative (Uganda) and a member of the SteemPOD team. We are curating using the steemcurator04 curator account to support steemians in Africa.

Participate in the various contests on steemit to maximize your rewards.

Always follow @steemitblog for updates on steemit.