In-depth Study of Market Maker Concept - Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

Is my honour to be part of the home work from my dear professor @reddileep which he introduced In-depth Study of Market Maker Concept] to teach us how it works. I welcome every one to this post, i believe you will find it interesting.

Am @kingworldline.

1- Define the concept of Market Making in your own words.

As regards to the question, therefore market making is the act of an individual of group of body to make an open and end order over a security which provides and as well increasing the liquidity in the market by placing bid for buying and selling which actually involve two basic concepts which are buying and selling in order of making profit out of it.

Mean while one of the basic function of market making help in limiting the fluctuation of the price in the market, hence all this can not take place without the settlement between the buyer and the seller placing their individual bid to merge.

Meanwhile as regards to the time interval to accomplish this bids, this always take little time in second to fulfill the bid depending on the rate of the order.

However i found out that without the work of the market maker it could be so difficult to reach out the market demand, there by causing low liquidity in the market sector which can cause difficulties in the entering and exiting in trading. Hence the buying and selling order keeps the market flowing.

2- Explain the psychology behind Market Maker. (Screenshot Required)

Before explain the psychology behind the Market maker i will first of all explain what market psychology which is the fact behind the market maker.

Market psychology is the interior sentiment of understanding over a market observation at a certain period of time.

Hence this shows the interior workings of the collective parties of security of the traders which are always between the buyer and seller.

Hence for this to occure, some factors are behind the build up of this called market psychology which includes fear, excitment, greed and as well fear all this are contributors of the market psychology

The psychology behind the market maker is due the fact that they are in charge since they control the deals, they make profit alot to their own interest, the manipulation due to there excess liquidity could be a fake out to to buy all and as well increasing the price of the market.

The market maker are similar to the whale which invest alot of liqudity into an asset in order to draw the investors attention based on the abundant of liquidity in place, there ideology there is to draw you near and collect the little you have in possession, that is why sometime there is fakebout in price or short term or long term trend as the case May be in order keep you in the trap, once they discoved they has gotten as much they want, they decided to pull off with out the notice of the investors, rendering some investors useless by collecting there possession in other to make up theirs with a huge profit.

3- Explain the benefits of Market Maker Concept?

•Based on the Benefit as regards to the Market making hence the market markers helps in maintaining the flow of the order in a well organize form in other to maintain and keep liquidity in the system, and also to avoid the dry of liquidy and hence they make liquidity available at all time even In time there is non. They also cover up the little gap in trading, there my making trading so easy for the trader .

•Since the market maker is known of maitaining the Liquidity in the market hence they also help to stabilize the market for the benefit of the traders.

• The Market maker, makes a quick move in acting as the buyer or the seller when ever he found that the order merging are not at the same volume, he steps out to act to avoid delay in fulfilling orders in the market.

•The Market maker organise and as well provide orders with different limit order in order to merge it up with the pending other, there making more market depth.

•The market maker also control the spread over the low and fixed in order to avoid the lost and also in order retain and manage the liquidity in the Market properly.

•The market maker keep increasing the order while the price continue increasing, this causes a very big change in the circle of order.

4- Explain the disadvantages of Market Maker Concept?

At this section am going to looking into the set back or disadvantages of the market marker concept are as follows

•This Concept does not support the investor that actually spend a little period of time, Hence it require a series of investigation along side with enough time factor.

• The concept of the Market maker causes different bids and as well the asking price as regards to the interest which involves different Market makers.

•Another disadvantage of this Market maker is that there is are unmerit profits as a result of hidden information which is not In acknowledgement of the public.

•There is always market manipulation which is as of result of the Market maker which are in charge of the deals.

•Crytocurrency is a decentralised medium or system which actually lacks intermediaries in the sense that there no body regulating it which cause excess artificial liquidity in the market.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

There are alot of indicator which can be used in market maker to explore chart, here are indicators that can be used to express the market maker;

•AStochastic oscillator

•Fibonacci retracement

•Average directional index

•Exponential moving average (EMA)

•Standard deviation

•Relative strength index (RSI)

•Ichimoku cloud

•Bollinger bands

•Moving average (MA)

•Moving average convergence divergence (MACD)

Hence I will be identifying two out of the listed.

Ones which are the Exponential moving average (EMA) and the Relative strength index (RSI).

EXPONENTIAL MOVING AVERAGE (EMA)

This is an type of moving average which calculates the reactions of the traders in the market hence by creating an entry and as well exit in the market, therefore this is done technically in lines with the chart.

Therefore this indicator is an indicator which shows signals, with the help of its boundary base on support and resistance level in the chart

Hence this indicator has two EMA, of which one is short and the other the longer EMA with respect to price, therefore if the shorter EMA moves across the longer one, it shows a base to buy which is called the Golden cross signal, while when ever we have the longer EMA moves across the shorter one shows the point to sell off.

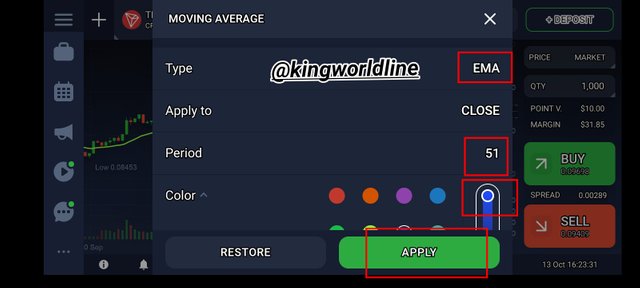

PROCEDURE IN APPLY THE INDICATOR ARE AS FOLLOWS

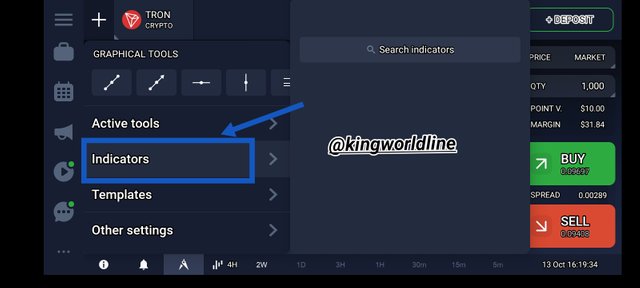

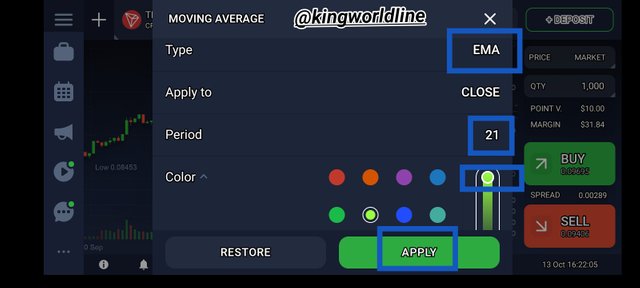

In the first place am going to use Iqoption demo to demonstrate this .

• In the first place, what I did was to lauch the Iqoption application from there, below the chart I click on icon, then another phase opened, where I was able click on the indicatior which show me different indicators, there I choosed the EXPONENTIAL MOVING AVERAGE (EMA) which replected on my chart immediately. All this procedure are shown on the chart below.

1

2

3

4

5

6

7

RELATIVE STRENGTH INDEX (RSI)

This is a type of indicator which works with momentum, hence it show technical analysis based on the recent price with respect to the overbought and oversold. They are two point to view out on this indicator which are staked at 70 and 30 on a graph which it display is from 0 to 100 rang, therefore the RSI serves as the oscillator

Further more when ever we have the RSI at 70 or above shows overbought while the other is when ever we have the RSI at 30 or below shows over sold.

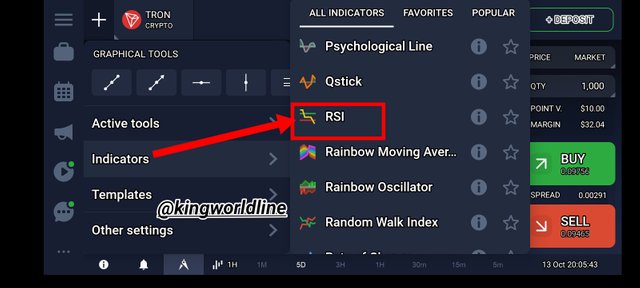

PROCEDURE TO APPLY THIS

As i said before i will be using my my Iqoption demo application once again to apply this.

Firstly open the application, navigate to an icon down as it shown on the screenshot, then click on it, on the next phase click the on indicator and choose the RELATIVE STRENGTH INDEX (RSI) and go back on the chart where is being reflected as shown on the screenshots below.

1

2

3

4

To rapup this assessment, hence the market maker is known to be resposible for the main deals which increase the liqudity in the market, base on the fact that they place in order not at the market price hence it add values.

Therefore since the are enough liquidity in the market, hence trader has a good insight in the Market and as well the negative version of it, meanwhile to have control over this market we need the assistance of some of the indicator to backup our psychological view of the market.

Finally was able to attempt all the available questions as it being asked on this homework.

Thank You...

My Regards to;

@reddileep

#reddileep-s4week6 #cryptoacademy #market-maker #crypto-manipulation #nigeria

.png)

.jpeg)