Steemit Crypto Academy [Beginners' Level] | Season 4 Week 1 | The Bid-Ask Spread BY @Khamara no

INTRODUCTION

Good day Professor @awesononso, and all my fellow students and crypto enthusiasts. It's wonderful to have the crypto academy back up and running again after the short break, and I am very happy to be taking part in this homework task from Prof @awesononso.

In this lecture we were taught aboutt the Bid-Ask Spread and we were given a set of questions. I will now attempt to answer those questions.

Question 1. Properly explain the Bid-Ask Spread

The purpose of any market is the exchange of goods, and the conducting of transactions between buyers and sellers. For any exchange to occur, sellers must be willing to sell at prices that buyers are willing to buy at, and vice versa.

This is of course the same in financial markets, including the cryptocurrency market. It is important to note however, that these prices are not always the same and there is usually a difference between the price that a seller is willing to sell at, and that which a buyer is willing to buy at. This is where the spread comes in.

In financial markets, the highest price which a buyer is willing to buy the trading commodity at is known as the Bid price;

and the lowest price which A seller is willing to sell the trading commodity at is known as the Ask price.

Sometimes these prices are the same, and sometimes there's a difference between them. The difference between them is known as the Bid-Ask Spread.

Being a difference between two amounts, the bid-ask spread is calculated as such:

Bid-Ask Spread = Ask price - Bid price.

The Percentage Spread can also be calculated.

Percentage Spread (% Spread)= (Spread/Ask price) x 100

The Bid-Ask Spread is an important factor in any market that helps market participants make better decisions.

Question 2. Why is the Bid-Ask Spread important in a market?

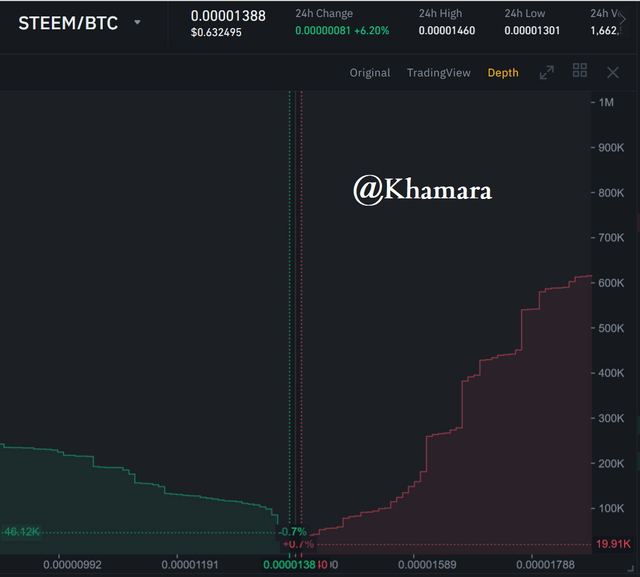

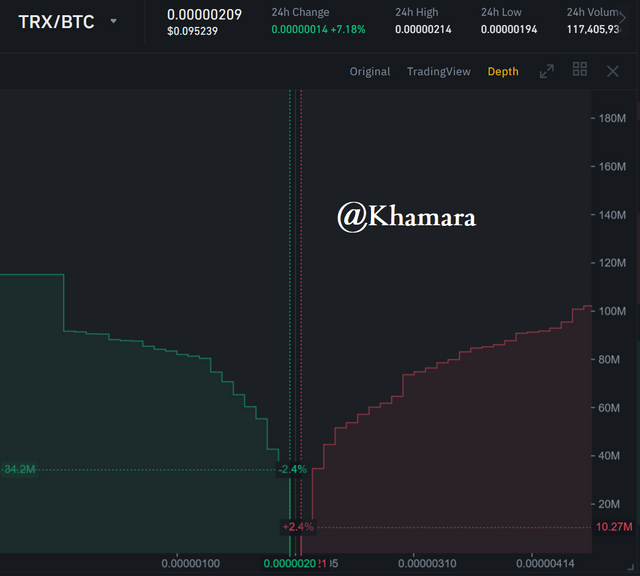

The size of the bid-ask spread can be used as an important measure of the liquidity of any commodity.

In a liquid market there is usually a small difference between the ask price and the bid price, hence a small spread. This is because there are more participants in the market willing to trade that commodity at the readily available price.

However in an illiquid market, that is, a market without as many buyers and sellers, there tends to be a larger difference between the ask price and the bid price and as such a large spread

There are different order types in a financial market, however, the two major order types are the Market order, and the Limit order. With a market order, a participant of the market is essentially willing to buy or sell the trading commodity, at whatever price the market is giving to him, at that particular point in time, until his order gets filled. With a limit order however, the market participant decides what price they will buy or sell that commodity, and place their order for it at that price. Therefore whenever the commodity is trading at that price, their order gets filled.

Participants of the market who use limit orders are known as market makers, because they are the ones who set the prices that other participants buy or sell at; meanwhile, participants of the market who use market orders are known as market takers because they take whatever price the market gives them.

When there are less limit orders placed by market makers in the market, the market is said to be illiquid, because the trading volume of the commodity in the market is low. This leads to a wider spread.

When there are a lot of limit orders placed by market makers in the market, this leads to a very liquid market, because the trading volume is high, and this in turn leads to a smaller spread.

Source:

The Bid-Ask Spread can help a trader to pick which exchange to use in trading a currency pair, and even which currency pairs to trade.

The spread in a market can also become much wider when the supply outweighs demand or vice versa i.e. when there is high volatility in the market, so the size of the spread can be used to measure the volatility of the market.

The bid-ask spread can also be an important factor to consider for expert traders to know what types of trades to place and where to enter the market from i.e. it can help a trader mitigate trading risk.

Question 3. If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a.) Bid price of crypto X = $5

Ask price of crypto X = $5.20

Bid-ask spread = Ask price - Bid price

Bid-ask spread = 5.20 - 5

Bid-ask spread = 0.2

b.) % Spread = (Spread/Ask price) x 100

% Spread = (0.2/5.20) x 100

% Spread = 0.0385 x 100

% Spread = 3.85%

Question 4. If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

a.) Bid price of crypto Y = $8.40

Ask price of crypto Y = $8.80

Bid-ask spread = Ask price - Bid price

Bid-ask spread = 8.80 - 8.40

Bid-ask spread = 0.4

b.) % Spread = (Spread/Ask price) x 100

% Spread = (0.4/8.8) x 100

% Spread = 0.0455 x 100

% Spread = 4.55%

Question 5. In one statement, which of the assets above has the higher liquidity and why?

Crypto X has the higher liquidity; because the bid-as spread is less.

Question 6. Explain Slippage.

As mentioned earlier, one of the types of orders in financial markets is a market order, and this is when a trader agrees to buy or sell the trading commodity at whatever the existing price of the commodity is in the market, until the order is filled completely.

In volatile markets like the forex market, or the cryptocurrency market (or even gold), the market price can change very quickly, as quickly as in seconds. This is to say that a market participant who places a market order for the trading commodity, may end up getting that order filled at a different price than the price the commodity was at when he placed the order. This is what is known as slippage.

Slippage is therefore the difference between the price of the commodity when the market order was placed, and the price it is executed, or completely filled at.

It is thus calculated as:

Slippage = Market Price at Order Placement - Execution price

Slippage is usually avoided by traders by using Limit orders.

Slippages could be positive or negative:

Positive slippage

This type of slippage is welcome to traders, as due to high liquidity, orders are opened at a better price than expected. Maybe a sell order for BTC was to be triggered at $55k but a spike triggered the sell at $59k, there is an extra $4k profit for this.

Negative Slippage

This type is the horrible type, a forex trader will explain this to you properly as it usually occurs when news like NFP are released. Orders are triggered at a worse price. For example, a buy order for BTC at $55k triggers at $59k, making a $4k loss

Question 7. Explain Positive Slippage and Negative slippage with price illustrations for each.

Slippages are a result of altering bid-ask spreads. These changes occur so quickly, the liquidity providers are unable to update the prices to cover the gap and orders are opened at a more suitable price for the liquidity providers.

There are two types of slippage:

Positive slippage: This is when the market order is executed, or completely filled at a better price than when the order was placed i.e. If a market buy order, positive slippage would be when the order is executed or completely filled at a lower price than expected; If a market sell order positive slippage would be when the order is executed or completely failed at a higher price than expected.

An example would be: A market buy order is placed at $4 for BTC, however, at the moment of placing the order, the price of BTC reduces to $3.5. The positive slippage there would be = $4 - $3.5 = $0.5

Another example would be: A market sell order is placed at $25 for ETH, however in that instant, the price jumps up to $27. Th positive slippage would therefore be = $27 - $25 = $2

Negative slippage: Negative slippage is the opposite of positive slippage. This is when the market order is executed or completely filled at a worse price than intended. For a buy order this would be a higher price, and for a sell order this would be a lower price.

Using the earlier examples, if in the first example the price of BTC had, instead of reducing to $3.5 from $4, increased to $7 in that instant, and the order was filled, the negative slippage would be = $7 - $4 = $3.

If in the second example above, the price of ETH had, instead of jumping to $27, dropped from $25 to $23, the negative slippage would be = $25 - $23 = $2.

CONCLUSION

The Bid-Ask Spread of a market is an important factor to be considered by traders when they want to enter into any market. It gives a rough idea of the market movement, volatility and liquidity.

Slippage is also another important concept in trading an should be avoided.

Thanks to Professor @awesononso for the amazing lecture.

Hello @khamara,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

All parts covered and explained properly. Great job!

What can I say? The arrangement is also great.

Thanks again as we anticipate your participation in the next class.