Elon Musk on the whale hunt: Dogecoin (DOGE) falls in the top 20

Elon Musk criticizes the centralization of Dogecoin assets and encourages whales to sell. Meanwhile, the rest of the top 20 coins also pays the bill for a bullish previous week. The market update.

After a volatile weekend, the crypto market is licking its wounds. At the time of going to press, Bitcoin and the top 20 altcoins show significant price losses compared to the day. The biggest sale was the “Memecoin” Dogecoin (DOGE).

Elon Musk demand Dogecoin whales for sale

The Twitter activity of Tesla and SpaceX boss Elon Musk is both a blessing and a curse for Dogecoin holders. On the one hand, Musk Dogecoin has achieved enormous popularity through semi-ironic tweets in recent weeks, which is still reflected in a plus of around 490 percent in a month-on-month comparison. However, with his recent DOGE tweet, Musk has shown that he can fuel sales too. Elon Musk advised the Dogecoin whales to downsize their DOGE positions in order to ensure a better distribution of wealth within the Dogecoin cosmos.

"If major Dogecoin holders sell most of their coins, it will get my full support. Too much concentration is the only real issue imo." - Elon Musk

source: https://twitter.com/elonmusk/status/1361094185412100096

Musk is referring to the fact that over 54 percent of all DOGE are distributed over just 20 wallets. A single address currently holds 28.7 percent of all Dogecoins.

The five richest Dogecoin addresses | source: tokenview

Musk seems to be serious about his request. At least he tries to get the whales to cooperate with money:

"I will literally pay actual $ if they just void their accounts"- Elon Musk

source: https://twitter.com/elonmusk/status/1361255427669909504

the richest man in the world waves his wallet.

Whether the uneven distribution of DOGE's assets is actually the only “real” problem facing DOGE depends on which valuation standard is used. If you regard it as a pure meme coin for the masses, you can leave it that way. However, if you want to see Dogecoin as a store of value, you will find further points of criticism in the lack of a cap on the overall supply in connection with an inflation of 10,000 DOGE per minute.

Dogecoin has since plunged below the $ 0.05 mark following the tweet from Elon Musk.

source: https://de.tradingview.com/symbols/DOGEUSD/

DOGE on one US dollar: unrealistic?

One can confidently question whether Dogecoin will ever reach the price target of one US dollar propagated by the community. A Dogecoin rate of one US dollar would currently correspond to a market capitalization of over 128 billion US dollars. Dogecoin co-inventor Billy Markus recently pointed out in a detailed Reddit post that this is a horrific number for a pure meme coin:

"People are talking about Dogecoin going to $1 - that would make the "market cap" larger than actual companies that provide services to millions, such as Boeing, Starbucks, American Express, IBM. Does Dogecoin deserve that? That is not something I can comprehend, let alone answer."

source: https://www.reddit.com/r/dogecoin/comments/lfl5iz/true_value_an_open_letter_from_billy_markus/

At the time of going to press, the Dogecoin rate was showing slight signs of recovery. However, at $ 0.054, Doge is still trading 16 percent below its level 24 hours ago.

Bitcoin rate in line with stock-to-flow model

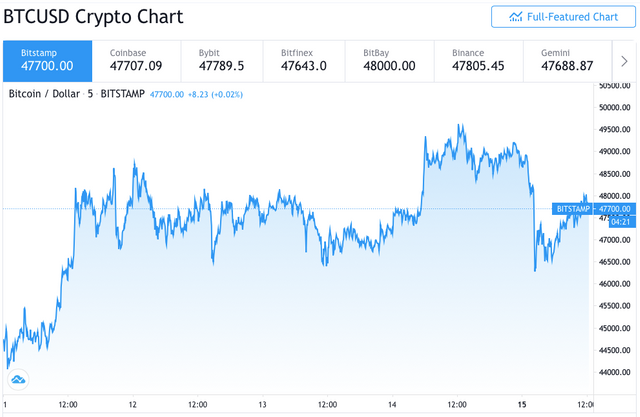

The weekend also resulted in a price correction for the crypto key currency Bitcoin. On the march to the US $ 50,000 mark, shortly before the next psychologically significant brands were reached, major profit-taking occurred, which BTC has meanwhile pushed below US $ 46,000.

source: https://de.tradingview.com/symbols/BTCUSD/

Despite the price setback, which is moderate for crypto conditions, Bitcoin moves in accordance with the stock-to-flow model (S2F). According to data from the analysis house Glassnode, BTC is trading on a 7-day moving average with a stock-to-flow deflection of 0.977, only slightly below the level predicted by S2F.

source: https://academy.glassnode.com/indicators/stock-to-flow/stock-to-flow-deflection

It is noticeable that the deviations have tended to decrease in recent years. If you consider that S2F represents an ultra-bullish model for the Bitcoin price, BTC Hodlers should welcome this development.

That good

appreciate that. Thank you

Elon Musk frankly did a 'psyop' just before he invested $1.5b into bitcoin. Remember what he did? He influenced/manipulated the BTC price to drop before pouring his money in. He did use Dogecoin as a distraction! wow, clever!

Loved that picture 😂