Steemit Crypto Academy,Season 3 Week 1 Homework Post for prof @imagen [STAKING].

Hello, how are you all, long time no see. started completing assignments from each professor from season 1 and now in season 3 many professors have changed.

And for the new professors, congratulations on being chosen as part of the crypto professors, hopefully they can help us get to know more about crypto.

this time I will try to complete the assignment from the professor @imagen. The task this time is very extraordinary, I am very excited to do it.

Like many things we have learned so far about crypto, staking can be a good idea as well as a bad idea it all depends on the skills we have in running it. traders as well as their investors know a lot about how to get rewarded of course by having various kinds of cryptocurrencies. The point is that the more knowledge we understand about crypto, the more useful it will be.

How does staking work?

To do staking we need to review everything from the user's point of view, where staked is a mechanism where funds from users will be locked in the wallet and later they will get prizes

Any funds that will be locked will be a guarantee that stakeholders must be honest when trying to validate transactions, if there are validators who are dishonest, they will be punished.

Later the rewards given from the results of transaction validation will usually be given in the form of coins or tokens that users have bet on. However there are also some projects that provide rewards in the form of different tokens.

1.) Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion.

KUCOIN

SOURCE

In kukoin they rely on soft satking where soft satking is a process that allows users to get prizes without ever locking funds. This soft satking concept was first introduced to the public by Kucoin in July 2019, and very quickly attracted the interest of more than 300,000 users.

This soft staking method can reward users every day, it means that they don't have to wait a long time to get rewards. This can lead to faster and more efficient compounding, as well as the added flexibility that comes with portfolio management.

ZIPMEX

SOURCE

Staking certainly requires a trusted crypto asset exchange platform. One of them is zipmex by using the ziplock feature.

ZipLock is a useful feature to lock an asset in the form of ZMT that you already have. In this ZipLock feature, your assets will be locked for the next 90 days. Later during the lock-up period you will get a reward of 16 percent interest per year which will be paid every day.

How much or how little ZMT you have locked in ZipLock can affect your status as a user on zipmex.Inside Zipmex there are three levels for users:

ZipStarter: Users who have locked assets 1-99 ZMT

ZipMember: Users who have locked 100-19.999 ZMT assets

ZipCrew: Users who have locked over 20 thousand ZMT assets

Because it is caused by a lot or at least the number of assets that are locked. The greater the number of assets that have been locked. The greater the interest that will be obtained and vice versa. Other things that can also affect the benefits and benefits that will later be obtained are all caused by the level of the users.

Difference between KUCOIN and ZIPMEX.

The difference between the two is clearly seen from the distribution of prizes where in KUCOIN you can get prizes every day, unlike ZIPMEX you can only get prizes per year.

2.) What is Impermanent Loss?

Loss incurred and impermanent loss is a risk associated with the existence of a pool of liquidity in the deficit.

This can lead to a difference in value between the funds you have stored in AMM and the funds stored in your wallet. This results in non-permanent losses because the value of the funds staked to AMM fluctuates drastically.

With significant price fluctuations, this results in even greater impermanent losses.

Basically price fluctuations result in temporary loss of user funds due to volatility in trading.

The impact of non-permanent losses is that investors are afraid to provide liquidity into the liquidity pool.

How to recover from impermanent loss?

If you want to get your money back there is one way you can do that is by:

When you stake your token to AMM and the Token Price returns to the initial price when you staked it can make your money back. And this has also kept you out of permanent losses, thus you can get back 100 percent of your trading fees. This can happen every ten years because this is a rare possibility, even more often it happens that you lose your money permanently.

How to minimize impermanent losses!

The most important thing is to be able to protect ourselves and we can minimize losses through stable coins.

With the accumulated liquidity and providing liquidity through stablecoins that have been locked in smart contracts, it is certainly not too volatile, this can basically reduce the occurrence of permanent losses.

There is also another way that you can use to reduce the risk of permanent loss where you can join groups that offer arbitrary weights

There are many liquidity pools that give users the option of being able to deposit two assets where the ratio is 50/50,80/20 or 98/2 this aims to reduce the impact of impermanent losses.

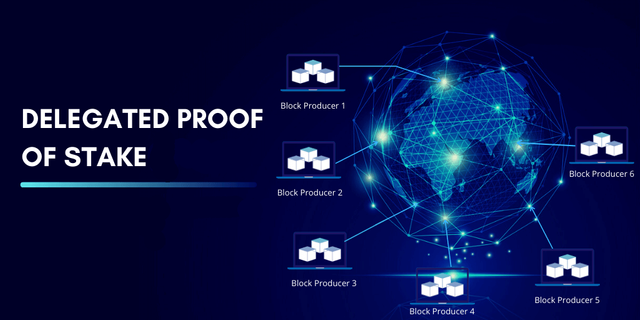

3.) What is Delegated Proof of Stake (DPoS)?

Delegated Proof of Stake (DPoS) is a creative invention from Bytemaster Daniel Larimer who is also the lead developer at Bitshare. He has the goal that every coin holder has a vote at the time of a democratic consensus resolution.

The Delegated Proof of Stake has worked with the goal of each shareholder being a major player in a particular blockchain network. Later, the shareholders will be responsible for voting for the witnesses who are then given the task of verifying transactions and producing blocks. These witnesses will receive payment from the transaction fee that has been determined by the representative of the delegation.

The Delegated Proof of Stake those who have been delegated have an important role where they are obliged to ensure that the chosen witness does not fail to confirm their transaction because the system can actively detect failed communications in the network. This is intended so that there is no double spending on transactions carried out in the system so that security is created in 100.00 transactions / second destination.

4.) Conclusion

1. To do staking we need to review everything from the user's point of view, where staked is a mechanism where funds from users will be locked in the wallet and later they will get prizes.

2. Loss incurred and impermanent loss is a risk associated with the existence of a pool of liquidity in the deficit.

This can lead to a difference in value between the funds you have stored in AMM and the funds stored in your wallet. This results in non-permanent losses because the value of the funds staked to AMM fluctuates drastically.

3. Delegated Proof of Stake (DPoS) is a creative invention from Bytemaster Daniel Larimer who is also the lead developer at Bitshare. He has the goal that every coin holder has a vote at the time of a democratic consensus resolution.

Sorry if there are words and writing that are wrong, if other friends want to comment, please comment in the comments column below.

Thank you for reading my writing, see you in the next assignment.

Best regards @karimjz

CC:

@imagen

Hi @karimjz. Thank you for participating in Steemit Crypto Academy Season 3.

You made a good description of the impermanent losses and suggestions to avoid or minimize them, however, the comparative study between the platforms you selected is incomplete and lacks information of interest for decision making (cryptocurrency offer, APY and/or APR rates, how to access them, among others).

I expect more effort from you and wish to continue correcting your next assignments.

Rating: 6.5

Thank you very much, professor.