Steemit Crypto Academy | Season 2 Week 2 Homework Post for @kouba01 - CFDs

Source / License Details

What is a cryptocurrency CFD?

CFD is the agreement between the investor and the stock market to exchange the differences between prices at the opening and closing times of the product. So in CFD trading, you don't actually buy that product. You buy your expectations for that product. Depending on the up or down of that product, you will make a profit or a loss. CFD trades are usually carried out on products such as indicies, stocks, currensies-cryptocurrensies, commodities.

In CFD, it is aimed to gain profit by taking long or short positions on the products. Long and Short positions represent the direction in which a product will move. In other words, if you open a trade with a long position, you have made a forecast with the expectation that the product will rise. If you open a trade with a short position, you have made a forecast with the expectation of the product falling.

The most important factor in its use is the leverage ratio. For example, let's say leverage 1:20. You have $500 in your capital. You can open a trade of 10000 dollars. You can take a much higher position with low capital. That's why CFDs are seen as a kind of gambling.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

CFDs have started to be preferred frequently for cryptocurrency products today. The reason for this is the constantly moving cryptocurrency market situation.

You can make good profits by opening long positions in the bullish period, which expresses the rise period. On the contrary, in the bearish period, which refers to the fall period, you can make good profits by opening short positions.

Sometimes it is not clear what the market will be, as it is nowadays, and it rises and falls unevenly every day. In such a period, it would be best not to engage in leveraged trading.

When a coin reaches its deep or highest point, you can earn high profits by opening long-short positions.

You have little capital, but you want to earn high profits. You can perform this request by performing leveraged trading. But remember that you can also completely lose the capital you have.

Are CFDs risky financial products?

There is a risk in all kinds of investments of the stock exchange, not just crypto. Therefore, we can say that it is a risky investment type in CFD. The only difference is that the risk is higher than the others. Because when you say that you will make a high profit, you can suddenly lose all your capital. However, there is another fact that the profit you will make is higher than the others. You can use demo accounts to learn CFDs or enter these trades with a small portion of your capital. Without sufficient information, this type of trade should never be entered with high capital.

Do all brokers offer cryptocurrency CFDs?

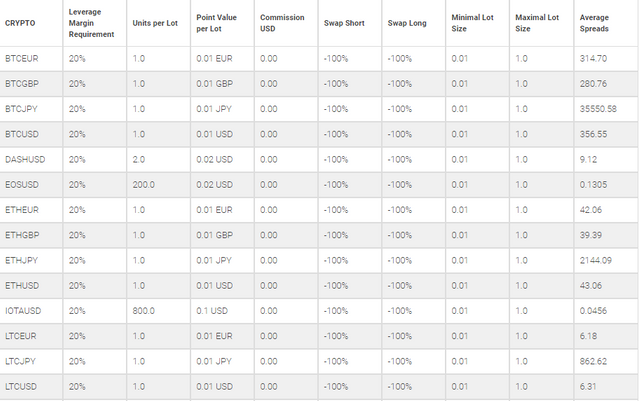

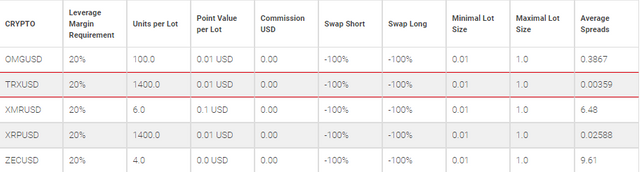

No, not all brokers offer cryptocurrency CFD. Some of them are: BDSwiss, eToro, avatrade, roboforex, plus500.

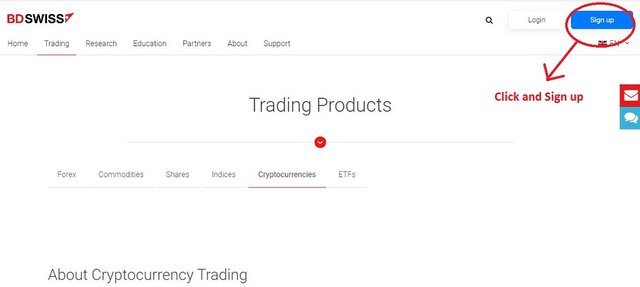

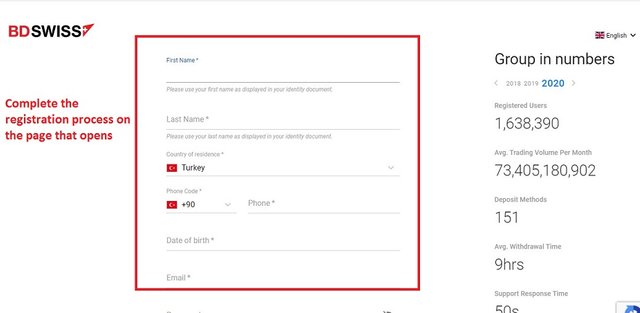

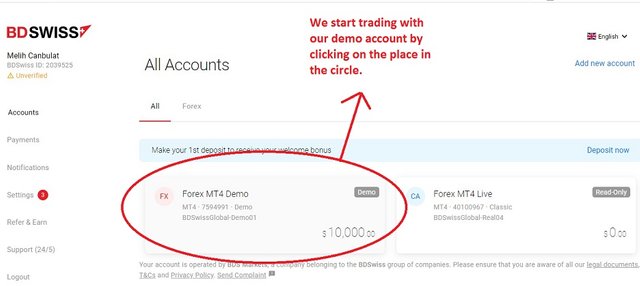

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

I traded with the BDSwiss broker.

cc: @kouba01

Hello @kadabra,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 5/10 rating, according to the following scale:

My review :

Medium content that lacks analysis of some ideas that remained unclear. Thank you for trying out the platform BDSwiss as a CFD broker.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thanks professor, I'll be more careful in my next homework.