Crypto Academy Week 14 │Homework task for @levycore │Learn About Cryptocurrency.

Thanks to professor @levycore for such a good conference, day by day learning more thanks to SteemitCryptoAcademy and his great team, then I will start the task.

Imagen Source - Used under a CC BY-ND 4.0 license

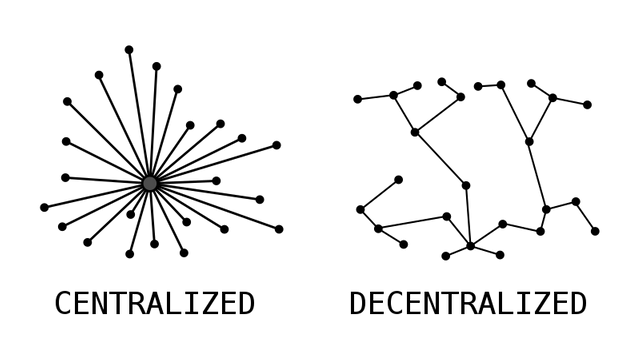

Cryptocurrencies: could be considered a monetary system. They do not have a value for the material from which they are made, as could be the case with silver or gold. They do not depend on any government or institution (that is, they are decentralized assets), if not on supply and demand. So we can say that the value is what we give it people. The more people are interested in cryptocurrencies, as in other types of articles, the more their value will increase.

Financial system: It is what we all know, part of our daily life, every time we use money we sometimes interact with the financial system in some way, the goal of financial institutions is to facilitate the movement of money in the economy allowing us to make payments, deposits, purchases, transfers, among others. This is a totally centralized system by the well-known banks.

With these two definitions we can realize the fundamental difference is that cryptocurrencies are decentralized and the financial system is totally centralized.

| Decentralized | Centralized |

|---|---|

| The assets of each user who owns cryptocurrencies does not depend on any central authority to control them, therefore the user has full control of their assets | In the centralized system, the central entity has the authority to control our money |

| Transfers are totally anonymous and public, if a transfer of any cryptocurrency is made, the details of the transfer can be seen on the blockchain, but it will not be known who made the transfer or who received it | When a transfer is made, the centralized entity knows all the details about it, information about the person who sends the money and the person who receives it can be observed. The name, address, identification, among other personal information |

| Transfers are almost immediate, although it depends on the cryptocurrency, most make transfers in minutes and some take seconds to send an asset, regardless of whether you are in another country or continent | Transfers are usually instantaneous only if the users belong to the same centralized entity and if a transfer is made to a bank in another country, the transfers usually take days and have a high cost in commissions |

| Transfers are not reversible, if a transfer is made to a wrong address you will not be able to recover the money unless the person who received it makes a return transfer | In this system transfers usually have a cancellation period, if you make a sent to a wrong user you can call the bank and ask them to cancel the operation |

Imagen Source - Used under a CC BY-SA 3.0 license

Decentralization is often thought to contribute to chaos and the absence of norms and agreements, when in reality it encourages autonomy, development, progress, evolution, collaboration rather than competitiveness. While it is true that its main is non-censorship, these are not the main reasons why we need a decentralized system

In a decentralized system, each person is the same, that is, there is no one with a greater benefit of power than another. The drawback of this system is that it is difficult for them to scale and make efficient decisions at the same time and where the blockchain and Bitcoin intervene, today it is possible to scale and make efficient decisions at the same time as it is operating.

The main importance is to give more freedom, independence and strength to the users. In this important system, sacrificing decision-making for the benefit of all, in other words, with decentralization we can obtain greater autonomy by sacrificing the authoritarian system, with greater security, speed of transfers, without geographical barriers, without hours for transactions and whatnot. more importantly, without asking permission to use your assets at will.

In the world of cryptocurrencies we will find differences with the usual financial model. One of them is its price, what really establishes it? Each cryptocurrency is a different world. The value of each cryptocurrency does not depend on the defined economy, it depends on supply and demand and cannot be controlled since they come from blockchain technology.

Nobody audits them because they come from blockchain technology. They don't even require a bank to back them as is the case with the currency we've always known. These coins having a fixed supply reduce the existence of inflation. Its value is supported by comparable characteristics such as: the speed at which the market changes, the increase in people who trade cryptocurrencies, the projects behind each currency, among others.

Let's focus on pioneering cryptocurrency to explain the cryptocurrency valuation process

If we had bought a BTC in 2013 we would have paid only $ 100 and after 8 years we would have obtained, at the time of writing this task, $ 39000. Going from $ 100 to $ 39,000 is surprising, especially for the amount invested, but ** why does this scenario occur? **

Imagen Source - Used under a CC BY-ND 4.0 license

The BTC is a system that contributes to decentralization, this currency is not issued by any government or private entity, however, it has a lot of power. Its demand and supply, its purchase and sale and the operations of the users will always determine the value, although it is true that some elements intervene in this process:

The miners: They can reach cost agreements with those interested in obtaining the cryptocurrency.

Exchange platforms (Exchange): When a sale offer is equal to yours, the operation is carried out automatically, in such a way the operation on a certain platform can cause the price to be established due to the exchange made.

The trust of users: This has also influenced the progress of its value over time, this due to the trust that people take with the world of cryptocurrencies.

People with a lot of financial power: In recent months we have seen the price of bitcoin fluctuate violently, many times up and many times down, this happens when people like the well-known Elon Musk make a post on twitter about the cryptocurrency causing the price to vary.

We are in a busy world, and that affects the rise and fall of the price we put on everything, even if we are not aware of it. It happens with stocks, with any product we buy and it happens with cryptocurrencies. If something becomes popular and everyone starts buying, its value will go up, so we can say that there is no single price for Bitcoin and other cryptocurrencies.

Many companies and professionals continue to question whether cryptocurrencies are a safe bet or a risky investment. Bitcoin, being very volatile, has encountered great price variations at times since it was created. When it was launched on the market, it could be purchased for a few cents on the dollar, but its price has been increasing every year, thus it has reached an all-time high of $ 64,000 last month and is now at $ 40,000.

Imagen Source - Used under a CC0 1.0 license

To explain this we must first know the concept of cryptocurrency mining:

Imagen Source - Used under a CC BY 2.0 license

If we analyze gold mining, we can see that it resides in moving earth with heavy loading machines to obtain the gold that is on the surface of the earth in sufficient quantity to pay expenses and make a profit. The same happens in cryptocurrency mining, with the difference that the heavy machinery here is very powerful computer equipment that solves complex computational mathematical problems and as compensation they get two incentives: New bitcoins that are placed in transit and transfer fees.

| Mining requires powerful and expensive equipment such as GPU and special equipment for mining ASIC very high cost equipment such as computer, GPU, ASIC. This makes the purchase of the equipment complicated, since a lot of money must be invested |

|---|

| ♦ These equipments must have a strict maintenance since they are in constant operation |

| ♦ Being powerful equipment, they consume a lot of electrical energy, which increases operating costs, although this depends on the electricity tariff of the country where you live) |

| ♦ There are countries where any relationship with cryptocurrencies is prohibited, such as China, which has just banned BTC |

| ♦ In tropical countries it is more complicated for mining to work due to the high temperatures, this equipment must be in cold temperatures, so the investment cost increases |

| ♦ As the price of cryptocurrency increases, mining becomes more complicated, so the equipment undergoes constant updates, which requires investing money |

The main limitation for which we cannot all be a miner lies in money, this is not an economic process, USED mining equipment can cost $ 3000 dollars and the graphics cards with which Ether is mined have increased in price due to the Little stock is available, so graphics cards went from $ 100 to $ 300 in just months.

The blockchain is a per to per database where the transfers made from one user to another can be observed in detail, these transfers cannot be edited or eliminated in any way. Each of these transactions must be verified and validated by the system.

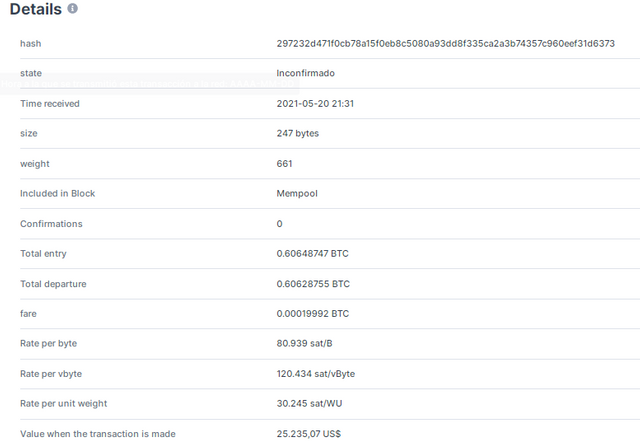

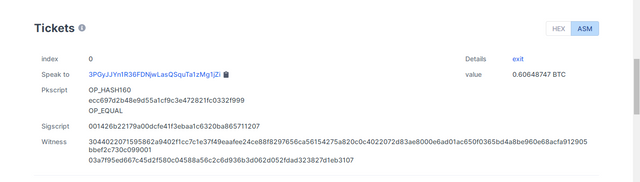

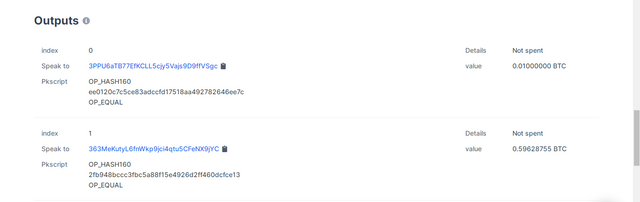

Next, I will show you a BTC transaction, these screenshots are taken from https://www.blockchain.com which is the bitcoin blockchain explorer where you can see all the transfers.

As you can see, all the information of the transfer is fully visible and that happens with all transfers in any cryptocurrency, if this is not transparency, what is it?

In my country, cryptocurrencies are known by a small group of inhabitants, at the moment there is a lot of ignorance regarding the subject and people from day to day do not know anything.

The Venezuelan government tried to implement a false cryptocurrency in the country that they called '' Petro '', this currency based its value on the cost of a barrel of oil, and when I say false it is that they made a Centralized currency, they placed it the price at convenience and this totally breaks the scheme of what a cryptocurrency is. In Venezuela, there have been known cases of arrests by people who mine cryptocurrency and there is a cryptoactive law that must be complied with, mining is regulated and you must have a special license to exercise it.

Here in my country I only know a large department store called Traki that has cryptocurrencies among its payment methods, however, there are small businesses that accept digital payments through cryptocurrencies using the Binance and Uphold platform, that has encouraged many to be motivated to know about the subject.

Cryptocurrencies work on Blockchain technology, like any other system it is not 100% secure.

Investing with Cryptocurrencies has its dangers like any other investment and although it is not called a Currency, for the United States Futures Trading Commission (CFTC) defines it as a commodity, which translates as recognition in the stock market. The amount of cryptocurrencies that exist is very large but the undisputed leader is still Bitcoin, today many large companies have begun to accept bitcoin as payment methods, including Microsoft and IBM.

This technology is just beginning and we will see how it will be recognized around the world as it develops, cryptocurrencies are here to stay.

Hi @josegma96 , Thanks for submitting your homework

Feedback: You have completed every point and you have understood the basics of cryptocurrency

Rating: 7

Thanks you Teacher ☺