In-depth Study of Market Maker Concept - Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

Hello fellow steemians,

Welcome to week number 6 of the steemit crypto academy. Today I want to attempt the assignment task given by professor @reddileep after delivering his lecture on the topic In-depth Study of Market Maker Concept. Let's get started.

Welcome to week number 6 of the steemit crypto academy. Today I want to attempt the assignment task given by professor @reddileep after delivering his lecture on the topic In-depth Study of Market Maker Concept. Let's get started.

1- Define the concept of Market Making in your own words.

Market making concept can be seen as a scenario where buying and selling of asset is done with the market markers having their own price at which the wish to trade in the market at that point in time. These set of traders define their prices which the wish to buy or sell their own asset. This fact can also be experienced in our day to day lives as people tend to buy or sell their goods on a particular price and anything outside that price won't be accepted.

For instance, a trader who is selling mango may decide to put them in batches or group for $5 per group. Now, if a buyer tends to buy mango for $4, and the mango seller has already put them in batches or group for $5 each, the buyer will have no other option than to add money to get the mango or he will decide to live buying the mango. In this example above, the trader who sells the mango is the market maker because he has a stamp price which he is willing to sell his mango.

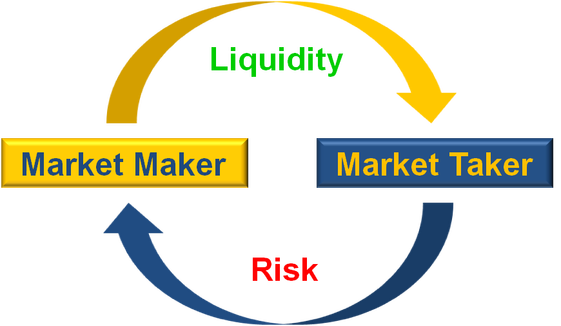

Another group of traders that are seen as the opposite of the market markers are the market takers. These group of traders do not have their own price which they are ready or willing to purchase their asset. The price the meet in the market is what they make use of. Now unlike the example we gave above where the market maker has put a price which he is willing to sell or buy his asset, in the case of the market taker, he accepts any price he meets at the market without any form of hesitation.

Source

From the explanation above, the market marker trade does not execute instantly as there are disagreement or conflict between the price of the exchange of that asset and the price which the market maker is will to buy or sell his or her asset. On the contrary, the market taker trade execute almost immediately because the is this agreement between the current exchange price of the asset and the trader. Market taker does not care what the price is he enters into his trade and buy or sell his asset.

Now let's consider this example again. If a crypto asset is to be sold at the current market price of about $20, and the market taker comes in to the picture, he will immediately pay the money and at once the trade will be executed. Similarly, when a market maker decide to come into this type of trade, he may decide to set an amount that he wishes to buy the asset instead of paying the $20. The market marker may decide to open a trade to buy the same asset when the price drops to around $18. So this trade, in the side of the market maker will not be executed until the price of the asset moves from $20 - $15.

2- Explain the psychology behind Market Maker. (Screenshot Required)

The market continues to move in a random format on daily basis as we experience buy and sell of asset almost every seconds of the day. Buyers and sellers continue to come in contact with each other. Looking at the block chain history of transactions, you will notice blocks been verified every seconds and minute and that is how the trade continues to circulate within the various traders. Though there are still traders who will not accept or agree to trade on the current price of the asset given by the exchange platform. In the case they will have to set their own price which they want to use or enter the trade, these group of traders are the once we refer to as market makers.

In scenario like this, the market makers who are known as liquidity providers most often tend to set up both buy and sell signal since they too are liquidity providers. They will set buy order at a discount price then they will also set sell order at a price that is much higher than the buy order this is do that they can make their own profit. Now, the space between the buy order and the sell order provided by the market makers or liquidity providers is normally not very large hence these space becomes opportunity for marker takers to take their trade entry.

Example if the market maker set a buy order at the rate of $50 and a sell order at the rate $52, there exist a space between the buy order of $50 and the sell order of $52. This space found between the buy and the sell order is the space of the liquidity. This is the region where most market takers take opportunity and then enters their trade within this region.

Source

The psychology behind Market Maker can never be complete without mention these group of dangerous fellows called the Whales. They are said to be dangerous because they are always manipulating the market to their favour there by extorting retail traders. Now they do this by supplying a large liquidity to the trade and those who do not know will quickly enter the trade and provide their entire asset and when these whales have made their gain from the said trade, they will quickly withdraw their liquidity from the market thereby leading traders to delima or confusion and they will lose their asset at the process. They initially entered the trade to make profit but the whales extorted them and left them with loss instead of profit.

3- Explain the benefits of Market Maker Concept.

There are many benefits of market maker concept and for the sake of this lecture, we will be exploiting few of them.

- Liquidity Provision: We have established that the market makers are liquidity providers, we said that the can place two different trade both buy and sell and within the range of this buy and sell there will be space of liquidity where retail traders such as market takers take the opportunity to place their own trade. Now the trade placed in this range by the market taker execute instantly with a delay.

- More people participation: Due to the liquidity provided by market makers, more traders tends to participate in the said trade. This is because all traders look for every opportunity available to enter the trade and make profit. When much people find their position on the said trade, the coin in question tends to have more value.

- Efficiency of Trade running: The market makers help in the efficiency of running of trade. The do this by simply providing liquidity to the trade. The absent of liquidity in any trade will make the trade not to be effective or efficient. There is always suppose to be enough liquidity in any trade to enhance the study flow of movement between the buyers and the sellers.

- Little volatility: As we have said earlier that the space provided by the market makers which serves as the liquidity space is not usually very large hence that will help the volatility of the said asset to reduce as we as it has been given a define section. Prediction of price in this case won't be too hard for the market taker, since the available space for liquidity is not large.

- Can be favourable to retail traders: Since the major aim of every trader is to make profit, the market makers usually due to the liquidity provided by them, make use of the opportunity to make a lot of profit. We said above that prediction will be easier since the space between the buy and sell region provided by the market sellers are not large enough.

4- Explain the disadvantages of Market Maker Concept.

There are many disadvantages of market maker concept and for the sake of this lecture, we will be exploiting few of them.

- Manipulationof prices: I said above, one of the most dangerous persons you can meet in trade is the whales. In the same way, the market makers can be dangerous too because we said they provide liquidity to retail traders and it implies that they too can withdraw their liquidity at any point in time since they are not answerable to any authority. They control every affair they are doing. Imagine that they accumulate many retail traders and then make their profit after which they decide to withdraw their liquidity. This will lead to loss in the part of the retail traders.

- Provision of short term liquidity: Just like the whales who come into the trade and make their profit and withdraw their liquidity, the same thing happens here in the case of liquidity providers or market makers. They do not have a time frame which their liquidity will last and then it is not guarantee that the liquidity wi stay long as it can be withdrawn at any time.

- Funds can be lost: Though retail traders make some profit from the liquidity provided by the market makers, but even at then, there are situations where traders will loss their asset almost completely, like withdrawn all their liquidity, most especially when the whales enter into the trade and decide to trick little retails into supplying all their asset and then the liquidity which is suppose to be used will be withdrawn leading traders to loss.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Moving Average: The moving average indicator is mostly use by traders because it is easy to read and interpret. When someone is carrying out a chart analysis on any pair of trade, aside physically looking at the trend movement, another way to clearly understand the trend is by looking at the indicator. The indicator is better read and understood when the MA line is included twice on the chart. When this is done, the length is change so as to have a clear picture of the movement of the indicator. Now the indicator shows it signal of change of trend when one of the lines of the MA cross the other. The point of this crossing is what we call the golden cross.

Source

In uptrend or bullish trend, the price is always seen above the two MA lines. In the same way, when the two MA lines are seen above the price, that scenario is usually a downtrend or bearash trend of the market.

Source

Just like other indicators, the MA indicator when it records a downtrend, is a moment when the traders in the market make their sells. So this period as indicated by the indicator is a period of distribution of asset. Traders tend to distribute their asset in this phase. The market at this point are completely controlled by the sellers.

In the same way, the MA indicator when it records a uptrend, is a moment when the traders in the market make their buys. So this period as indicated by the indicator is a period of accumulation of asset. Traders tend to accumulate their asset in this phase. The market at this point are completely controlled by the sellers.

Now market makers take the opportunity of some fake signals to extort from small traders. For instance if there exist a golden cross, and from the law it is expected that the trend reverse, but instead of the trend to reverse it breakout or possible make a little shift and another golden cross appears and in that way it has lead traders astray. Traders who are retail traders can loss their asset in this point because the analysis carried before entry into the trade might have been affected by the market makers.

Relative strength index(RSI): The Relative strength index(RSI) indicator is an indicator that often shows periods of accumulation and periods of distributions in a trade. Now this period of accumulation can be termed as an overbought region, whereas the period of distribution is termed as oversold region. The RSI indicator is scaled from 0 - 100. The accumulation region which is the overbought region is always seen at the range between 70 - 100, in the same way the distribution region which is the oversold region are found within the range 0-30.

Source

In the RSI indicator, when the line of the indicator is found at the range of 0 - 30, we are expected to see a bearish movement in the price of the asset and then be expecting a trend reversal because that point is recorded as a region of oversold.

Source

Similarly, if the RSI indicator line is found at the range of 70 - 100, we are expected to see a bullish movement in the price of asset at that point and then we are suppose to expect a trend reversal because that point or region is recorded as a region of overbought.

Now, the market makers as well as whales in the trading world mostly use this difference in the trend movement to extort retail traders. The market makers can provide lots of liquidity and when much buyers enters the trade, then they will withdraw their liquidity leading traders to much loss of asset. This is always seen in cases where there is a very sharp reversal in the trend movement of the asset.

Conclusion

In the crypto market, there are always traders who do not agree with the set price the meet in the exchange set for a pair of asset. These group of traders are always known as the market makers. They are set of traders who fix the price which they are willing to trade the asset in question. They ability of them providing a space between their buy entry and their sell entry is what result to what we call liquidity today in trade. They are very helpful when it comes to provision of liquidity in the crypto world. This provision of liquidity is what makes trading to run effective and efficient.

Thank you professor @reddileep for such an insightful lecture. This lecture has really enlighten me greatly on the concept of market maker. I do hope to learn more from you shortly as the season continues.

#reddileep-s4week6 #cryptoacademy #market-maker #crypto-manipulation #nigeria #krsuccess #moving-average

Hello @josantos Thank you for participating in Steemit Crypto Academy season 4 week 6.

Thank you professor for the review