Crypto Academy Season 2 - Week 14 - For @fendit

APPLICATION OF THE ELLIOT PRINCIPLE

Are you wondering how you can apply the Elliot wave principle? In this article we will be discussing about that; let us begin from a very elementary point of view, the Elliot wave principle can only be attained if the market price patterns are completely and correctly identified.

This is to say that the first thing to do is to analyze the waves on a chart carefully. According to the Elliot wave theory, it claims that the movement of price is according to five patterns, in an upward trend, when there is a five way rise what will follow is a three way fall, in the same way a three way rise will also have a five way fall following it.

The Elliotts pattern consists of two types of waves, these waves are the impulse wave and the corrective waves. Under the impulse we also have five subwaves. Its direction is not different from the trend of the next larger size.

Also under the corrective wave we have three different subwaves, the corrective waves movement is always in the direction that is against the next larger size.

These elementary pattern come together to make up the five and three-wave structures of increasingly larger size.

Taking a chart that contains 1, 2, 3, 4 and 5 together for instance complete a larger impulsive sequence,that may be considered as wave (1).

The impulsive arrangement of wave (1) tells a trader or an investor that the movement at the next larger degree of trend is also upward.

It also warns a trader to expect watch out for a three-wave correction which maybe a downtrend.

That adjustment, wave (2), may then be trailed by waves (3), (4) and (5) to finish an incautious succession of the following bigger degree, which beforehand as been named as wave 1.

By then, once more, a three-wave adjustment of a similar degree can be seen, and which can be named as wave 2.

Whenever we are applying the Elliott Wave Principle to any graph, a significant point should be noted which: the Elliott Wave Principle doesn't offer assurance about a market result yet , it gives you a target intends to discover the likelihood of a future course for the market.

At certain focuses, at least two legitimate waves translations exists. Thus, it is principal for any financial backer or a dealer to evaluate the likelihood of each

Another substantial method of applying the Elliott Wave Principle is in the Fibonacci ratios.

A very number of financial backers and dealers understand that Fibonacci examination of the business sectors was spearheaded by R.N. Elliott. The utilization of Fibonacci ratios needs an Elliott wave understanding as a starting point.

There are two significant two experiences as respects to Fibonacci connections in a wave. The first is the restorative waves that appears to withdraw previous motivation floods of a similar degree in Fibonacci extent basic wave connections incorporate 38%, half and 62%.

Also, in conclusion, is the motivation waves which include comparable degree inside a bigger drive grouping will in general identify with each other in a Fibonacci extent.

THE IMPULSIVE WAVE

An impulse wave pattern is a technical trading term that defines and shows a strong movement a financial asset's price which also coincides with the main direction of an underlying trend.

It is used mostly in discussion of the Elliott Wave theory, as a method of analyzing and predicting financial market price movements. Impulse waves are used to show an upward movement in uptrends and/or downward movements in downtrends.

Impulse wave pattern is used by investors and traders in technical analysis that confirms the direction and movement of market trends with short-term patterns.

THE CORRECTIVE WAVE

Corrective waves are an essential component of the Elliott Wave Theory, that was formulated by a man called Ralph Nelson Elliott in the 1930s. Corrective waves are a set of financial asset price movements that are associated to the Elliott Wave Theory of technical analysis.

Within a wave pattern, impulse waves move in a direction which have trend at one larger degree while corrective waves move in the direction that is opposite to that. Corrective waves are consist of three sub-waves.

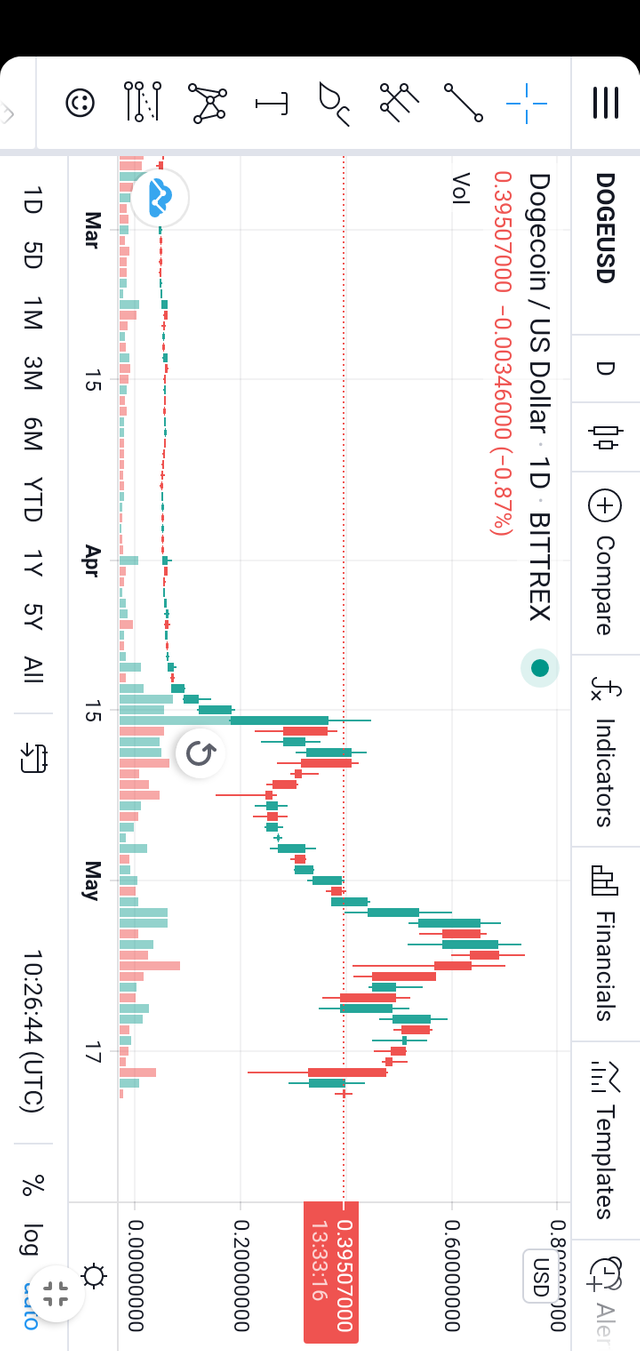

ANALYSING DOGECOIN PRICE

On Wednesday, Dogecoin fell by 30.62 percent. Dogecoin finished the day at $0.3303, down 2.32 percent from the previous day.

Dogecoin had a bullish start to the day, climbing to an intraday peak of $0.4794 before reversing.

Trading Derivatives can not be appropriate for all financial sponsors, so if it's not too complicated, make sure you fully understand the risks.

A Product Disclosure Statement (PDS) can be obtained from this platform or upon request from one of our working environments, and should be considered before engaging in business with us.

unprocessed Spread records have spreads as low as 0.0 pips and charge a fee of $3.50 per $100,000 traded. Dogecoin fell to an early evening int after failing to break through the crucial big resistance level at $0.5330.Dogecoin tumbled to an early evening intraday low $0.2079. The closeout saw Dogecoin slide during that time's critical assistance levels.

Even more inside and out, Dogecoin also fell through the 38.2 percent FIB of $0.4618 and the 62 percent FIB of $0.2882.

Finding evening support, Dogecoin quickly squashed soul through the 62 percent FIB and the third critical assistance level at $0.3947.

A bearish completion to the day, nevertheless, saw Dogecoin slide back through the third huge assist level with finishing the day at $0.33 levels. At the hour of creating, Dogecoin was somewhere near 5.85 percent to $0.3110.

A mixed starting to the day saw Dogecoin climb to an early morning high $0.3469 before tumbling to a low $0.2951. Dogecoin left the critical assistance and resistance levels not tested all along.

Thank you for being part of my lecture and completing the task!

My comments:

Your ideas don't seem to be quite connected in several paragraphs, it all just seems to be copied from different places.

As well as that, you didn't show the pattern in the second task.

Overall score:

1/10