Steemit Crypto Academy Contest / S14W5 -Exploring STEEM/USDT Trading

| Introduction |

|---|

Cryptocurrency as a dynamic market offers a multitude of opportunities for sharp traders. Among the multitude of pairs, the STEEM/USDT pairing stands out, blending the volatility of STEEM with the stability of USDT. This understanding allows traders to make well-timed decisions based on the current market analysis.

Image from and designed with PixelLab Image from and designed with PixelLab |

|---|

Bollinger Bands in the other hand, is characterized by upper and lower bands. They offer insights into price volatility. The tightening of the bands indicates a decrease in volatility. Understanding these bands equips traders with the foresight to anticipate and capitalize on impending market shifts.

| Technical Analysis |

|---|

The Moving Average Convergence Divergence known as MACD is a powerful tool for STEEM/USDT traders. The Relative Strength Index (RSI) and moving averages collaborate to provide a clear approach to entry and exit points. Identifying buy or sell signals involves interpreting MACD crossovers. A bullish crossover, where the MACD line crosses above the signal line usually indicates a potential buy.

Image source Image source |

|---|

Bollinger Bands, consisting of upper and lower bands, provide insight into price volatility. As STEEM/USDT volatility fluctuates, a tightening of the bands signals a decrease in volatility, often preceding a significant price movement.

| Trading Strategies |

|---|

Combining the Relative Strength Index (RSI) and moving averages aids in pinpointing entry and exit points. When there is oversold or overbought conditions on the RSI, it usually signals potential reversals, which when confirmed by the moving average, it provides good trade signals.

Image source Image source |

|---|

The Stochastic Oscillator is used to confirm trends and it is sensitive to market forces. A bullish or bearish divergence can validate the prevailing trend, assisting traders in making informed decisions.

| Risk Management |

|---|

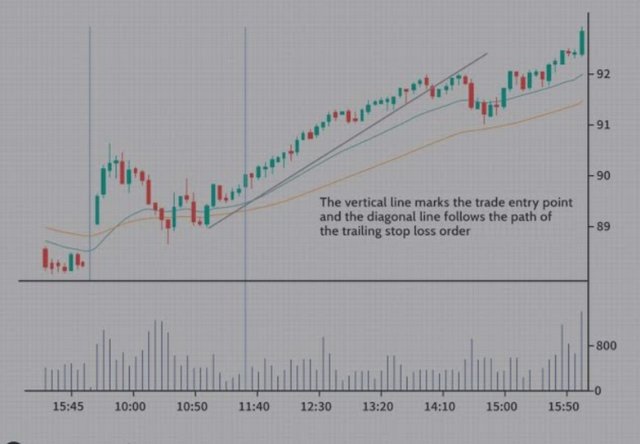

Implementing a well functional stop-loss mechanism is imperative when trading the STEEM/USDT market. This also guards against significant losses, aligning with technical analysis to set certain levels. Diversifying positions reduces risk, ensuring that a single adverse movement doesn't disproportionately impact overall performance.

Image source Image source |

|---|

| Fundamental Analysis |

|---|

Before entering a position, fundamental analysis is important. Traders should monitor Steemit platform developments, STEEM-related announcements, and stablecoin updates. External events such as External events, such as regulatory shifts or groundbreaking partnerships, have the potential to influence the STEEM/USDT pair's trajectory significantly.

| Leading Indicators |

|---|

Most times traders explore beyond conventional indicators and make use of trade volumes as an assessment tool. Apart from standard indicators, exploring lesser-known leading indicators enhances analysis. The Accumulation or the Money Flow Index can provide unique perspectives on price movements. spikes in trading volume can indicate potential trend reversals or confirm existing trends.

To attain mastery in STEEM/USDT trading, traders must view each of this as a piece of a cohesive strategy. Understanding the interconnectedness of technical, fundamental, and risk management elements is similar to assembling a puzzle. This approach ensures that traders navigate the STEEM/USDT market with depth and dexterity.

Each element contributes to the overall efficiency, guiding traders through the complexities of the STEEM/USDT market. Through continuous learning, adaptation, and practical application, traders can refine their skills, ultimately achieving mastery in STEEM/USDT trading.

In a market that never sleeps, where every candlestick tells a story, navigating the dynamic waves of STEEM/USDT trading is an ongoing journey. It requires a resilient spirit, a commitment to learning, and the ability to adapt swiftly to changing market conditions. For those willing to embark on this journey, the rewards are as dynamic as the market itself, promising not just financial gains but understanding the intricacies between technology and human behavior.

| Conclusion |

|---|

In conclusion, mastering the complexities of STEEM/USDT trading requires a comprehensive approach. Technical analysis tools like MACD and Bollinger Bands form the foundation, complemented by strategic trading approaches involving RSI, moving averages, and the Stochastic Oscillator.

Risk management through stop-loss and diversification safeguards capital, while fundamental analysis keeps traders abreast of market-changing events. Exploring beyond common indicators and deciphering trading volume enhances predictive capabilities. By using these elements, traders can elevate their understanding and proficiency in navigating the world of STEEM/USDT trading.

Thank you for reading my participation for week 5. I will invite my friends to share their knowledge on this topic; @sahmie @yancar and @steemdoctor1.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Has hecho un gran esfuerzo para abordar todas las pautas del desafío, tal vez algunos gráficos sean necesarios para alcanzar un mejor nivel de compresión.

Saludos y éxitos, ¡Feliz Año Nuevo 2.024!

You have shared a great post, and I have learned from your post. Success to you.

Thank you so much.

I'm glad you found the post helpful. Success to you as well!

Greetings friend,

Your entry for this engagement contains valuable information about the different strategies, indicators, and analysis tools that can be used for STEEM/USDT trading. It's great to see you sharing such knowledge with others in a way that's easy to understand. Your post is a valuable resource for traders looking to enhance their skills. I hope you don't get disheartened by the score but continue to share your knowledge with us. I wish you all the best and compliments of the season.

Thank you for your thoughtful feedback and warm wishes! I appreciate your kind words. I'm committed to sharing valuable information, and I'll keep contributing to help others in their trading journey. Compliments of the season to you as well, and best wishes!

I quite agree with you on this. The life of f a trader is his capital. Without it, There is no trader. So effort must be made to protect his capital.

Really appreciate your great effort in putting this piece down for our benefit I hope you will be more determined more than ever to continue doing this good work. Do not let the grade discourage you.

Wish you all the best.

Thank you for your review and encouragement

📈🔄 "Exploring STEEM/USDT Trading" - @jaytime5, your insightful exploration of the STEEM/USDT trading pair showcases a profound understanding of the cryptocurrency market dynamics. Your comprehensive overview of technical analysis, trading strategies, risk management, fundamental analysis, and leading indicators provides a holistic guide for traders entering this dynamic space.

The integration of technical tools such as MACD and Bollinger Bands, alongside strategic trading approaches like RSI and moving averages, reflects a keen understanding of the need for a multifaceted approach. Your emphasis on MACD crossovers, RSI, and the Stochastic Oscillator as signals for entry and exit points adds practicality to the technical analysis aspect.

The incorporation of risk management strategies, including the implementation of stop-loss mechanisms and diversification of positions, demonstrates a commitment to preserving capital and mitigating potential losses—a crucial aspect for any trader.

Fundamental analysis, especially monitoring developments on the Steemit platform and external events, highlights the importance of staying informed about factors beyond technical indicators. Your mention of external events influencing the STEEM/USDT pair aligns with the broader concept that cryptocurrency markets are influenced by both internal and external factors.

The insight into leading indicators, such as the Accumulation or the Money Flow Index, and the recognition of trading volume spikes as potential indicators of trend reversals or confirmations, adds depth to the analysis. Your analogy of viewing each element as a piece of a cohesive strategy, akin to assembling a puzzle, is apt and reinforces the interconnected nature of these components.

The call for continuous learning, adaptation, and practical application resonates well in the ever-evolving cryptocurrency market. Your concluding remarks inspire a resilient spirit and a commitment to learning, reinforcing the idea that navigating the STEEM/USDT trading landscape is an ongoing journey.

Overall, your contribution provides a valuable resource for both novice and experienced traders, offering a roadmap to mastering the complexities of STEEM/USDT trading. May your insights empower traders on their dynamic journey through the cryptocurrency market! 🚀💹🔍

I'm grateful for your comprehensive and positive feedback, and I hope that this exploration serves as a valuable resource for both novice and experienced traders navigating the complexities of STEEM/USDT trading. Thank you for your support!

@jaytime5

Improve your performance more and more it requires hard work the more you work more you will benefit and more you will get more good marks other activity is great and always on other friends posts. Keep commenting because your hard work can give you chances of more rewards

Yet dear friend you keep amazing me with hot creative innovative and powerful means of information your article is of high quality and very addictional. In fact after going through your post one could be granted a certificate of professionship im this crypto field..

Yes Friend this indicator is known for reliability in creating credible signals of predictions for crypto trends whether they are going upward or downward in other words going bullish or bearish.

Thanks for sharing wishing you success please engage on my entry https://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s14w5-exploring-steem-usdt-tradingwonderful articles

Your generous words truly brightened my day! I'm glad to know you found the article informative and valuable.

I'm here to share insights and contribute to our collective understanding of the crypto world. Thank you for your encouraging feedback!

Hello friend greetings to you. Hope are having good time there.

The technical tools are too much important for crypto trading. We use it for the confirmation of the market. You have made a nice attempt to answer all the questions asked here. The fundamental also works good along the technical news.

I wish you very best of luck here in the contest.