My homework post for Beginners' Fixed Course - Task 7: Dex, Cex, Popular Exchanges and Trading Cryptos | By @jaspichman125

Hello professor @imagen, I am glad to submit my CryproAcademy Homework Post For Task - 7: Dex, Cex, Popular Exchanges and Trading Cryptos.

Explain in your own words what an Exchange is. Differences between a Wallet and an Exchange. Mention the advantages and disadvantages of DEX and CEX. Have you used an Exchange before? tell us about your experience.

According to my understanding, Exchanges are well organised marketplaces where currencies are traded. Exchanges provides the platform where traders either buy or sell financial instruments such as fiats and cryptocurrencies. It is a place where buyers finds the exact currency they want to buy from sellers at a specified price based on demand and supply market forces.

Exchanges can be categorised according to the type of trade being executed, the financial instruments being traded e.g. Cryptocurrency Exchange, Stock Exchange, Foreign Exchange (Forex), etc.

With respect to cryptocurrency, Exchanges provides platform for market participants (traders) to trade one cryptocurrency for another or buy or sell their coins for fiat.

Digital cryptocurrency exchanges (DCE) could either be Centralised (CEX) or Decentralized (DEX).

These are exchanges that have a central authority (a third – party between buyers and sellers) that governs or controls the affairs of the Exchange platform. They are crypto custodial in nature – meaning they holds user’s funds (fiat or crypto) in one place. That means you have to “trust” them with your money.

Examples of centralised Exchanges are:

Top 3

- Binance: rated as the best Exchange platform with a daily trading volume of $84,105,104,873.34 as at the time of writing this post.

- Coinbase: 2nd rated exchange platform by trading volumes with $4,697,175,383.57 as at the time of writing this post.

- Huobi Global: trading volume of $6,075,942,872 in the last 24H

Other Exchanges and their trading volumes in the last 24 hours include;

- Bitfinex: $821,828,132

- Poloniex: $125,475,445

- Kraken: $1,176,794,224

- Bittrex: $129,954,886

- Gemini: $231,033,344

- GDAX

- Paxful

These are cryptocurrency exchanges that have no intermediaries between buyers and sellers. They operate without a central authority or a third – party between buyers and sellers by relying on self – executing programs called “smart contracts”.

The smart contracts facilitates trading on DEX.

Just like blockchains which works in a decentralized distributed manner, DEX use a similar trust – less protocol; meaning traders don’t have to trust the system/network or even the potential buyer or seller. Trades are executed by the Smart Contracts without the need to trust the buyer or the seller. This is what we call peer-to-peer (P2P) trading.

The Smart Contracts feature makes trading less costly on DEX compared to CEX. This is possible through the automated market makers (AMM) innovation which reduces transactions fees on DEX.

Decentralized Exchanges do not ask their customers for KYC or AML regulatory compliance, in fact, you don’t need to have an account. Transactions are executed directly from your wallet via the Smart contracts functionality.

Examples of decentralized Exchanges are

WavesDex, Bancor Protocol, Kyber Network, EtherDelta, AirSwap, Uniswap, Justswap, Tokenlon, 0x Protocol, Venus, Sushiswap, Compound, BurgerSwap, Curve Finance, 1inch Exchange, PancakeSwap

A cryptocurrency wallet is a software, hardware or a paper that allows users to interact (buy, sell, or HODL coins) with a blockchain network. This means crypto wallets can be grouped into 3 categories namely: (1) software wallets, (2) hardware wallets and (3) paper wallets. Depending on the interface (offline or online), wallets could also be either hot or cold wallets.

Software wallets are more convenient for users because it is based on software which is accessible by using Web, desktop or mobile phone. Examples of software wallets are Binance Trust wallet, Metamask, Electrum wallet, Exodus wallet, Xapo wallet, Atomic wallet, Luno, Coinbase wallet, Trezor wallet, etc.

El Salvador’s latest Bitcoin app, the Chivo wallet is the latest cryptocurrency wallet.

Hardware wallets are tools or devices that are used for the safekeeping of cryptocurrencies on an offline state/mode. They are considered to be the most safest/secure forms of wallets.

Hot or Cold Wallets

Hot wallets: are the ones that are connected to the Internet e.g. software wallets. This kinds of wallets are easily accessible by customers or users anytime, anywhere they have connection with the Internet.

Cold wallets: these kinds of wallets have no connection with the Internet. They’re kept offline. Private and public keys are kept offline which makes it difficult for cyber attack or hacking. This types of wallets are suitable for long time investors or “HODLers”.

Important features of Crypto wallets

Private and public keys: these gives you access to your funds (cryptocurrencies). Even when your computer or smartphone got lost or damaged, you can still have access to your funds once you have your private and public keys intact. Public keys are segments of digital code that are assigned to a decentralized blockchain, similar to a bank account number while Private keys are what matches and proves ownership of public keys. Private keys are used to conduct or sign all transactions with the cryptocurrency that they own. Public keys on the other hand is used for signing in to the blockchain or wallet.

Addresses: this consists of alphanumeric identifier which is generated based on the private and public keys. The Addresses are specific “locations” on the blockchain where cryptocurrencies are sent to or received.

| Wallets | Exchanges |

|---|---|

| (1) Does not store or hold user’s funds | Stores user’s cryptos - acts as custodial of your funds |

| (2) It could besoftware, hardware or a piece of paper | It is in form of software or blockchain |

| (3) Comprises of public and private keys generated by the network | Password is chosen by the user/customer unlike in wallets where the network generate the keys. |

| (4) Suitable for HODLing investments especially, hardware wallets | Suitable for trading e.g. peer-to-peer, spot, futures and margin trading. |

| (5) All wallets are centralised | Both centralised (CEX) and decentralized (DEX) |

| (6) Stores public andprivate keys | Stores assets or funds |

Advantages of CEX

- It manages user’s keys (Customerprotection)

- Suitable for trading (buying and selling crypto)

- You can easily deposit fiat with you debit/credit card

- More popular than DEX because of high liquidity. They provide a crucial source of liquidity to the global cryptocurrency market.

- Fair pricing and security. Prices are determined by market forces of demand and supply.

- Easier to buy and sell (trade) crypto. You exchange fiat for cryptocurrency and vice versa. Cryptocurrencies can be swapped for another cryptocurrency e.g. ETH to XRP.

- Higher liquidity which makes it easier for traders to always have options and alternatives in their buying and selling activities on the platform – this is one the major advantage of CEX

- Cryptocurrencies are kept safe by the central authority.

- Accountability/Transparency : they publish information about their physical office, their CEO, or managers, etc.

- Regulatory compliance: Anti Money Laundering (AML), and Know Your Customer (KYC) regulations allows users to provide their true identity and information about them. This helps in preventing people from creating fake accounts for fraudulent activities.

Disadvantages of CEX

- Exposure to counterparty risk

-Hassles of regulatory compliance: failure to meet up the regulatory requirements, your funds may be freezed or your account deactivated. Thus is not a good experience for traders. The hassles of going through the “verification process” or the - KYC sometimes is very disappointing 😞 - Susceptible to downtime and cyber attack: since the network has a central authority that controls it, downtime may occur at an unexpected time, leaving traders stranded. Storing billions of dollars worth of cryptocurrencies in one place can also make CEX a centre of attraction for cyber criminals.

- Users have to sacrifice ownership of their funds by trusting the Exchange platform. some people may find it difficult to temporarily sacrifice ownership of their assets most especially if the assets are in millions of dollars.

Advantages of DEX

- It allows traders to manage or hold their keys while trading

- The Smart Contracts functionality enables instant trades at lower cost compared to CEX.

- The non – custodial feature of DEX ensures people retain custody of their cryptos and managing their accounts or wallets.

- They have limited counterparty risk. Because of the decentralized nature, it is a lot more costly to hack the system. Another reason is that DEX do not hold people’s funds in custody – this makes it less appealing targets for cyber attacks.

- There’s no regulatory compliance checks. Therefore, users are shared from going through the hassles of verification processes of KYC or AML.

- They use various features such as order books, liquidity pools, and aggregation tools to offer novel and experimental financial services.

- They are completely Decentralized – meaning, no single individual have control over the network.

- User friendly platforms such as Uniswap, Curve, Balancer, Sushiswap Compound BurgerSwap, etc.

- Trading is done directly from the user’s wallets via Smart contracts.

Disadvantages of DEX

Problem of liquidity: decentralized exchanges have less liquidity and trading volumes compared to centralised Exchanges.

Absence or lack of fiat deposits and withdrawals. Only cryptocurrencies are traded on DEX

Lack of private and public keys recovery option. When you lost your keys or seedphrases, you’ll loose your assets irretrievably forever unlike in CEX which offers passwords recovery option.

My experience on cryptocurrency Exchange platforms has not been smooth but I have learnt from my experiences.

Other cryptocurrency exchanges: Apart from STEEM, SBD and TRON, I now have other cryptocurrencies in my crypto wallets such as Trust wallet, Binance, and Roqqu

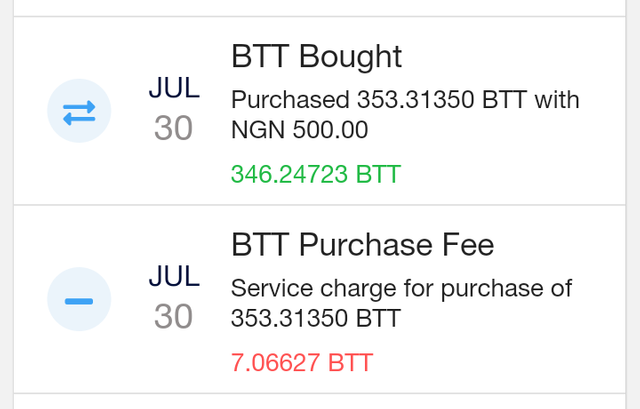

I use Roqqu often because of its simplicity and better customer service. You can easily deposit fiat in Nigerian Naira despite the ban on cryptocurrencies in Nigeria.

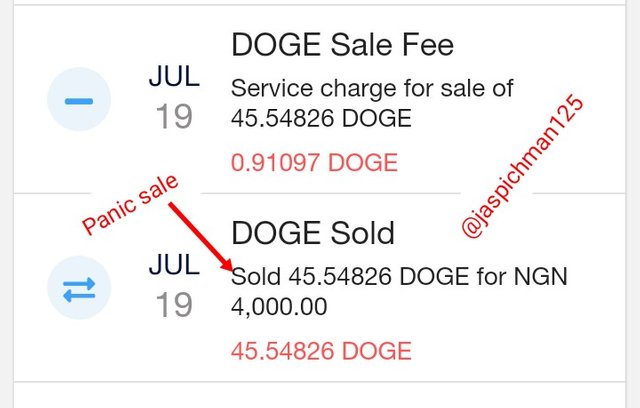

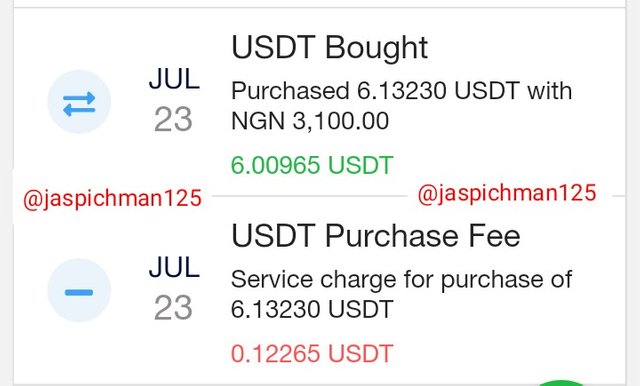

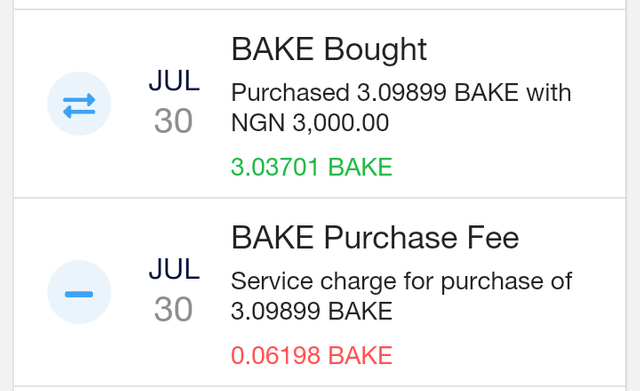

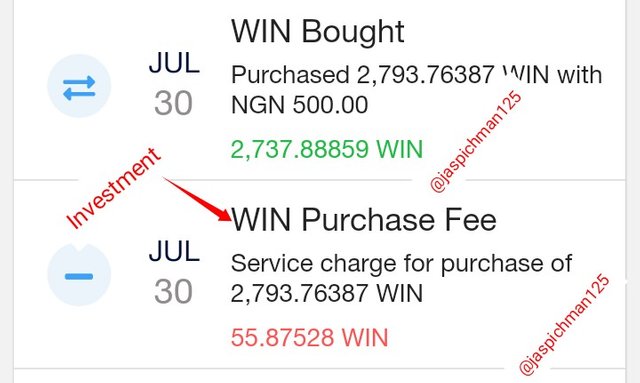

Below are some of my transactions on Roqqu Exchange platform.

Panic sale due to the fear of missing out (FOMO)

I was HODling some cryptos sometime ago, as the price started declining below the price I bought the coins at, I immediately sold them due to FOMO. In the process, I lost some fortunes but I have learnt a great lesson not to succumb to FOMO or panic sale.

Investing in cryptos:I bought some crypto projects that have the potential of giving me turnover in the long run. E.g. WIN, BAKE, REEF, HIVE, etc.

Cryptocurrency Exchanges provides liquidity to the global cryptocurrency market, they enhances the acceptability and adoption of cryptocurrencies at a fast speed.

Centralised Exchanges are the best so far, though Decentralized Exchanges are proving to be a challeger to the Centralised Exchanges in the near future.

Wallets are where traders most especially long time investors (HODLers) keep their funds safe.

My experience on both cryptocurrency Wallets and Exchanges is great so far. I look forward to building better user experience. Thanks to prof @imagen for a great lesson on CEX, DEX, Wallets and Exchanges.

Special thanks to my professors;

@imagen

@awesononso

@reminiscence01

@dilchamo

Thanks for reading through my homework post. Hope you liked it?

Best regards; @jaspichman125