Steemit Crypto Academy: Season 2. Week2// Homework Post for @kouba01 | Cryptocurrency Contracts For Difference (CFDs) Trading

.png)

Contracts for Differences (CFDs) as the name says are contracts on a financial instrument, where an agreement is made between an investor and an intermediary (Broker, Dealers, issuing bank, etc.), based on speculation of the difference in the price of an underlying asset for a period established between the time of opening and the termination of that contract, without the need to acquire such asset.

The difference in the price of the asset during the period established in the CFDs is exchanged between the parties (investor and intermediary), the guidelines are established with each supplier of the CFDs, i.e. they may vary from one broker to another, but always within the legal framework.

These contracts were first used in London in the early 1990s and were until the late 1990s and were introduced to the retail market, their popularity increasing among minority traders during the 2000s.

What is a cryptocurrency CFD?

Cryptocurrency CFDs are widely used in the cryptocurrency world today, this consists of a contract where an investor (traders) agrees with a broker or provider (Brokers) to buy or sell a cryptocurrency asset (without owning it) in the long 0 short term, being able to obtain a profit or monetary loss from the bullish or bearish movements of the asset , depending on the choice of the investor.

It is important to note that contracts for differences do not have an expiration date, however those positions that are held more than one day should be considered, because the profits or losses were charged to the Traders, as well as the commissions and charges established by the Brokers and will continue for the next day.

Likewise, cryptocurrency difference contracts offer low-capital traders an opportunity to a larger market they do not have access to, where they can get a higher monetary return on their investments, of course if it is previously studied and analyzed the movements of the asset and its trend (bullish or bearish).

In addition, investors have the advantage of making money profit from the bear market with contracts by difference by the option to set the short-term position they offer.

Finally, one of the advantages mostly taken into account by investors is that the profit losses will be paid at the end of the section for positions executed during the trading day, as well as savings in commissions.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

CFDs are suitable for investors who, as I mentioned in the previous point, have low initial capital, as well as maintain a short-term strategy that provides excellent results.

On the other hand, among its trading strategies are: short-term investments, profit-making with margin trading and investments with small price changes in the market.

Likewise, CFDs are conducive to risk-loving investors, where they maintain calmness and objectivity in the moments of assuming losses and rethinking the necessary adjustments based on market study and analysis and trading techniques.

Finally, it is suitable for those who are comfortable with the security of a regulated CFD broker, with experience and market recognition that offers support and protection to investors.

Are CFDs risky financial products?

CDFs are considered high-risk products, even mentioned that between 71% and 89% of minority investments have lost their accounts when trading CFDs.

Obviously, CFDs are a very complex instrument, which can generally be difficult to understand at the time of making investments, resulting in a high risk of loss of invested capital.

It is important to keep in mind that CFDs due to their high leverage can result in substantial losses in invested capital if the necessary knowledge is not available on the subject.

On many pages visited during this investigation, I found some warning messages like the ones I show below:

Do all brokers offer cryptocurrency CFDs?

Not all brokers really offer it, below I present a list of some of them:

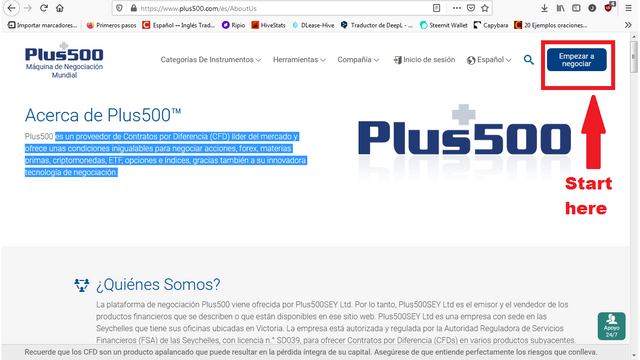

1.- Plus500: is a platform headquartered in Israel and offices in the United Kingdom, Australia and Cyprus. It is a well-known CFD provider, which has a fantastic technology that allows you to offer the best conditions to trade stocks, forex, commodities, cryptocurrencies, ETFs, options and indices.

It advertises on its portal that it keeps its clients' money in separate accounts and is regulated by the Seychelles Financial Services Regulatory Authority (License No. SD039).

Offers 1:30 leverage (for non-EU citizens) and a minimum deposit of $100 for debit/credit cards and $500 for bank transfers.

It handles the following cryptocurrencies: Bitcoin, Ethereum/Bitcoin, Ethereum, Litecoin, Stellar, Bitcoin Cash ABC and Cardano.

2.- eToro: It was created in 2007, then in 2013 it began offering CFDs of the Bitcoin cryptocurrency and then in 2017 incorporated other recognized cryptocurrencies.

It is regulated by CySec and FCA, and also has the authorization of the Consob in Italy and the CNMV in Spain.

It offers CFDs on all assets: Stocks, Forex, Indices, Commodities and Cryptocurrencies.

It offers Leverage Allows withdrawals starting at $30, with a minimum withdrawal fee of $5 and charge 12-month inactivity fee of $10.

Among the cryptocurrencies available are: Bitcoin, Ethereum, Ripple, Litecoin and other popular cryptocurrencies

It is authorised and regulated by the Cyprus Securities and Exchange Commission under license CIF number 272.

It makes available to its users a large repertoire of support material for the preparation of its members, such as the Free Ebook in PDF format.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

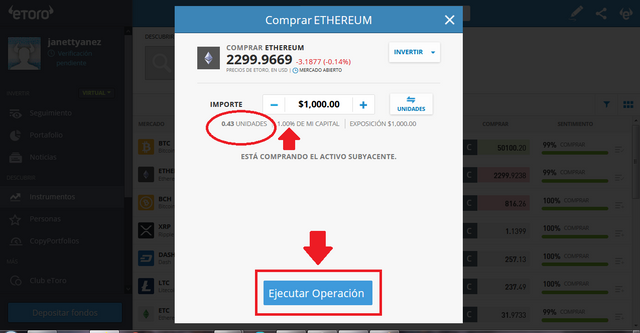

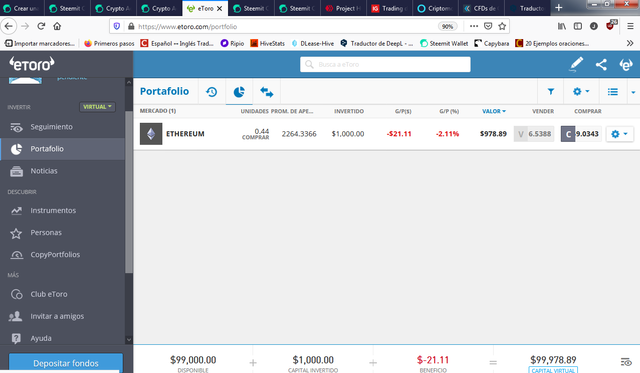

1st Test: eToro

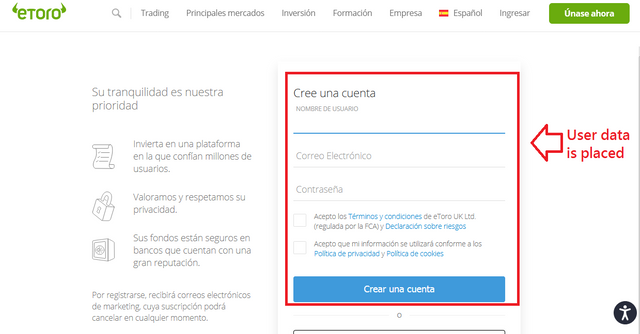

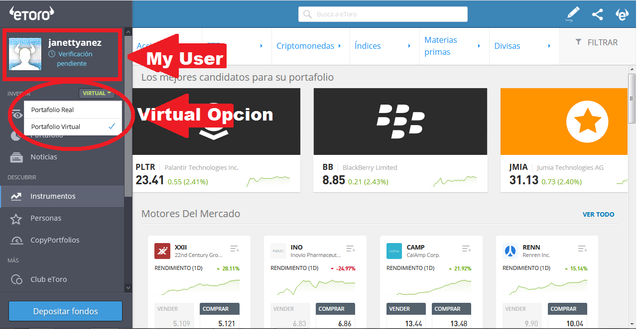

When I did the registration by mistake I filled out the data form and it appears as pending.

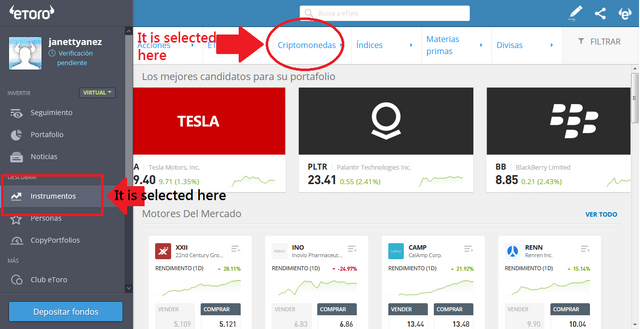

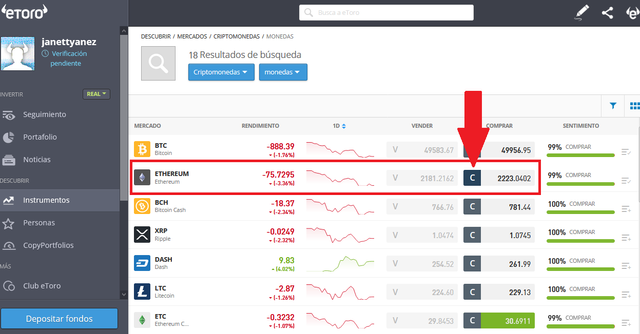

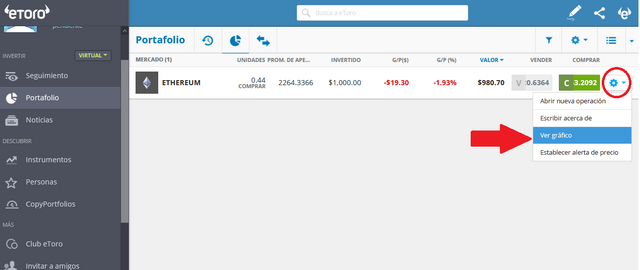

With this option you can review and analyze the movements of the cryptocurrency and make the decisions when to close the trade.

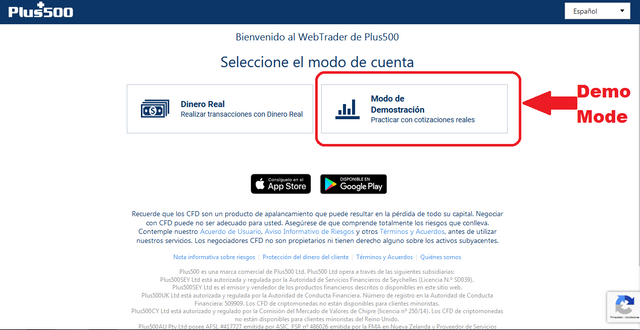

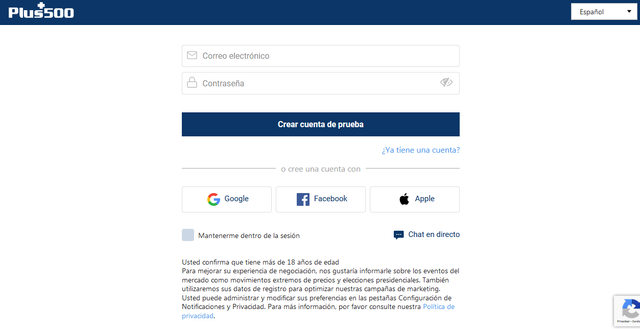

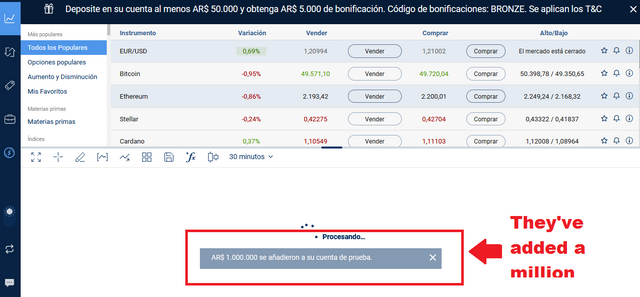

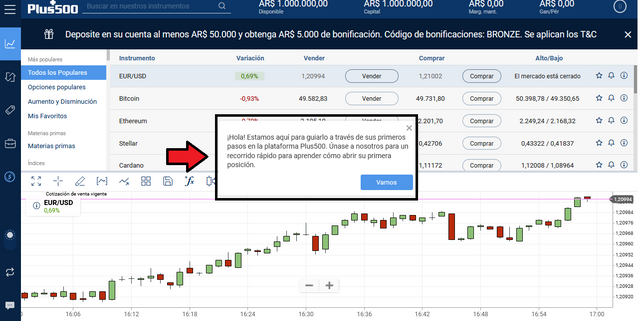

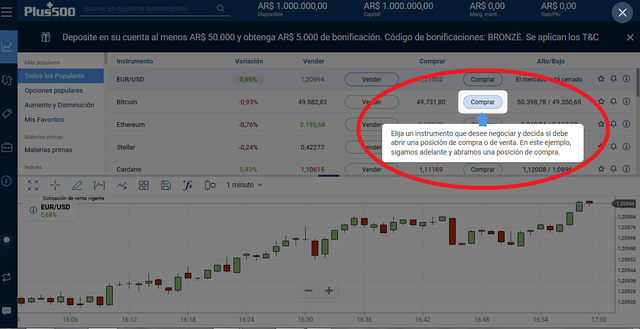

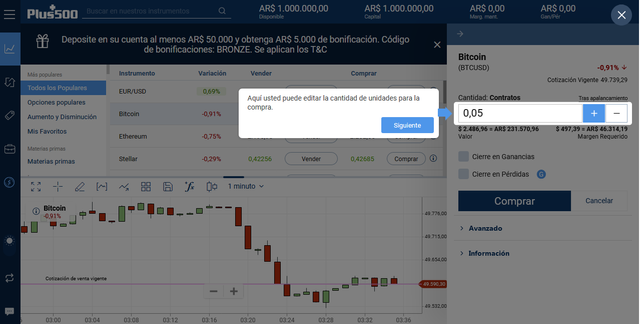

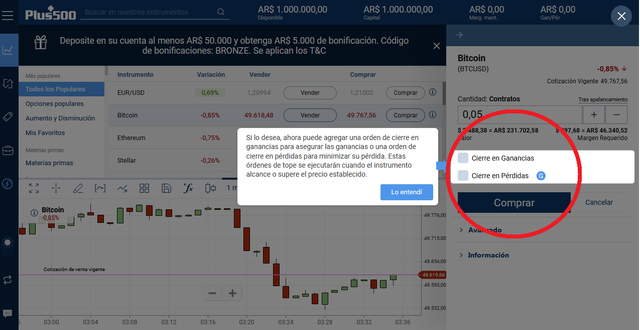

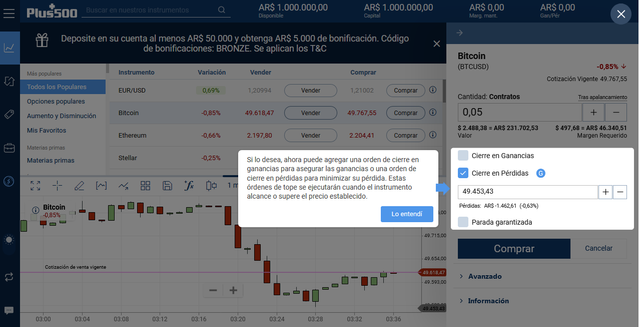

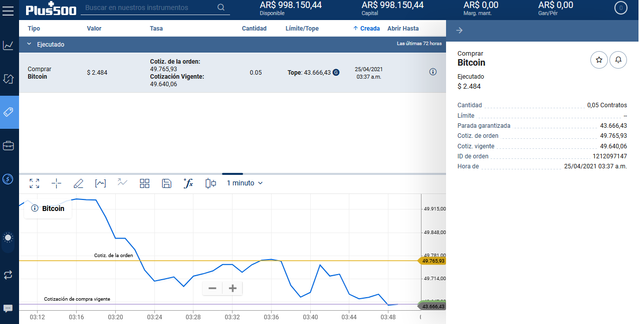

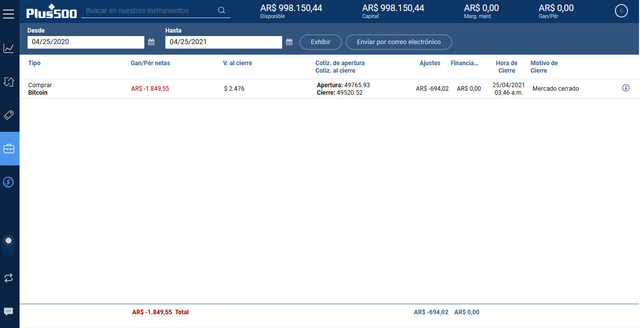

2nd Test: Plus500

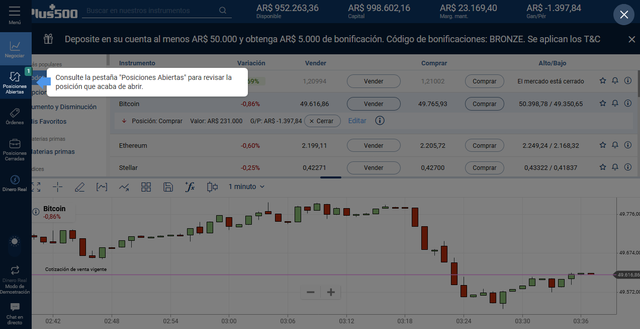

Then immediately a warning appears notifying you that a guided test begins, where they explain with warnings each step that must be done.

For this example it was taken, purchased and then indicated the number of units selected, in this case it was 0.5 units.

Finally, they offer you the option to select the option you want to guarantee, gain or minimize loss, where they will then show you the amounts according to your selection.

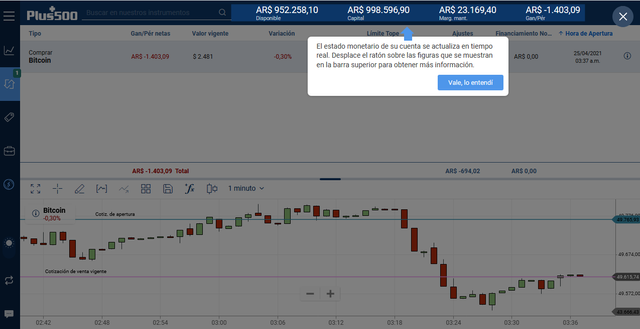

Then the image showing the real-time balance of your capital is displayed.

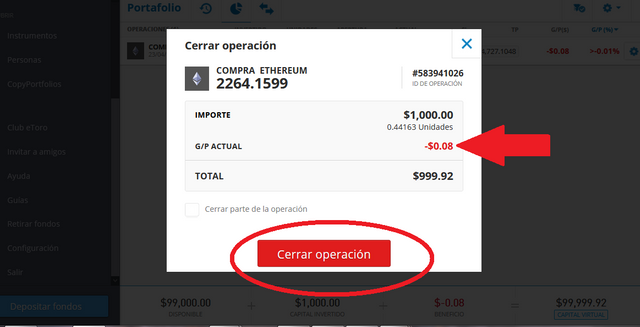

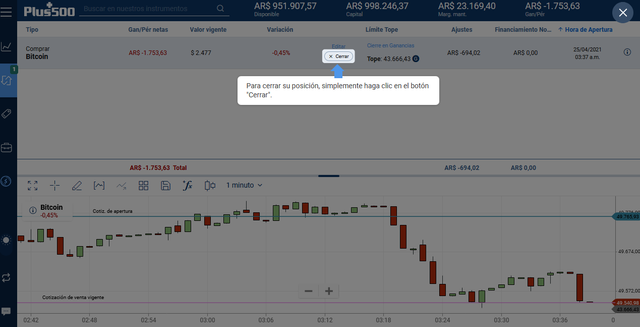

Immediately the image where it is indicated where the trade can be closed when the investor decides.

And the last two images are with the data of the results obtained.

Both experiences were very ratifiing.

However, the Plus500 broker has a very easy and simple demo guiding system for beginners to understand.

.png)

Conclusion:

CDFs are a very high risk financial instrument, where you need to study and analyze the market and the behavior of cryptocurrencies before starting on this investment path.

Reference Sources:

1.-CFD (Contrato por diferencia). Efxto. Link

2.-CFDs ¿Qué son? Trading con CFDs. QuamGemFX. Link

3.-CFD | Guía completa a los Contract For Difference. Bolsa 24.Link

4.-Plus+500. Link

Hello @janettyanez,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 10/10 rating, according to the following scale:

My review :

An excellent article in form and content, a clear understanding of the topic, which gives you a clear methodology for answering questions, a great way to analyze information, and to create ideas to achieve the goal

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thank you, Professor @kouba01

Have a great day!

Regards