Steemit Crypto Academy Contest / S15W2 - Stock to Flow Model

Hello everyone

I hope you are all doing well and enjoying life . Today I am so excited to share my entry in the Stock to Flow Model contest. Because I absolutely love soaking up everything about crypto and these contests are like my weekly ticket to new learning adventure. Now lets get down to it! The Stock to Flow Model is like crypto crystal ball helping us figure out the price of Bitcoin. Its all about how much Bitcoin is out there versus how much is mined each year. Its like peeking behind the crypto curtain to see where the prices might be headed.

So without further ado lets dive into my take on the Stock to Flow Model and see the answers that have been asked in the contest .

Explain in your own words the Stock to Flow Model, what is its function? |

|---|

The Stock to Flow Model is like a financial detective tool especially for cryptocurrencies like Bitcoin. Imagine you are trying to figure out the future price of Bitcoin and you have this model as your Sherlock Holmes.

Now here the breakdown "Stock" refers to the existing or available Bitcoin and "Flow" is the freshly mined Bitcoin each year. The model basically looks at the balance between these two. If there a lot of existing Bitcoin (high stock) and not much new Bitcoin being mined (low flow) it suggests scarcity. And you know what happen when something is scarce it tends to be more valuable.

So the function of this model is to give us roadmap prediction tool. It help us estimate where the price of Bitcoin might go based on how much is already out there and how much is being added annually. Its like predicting the weather but for cryptocurrency prices

It helps us understand if Bitcoin is becoming rarer or more abundant and that can tell us a lot about its potential future value. Its like peeking into the crystal ball of the crypto world

What would be the advantages and disadvantages of the Stock to Flow Model? |

|---|

| Advantages of Stock to Flow Model | Detail |

|---|---|

| 1. Price prediction: | The model provides systematic approach to predicting Bitcoin price offering insights into potential future value based on the existing stock and annual flow of newly mined Bitcoin. |

| 2. Scarcity evaluation: | It helps in evaluating the scarcity of Bitcon by comparing the available supply with the annual production drawing parallels with precious metals like gold which tend to hold value due to scarcity. |

| 3. Long Term Trend analysis: | Enables long term trend analysis by considering both existing stock and annual flow allowing investors to assess whether Bitcoin value is likely to be sustained over an extended period. |

| 4. Use beyond Bitcoin: | While primarily designed for Bitcoin the model has sparked discussions about its potential applicability to other cryptocurrencies providing framework for evaluating scarcity in various crypto asset. |

| Disadvantages of stock to flow model | Detail |

|---|---|

| 1. Simplicity Assumption: | The model simplifies a complex market into a single metric assuming that scarcity alone determine value. This overlook other market factors that can influence price potentially leading to oversights. |

| 2. Market Dynamics Changes: | Cryptocurrency markets are dynamic and influenced by various factor. The model might not account for sudden changes in market sentiment regulatory development or technological advancement. |

| 3. Limited Historical Data: | The models effectiveness relies on historical data and the cryptocurrency market is relatively young. Limited historical data might not fully capture the complexities of the evolving market. |

| 4. Not a Crystal Ball: | While valuable the Stock to Flow Model is not foolproof. Its a tool not a crystal ball. Economic and market uncertainties can still impact Bitcoin prices and the models predictions are subject to change. |

3.- Make an analysis of the Stock to Flow graph, |

|---|

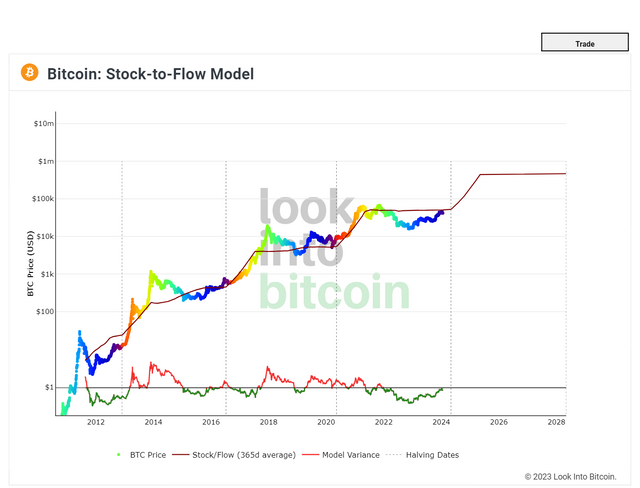

So according to the Stock to Flow Model on Sunday January 21 the actual price of Bitcoin was $41619 USD. But when we look at what the model predicted it said the price should have been around $50459 USD.

Now this difference is interesting. Its like the model had one idea but the real world did something bit different. This can happen in the wild world of cryptocurrencies because they are influenced by lots of things like people buying and sellng news and technology changes.

So this gap between the model guess and what actually happened is like a puzzle. It makes us wonder what factors might have caused Bitcoin price to be lower than the model expected. Maybe there were unexpected events or changes in how people were using Bitcoin during that time.

Can this model be applied to STEEM? Give reasons why this Stock to Flow graph model can or cannot be applied. |

|---|

Yes it can be applied and here is the reason why?:

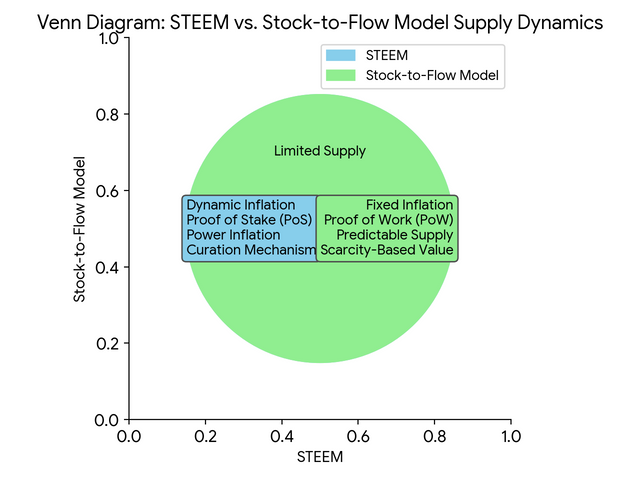

Similar Supply Dynamics: If STEEM shares similarities with Bitcoin in terms of how its supply is managed comparing the existing amount to the newly created coins then the Stock to Flow Model could give us insights into how STEEM price might behave.

Scarcity Factor: Assuming that STEEM has controlled or capped supply like Bitcoin the scarcity element can be examined. The model tends to work well with assets that have limited supply as scarcity is significant factor in determining long term value.

Price Stability: If STEEM is used a store of value and demonstrates relatively stable pricing over time akin to Bitcoin role the Stock to Flow Model might prove effective in predicting future STEEM prices.

However there are factors to consider:

Different Use Cases: If STEEM serves a different purpose than Bitcoin for example if its predominantly used as utility token within a specific ecosystem rather than as store of value the models effectiveness may be limited.

Market Dynamics: Cryptocurrency markets vary in terms of user behavior adoption rates and external influences. If STEEM market dynamics significantly differ from Bitcoin the assumptions of the Stock to Flow Model might not hold.

Economic Model Variations: If STEEM has different economic model such as a distinct inflation rate or distribution mechanism applying the Stock to Flow Model may not accurately reflect its valuation dynamics.

The applicability of the Stock to Flow Model to STEEM hinges on how closely STEEM aligns with the characteristics of Bitcoin that the model is designed to evaluate. A thorough examination of STEEM supply dynamics use cases and economic model is crucial to determine the models effectiveness in predicting STEEM's price movements

i am inviting:

.gif)

.png)

Saludos cordiales gran amigo hamzayousafzai, un gusto para mi saludarte y leer tu participación.

Felicitaciones por obtener una buena calificación en este reto, como siempre buenas palabras para dar a entender tu punto de vista en cada pregunta.

Te deseo muchos éxitos, que tengas una feliz, bonita, productiva y bendecida tarde.

@yancar Thank you so much for your kind words and warm wishes ! I truly appreciate your congratulations on my performance in the challenge. Its always a pleasure to share my thoughts and perspectives on each question.

I am grateful for your support and good wishes. Wishing you continued success as well and may your afternoon be filled with happiness beauty productivity and blessings.

Assalamualaikum.

Masha'Allah brother your post is really informative for all the users who are writing and working on this challenge. Brother I am facing a problem in last question about the steem S2F chart...

Please guide me how I can draw and understand such a diagram like yours.

You can use flow chart .. check i also give the link of website in the source

Well written brother.

Indeed stock to flow model helps to analyze and examine the existing price of a crypto commodities like the gold or Bitcoin.. this aids the top investor to plan and really know their next nove.

All agreed 👍 with you advantages and disadvantages given.

And too comparing the model to analyzing steem too is kind of hectic and not straightforward.

But you've made justice to it .

Good 👍 luck sir

Thank you so much for your feedback

TEAM 5

Congratulations! Your comment has been upvoted through steemcurator08.Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

For me, your post gave me a basic understanding of the model. You summarized it very well and listed the advantages and disadvantages. I am also learning about the model. Just like the prediction model of deep learning, it provides us with for more suggestions and thoughts

Thank you so much for your thoughtful comment I am glad to hear that my post helped you gain basic understanding of the model. Its always great to share knowledge and insights in the learning process. I agree with you about the similarities with deep learning prediction models

Thank you so much for your invitation you have elaborated stock to flow model in your best words as well as you have also make analysis of it and I would try my best to participate in this engagement challenge and my entry is just on loading.....

Good luck bro 🤞

Best of luck

.

Thank you 👍

Your breakdown of the Stock to Flow model provides a clear understanding of its components and their significance.

Overall, your article provides a user-friendly overview of the model, making it more accessible for those seeking to understand its predictive capabilities. Well done!

I sincerely appreciate your thoughtful feedback on my breakdown of the Stock-to-Flow model. It's fantastic to hear that the article provided a clear understanding of its components and significance.

Greetings friend,

Imagine the Stock-to-Flow graph that seems to be so complicated being broken down with ease, don't imagine because that's what you've just done. You broke it down into its different pieces and explained why each piece is important. Your article is like a guidebook that makes it easier for people to understand how the model can predict the future probably price of an asset. You made a complicated topic simpler for everyone to grasp. Your effort is truly commendable and keep up the fantastic work.

Thank you so much for your incredibly kind words! I'm thrilled to hear that my breakdown of the Stock-to-Flow graph resonated with you. It's always my goal to simplify complex topics and provide a clear understanding for everyone.

This has always been displayed on your works and publications in this community so I am no stranger to how you make complex topics seemlessly and effortlessly easy. All the best brother.