Crypto Academy Week 4 Homework Post for [@gbenga]

What is Uniswap?

source

According to the project whitepaper, Uniswap V1 is an automatic liquidity protocol, implemented by the smart contract system on the Ethereum blockchain, and follows a constant product formula.

Its main objective is to provide liquidity to the Ethereum ecosystem without the need for reliable intermediaries, and to prioritize decentralization, resistance to censorship and security.

how uniwap works

This decentralized exchange provides various services. In addition to trading and providing liquidity to various markets, you can also join the Uniswapper community and vote for platform updates. Let's take a look at each of these services.

Token Swaps

characteristics of uniwap:

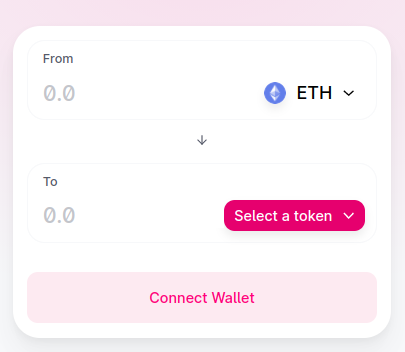

There are two main functions when it comes to Uniswap: Swap and Pool:

- Exchange: Or called exchange, this function allows the exchange of Ethereum and different ERC-20 tokens.

- Pool: This Uniswap feature can help users to become LP to earn money. This is done by sending the token to a smart contract, and in return you will receive the token in the pool.

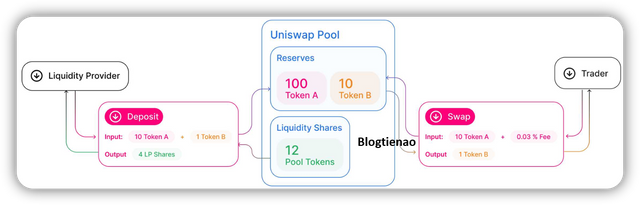

It can be viewed simply as these two functions work according to the Uniswap scheme, as shown below:

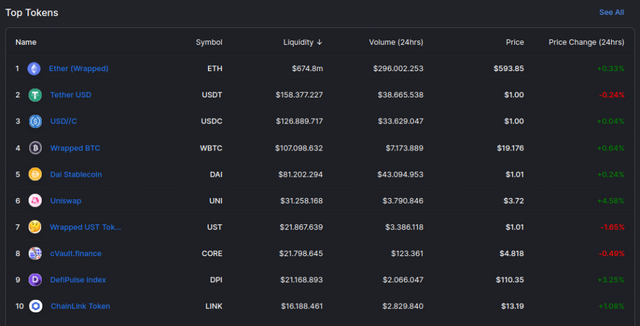

You can use Uniswap to trade between dozens of cryptocurrency pairs on the Ethereum network. The biggest advantage of this platform is that you can find many new projects that have just appeared on the market. In this way, it is possible to outperform Bitcoin and cross a large number of cryptocurrencies with great potential.

advantage

- Since there is no guardianship, it is impossible to steal money with user funds stored on the exchange.

- No brokerage fees are charged, which reduces transaction costs;

- Because it runs on the blockchain, it is difficult to censor the service. Uniswap is censorship resistant.

disadvantages

- By operating directly on the Ethereum blockchain, it is only possible to exchange tokens from that network. It is not possible to carry out a BTC / ETH transaction, for example;

- Although there are no brokerage costs, the fees for the Ethereum network can be quite high;

- Smart contracts can be exploited by hackers.

Hello, This is an assignment for week 4 and not for week 5. More so, your post is less than 300 words which makes it ineligible. You can write on week 5 post.

Thanks