Crypto Academy week 13- Homework Post For Professor (@imagen)- Dominance In Cryptocurrency Market

Hello amiable steemians, I am delighted to be participating in this week's homework given by

Professor - @imagen

The Concept Of Dominance In The World Of Cryptocurrency

Dominance in relation to the world of cryptocoins refers to the measure of the dependency ratio of other crypto coins to Bitcoin. Since Bitcoin was the first cryptocurrency ever to exist in 2009, it has gathered alot of trust, value and dominance in the crypto market. Because of this, some othe cryptocoin price that are existing after Bitcoin are dependent on the rise and fall of Bitcoin price. So since Bitcoin is more like the father of cryptocoins, dominance in crypto world is always defined with Bitcoin. In essence, studying cryptocurrency dominance is an attempt to understand how dependent some or all cryptocoin prices are upon the price of Bitcoin.

Dominance can also refer to a measure of the value of Bitcoin when placed in the vast market of Cryptocurrency.

A very crucial aspect of the study of Bitcoin Dominance is that it could aid traders to gain knowledge of the uptrend or downtrend of Altcoins.

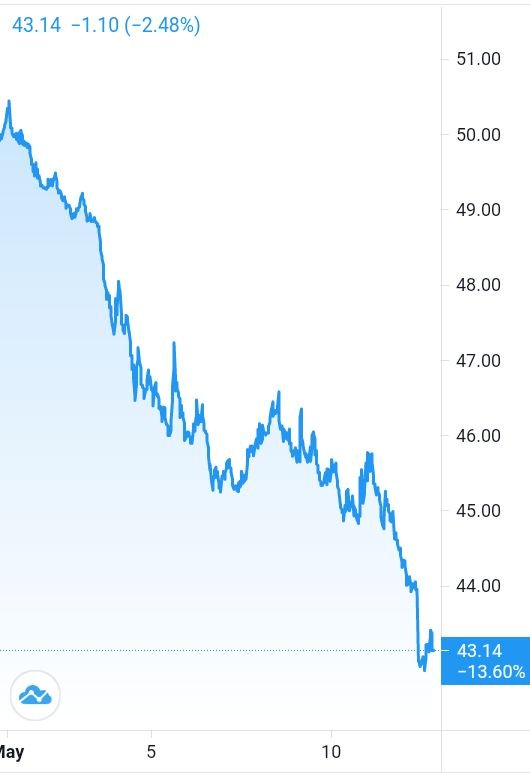

At the time of making this post, the percentage of Bitcoin Dominance in the crypto market is 43.14% on May, 12th 2021.

Below is a Bitcoin Dominance index chart showing the interval of 1 month.

In the chart graph above, we can observe that Bitcoin current dominance percentage is 43.14%

Mention At least Two Times When the Market Had Strong Falls And Mention Several Affected Currencies

From 18th-26th April 2021, Bitcoin encountered a fall in price. Simultaneously, some other coins also encountered this fall in their respective prices as a result of their dependency ratio on Bitcoin in the vast crypt market. Texoz and Algorand are included in this category.

Similarly, from 22nd April 2021 to 3rd march 2021, Bitcoin suffered a fall in it's price. Resultantly, this same coins followed suit.

What is the Altcoin Season

Altcoin Season refers to that moment when all other cryptocurrency (usually the top 50) performs better than Bitcoin in the crypto market in a given period or time interval.

The Altcoin Season simply means that period or time in the crypto market when all other cryptocoins have little or no dependence on Bitcoin. The Altcoin Season can be defined by the Bitcoin Dominance index percentage.

The Bitcoin Dominance index percentage helps traders to know how Altcoins are faring in the vast crypto market.

Here we can see that the percentage of dependence of other cryptocoins upon Bitcoin is gradually decreasing.

With the current percentage, we are surely in the Altcoin Season as more and more Altcoins are gaining their independence on the crypto market.

How can relevant news influence the price of cryptocoins in a positive and negative way

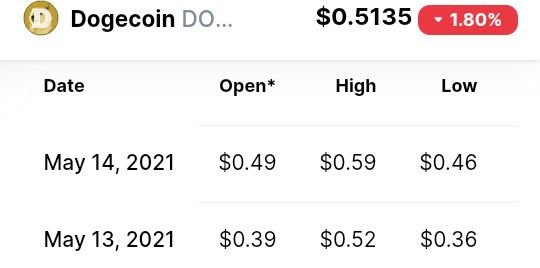

• Dogecoin saw in increase in value on Friday after Elon musk's tweet and after coinbase stated that it would add dogecoin to it's list.

This influeced dogecoin price to reach an all day high which was over 56 cents.

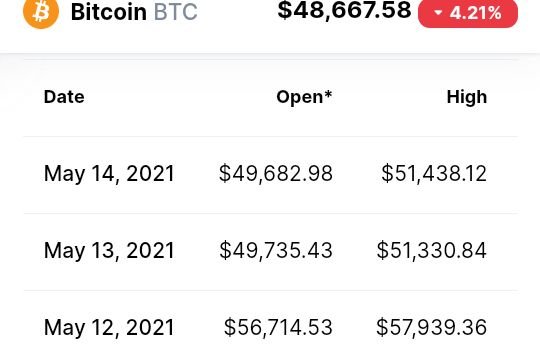

• On Wednesday, Elon musk announced that the Tesla firm would no longer accept Bitcoin payment.

This brought about a massive sell off of Bitcoin in the following day which has brought about the drop in price of Bitcoin

Give a brief description of atleast 2 Altcoins that are in the Top 50

Uniswap (UNI)

p

The Uniswap is one of those decentralized application which is ethereum based and is used for the exchange of ethereum token. Uniswap offers two main services which are

• providing Liquidity

• Using Liquidity

Uniswap makes room for it's users to exchange ethereum based coins very fast.

On the Uniswap exchange, fees are usually paid using the UNI Token.

One UNI token is worth $36.60

Aave (AAVE)

.jpeg)

p

Aave is one of the leading decentralized lendings that promises interest rates which is higher when compared to the intrest rates of centralized lending. Their lending services also comes with anonymity and a better security.In Aave,the intended borrower usually offers collateral which must be greater than the intended amount which they wish to borrow. This is so that if the loan is not paid by the borrower, the money will be paid back to the lender automatically.

Currently, one AAVE is worth $506.08

Conclusion

In the course of completing this interesting and informative homework, I have been able to understand what dominance all thanks to professor @imagen for this. I now also have knowledge of what Altcoins are and how news does influence the price of cryptocoins.

Hola @gabikay

Gracias por participar en la Academia Cripto de Steemit.

Tienes que investigar más.