[In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for @reddileep by @g0h4mroot.

For a market to exist there must always be people who want to buy and sell something, it does not matter if the market is online or it is a traditional market, the characteristics are similar.

This is when the marketmaker intervenes, it could be said that they are a group of people who add liquidity to the market by creating buy and sell orders to attract the public and encourage them to carry out operations.

The purpose of the marketmaker is to attract as much public as possible by moving the price at convenience, creating a difference between supply and demand to the point that they can obtain profits, the profits of the marketmakers are obtained by that difference that separates the prices and not by High prices.

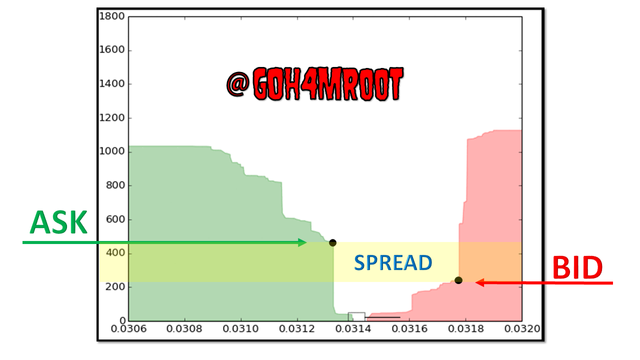

SPREAD

This price difference is known as spread and it is the stipulated exchange rate that is added to the asset in the purchase or sale price, as an example we can observe the spread when buying a barrel of oil, let us suppose that the price of the barrel for the purchase is quoted in 48 $ and the price of sale quoted in 46 $ at this difference of 2 $ is what is called spread.

BID

It is the price that is stipulated for the sale.

ASK

It is the price that is stipulated for the purchase.

The psychology in the cryptocurrency market is very susceptible and leads us to make many mistakes induced by fear and fomo.

Many marketmakers take this opportunity to take advantage of small investors and take our money.

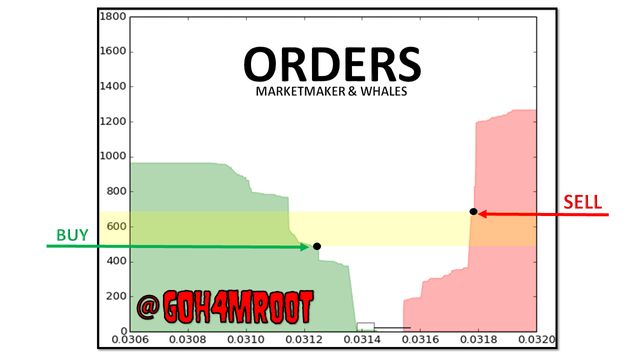

A marketmaker creates a buy order # 1 for a value of $ 5000 in a pair "X" and then places a sell order for $ 5100 in the same pair, these orders are created with the purpose of adding liquidity to that market and incentivizing the other investors to open orders within this previously stipulated range.

There is another group of people who also add liquidity to the market in order to get the most benefit in a short time, attracting many small and medium investors to the market, these people are classified as whales and their capital is huge and for this reason they are able to move the market at will.

Explain the benefits of the Market Maker concept?

Market Makers can make a drastic change in the price of the asset, even increase it significantly up to more than 100%.

When the price of an asset increases significantly in a couple of hours, a fomo is created causing many investors to enter the market to obtain profits, this is a double-edged sword since if we enter at the right time our capital will multiply, but if we enter at the wrong time we could lose everything.

Identifying when a whale or a market maker will enter the market is not easy but not impossible, if we can deduce when they entered our profits were very good.

Good profits are made in short periods of time, as whales and market makers do not usually operate for long periods of time.

Does it explain the downsides of the Market Maker concept?

Currencies are very volatile, this generates fear in small and medium investors, the market maker takes advantage of this to obtain profits.

As the cryptocurrency market is not regulated, it is very difficult to know if the market maker is a trustworthy person and this puts our capital at risk.

Market makers take advantage of market volatility to lower the price and buy for an extremely low amount.

When trading with leverage, traders are more prone to this type of practice, it can even be seen at times with the price falling suddenly, closing orders and stoploss in a matter of seconds and returning to its price as if nothing had happened. .

Entering a very volatile market with very little knowledge on the subject is a very high risk.

Whales and market makers act very fast and when we enter the market it is too late.

Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot required)

In technical analysis there are endless technical indicators that provide us with relevant information to be able to operate in the market.

I have chosen the two indicators below to be able to explain its concept and its relationship with market makers through an image.

RSI

The RSI is a technical indicator of the oscillator type, this indicator collects as much information as possible and represents it graphically on lines that delimit the state of the market, that is, each line indicates the movement of the market and its possible future behavior.

The RSI stipulates 2 lines and a wave, an upper line and a lower line.

- WAVE

The RSI uses a triangle-type wave to represent market behavior.

- TOP LINE

This line stipulates a maximum percentage in purchases to stipulate if the asset is overbought.

- LOWER LINE

This line indicates the minimum percentage so that it can be stipulated if the asset is oversold.

The triangle wave indicates the amount of orders that exist in the market, if the wave does not exceed the limits it can be said that the market is normal, but if the wave exceeds the upper line it can be said that the asset is overbought and exceeds the bottom line will say that the asset is oversold.

Marketmakers and whales use this information as inside information to manipulate the market, they know that small and medium investors use popular access technical indicators such as rsi, if information is obtained from the well-detailed sales book and rsi is used, a marketmaker can do whatever he wants.

In the graph we can see how small and medium investors buy at the highest point, while the marketmaker and whales buy at their lowest point.

THE STOCHASTIC.

It is an indicator of the oscillator type with which we can determine exits and entries to the market, this indicator consists of 2 lines K and D, one line is for fast periods (K) and the other line for slow periods (D).

This indicator, like the rsi, has an upper line that indicates when it is overbought and a lower line that indicates when it is oversold.

This indicator offers us endless signals that, although combined with other indicators, can be a very useful tool.

The crossings of the indicator lines are signals of possible purchase or possible sale depending on the case, they indicate when the market is overbought or oversold, changes in trends, closings and openings, and divergences.

This indicator has many uses, but some professional traders suggest using it when the market enters range.

Just as traders use this indicator to create a market strategy, whales and marketmaker also use it to get ahead of the market and be able to handle it at will.

Marketmakers use the same conventional tools that small and medium investors use to draw on the psychology of the common trader and manipulate the market at will.

As we can see in the following illustration, the stochastic is making a line crossing, when the stochastic makes a line crossing above the upper overbought line it is indicating that it should be sold.

But traders do the opposite and start buying causing the price to go up.

Then the marketmakers take advantage of this to place their sell orders and knock down the price of the asset.

I have circled the line crosses of the stochastic.

In the wonderful world of trading, constant training is important to know how to deal with the ups and downs of the market.

Psychology plays an important role within this profession, if as traders we are weak, we will probably be easy prey for the market makers and the whales.

In this class we learned about market making and how it works.

We learned about its advantages and disadvantages, we explained with charts how the bid ask spread works and how orders are created to manipulate the market.

The rsi indicator and the stochastic were explained in depth.

It is expected that the fulfillment of all the elements requested by the crypto teacher will be to your liking.