[Heikin-Ashi Trading Strategy] - Steemit Crypto Academy | S4W2 | Homework Post for @reddileep

Hello All Steemians !!!

Today I'm going to make my Steemit Crypto Academy Homework task by professor @reddileep that talking about Heikin-Ashi Trading Strategy. Very interesting lessons. Actually I have very little knowledge about this, but I will try to discuss it to improve my writing skills. On this occasion I will try to discuss it.

Define Heikin-Ashi Technique

Heikin-Ashi is a chart pattern that focuses on the candle of a crypto asset that shows the average price formed in the market thereby creating next candle. It aims to provide clarity and smoothness of the price movement of a crypto asset in the market. Heikin-Ashi is the current candle which is the result of calculating the average of the previous candle. Some traders use this chart pattern in conducting technical analysis to provide market data and information of crypto asset.

Heikin-Ashi technique is a understanding of chart pattern that focuses on the average of two candle periods so that it can form a current candle in the middle of the previous candle. Each candlestick that forms on the chart of a crypto asset in the market shows a body, an upper wick and a lower wick. Each candlestick has an open, close, high and low price. All of these prices are references that represent the Heikin-Ashi technique where the calculation of the average price of the current candle is based on the open, close, high and low prices of the previous candle.

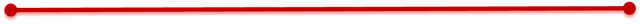

Based on the chart above, Heikin-Ashi chart pattern shows market trends of DASH/USDT is easier to analyze and observe. You can see an indication of a Strong Bullish Candle which shows the upper wick, a Strong Bearish Candle which shows the lower wick and an Indecision Candle which shows the wick on both sides. Indecision Candle is a candle that is formed after an uptrend or downtrend. This indicates that a trend change or temporary stop will occur. This will help traders to analyze market trends.

Differentiate Between the Traditional Candlestick Chart and the Heikin-Ashi Chart

Chart Pattern

Based on the chart above, you can see the chart patterns of DASH/USDT formed using Heikin-Ashi and Traditional Candlesticks. The difference between the two charts in terms of chart pattern is clearly different where Heikin-Ashi has an advantage about this. This is evidenced by Heikin-Ashi providing very smooth chart pattern and Traditional Candlestick providing rather complex chart pattern. This serves to make it easier for traders to analyze chart pattern of a crypto asset.

Market Trend

Based on the chart above, you can see the market trend of DASH/USDT formed using Heikin-Ashi and Traditional Candlesticks. The difference between the two charts in terms of market trend is clearly different where Heikin-Ashi has the advantage about this. This is evidenced by Heikin-Ashi showing market trend that are easy to identify and Traditional Candlesticks showing market trend that are difficult to identify. This serves to make it easier for traders to analyze market trend of a crypto asset.

Price Change

Based on the chart above, you can see the price change of DASH/USDT formed on the Heikin-Ashi and Traditional Candlesticks. The difference between the two charts in terms of price change is clearly different where Heikin-Ashi has the advantage of this. This is evidenced by Heikin-Ashi showing no change in the type and color of the candle if the price change is not strong and the Traditional Candlestick showing any change in the type and color of candle if a price change occurs. This serves to make it easier for traders to analyze price change of a crypto asset.

Candle Position

Based on the chart above, you can see the candle position of DASH/USDT formed on Heikin-Ashi and Traditional Candlesticks. The difference between the two charts in terms of candle position is clearly different where Heikin-Ashi has advantages about this. This is evidenced by Heikin-Ashi using the calculation of the average candle price where the candle position is in the middle and Traditional Candlestick does not use a calculation where the candle position continues. This serves to make it easier for traders to analyze the candle position of a crypto asset.

Explain the Heikin-Ashi Formula

Heikin-Ashi Open Calculation

Heikin-Ashi open calculation is done by adding two crypto asset prices formed in the market where the open price of the previous candle is added to the close price of the previous candle and the result is divided by two. The formula is as follows:

Open = (Open of Previous Candle+Close of Previous Candle)/2

Based on the chart above, you can see that the previous candle open price is $137, the previous candle close price is $132.8, and the current candle open price is $134.9. This is evidenced by the following calculations:

Open = ($137+$132.8)/2 = $134.9

Heikin-Ashi Close Calculation

Heikin-Ashi close calculation is done by adding four crypto asset prices formed in the market where the open, close, high, low prices of current candle are added and the result is divided by four. The formula is as follows:

Close = (Open+Close+High+Low of Current Candle)/4

Based on the chart above, you can see that the open price is $137, the close price is 132.8, the high price is $137, the low price is $129.6 . This is evidenced by the following calculations:

Close = ($137+$132.8+$137+$129.6)/4 = $134.1

Heikin-Ashi High Calculation

Heikin-Ashi high calculation is done by selecting and analyzing three crypto asset prices formed in the market where high is equal to the maximum value of high, the open price or the close price of the current candle. The formula is as follows:

High = Maximum Value of High, Open or Close of the Current Candle

Heikin-Ashi Low Calculation

Heikin-Ashi low calculation is done by selecting and analyzing three crypto asset prices formed in the market where high is equal to the minimum value of low, the open price or the close price of the current candle. The formula is as follows:

Low = Minimum Value of Low, Open or Close of the Current Candle

Explain Trends and Buying Opportunities Through Heikin-Ashi Candles

Heikin-Ashi Candles are very helpful for traders in providing smooth chart patterns and identifying market trends. The candle wicks indication is the main factor that shows the strength of the trend, either uptrend or downtrend. The upper wick of the candle is an indication that the market is in an uptrend. The lower wick of the candle is an indication that the market is in a downtrend. In this case, a low price changes in the market indicates the type and color of the candle has not changed except for high price changes in the market.

Based on the chart above, you can see many of the upper wicks of the candle showing that the price of DASH/USDT is increasing and the market trend is uptrend. And you can also see many lower wicks of the candle showing the price of DASH/USDT is decreasing and the market trend is downtrend. Market situations and conditions like this are bound to happen over time due to several factors that affect the volatility of crypto asset prices. Trend analysis through Heikin-Ashi Candles is the right solution.

Heikin-Ashi Candles also indicate the right signal and time to place buy and sell orders during the trading process. This is shown when the market trend tends to be sideway and market indecision. If there is a bullish Heikin-Ashi Candle that opens at a certain level then this is a buy signal and you can place a buy order. This also applies if there is a bearish Heikin-Ashi Candle that opens at a certain level then this is a sell signal and you can place a sell order.

Based on the chart above, you can see market indecision, indecision candle, bullish candle and uptrend on the chart of DASH/USDT. Indecision market indicates a sideway trend due to low trading volume so that prices do not rise and fall significantly within a certain period. When an indecision candle is formed in the market then it is an early indication of a sideway trend change towards an uptrend. An open bullish candle is a buy signal that you can place at a certain level. Buying and selling opportunities through Heikin-Ashi Candles is the right solution.

Is it Possible to Transact Only With Signals Received Using the Heikin-Ashi Technique?

In my opinion, every trader expects good analysis results in order to bring profit and minimize losses in the trading process. This answers that it is impossible to transact using only the Heikin-Ashi technique. This is because everything that happens and is related to the crypto market has no certainty such as price volatility, trend changes, liquidity and others. Traders are only able to analyze and predict market situations using indicators and strategies including Heikin-Ashi.

However, analysis results and received signal are not 100% effective and may fail. To improve the quality, accuracy, completeness, and produce better analysis, a combination of several indicators that have different functions and characteristics such as EMA is the right solution to be applied as a supporter of the Heikin Ashi technique.

Based on the chart above, you can see the EMA indicator which is very helpful for traders in the trading process. The EMA indicator increases the accuracy of the analysis and serves to identify buy or sell signals at a certain time. The EMA indicator provides an indication of support levels and golden crosses on the DASH/USDT chart so that traders can place buy entry and stop loss levels during an uptrend in the market.

Perform both Buy and Sell Orders Using Heikin-Ashi+ 55 EMA+21 EMA

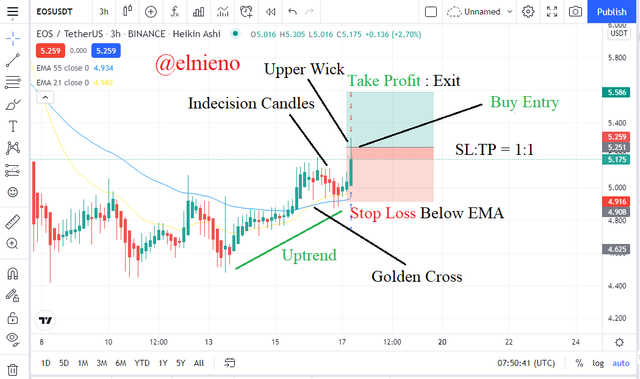

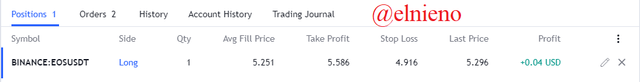

Trade 1: Buy Entry

I analyzed the EOS/USDT crypto pair using Heikin-Ashi and using the 3 hour time frame on the chart. I placed a buy entry after a bullish candle and after a few indecision candles formed in the market. I use the EMA indicator which serves to increase the accuracy of the analysis and also serves as an indication of support levels. The 55 and 21 EMA lines are also experiencing a Golden Cross in the market. I placed a buy entry with a stop loss and take profit ratio of 1:1 and by setting the stop loss slightly below the 55 EMA. The details of trade 1 are as follows:

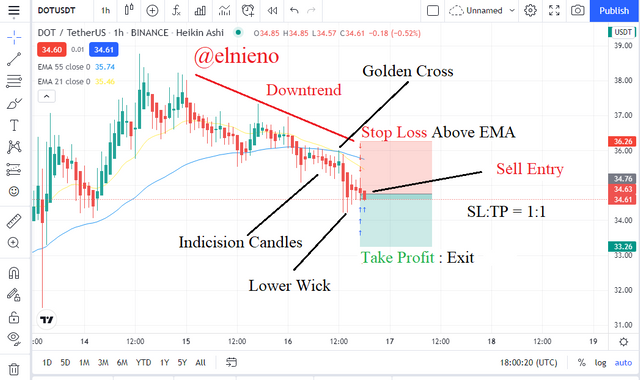

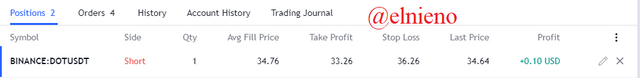

Trade 2: Sell Entry

I analyzed the DOT/USDT crypto pair using Heikin-Ashi and using the 1 hour time frame on the chart. I placed a sell entry after a bearish candle and after a few indecision candles formed in the market. I use the EMA indicator which serves to increase the accuracy of the analysis and also serves as an indication of resistance levels. The 55 and 21 EMA lines are also experiencing a Golden Cross in the market. I placed a sell entry with a stop loss and take profit ratio of 1:1 and by setting the stop loss slightly above the 55 EMA. The details of trade 2 are as follows:

Conclusion

In the world of cryptocurrencies, there are many strategies and indicators that traders use to analyze the crypto market. Heikin-Ashi is one that can help and facilitate traders in the analysis process. The function and characteristics of Heikin-Ashi which are different from Traditional Candlesticks is an alternative that can be used by traders. Heikin-Ashi provides smoother charts and market trends that are easier to identify. The combination of several other indicators such as the EMA indicator can improve accuracy and produce good analysis.