Crypto Academy / S4W4 - Homework Post for [reddileep] - Arbitage Trading.

Hope you are all doing well. We are in week 4 /season 4 of cryptoacademy. Today i am writing homework task for professor @reddileep which is about Arbitage Trading.

Define Arbitrage Trading in your own words.

Crypto world is diversifying exponentially and so are crypto exchanges and cryptocoins. We know that crypto trades are carried out in pairs and rates of pairs vary among different exchanges and even in different pairs. Although these variations are not very significant often but sometimes these rates do become significant and reflect market inefficiency. Some traders take advantage of these variations and resort to type of trade where in they buy at lower rates and sell at higher rates. Such a type of trading where traders take advantage of price difference is known as arbitage trading.

Arbitage trading is a risk free trading that requires no advanced knowledge and skill. Arbitage trading prevents significant price variations and keeps check on market inefficiency. With the advancement in technology, market errors are less likely. Arbitage traders too are making use of computers and advanced softwares to spot the opportunities and execute the trades.

Let me give a hypothetical example of arbitage trading. Suppose a trader buys an asset A on exchange at 100$ and spots arbitage opportunity. It means asset A is instantly selling at higher price on some other exchange. Trader will send asset A to other exchange where it will be available at higher selling price and sell it their to gain profit. Such a trading tactic is known as arbitage trading.

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

There are many types of arbitrage trading. Most of them are common in stocks and forex trading. In crypto, some of them include triangular arbitage , exchange arbitage and convergence arbitage.

Exchange Arbitage .

Exchange aebitage is a type of arbitage trading where a trader benefits from difference in price of an asset on different exchanges. A crypto that costs low on one exchange is bought there and sold on other exchange where that costs higher. The difference in price is earned as risk free profit.

Traingular arbitage

Triangular arbitage is so called because it involves three trading pairs. The trader takes advantage of price difference in such a way that original asset is purchased back with some benefit. Suppose we take example of three crypto coins as A, B and C. Here A is exchanged for B and B is exchanged for C and C is exchanged for A. Due to disparity of price , we get more amount of A from C after completion of this traingle of exchanges.

Convergence arbitrage:

In this type of arbitage, a trader buys a coin on one exchange and short sell the same coin on another exchange. An arbitager holds the position untill both prices converge.

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

A triangular arbitage refers to trading of three crypto pairs in such a way that the original crypto coin which is sold at the beginning of the trade is bought back at the end in a quantity more than that was sold . The amout of additional Crypto that we gett out of this trading strategy is known as a triangular arbitage and this type of trading is known as arbitage trading.

Trianguler arbitage is rare in the market and is difficult to spot manually. But we can still spot it through difference in cross rate of the three assets. However, nowadays different trading tools and softwares like "crypto arbitage calculator " are available to spot it out. coygo is one such tool to get notified about differences in prices.

Let me give hypothetical example of crypto pairs to clarify the concept of crypto traingular arbitage. Suppose i had 1 BTC and i spotted arbitage. I sold 1 BTC for USDT and got 52500 USDT. Than i bought BNB from USDT that i have and got 120 BNB. Now I'll have to get BTC back by converting BNB to BTC. On trading BNB for BTC, suppose i get 1.05BTC. So there is 0.05 BTC as a profit from traingular arbitage.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

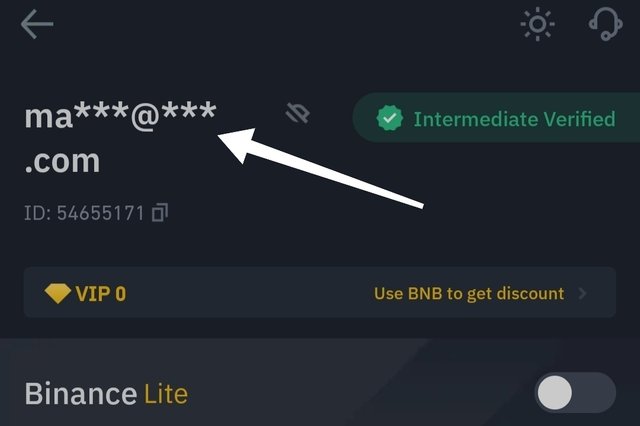

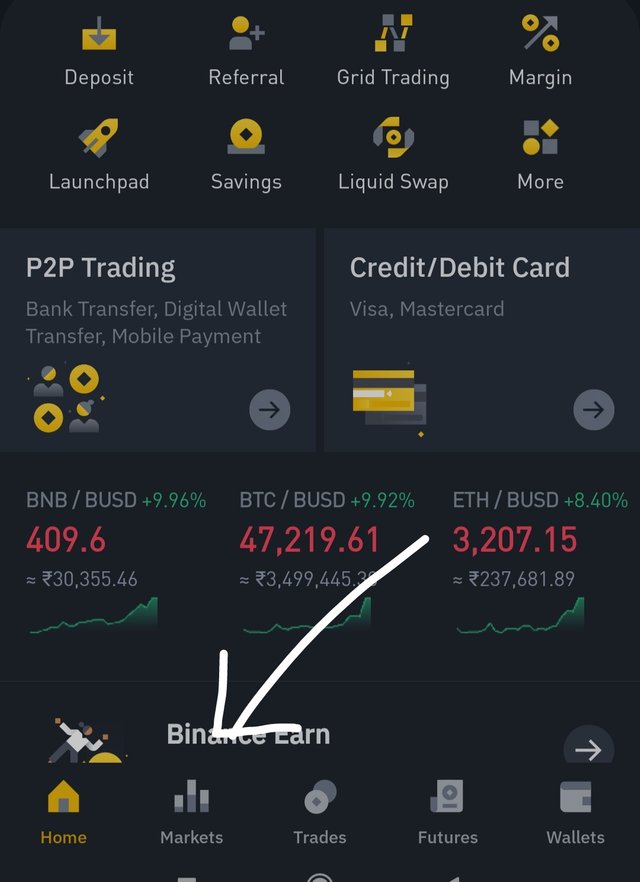

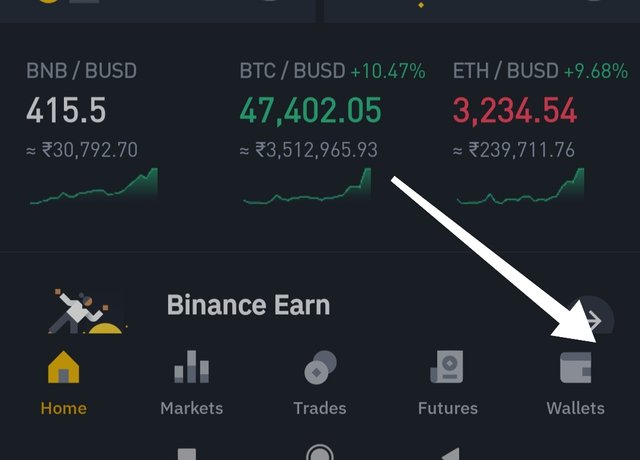

Before performing the transaction as demanded by the question, let me first share the screen shot of my verified Binance account.

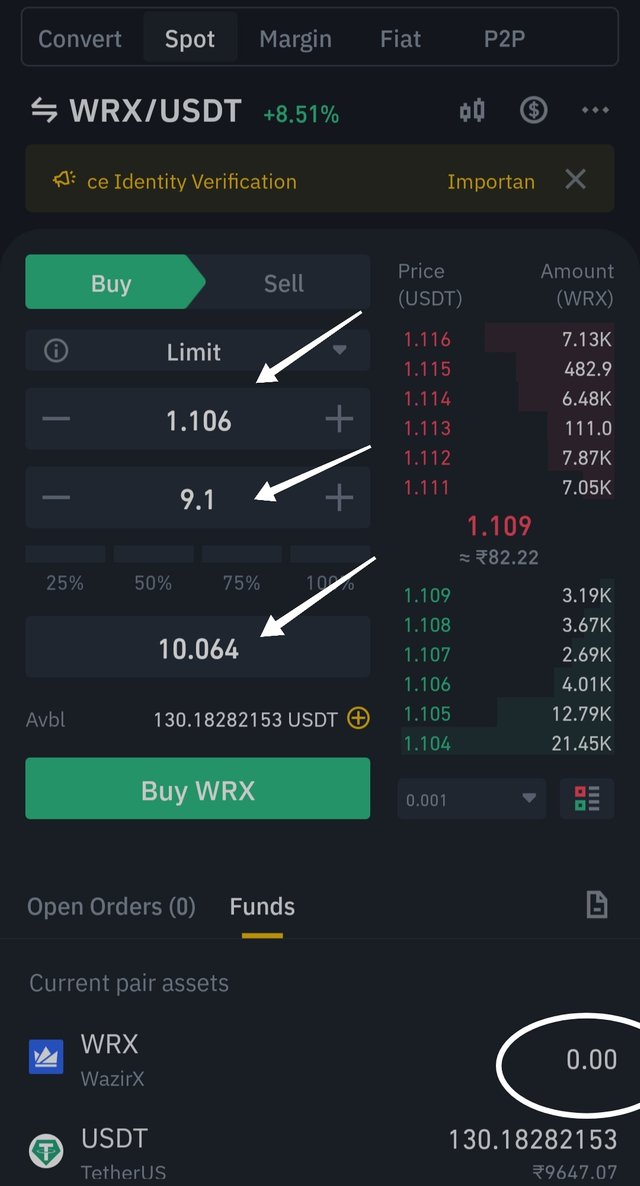

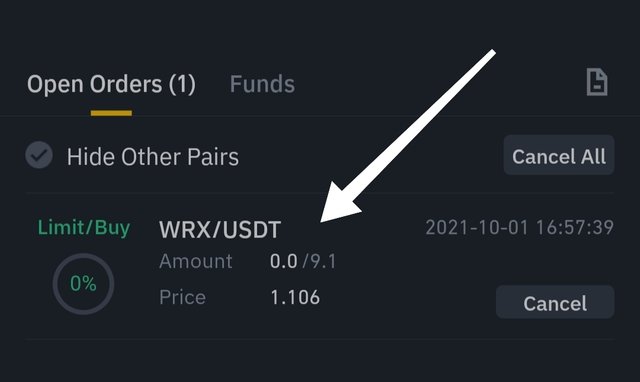

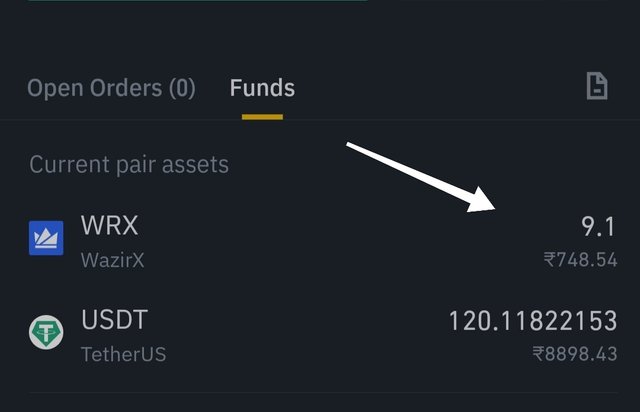

To perform transaction, I'll purchase WRX coin for 10 USDT on BINANCE and sell it on WazirX . So i open Binance markets and select spot trade and search for WRX/USDT pair. Next I'll be entering amount of USDT as 10 . For 10 USDT , i got 9.1 WRX. Place buy order and order is executed shortly. I have shown pending order and 0 WRX balance before order execution. And 9.1 WRX after executiom of order.

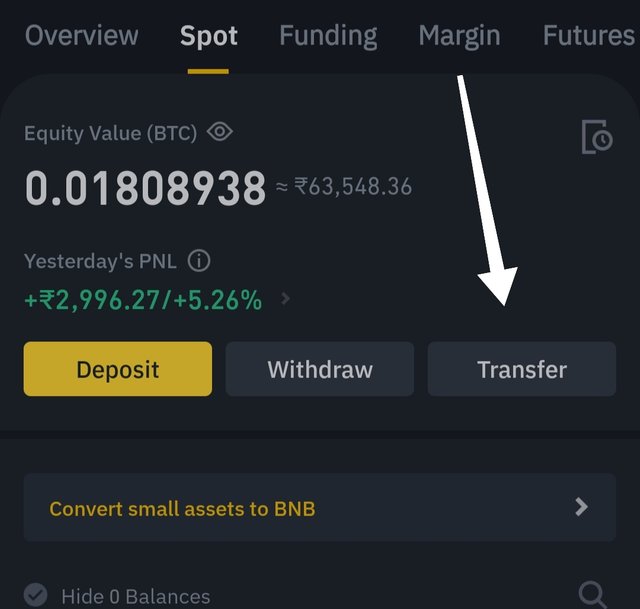

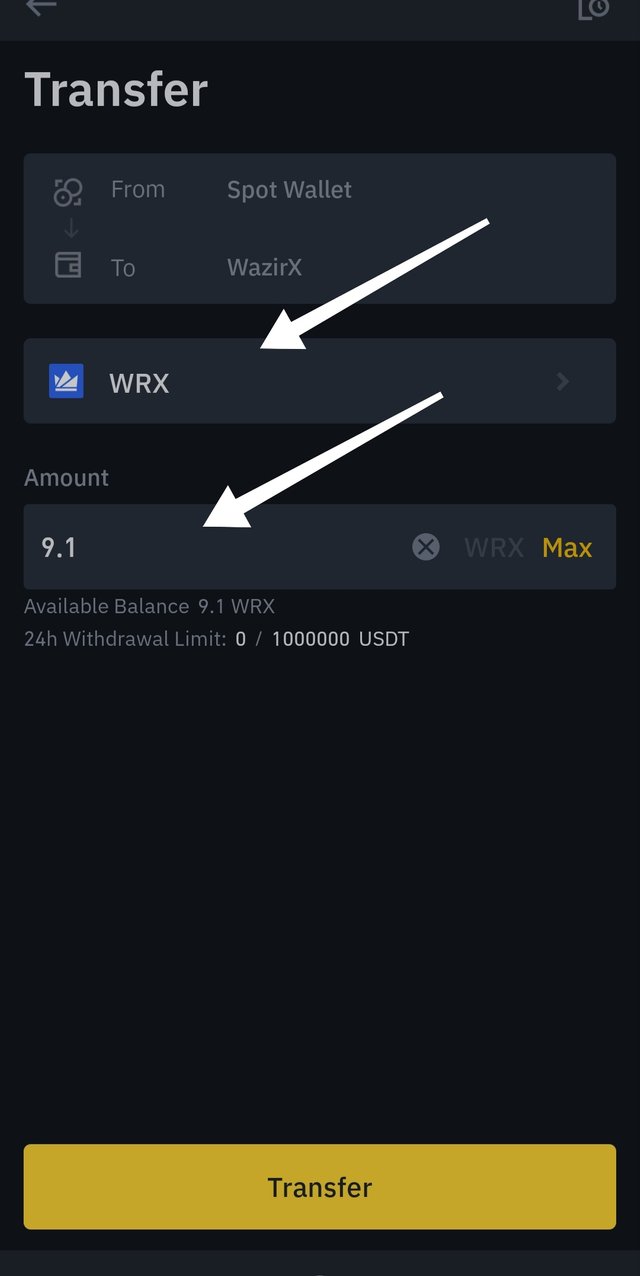

Next I'll transfer WRX from Binance to wazirx . And than sell it there. For doing so. From the bottom panel of binamce, click on Markets , next select Transfer option and then on the next page select Token as WRX , amount as Max ( 9.1l) and select To as wazirx. Binamce will send two OTPs, one to the phone number and second to the email id. Enter both of them and click on transfer. We are done.

Before selling on Wazirx, i would like to share screenshot of my WRX balance before and after transfer. Before transfer, i already had 11.842 WRX and after transfer of 9.1 WRX, total amount of WRX that i had equals 20.942 WRX.

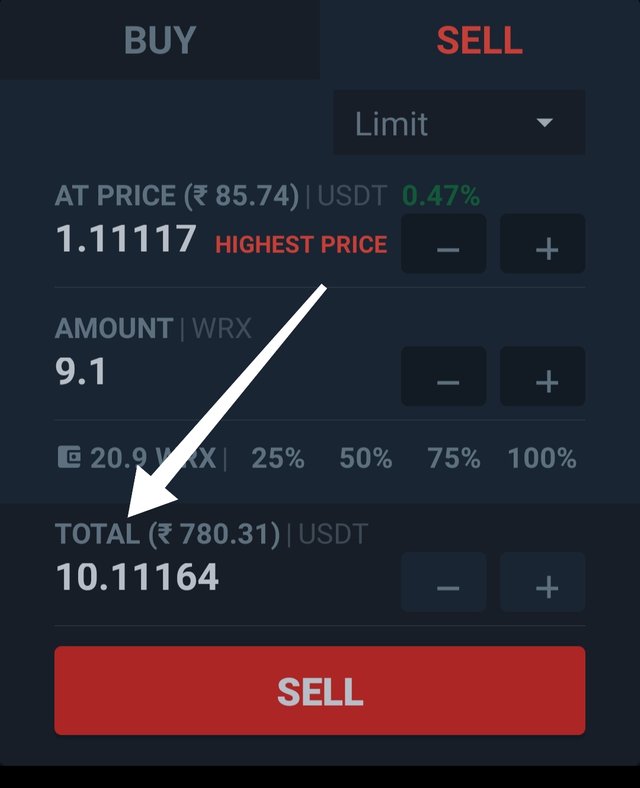

Now I'll go to Binance market and select WRX/USDT pair and try to sell 9.1 WRX.

So we got a profit of 0.05 USDT . Since our amount of WRX was small, profit was small also. Suppose we had 1000 WRX, our profit would have been 50 USDT.

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

I'll be demonstrating traingular arbitage by buying WRX from USDT on Binance, transfer WRX to wazirx and buy TRX from WRX and than sell TRX for USDT again.

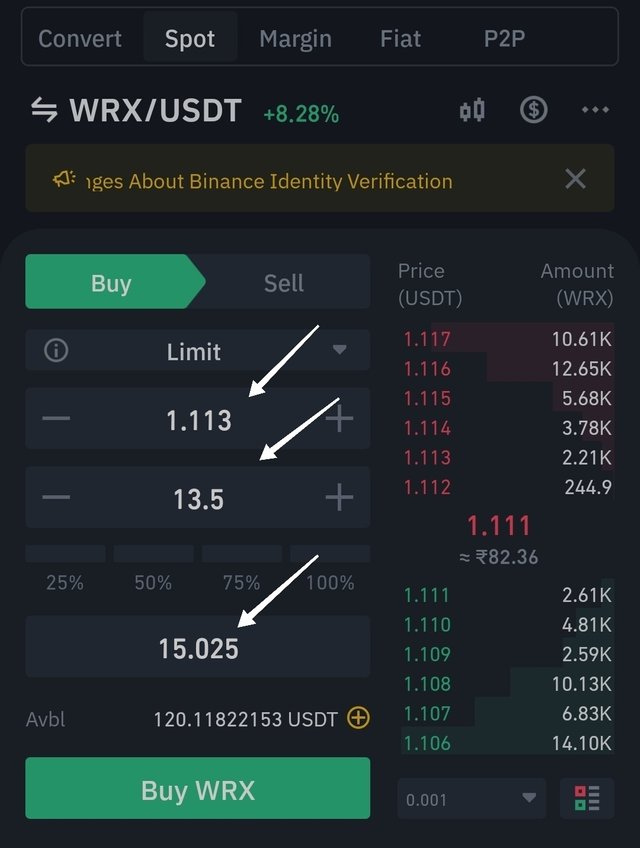

Step 1: As demonstrated above, first step will remain same except we will make purchase worth 15$ (USDT) and we get 13.5 WRX . Transfer WRX to wazirx as shown above.

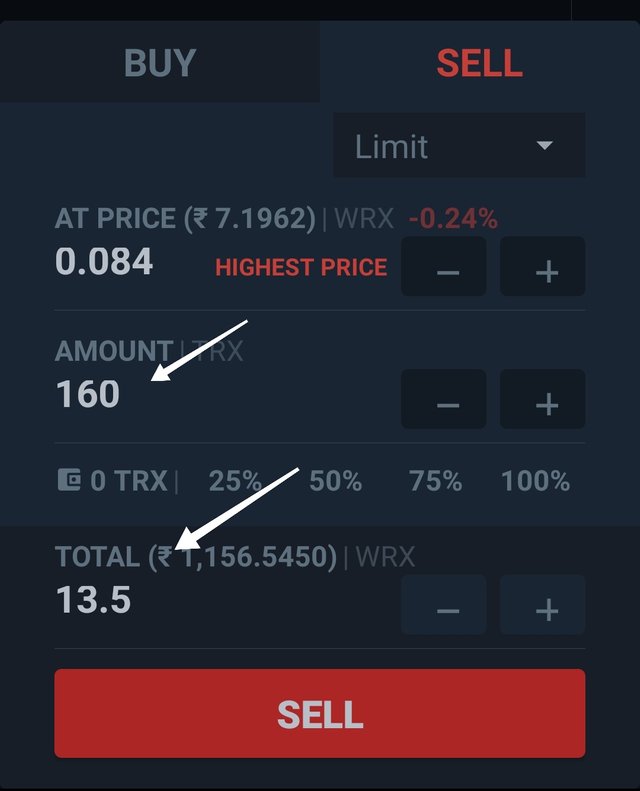

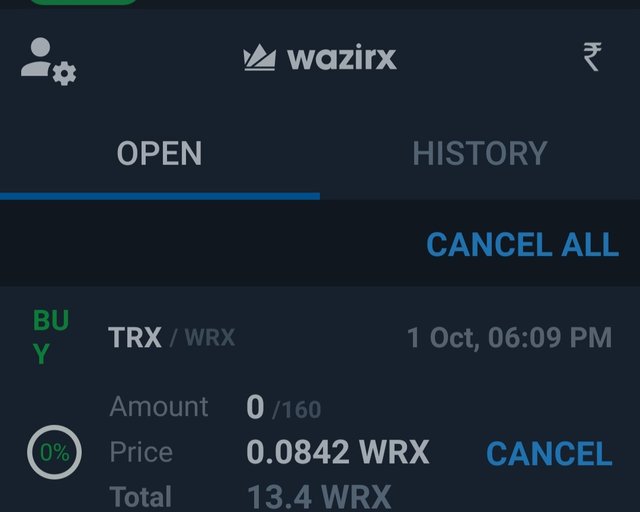

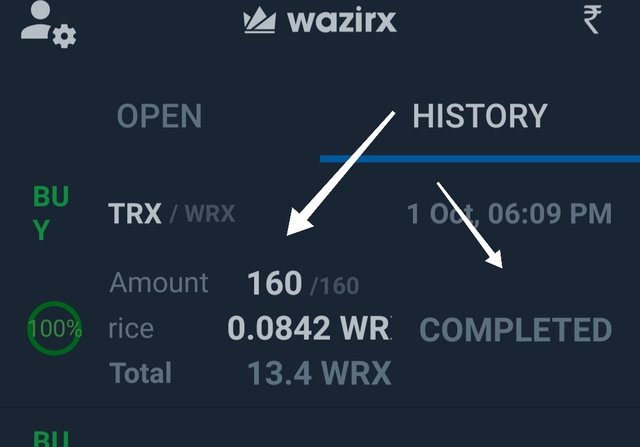

Step 2 : Sell WRX for TRX. For 13.5 WRX we got 160 TRX.

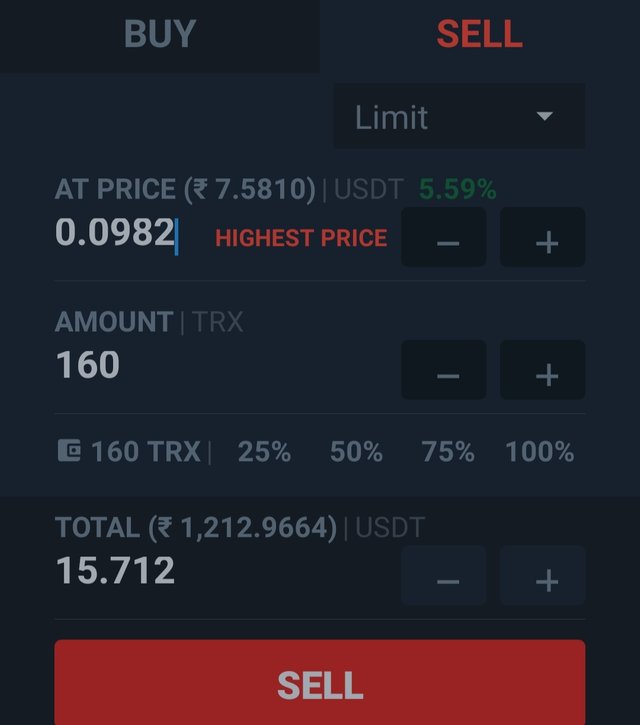

Step 3 : We will get back USDT. We will sell TRX for USDT. For 160 TRX, we will get 15.7 USDT. A profit of 0.7 USDT in 15 USDT trade. For 1000 USDT, it would have mounted to 70 USDT.

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Benefits of Arbitage trading.

There is no trading skill like knowledge of technical analysis or fundamental analysis of asset required. Even a layman with simple knowledge of basic maths can take advantage of aebitage trading.

There is almost negligible risk involved.

There is no monitoring of price required, as it is carried out instantly. So there is little interference by market forces and is less time consuming.

It adds liquidity to the maeket.

it eliminates the market inefficiency by filling high price orders and buying low price orders amd therefore bridges the gap.

Disadvantages of Traingular Arbitage.

Traingular arbitage involves multiple trading pairs and therefore is subjected to slippage risk in high volatile and low liquid markets. As these trades are performed at market price, these are subjected to slippage risk especially if markets are volatile and show dip in price between the time of placement of trade and its execution and same can be seen in low liquidity assets and markets.

Data exchange varies between different exchanges and approximation of decimals tends to average out the profits earned out of arbitage. Example, wazirx approximates upto 5 places of decimal and in BTC we know that even 8 places after decimal have value.

Triangular arbitage is difficult to spot and traders may need to buy some softwares for the same.

Conclusion

Arbitage is a low risk trading strategy where in traders take advantage of market inefficiency which is manifested in the form of variation in the price among different exchanges and among different trading pairs. Arbitage in turn results in correction of inefficiency and bridging of gap. When spotted properly, it is a risk free and minimum skill and knowledge requiring tactic to gain profit from the market.