Crypto Academy Week 10 Homework Post for [@kouba01] / Cryptocurrency Contracts For Difference (CFDs) Trading

On this occasion, I will complete the homework given by professor @kouba01 which is discussing cryptocurrency CFD.

What is a cryptocurrency CFD?

Cryptocurrency CFD is a trading activity carried out by a trader. But there is a slight difference from trading on Cryptocurrency CFDs with trading normally. Usually, we trade by buying cryptocurrency at a low price and selling it when the price is rising/expensive, so that way we will get a profit, if the opposite happens then we will get a loss. Because of that, that's why we will only get profit when the cryptocurrency is up.

In contrast to Cryptocurrency CFD, we can get profit in two conditions, we can get profit when the cryptocurrency price is rising and we can still get profit even when cryptocurrency is experiencing a decline in price. This is what makes Cryptocurrency CFDs very popular for world traders. Cryptocurrency CFD has succeeded in making a new innovation in the world of cryptocurrency trading.

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

In determining whether trading activity is suitable for the way you trade, you can look at several aspects that exist.

Capital Preparation

It is undeniable that we need capital for each of our trading activities, the smaller the capital, the smaller the profits we will get. in Cryptocurrency CFD there is an offer to lend capital to traders so they can get bigger profits, so even though we only have small capital, we can still get big profits.Potential Profits

Unlike ordinary trading, if we trade on Cryptocurrency CFD, we will get a huge profit, this way because we can benefit from 2 movement options, from bullish or bearish movements. And because we borrow more capital to trade, we will also get more profit.Taking Risks

Although Cryptocurrency CFD has great advantages, it also has a big risk, this is because if we are wrong in predicting cryptocurrency price movements, we will get big losses. So before you trade on Cryptocurrency CFD, you have to dare to take that risk.Trading With Various Assets

In Cryptocurrency CFD trading, we can freely choose to trade with any asset, it can be with stocks, gold, ETFs, etc. depending on the market provided by the broker.Learn Technical Analysis

Because Cryptocurrency CFD has a high risk before you start you have to study the existing technical analysis first so that you can get maximum profit.

Are CFDs risky financial products?

If you ask me about the risks of the Cryptocurrency CFD, then I will boldly say that Cryptocurrency CFD is a very high-risk trading activity. Because we can lose our money in just the blink of an eye, this can happen because the type of trading used in the Cryptocurrency CFD is margin trading, where the trading system will lend us a certain amount of money to trade with a certain multiple, if we are wrong in estimating the cryptocurrency price, then our money will be forfeited with these multiples.

That's why many people who are just starting to try Cryptocurrency CFD often wonder why their money runs out suddenly, even though their percentage of losses is not too large.

Therefore, we must be very careful when trading Cryptocurrency CFD.

Do all brokers offer Cryptocurrency CFDs?

The answer to this question is No.

Not all brokers provide Cryptocurrency CFDs on their markets. This is because at the beginning of CFD history it's an agreement based on an underlying asset, usually, the underlying asset is stocks, commodities, gold, or fiat currencies. Therefore, many brokers still provide other assets for trading.

Examples of brokers who provide assets other than cryptocurrency on their market are:

- Plus500

- Forex XM

- eToro

- IQ Option

- CMC Markets

- etc.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account)

This time I will give an example of how to trade Cryptocurrency CFD using a demo account. The broker platform I took as an example is AVATRADE.

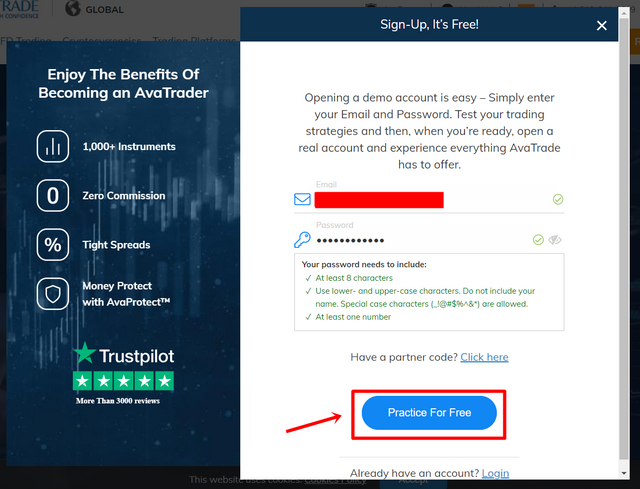

The first step to do this is to create an account on the AVATRADEplatform, you can visit the official website directly. The image below is the start page of AVATRADE.

After that, select the option to create a demo account under the "Register Now" button.

Enter your email, and create a strong account password, there are at least 3 requirements given by AVATRADE to create a strong password. After that click on the "Practice For Free" button.

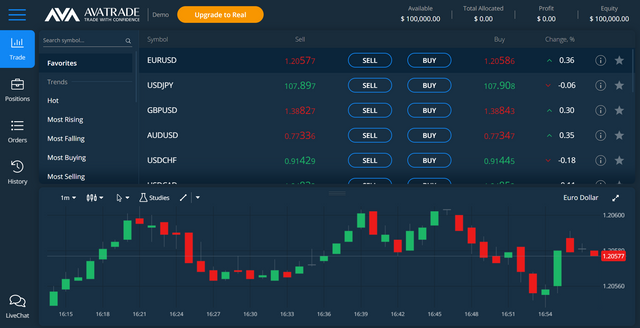

Then you will be shown the start page of your demo account as shown below.

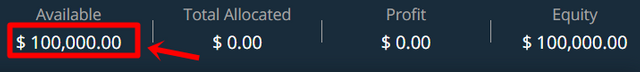

You will be given a loan of $ 100,000 as initial money for you to use in trading activities.

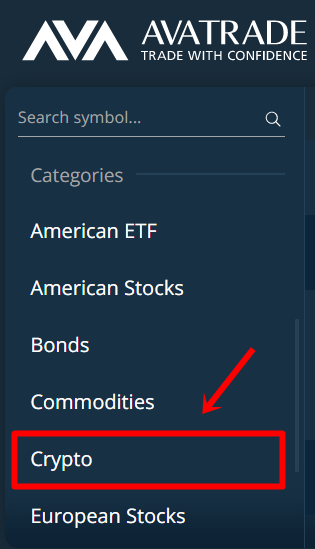

After that, look for crypto trading options in the search field and find crypto options in the column according to the category.

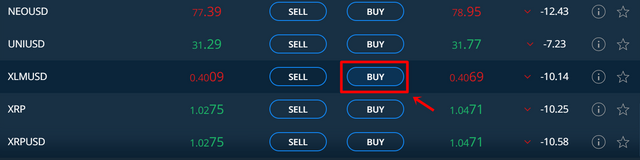

Then choose what crypto to trade. Here I bought XLM as an example of trading at this time.

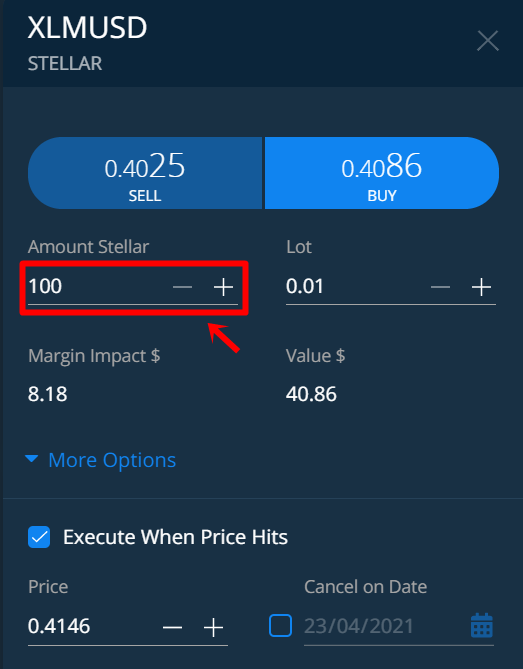

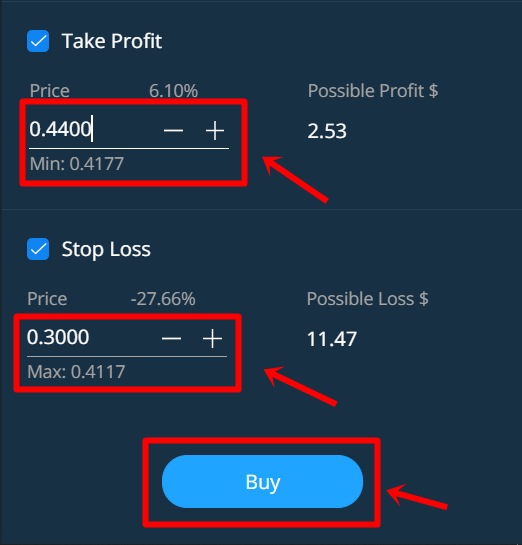

After that, the options will appear to determine the things that we will compare. Enter the amount of XLM, then specify the profit you want and also specify the Stop Loss price you want, then press "Buy".

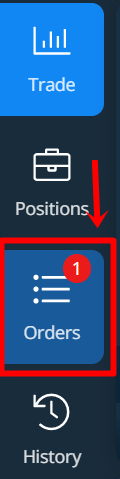

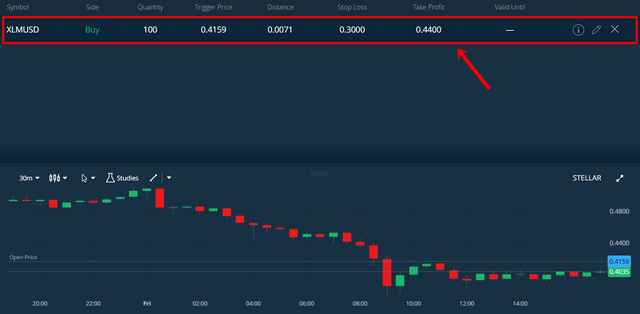

In the Order tool there will be a new notification, click on the tool.

Then, you will be taken to your order page. It shows details of the orders you have made and below shows a chart of the cryptocurrency you are trading.

That is my explanation of Cryptocurrency CFD and about the steps of doing Cryptocurrency CFD trading on the AVATRADE platform.

Thank you for reading my article, I'll see you in the next article.

CC:

Hello @diegopreman,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 8/10 rating, according to the following scale:

My review :

Good content article, just for the second question I wanted you to talk about your personal opinion on trying this type of contract.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Thank for your review and feedback

I'll take it for guide in next week homework

My tweet on Twitter :

https://twitter.com/diegopreman/status/1385547493451173888