Crypto Academy Week 11 - Homework Post for @sapwood

In this post, I am here to submit my S2 Homework Task 3 which I have carried out as required by @sapwood.

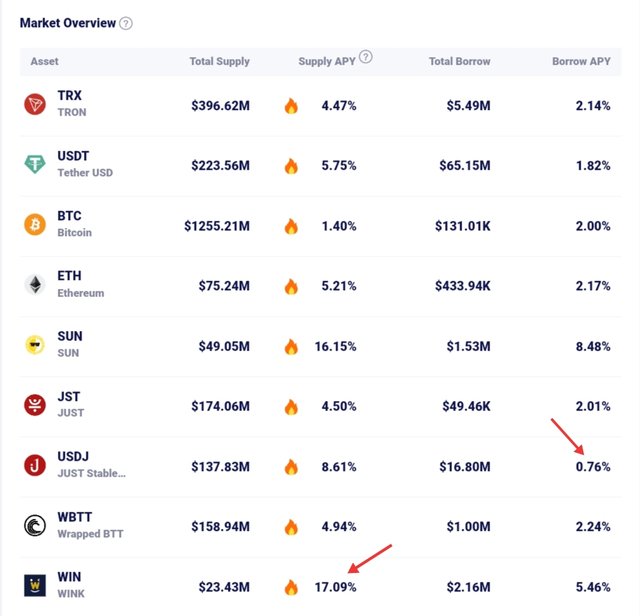

Q. What are the different Markets available in JustLend, which market offers the best Supply APY, and which market offers the lowest borrow APY?

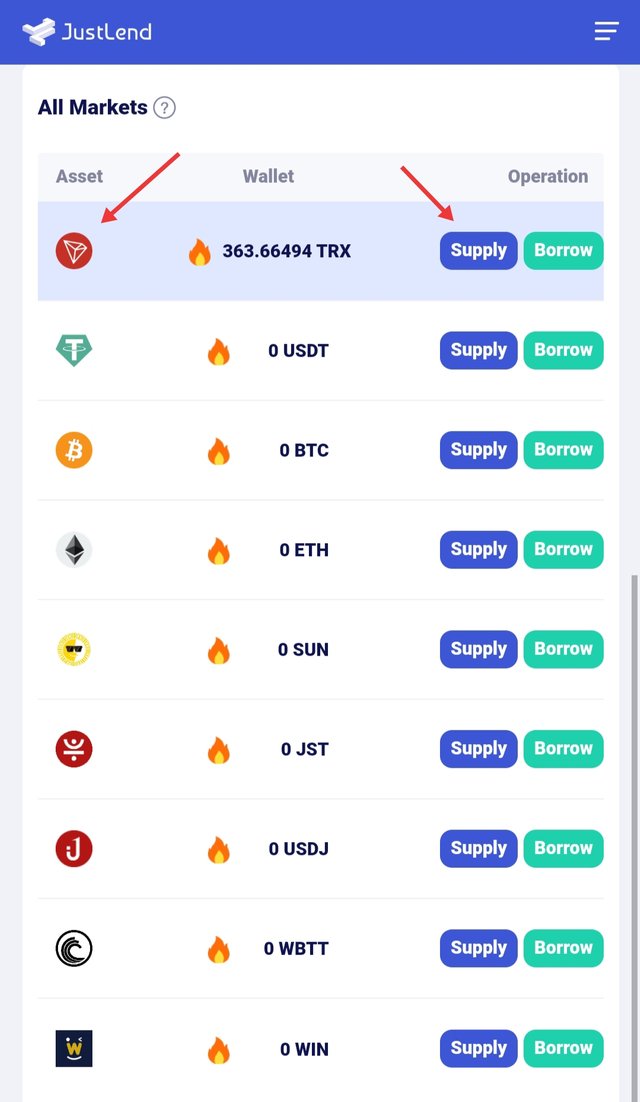

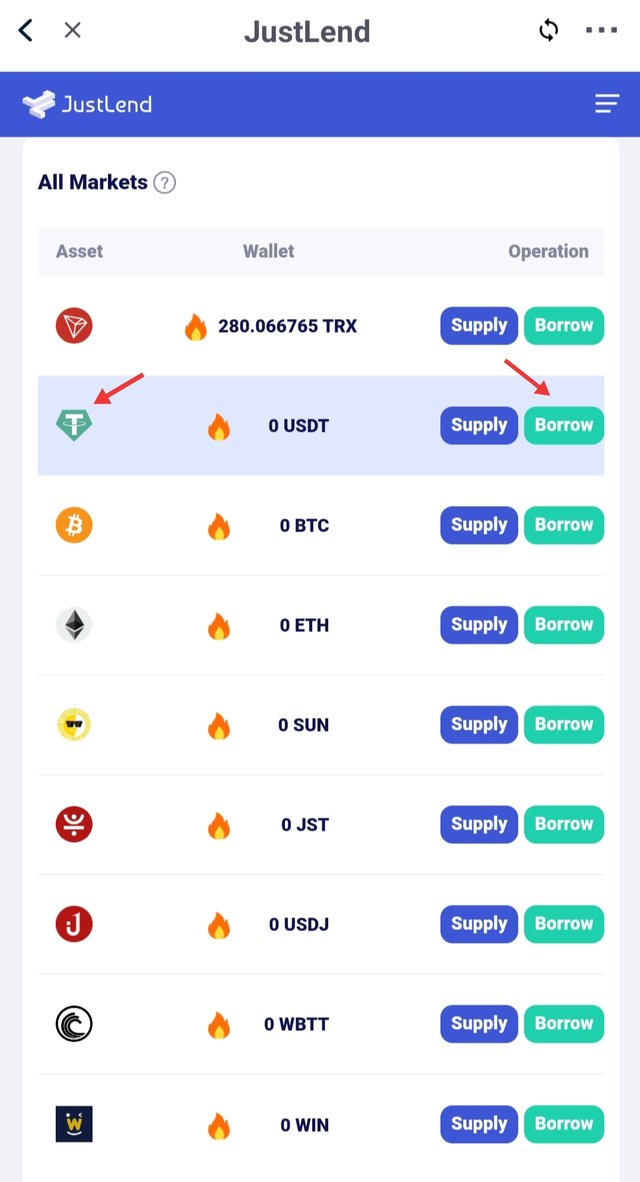

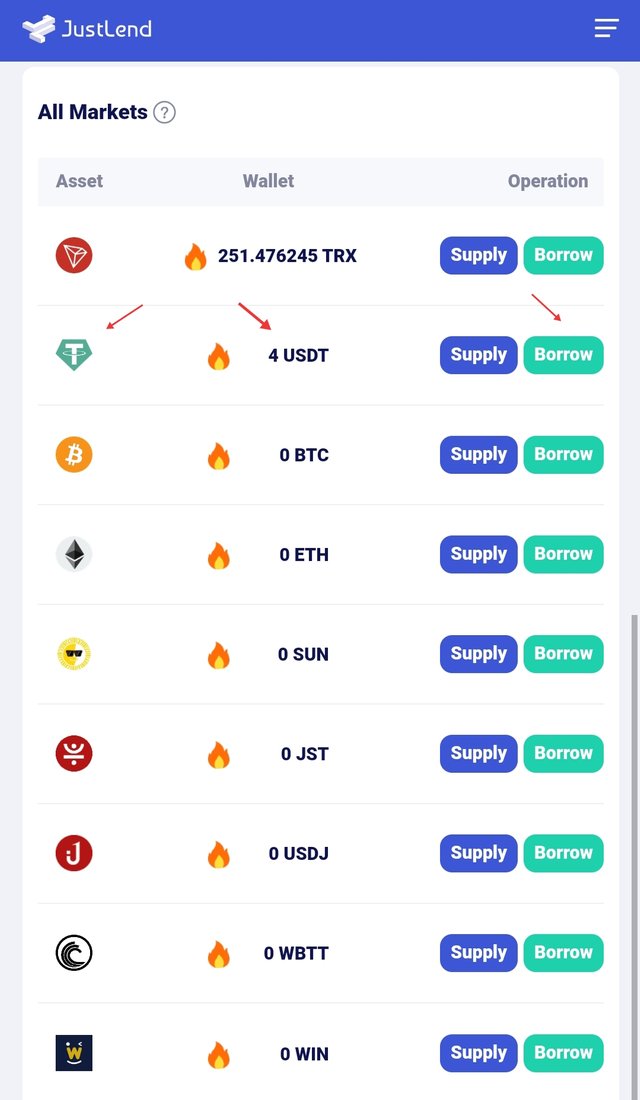

In JustLend, there are 9 different markets available which are listed below.

- TRX

- USDT

- BTC

- ETH

- SUN

- JST

- USDJ

- WBTT

- WIN

As on 30/04/2021, 20:47 | https://www.justlend.org/#/market

Recently, SUN was offering the best supply APY but now WIN has left it behind. But markets keep going up and down. While taking Screenshot, WIN was offering the best Supply APY (17.09%), and USDJ was offering the lowest borrow APY (0.76%).

Q. How do you connect TronLink Wallet to JustLend, and How do you supply a token(e.g. TRX, SUN, JST, etc) to earn Supply APY?

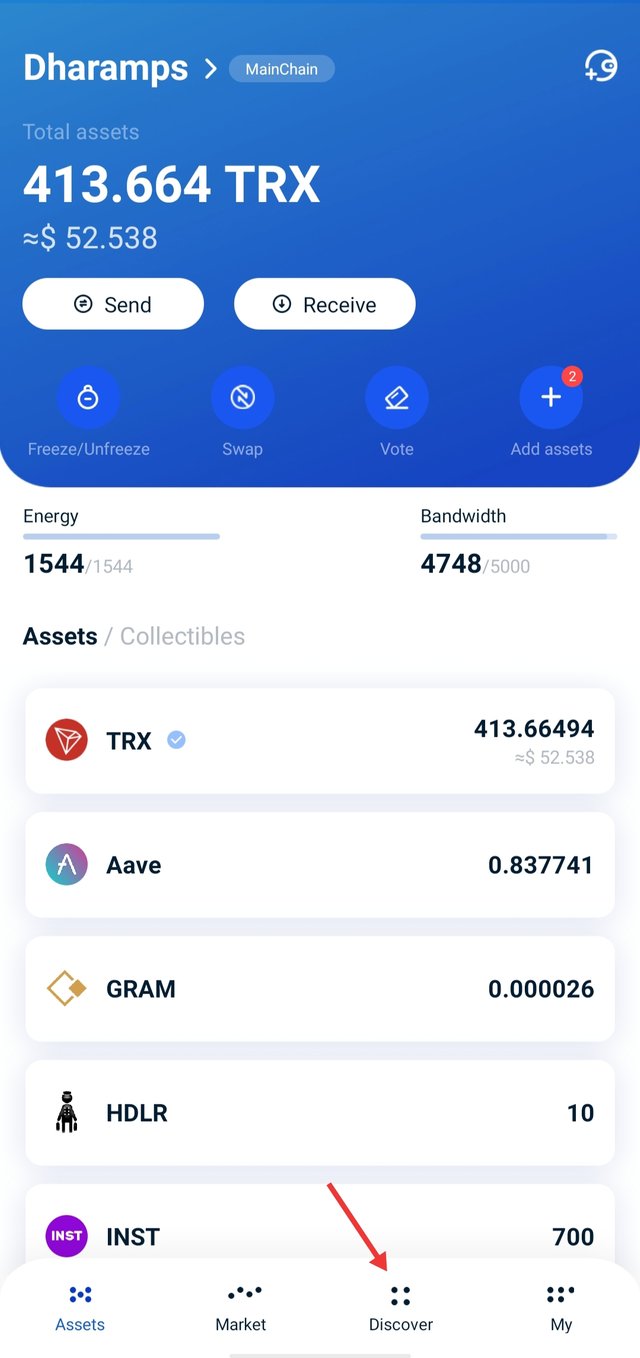

Steps to connect TronLink wallet to JustLend through TronLink Pro app :

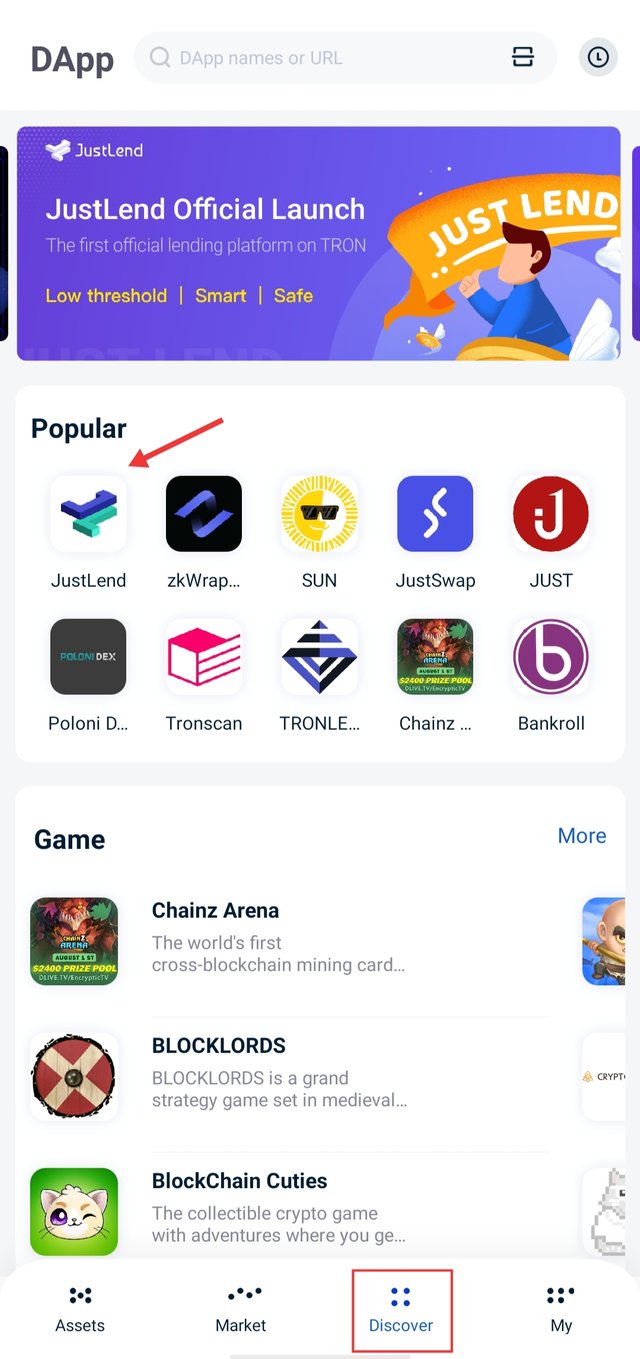

- Open the app => Go to Discover ( third option in the bottom menu ).

- Here you can see various Dapps such as JustLend, SUN, Just etc. Simply Click on JustLend.

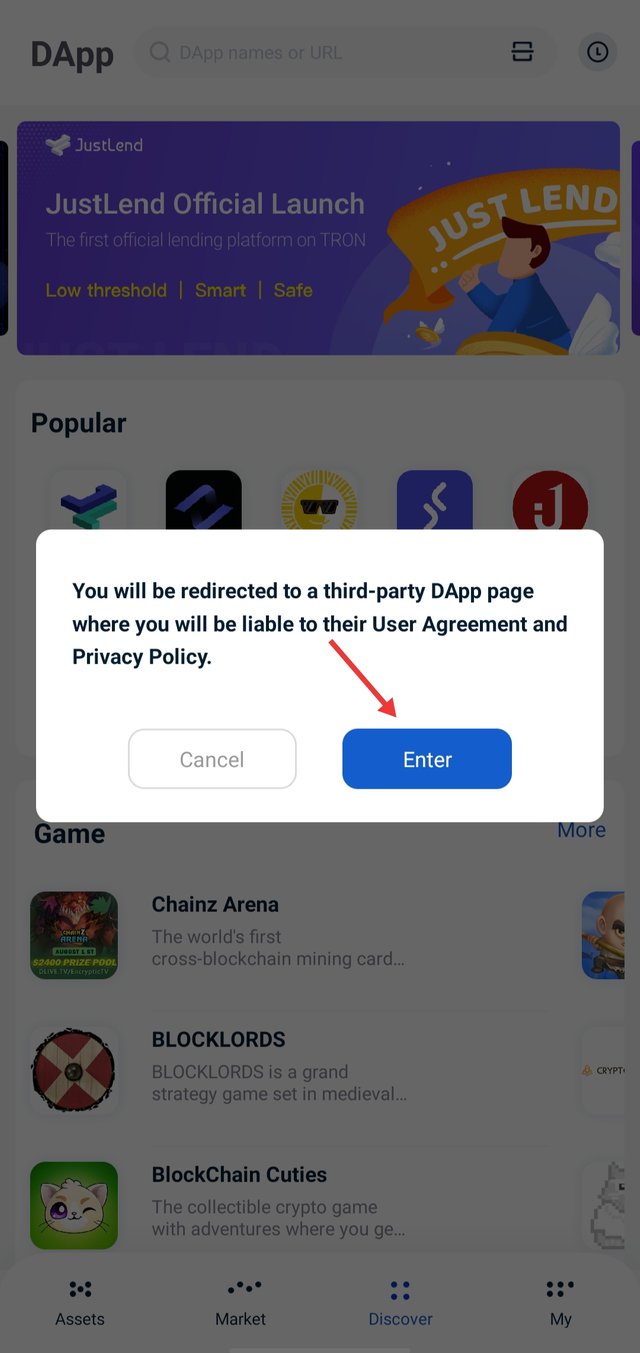

- Click on Enter

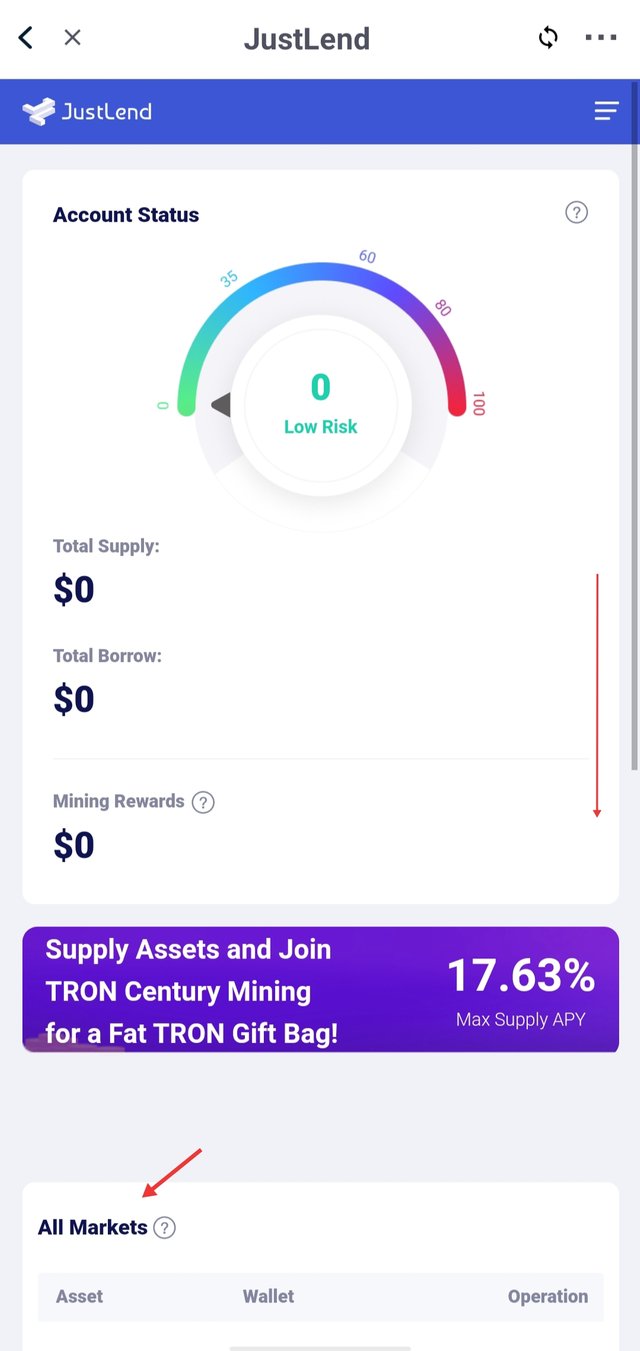

- Wallet will successfully connect to JustLend. To check, click in the top right corner. This is the Homepage of JustLend. Here you can see account status and all market & options to supply and borrow.

Steps to supply a token and earn Supply APY :

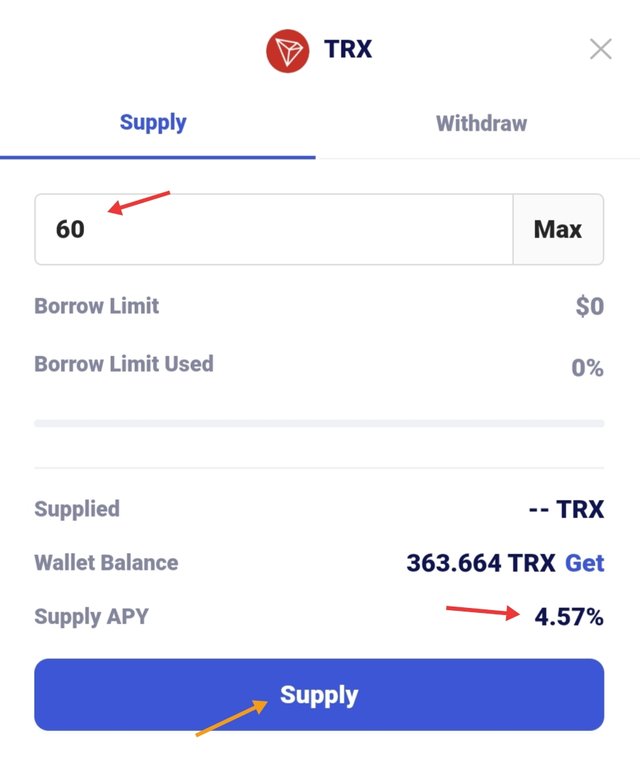

- Go to the markets => Select a token/market (it's up to you) I have selected TRX. => Click on Supply

- Now a new interface will pop-up. Fill the amount of TRX you want to supply => Click on Supply ( I have used 60 TRX at 4.57% supply APY ).

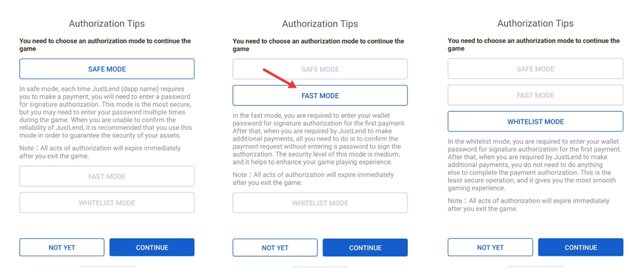

- Select a mode to transaction ; Safe mode, Fast mode, Whitelist mode. These three modes have their own specialty (Check it) I have selected Fast Mode for fast transactions.

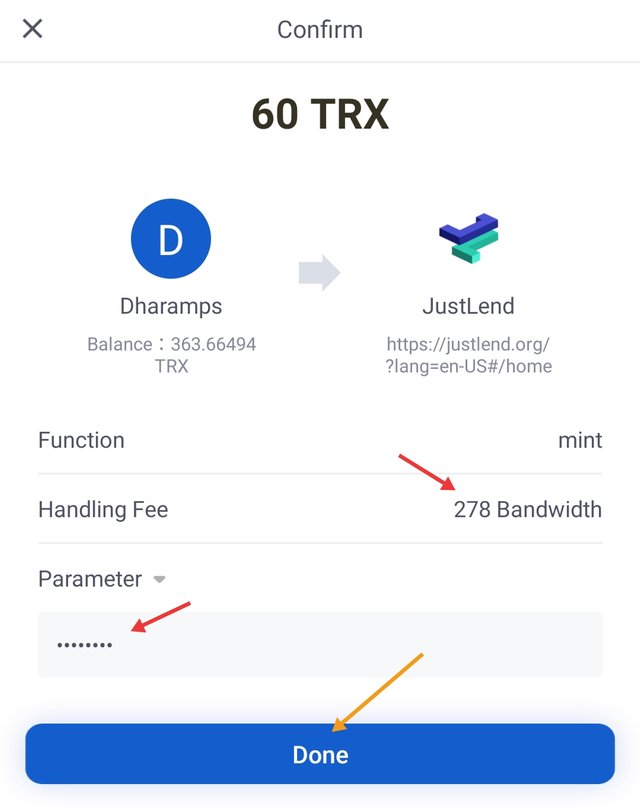

- Confirm the supply | Enter the password => Click on Done. ( Handling Fee - 278 bw )

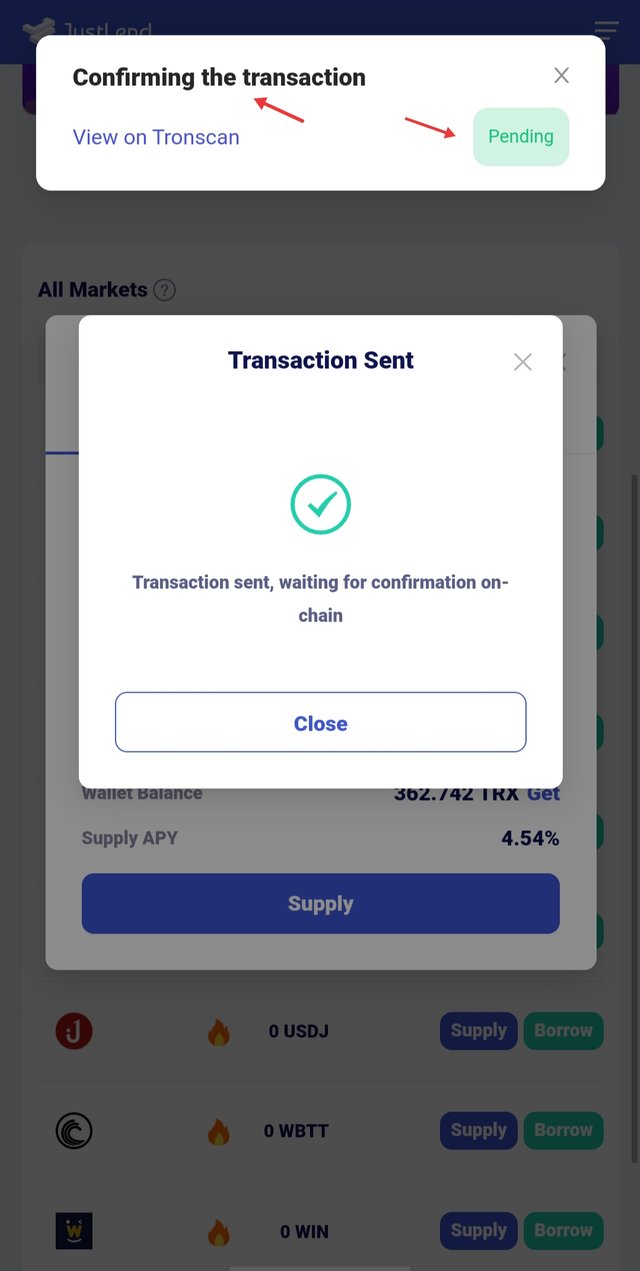

- Click on Continue

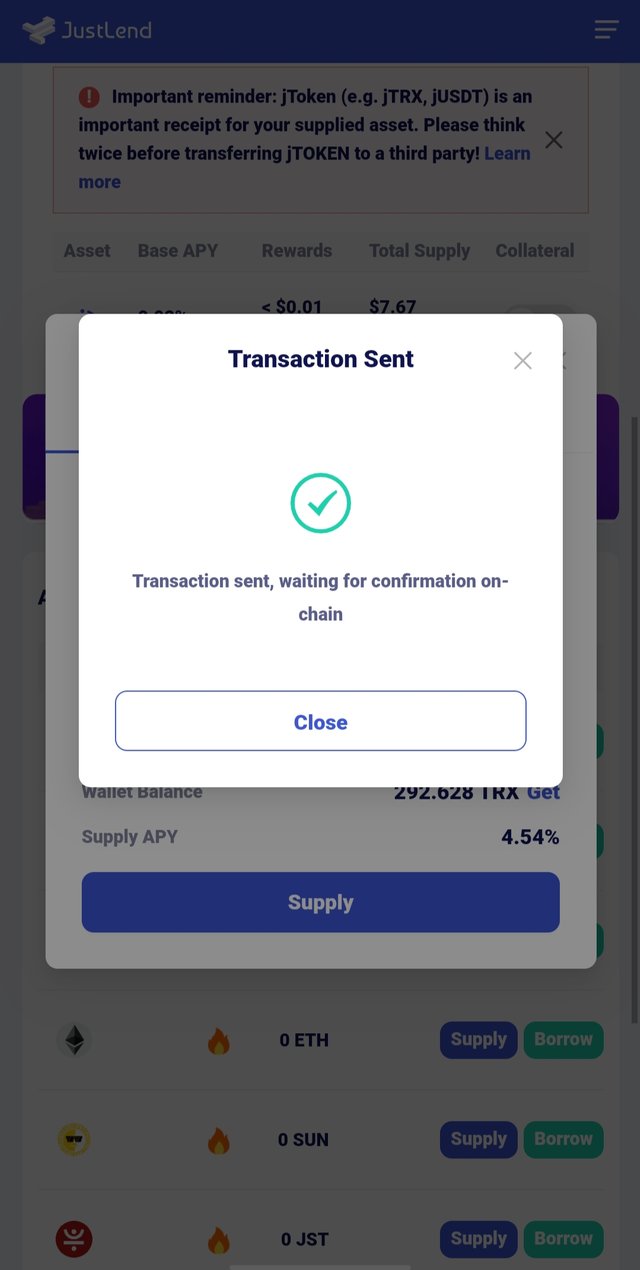

- After 3 or 4 seconds the transaction will be completed.

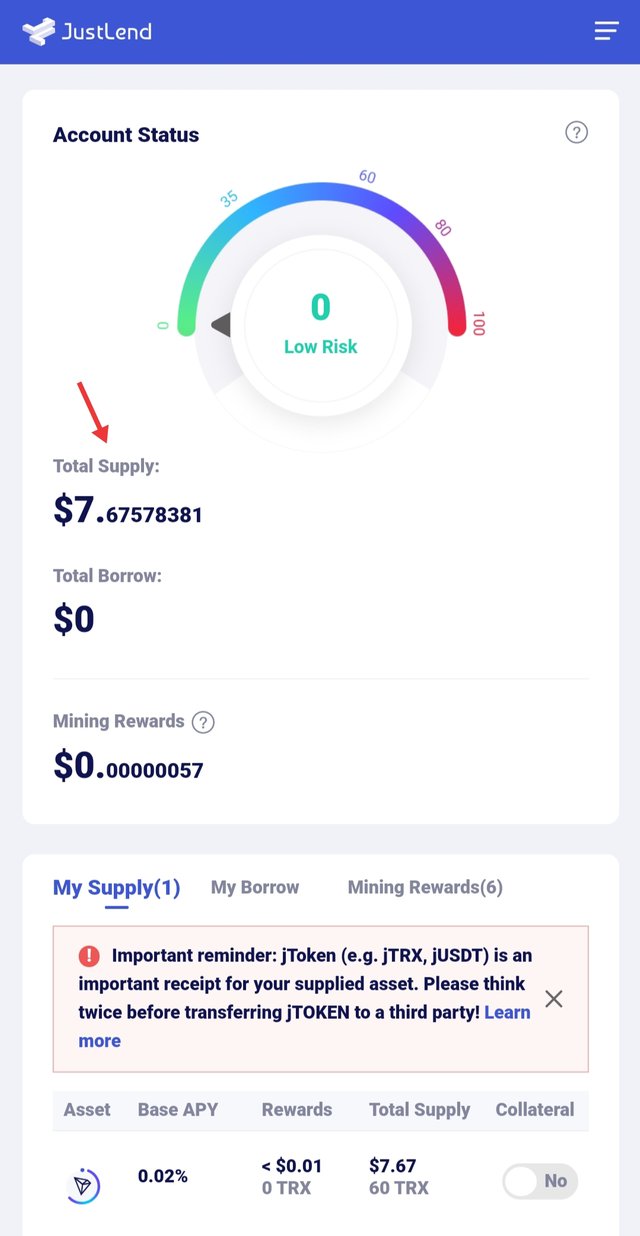

- Check on the homepage | Account Status ( Risk value, Total supply, mining reward)

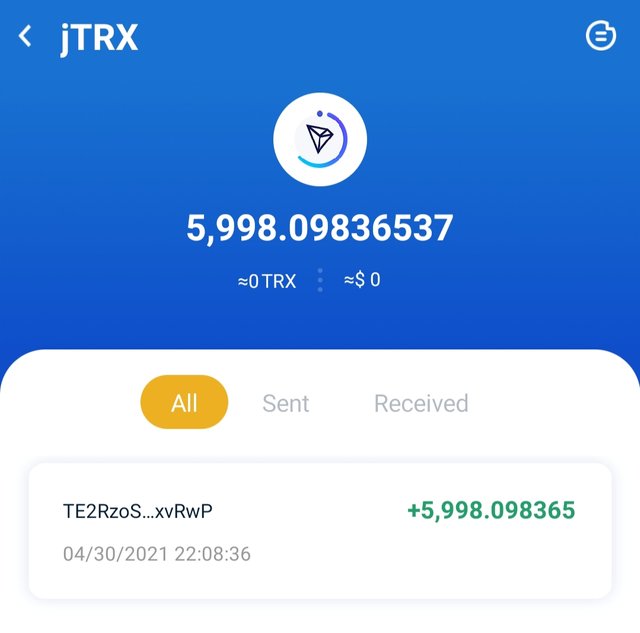

Q. How do you acquire jTokens, after supplying a particular token, check your TronLink Wallet and indicate how much jTokens you have acquired?

After supplying an asset, you can check the jTokens in the TronLink wallet. Different tokens have different jTokens. Sometimes jTokens do not show directly in the wallet. So Go to the Add assets option and Add the jTokens

I supplied 60 TRX. So after supplying I have acquired 5,998.09 jTRX in my wallet.

Q. How do you collateralize jTokens to borrow another asset? Borrow any asset of your choice(e.g. USDT), you can borrow a micro amount(as little as 1 USDT).

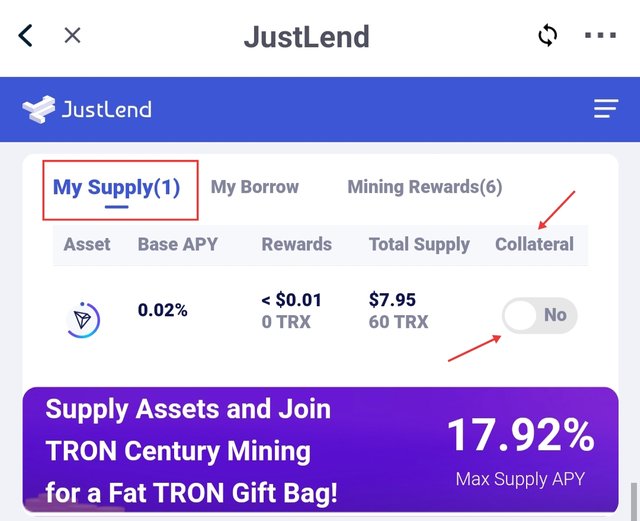

Steps to collateralize jTokens to borrow an asset :

- After supplying an asset, You can check your supply under the my supply section.

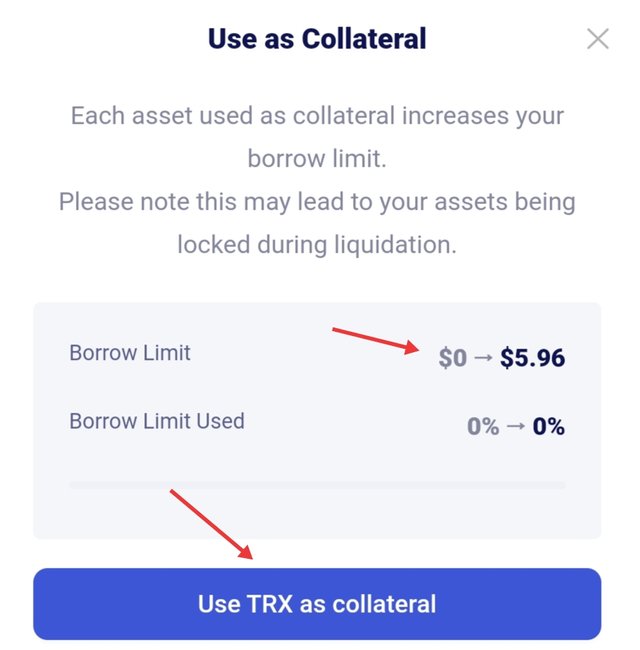

- To collateralize your supply, you must enable the collateral button | Slide the button.

- Now a new interface will pop-up. Click on the Use TRX as collateral.

- Complete the transaction process (Select transaction mode, enter the password, click on done)

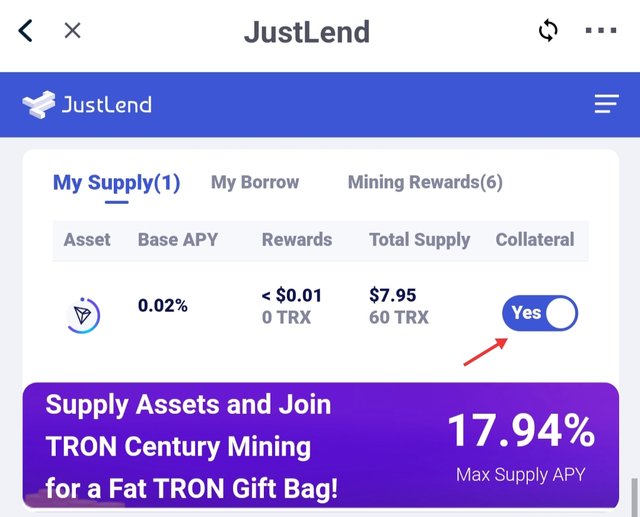

- The collateral button will be enabled after the transaction process is complete.

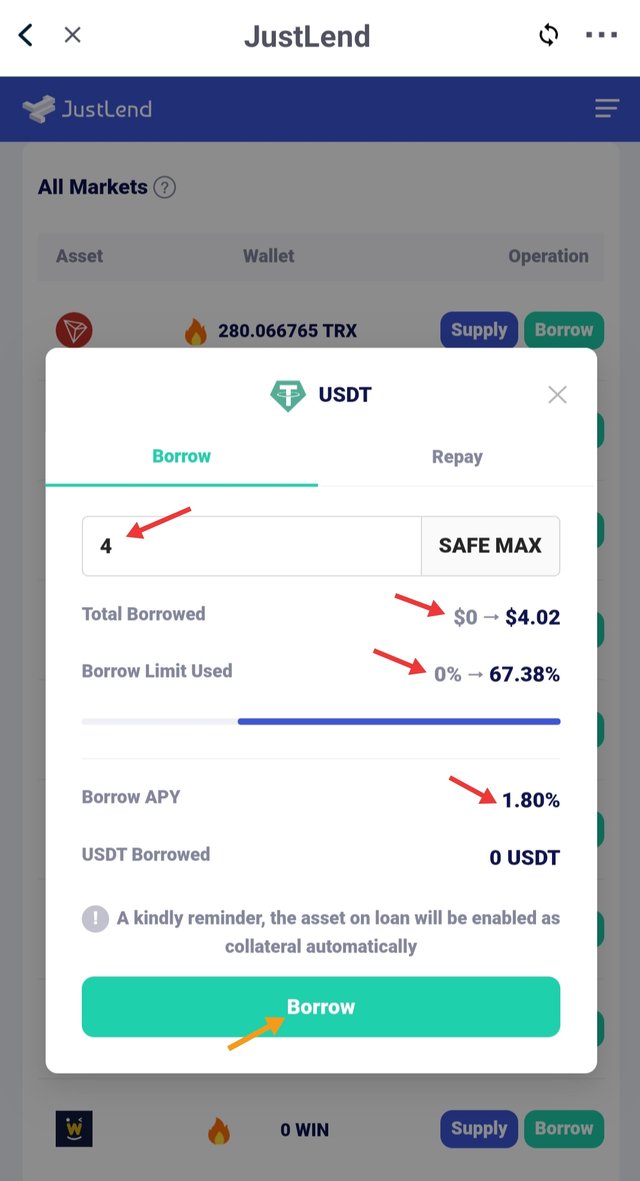

- Now Go to Market Section => Select any asset to borrow. I have selected USDT.

- Enter the amount you want to borrow ( I have borrowed 4 USDT at 1.80% Borrow APY ).

- Click on Borrow => Complete the transaction process.

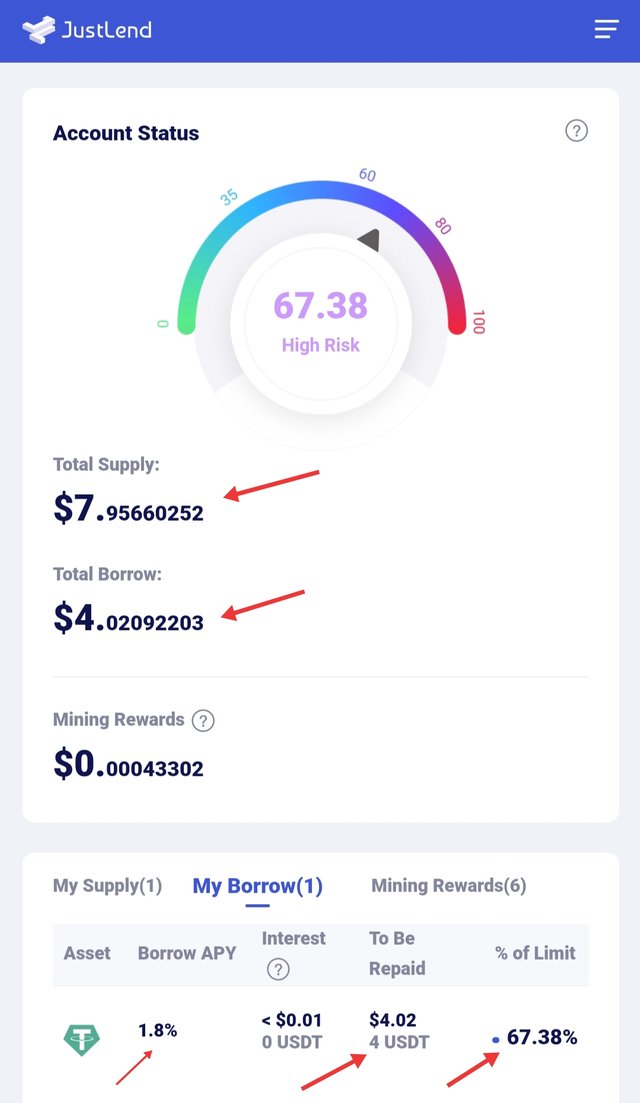

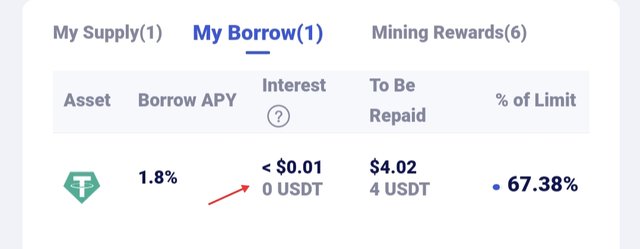

- You can see the borrowed asset in My Borrow section and check all the details as well ( APY, Interest, %of limit ).

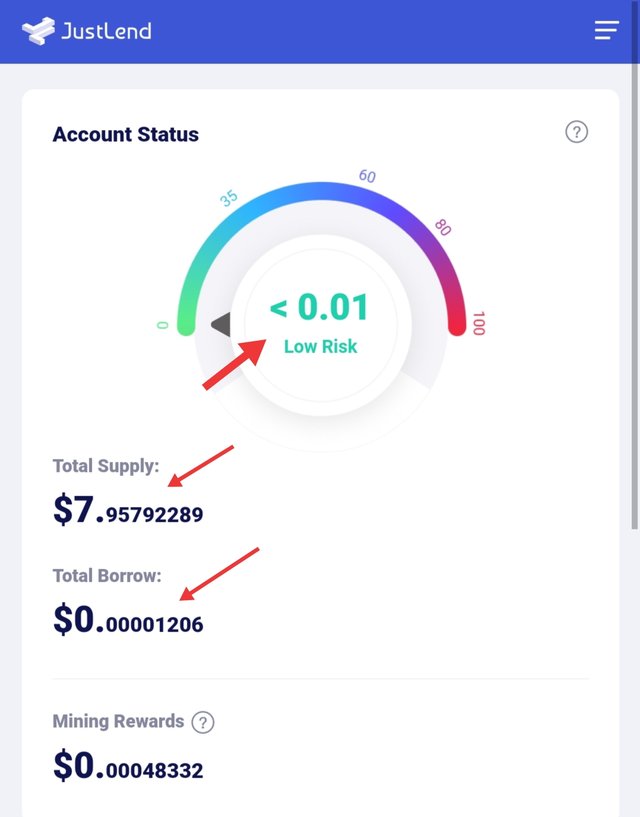

Q. How much interest did you pay, under what condition it will trigger liquidation? What is the net APY in your case? What is the Account Status(Risk Value) in your case?

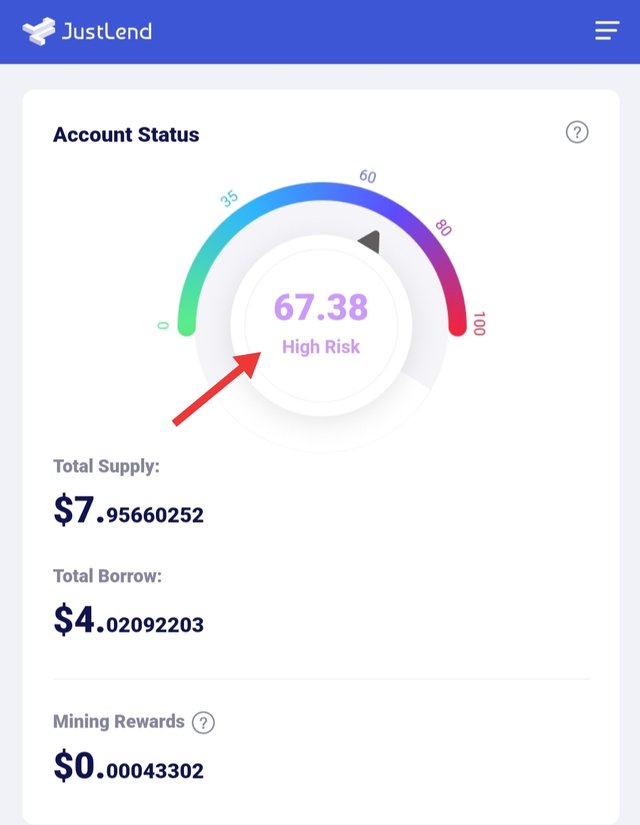

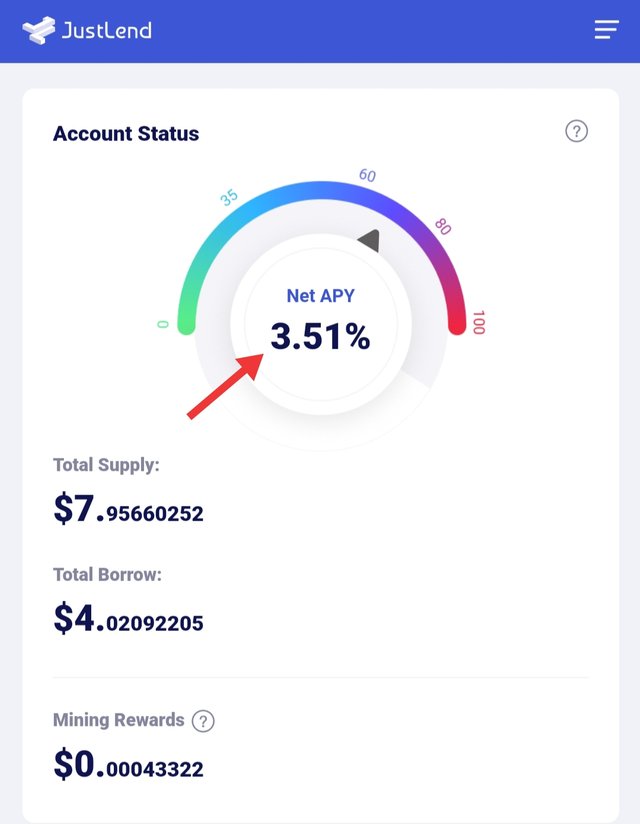

In my case, I have to pay interest of < $0.01. & to be repaid $4.02. In this process my account status (Risk Value) is 67.38 ( High Risk ). If any condition, the risk value reaches 100, It will trigger liquidation. And the Net APY is equals to 3.51%.

Q. How do you repay & unlock your asset in JustLend?

Steps to repay & unlock asset :

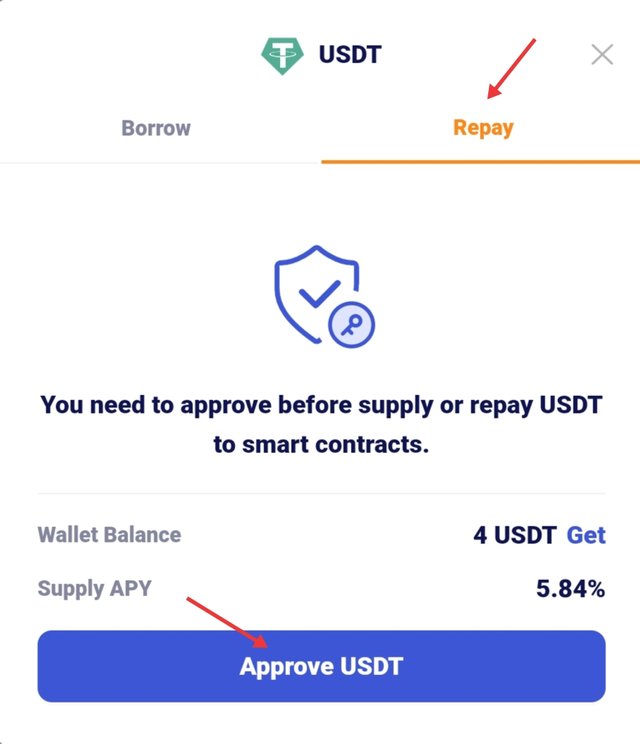

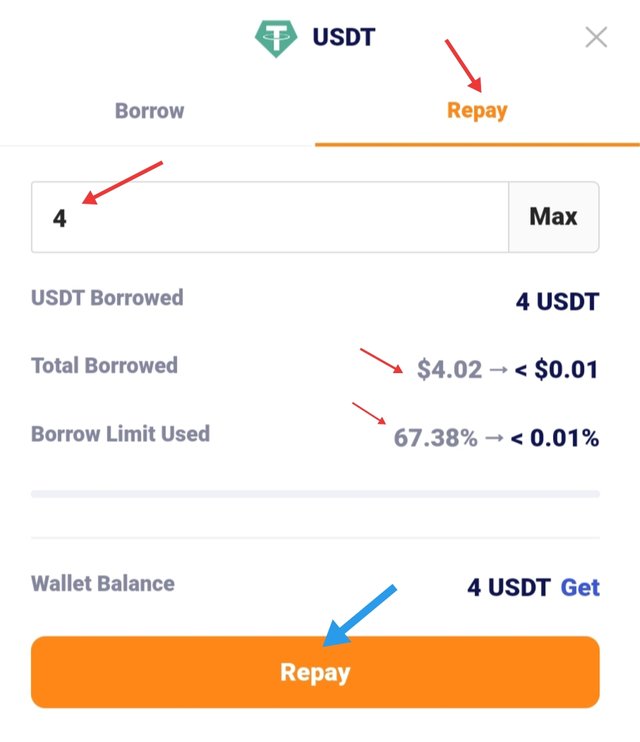

- Go to Market Section => Select the asset you borrowed ( As I borrowed USDT, selected ) => Click on Borrow.

- Now a new interface will pop-up.

- Go to Repay on the same interface.

- Now you have to approve USDT. Click on Approve USDT & Complete transaction process.

- Now Repay's interface changes. Enter the amount you want to Repay. ( I have entered 4 USDT )

- Click on Repay & Complete the transaction.

- Now the amount of the borrowed asset that you entered will be repaid.

You can check it on the homepage of JustLend.

( All screenshots are taken by me from the Tronlink app (JustLend) and edited by me. )

Cc-

@steemitblog

@sapwood

Thank you for attending the lecture in Steemit-Crypto-Academy- Season 2 & doing the homework task-3.

Literally, you mint jTRX tokens by supplying TRX tokens.

The borrowed amount is such a small amount that the incurred interest is infinitesimal. That is why it is showing as <0.01. Figure $4.02 is due to USDT being slightly greater than $1.

Feedback/Suggestions:-

Thank you.

Homework Task -3 accomplished.

[9]

Thank You Prof. I really got to learn a lot from this task. Hope to keep learning from you even further.

I am very curious to know one thing. I did not understand it .

Is it (collateral factor) fixed for all or different?

Thank You

The collaterall factor is different for different markets.

Thank you.

Okay .

Thank You