Steemit Crypto Academy [Beginners' Level] | Season 4 Week 5 | Stability In Digital Currencies

Greetings friends it's my pleasure to participate in this week's lecture and I wish to appreciate professor @awesononso for his incredible lecture thanks and below are my answers to the questions.

Explain why Stability is important in Digital Currencies

First digital currencies are currencies that Exist in online forms specifically we can find them in electronic machines like computers and phones, they are also known as electronic money or possibly we can have them to be cybercash.

Nevertheless digital currencies are only accessible with our digital machines like phones or computers.

On the other hand, we can have cryptocurrencies to be digital currencies but not all digital currencies are cryptocurrencies, this is what that must be noted very importantly.

Finally we can use digital currencies for seamless unrestricted transactions across borders of the world unlike our normal physical currencies like banknotes which can only be used or spent within a jurisdiction Digital currencies on the other hand is not so.

Example of digital currencies includes:

Virtual currencies, Central Bank digital currencies (CBDC), Cryptocurrencies and it is worth noting that cryptocurrencies are regarded as digital currencies because they exist in digital platforms.

WHY WE NEED STABILITY IN DIGITAL CURRENCIES.

TO REDUCE THE RISK OF ASSET LOSS:

The volatility in cryptocurrencies can not be overemphasized as this has been the trend since it's invention as traders are warned to trade what they can bear to lose. But if digital assets are stabilized, it will actually rate at which assets are lost .TO BUILD A STRONG FINANCIAL BASE.

If digital currencies are stabilized, it will help to boost the financial capacity of traders and holders of the asset. For instance, if there is a stable and non intermittent rise or fall in digital assets, traders can actually benefit by knowing when exactly to sell or buy a particular currency in the market.

- TO ENCOURAGE PEOPLE IN CONFIDING MORE IN DIGITAL CURRENCIES.

If this currency is stabilized, people in general will be propelled to hold more of it than banknotes which may seem bulky to convey and they can keep their money in it till any day they wish to make use of it which is actually the reason why people are also looking upto coins and tokens like the USDC and USDT and other likes of them against the rampaging volatility in digital assets

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

First, let's go through some pros and cons of CBDC below:

PROS OF CBDC:

REDUCTION IN THE RATE OF FOREIGN EXCHANGE

On like the USDC which is pegged to unity in their currency, if other countries should adopt this modus-operandi, it will actually assist them in controlling the unreasonable value of dollar over their domestic currency through the possible rate of demand and supply of their domestic currency.INCREASED REVENUE GENERATION BY THE DOMESTIC ECONOMY

I believe that every business is geared towards making profit or generating revenue.

So the adoption of CBDC by different economies of the world will help them in generating revenue through the imposition of unavoidable tariffs by holders of their currency.

- ABSENCE OF LOSS OF ASSETS WHILE YOUR VALUABLES ARE WITHIN THE JURISDICTION OF THE CENTRAL BANK.

We know that banks are liable to the reimbursement of their customers assets if paradventure they losses it to armed rubbers and thieves.

Moreso if the central bank should lose customers money to hackers, they are liable to reimburse their asset to them if actually it was not tye fault of the investors and this is actually a secluded privilege which investors may stand to gain.

CONS OF CBDC

- INCREASED DEPRECITION OF ASSET:

we know that crypto assets are very volatile and on the other hand, traders are lisble to lose or gain some reasonable worth of their assets at any time during trades and contrarily CBDA are regulated and may acrue certain tariffs by their holders.

So if traders on the one hand loses their assets through trades and on the other have some reasonable worth of their assets reduced through the imposition of probably tariff by the Central Bank of their country, it will actually increase the rate of depreciation of their assets value.

- ABSENCE OF PRIVACY

Since this assets is subject to Central Bank control, it is possible that the holders of such coin will have their data enrolled on the Central Bank digital sheet which will help them in ascertaining the digital net value of their investors thereby denying the holders of such asset their privacy right.

MY STAND OVER THIS SYSTEM:

Finally, don't really buy into the idea of CBDC as more of the advantages goes to the government because of the centralized nature of this invention as also holders of such currency or currencies are susceptible to hackers if proper measures are not put in place.

Also due to unwarranted regulation of one's portfolio by the Central Bank, this will also discourage people to hold this currency since everyone would love to have his privacy at all time.

Explain in your own words how Rebase Tokens work. Give an illustration.

First Rebase tokens are elastic tokens that have an unfixed total supply but adjust automatically on a normal basis according to fluctuations in price.

Now let's go through how this process works.

Like our fundamental knowledge of price elasticity of supply in which price responds according to the supply trend, where an increase in price will effect a corresponding increase in supply but not actually at equal count.

The Rebase token is not actually a token that follows price increase or decrease on a simultaneous basis.

The involved tokens are rebased after a stipulated period where stakers are rewarded or the token wallet holders are rewarded after an increase or decrease in price.

Nevertheless, most Rebase tokens are on Dollar target equivalent and in this case, an increase above the target dollar price will result in an equal percentage increase in the circulating supply of the asset but still maintaining its current dollar price equivalent

ILLUSTRATION

Let's go through a practical illustration of how this works.

Let's assume that Steem is a Rebase token and I have 20 Steem in my wallet and steemit blog targets Steem to come up to $1 for the day and finally, Steem traded for $1.10 at a percentage increase of about 8%. Let's now see what will be my Steem Rebase token for the day.

Total Steem before Rebase = 20

1$ target by steemit blog for the day

Steem price for the day = $1.10

% increase of Steem = 8%

Solution

8/100 x 20steem = 1.6steem

1.6steem + 20steem = 21.6steem

21.6steem x $1.1 = 23.76steem

Therefore after the Rebase, I will be having 23.76steem for the day.

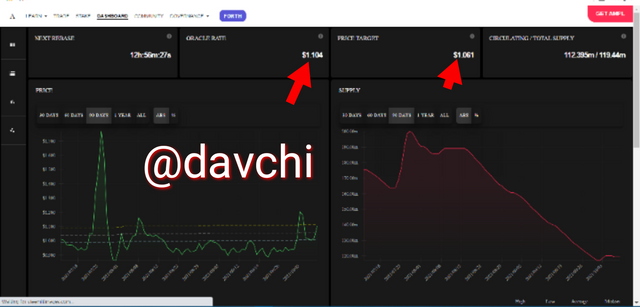

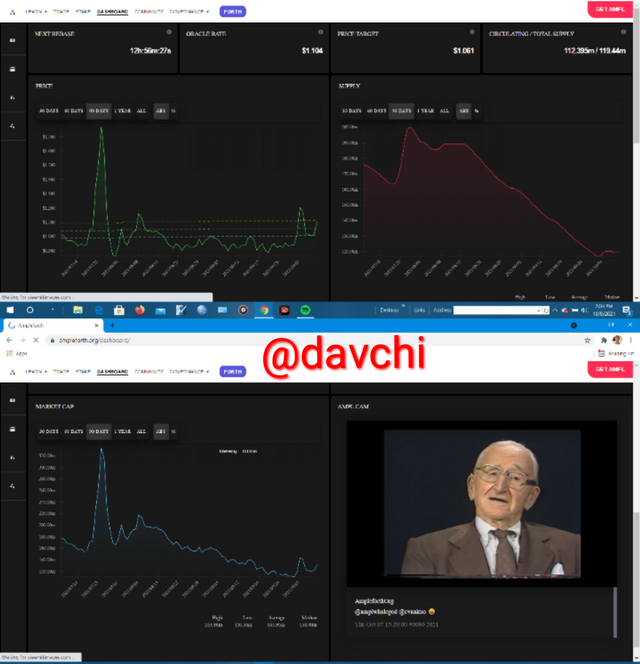

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

Now let's calculate the Rebase percentage

R% = {(oracle rate - price target) ÷ price target x 100/10}

But from the screenshot above we have the following:

Oracle= $1.104

Price target=$1.061

Therefore R% = 1.104-2.061 ÷ 106 x 100/10

=0.043/1.061 x 10

R%= 0.41

Some other things on the page:

On the page we can see the time of the next Rebase option at the top left corner of the popped up dashboard interface.

On the right side, of the dash board interface, we can also see the total circulating supply at different respective times

On the left downside of the dashboard interface are the respective times market cap.

Finally on the down right corner is the AMPL CAM

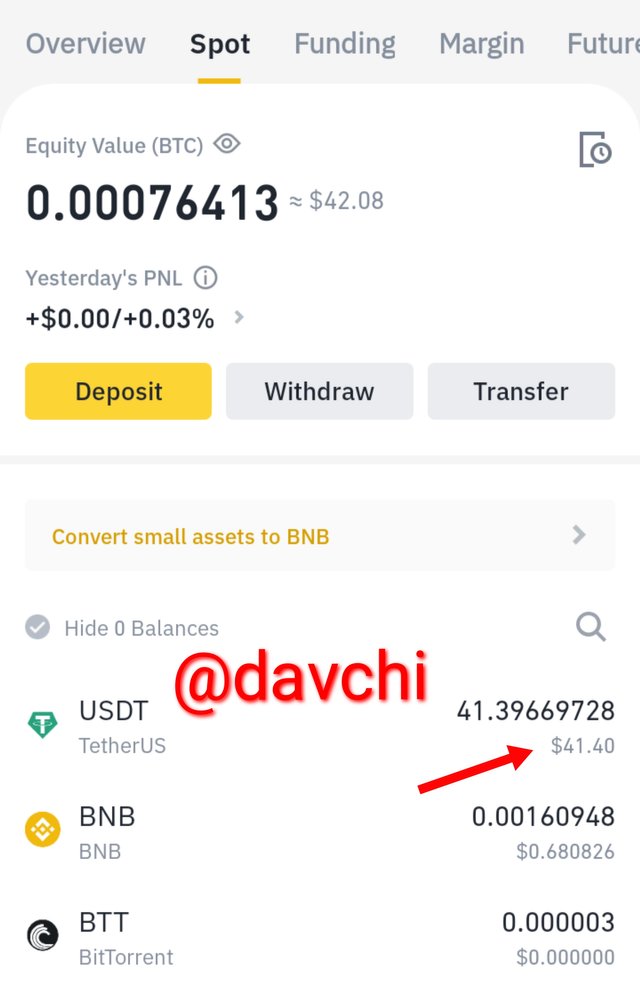

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

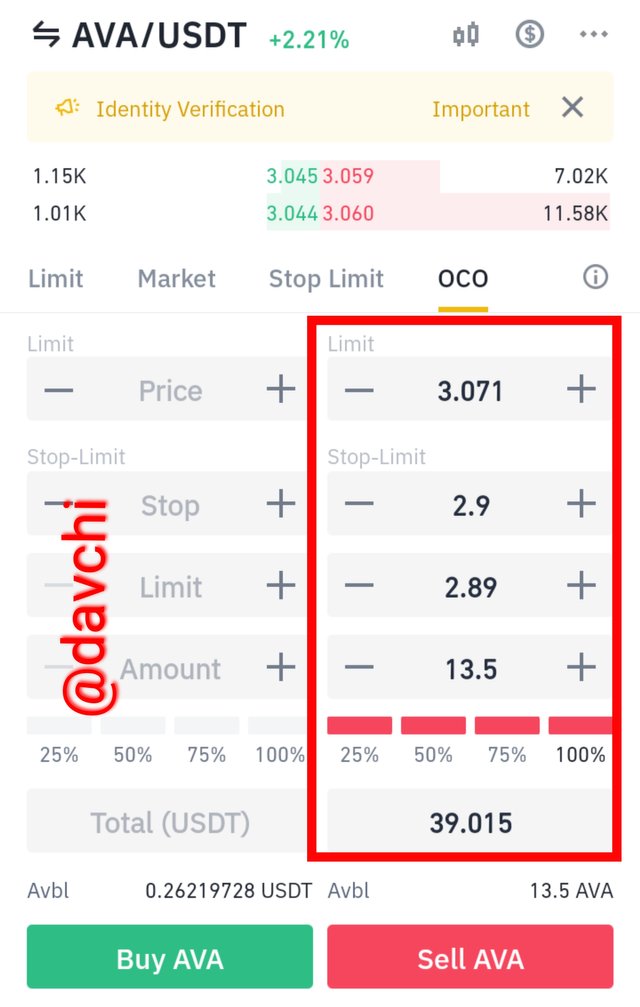

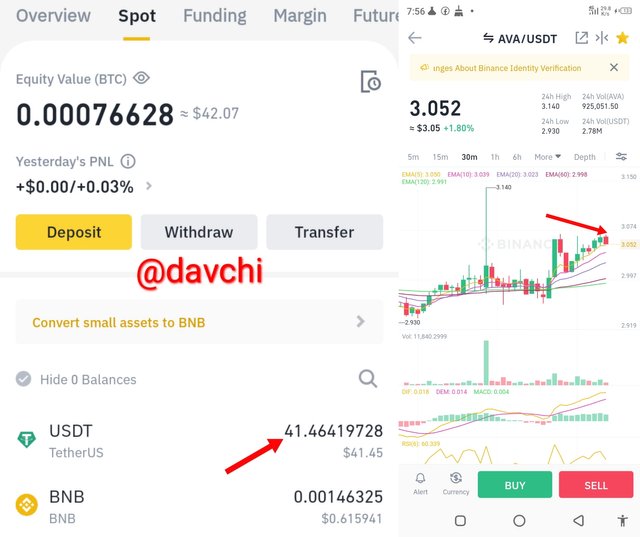

In this trade example, I will be Trading the AVA against USDT on the Binance Trading platform, below are the procedures:

From the screenshot above, we can see that I have 41.40 USDT worth of asset.

Next, I enter the market for AVA using all the USDT asset in my wallet

Here is my stop loss and take profit level after entering the buy order below.

Finally I was able to make a little profit from my buy entry and here is my account balance although I didn't go high for my profit margin and below is my balance.

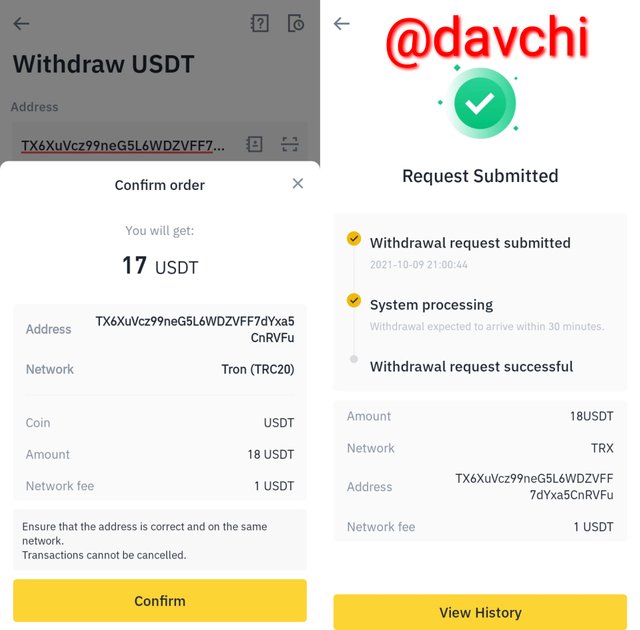

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

The pros of the transaction are:

The Transaction cost only one USDT despite the quantity one wishes to transfer which may not be the same in fiat currency.

It takes only a munite for the transaction to be confirmed while most fiats takes more than a munite for their confirmation

The value you are sending after the one dollar deduction is still the same value you will be receiving in the second wallet but their may be some variance in value if it were some fiat assets since they are unstable assets.

The Screenshot Of My Transaction:

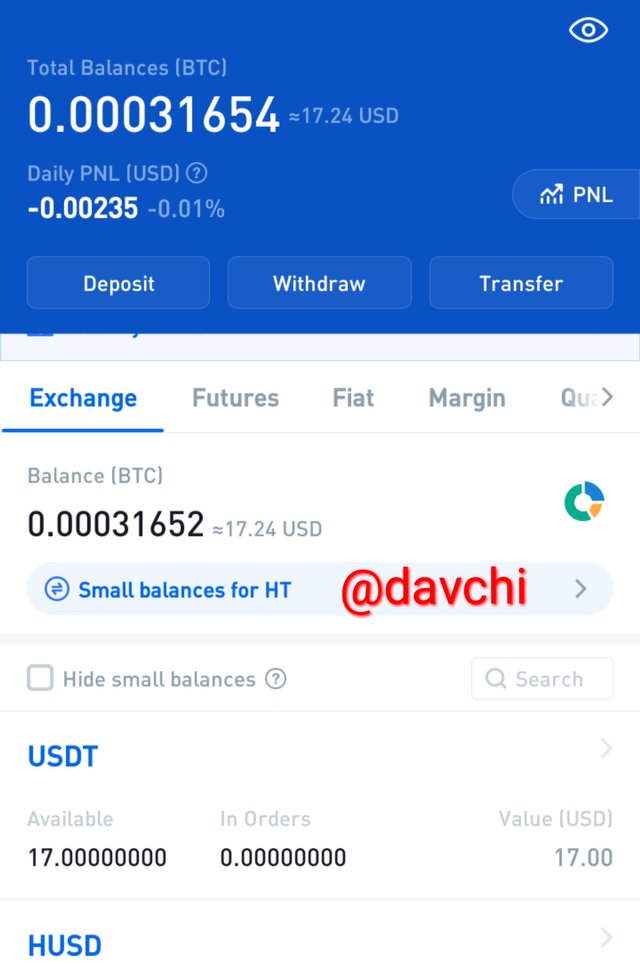

This is after copying my USDT address from Huobi Exchange, so I made the transfer.

This is the balance of the transaction in my Huobi USDT wallet below.

CONCLUSION

The CBDC is actually a good invention which will help in generating revenues for owner countries.

The Rebase or elastic tokens as an invention is still gaining ground as it's pros and cons are not all that too obvious to everyone but it's actually a good an investment opportunity since the rate of loss is not just felt by a single investor as all risk and profits are shared equally based on target demand.

Stable coins on the other hand is actually the morality of traders in the digital asset world which has been an all time aid against the volatility in digital assets.

Thanks for patiently going through.

Cc: @awesononso.