SRMUSDTPREP Buy (Long)-Steemit Crypto Academy | S6T3 | Team Trading Contest Post for Reminane

Hello everyone, this is my last post for this week's trading contest. Once again I am honoured to join Team Reminane for this week. The week was a successful week on my end. I made mistakes, learnt a lot, gained experience and also made profits.

Without wasting much time, let's go!

Serum (SRM)

Serum is a Decentralised Exchange (DEX) built on the Solana blockchain network. Serum was created by a group of 3 organizations. These are FTX, Alameda Research, and the Solana Foundation. Serum offers fast transactions and low costs for its users. It aims to provide speed and convenience offered by centralised exchanges in a decentralised and transparent way.

.png)

SRM is the native token of Serum. At the time of writing this post, it had a value of $3.04 and a rank of #147 in the list of cryptocurrencies on CoinMarketCap. Its market cap was $404,978,424. SRM has a max supply of 10,161,000,000 SRM. Just about 1% was in circulation which is 133,231,781.00 SRM.

SRM recorded its all-time high of $13.72 seven months ago. Within the past 3 months, its highest was $4.28. Its lowest price recorded since its all-time high is $1.66. Its highest this week is close to that of this month. They are $3.15 and $3.26 respectively.

.png)

SRM is available on many exchanges. You can trade SRM on exchanges like Binance, Gate.io, KuCoin, Huobi Global etc with different asset pairs.

Why I am bullish on SRM today

This trading contest has limited us to trade a token just once. Because of this, I just check available assets I haven't traded yet and decide to trade them. Most of the time I don't even know the tokens, I just make some little research and head to the charts to find an entry.

After making some little research and looking at the charts, I felt its price was going to rise today and so I got some interest in it. I think with this current uptrend season, it has the potential to reach about $3.5 or higher.

Analysing SRMUSDTPREP for Trading

As usual, I use Binance on my mobile to place the orders while I make analyses using my PC. I used the same strategy used in my previous trades. The name of the SRM asset I traded was SRMUSDTPREP.

.png)

I marked the support and resistance levels from the day's timeframe. It seemed SRM had hit support and was in an uptrend.

.png)

I switched to the 4-hour timeframe to identify price reaction zones and drew lines to represent them.

.png)

I further zoomed in to the 30 minutes timeframe to spot reaction zones and drew lines to represent them.

.png)

Time was of the essence and I wanted to keep this trade as short as possible and so I switched to the 5 minutes timeframe to spot an entry and exit position.

.png)

I identified a possible entry point and I placed my orders.

.png)

After a while, my entry was triggered. The trade details are available in the next section.

My plan for SRMUSDTPREP

My plan for SRMUSDTPREP was to trade for a short period. I had a deadline to meet and so I focused on trading in the direction I expected the price to move to.

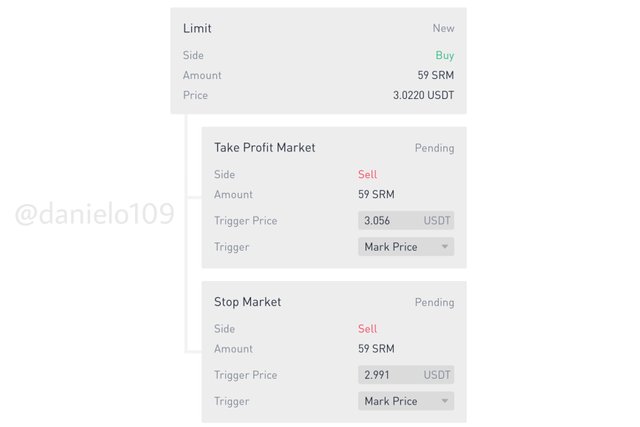

I bought 59 SRM at 3.022 USDT. My TP and SL were 3.056 and 2.991 respectively. I changed them in the course of the trade when I noticed certain signals.

.png)

After the price nearly hit my SL after triggering my position, I used RSI to check the condition of the asset. I should have done this earlier before placing the order as it would have helped me spot a better entry. After noticing it was oversold after it nearly hit my SL I maintained my position because it hadn't approached that level of overselling for quite some time and so I expected the price to move towards my predicted direction.

.png)

I was studying the candles for this trade. I predicted from their behaviour and the trading volumes the price was going to go higher than I expected. I drew a patch of what was expected.

.png)

I changed the TP with this knowledge.

.png)

After the price broke through certain resistance zones, I set a new SL just in case the trend reversed. I mostly do this to keep me in profits even when the price retraces. It has a downside which we'd see soon.

.png)

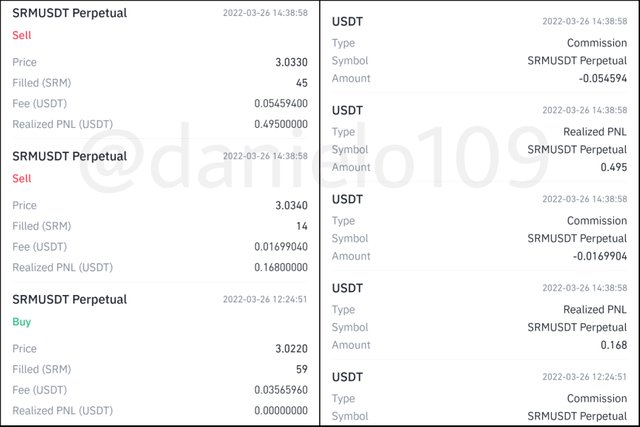

I got kicked out of the trade with my new SL.

.png)

Later on, the price rose and hit my estimated level. A lot of should-haves and could-haves after this but I cleared them out. We go again another time with more knowledge and experience.

My SL order was split into two. This happens at times and so my estimated profits from the trade were reduced. I made a profit of 0.663 USDT.

My recommendation on Serum

This token has just 1% of its total supply in circulation. This means that many traders are holding. This explains why it has a very low trading volume. One of the reasons I decided to trade it was because its volatility was low for quite some time when I saw it. And so I figured it'd be a safe trade.

I wouldn't recommend anyone to buy this token currently. With the amount being held compared to the circulating supply, it's going to be a blood bath if the holders decide to sell. Majority of the comments from the live Serum Chat on CoinMarketCap suggest that you should sell. Others also suggest that there's going to be another wave and that you should hold.

You could wait for an opportunity to short after it has seen a significant increase where you are positive most of the holders are going to sell.

Conclusion

This week is one of my successful weeks when it comes to profits. Taking a break really helped as I have seen good results since I got back. The table below shows a summary of my trades posted for this week.

| No | Asset traded | Profit (USDT) |

|---|---|---|

| 1 | APEUSDTPREP | 5.175 |

| 2 | XRPUSDTPREP | 1.1730 |

| 3 | XLMUSDTPREP | 6.25359 |

| 4 | SRMUSDTPREP | 0.663 |

| Total | 13.26459 |

Still working to improve my strategy and identifying a good entry point. Professor @nane15, thanks for your reviews. It's been fun this week, learnt a lot, gained more experience and made mistakes. It's all good and we go again next time prepared. This is how I motivate myself to continue this work as it isn't easy. All the best to the traders out there. We're strong.