[In-depth Study of Market Maker Concept]-Steemit Crypto Academy | S4W6 | Homework Post for @reddileep

Hi guys!

On this occasion I will try to do the homework given by professor @reddileep. I will work and try my best as this is my first class with him, so let's get started.

1- Define the concept of Market Making in your own words.

We may very often use exchanges to trade cryptocurrencies, and also very often hear the term market makers but we do not know what and who is a market makers, therefore I will provide a definition and a small overview of the market makers.

Simply put, market maker is the activity of providing liquidity to the market by setting prices simultaneously to buy and sell assets. When a user wants to buy a cryptocurrency say ETH, he or she must first access a cryptocurrency exchange where the buyer and seller meet.

A typical centralized cryptocurrency exchange will use an order book and order matching system to connect buyers with matched sellers. An order book is a dynamic real-time electronic record that stores and displays all orders to buy or sell cryptocurrencies at different prices at any given time.

The order matching system is a special software protocol that matches and calculates orders registered in the order book. Sometimes, if the number of assets and volume is limited to trade, users may not be able to execute their ETH orders on the exchange. If this happens, then we will definitely say that the ETH market is not liquid.

In this case, liquidity is an indicator or measure of availability in the market. It is the rate at which an asset can be bought or sold without significantly affecting its price stability. When the market is illiquid, there are not enough assets or traders available. It becomes difficult to complete a trade without significantly affecting the price of an asset on a particular exchange, surely the price will be affected due to the lack of available assets, allowing buyers to be more dominant than sellers and sellers trying to take profit of the lack of available assets (illiquid).

This is where the Market Makers works to ensure liquidity, represented by banks, brokerage houses and various other financial groups. They constantly provide liquidity on the exchange between sellers and buyers. In other words, these market makers are constantly offering to buyers and sellers assets at different prices so users always have someone to trade with it.

The process of providing liquidity to an exchange is called market creation, and the organizations that provide this service are called market makers. The role of market makers is to make financial markets more efficient and reduce asset price volatility by providing constant liquidity for assets.

2- Explain the psychology behind Market Maker. (Screenshot Required)

As I explained above, Market Makers have a huge influence on the cryptocurrency trading market because they are Market Makers by providing trading liquidity, but behind it all there is a psychology played by Market Makers.

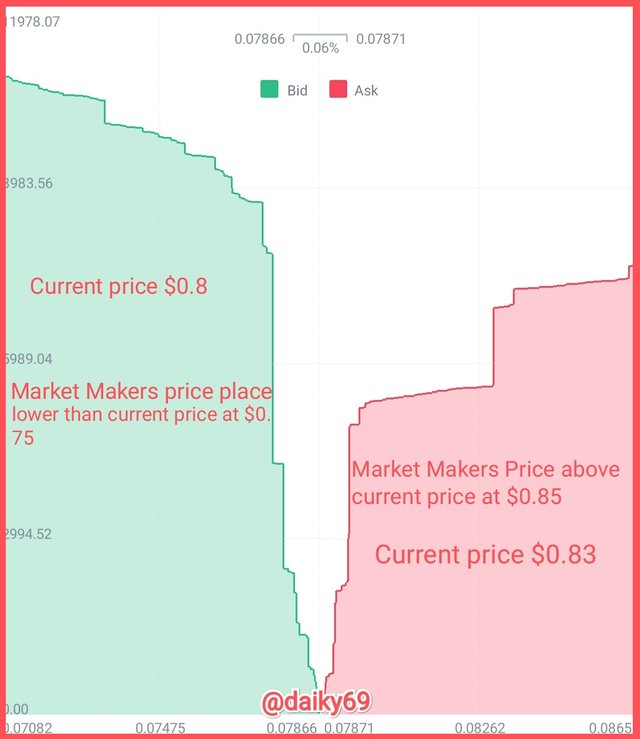

Market Makers are known as liquidity providers on the exchange by placing buy and sell orders simultaneously known as bid-ask spreads which are sent to the order books in the form of pending orders until the price matches, and people will trade between the prices that have been placed by the Market Maker.

For example, let's say Market Maker places a buy price of $10 for an asset, then at the same time they place a selling price of $11. While your order between the two prices belongs to the people. Market Takers will immediately execute buy or sell orders at the price at the same time, because Market Takers are instant unlike Market Makers. The point is only one, Market Maker places a buy order at a price lower than the current market price, then places a sell order at a price higher than the current market price so that the market is not empty but is filled with order books from Market Maker. This is just an example, because the bid-ask prices will not be far apart if the market has high liquidity.

Market Maker has a psychology of bid-ask spread, which is the difference between buying and selling prices. It should be noted that the difference can be larger in a market with less liquidity or in other words a small amount of assets, but in a market with high liquidity the bid-ask spread will have a very small difference.

The difference of $1 in the ask and bid prices in the above example made by market makers looks like a very small spread. But keep in mind, small spreads with large volume trades will make the profits bigger. In addition to Market Makers, there are also investors who trade with large volumes or commonly called whales, they are also able to bring down the market by selling assets in large quantities so that other people panic and sell them too, but this is a whale trick because they have placed buy orders. with a much cheaper price, people who are provoked by this whale manipulation will certainly suffer losses.

3- Explain the benefits of Market Maker Concept?

Talking about the benefits offered by Market makers will not be separated from the liquidity they offer to the market, for more clarity I will describe it below.

1. Providing liquidity to the market

The first benefit offered behind the Market maker concept is of course liquidity, without liquidity we will not be able to trade or maybe we can but it takes a long time for orders to be executed until someone wants to trade with us. However, with Market Makers, we can trade at any time because they are always there for us to provide market liquidity.

2. Smooth trading

With Market Maker we can trade smoothly because there will always be people available to trade with us even with their bid-ask, but at least this will make trading easier because we don't have to wait for someone to start trading.

3. Reduce volatility

Market Makers also help to control the market, they will increase or decrease the bid-ask if it is necessary such as when the price of an asset is under or overvalued, so it will help to make the market more controlled to reduce volatility.

4. Bid-ask spreads that are always updated to reflect current supply and demand

Offers and requests will always be made by Market Maker and updated from time to time. Market Makers always update prices to reflect current market conditions, as we know that prices cryptocurrency are always changing. Market makers will continuously update their buy (bid) and sell (ask) prices to reflect market conditions, i.e. supply and demand.

4- Explain the disadvantages of Market Maker Concept?

Although the Market Maker is an indispensable thing in trading crypto or stocks, it should also be noted that this concept has several drawbacks and also disadvantages for us small investors.

1. Controlling the market and manipulating it

As we know that Market Maker is even more than capable of controlling the market and manipulating it. They can stop supplying the market for a certain time thus making the market illiquid, after which the price will fall which stop loss orders may be executed automatically and they are already there to hold all the assets.

2. Move prices

They are also able to move the price of an asset, because the power they have in the market is so dominant that they are able to do anything, including making the market tattered with volatility and fluctuation, after buying all assets at low prices they will move the price again. This can be confirmed to be true, for example, the shiba inu which is still a mystery over the transfer of 6000 trillion shib coins before the price skyrocketed.

3. Makes the difference in the bid-ask spread very far

As I described above, this may not happen in a high-liquidity market, but it can happen in a low-liquidity market. After all, Market Makers are people who provide liquidity so they can manipulate it or make it look like the market is in a liquidity crunch so they can buy a vastly different bid-ask difference.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

In this case I will say Accumulation/Distribution and RSI as two indicators that can be used to see market movements and market makers.

1. Accumulation/Distribution Indicator

The A/D indicator is a very popular indicator among traders, this cumulative indicator is able to predict trends as well as divergences. This indicator is closely related to the trading volume of an asset, because the A/D Indicator works by measuring supply and demand in what period the price closed, then multiplying that number by the volume.

It is also very easy to find out the direction of the trend, if the trend is bearish then the line of the A/D indicator will move up and vice versa if the trend is bearish then the line of the A/D indicator will move down. To read divergence signals, we only need to pay attention to the lines of the indicator. If the price of the asset on the candle shows it is rising and the A/D line is falling instead, indicating a bearish divergence signal, this is because the buying or accumulated volume may not be sufficient to support the price increase and may cause the price to fall.

To read a bullish divergence signal as opposed to a bearish divergence, if the price of the asset is falling and the A/D line is rising, this is a sign that the asset will soon enter a bullish trend and end the bearish trend.

Now let's discuss the relationship with Market Maker, most of that trading volume comes from Market Maker so they are able to put selling and buying pressure according to their wishes, meaning this indicator has no effect on them but has a real impact on we are retail traders.

Market Makers are able to see the situation and read market conditions with this indicator, because most of the traders are guided by the signals given by the indicator so that Market Makers will enter the market and manipulate it to squeeze retail traders.

When we see a bearish divergence signal i.e. the A/D indicator line is down and the asset price is going up, we will definitely sell it and believe the buying volume is not enough to support the price increase and can cause the price to fall so that it will make the price go down, this is also influenced by psychology market. But at the same time the Market Maker is able to supply the volume that the market wants so that the price will go up and they make a profit.

2. Relative Strength Index (RSI) Indicators

The Relative Strength Index RSI is a leading momentum indicator that shows potential reversal points in the price trend. Its work is based on the rate of price change, displaying it on a scale from 0 to 100. The main signals of a change in the direction of the trend are overbought and oversold. If the line of the indicator is at a level below 30 then this indicates the market is oversold, while if the line is above 70 it indicates the market is overbought, and between the two 30-70 is a flat market (sideways) there is no trend going on.

In addition, we can also expect a divergence from this indicator because when an asset enters an overbought level, it signals the end of the bullish trend and soon enters a bearish trend and vice versa, i.e. the asset is at an oversold level, will soon enter a bullish trend.

This is a signal for us to start trading, because there will be a price reversal so we can buy in an oversold market or sell it in an overbought market.

Market Makers are very observant in looking at market psychology, this is as explained above. Market Makers are able to create buying and selling pressure because they control the trading volume, so we are fooled by the false signals given by the indicators because of the Market Makers.

Look at this line from the RSI, the line has touched the overbought level and I believe that this is the pressure created by the Market Maker. When everyone believes that the price of the asset will immediately decline, the opposite happens because the price of the asset is able to continue to rise so that Market Makers will laugh because they have succeeded in deceiving us retail traders who have fallen into their trap.

Conclusion

Market Makers are individuals or groups who are really needed in the market because they are able to create markets by providing liquidity, they are also able to maintain the volatility of these assets. But behind the things offered by the Market, of course there will be losses that will occur because they will not work just to fulfill our orders without getting a penny of profit.

I want to thank professor @reddileep who has raised this very impressive theme, I'm happy to get new knowledge from him. This is also my first participation in clearing him I hope he has made a good post for him to review