Steemit Cryptoacademy Week 9 Homework Submitted To @yohan2on| The Ripple (XRP) by @bukkyi4u

ABSTRACT

Generally, altcoins is a term used to refer to cryptocurrencies besides Bitcoin itself. Usually, they could still have some features already inherent in Bitcoin. However, they may come with other dissimilar ones most probably aimed at producing better results.

Some are known to come with additional distinct features like low volatility in price and smart contracts. Also, others may use much different consensus mechanisms in validating transactions and producing new blocks.

Precisely, one distinct altcoin tickles my fancy and that is the Ripple (XRP). Consequently, I intend to undertake an in depth analysis of this particular interesting altcoin mentioned by professor @yohan2on for this week in this space.

WHAT IS RIPPLE (XRP)

The Ripple (XRP) is the cryptocurrency token which the in-built ledger of the ripple technology and network uses. Ripple (XRP) as a digital asset or currency is developed mainly to facilitate payment. This token is the major digital asset developed on the Ripple (XRP) open-source ledger.

Actually, it is used for the representation of value over the Ripple ecosystem. Ideally, it acts as a mediator between different currencies both crypto and fiat in the exchange of values across the network. The interesting feature is that this token can become anything in order to minimise transaction cost or charges.

What this means is that the XRP can act as euros when transfers are being made in euros. Also, it could act as dollar when transfers are being made in dollars.

With the XRP you could send euros from one end or from your own payment gateway while the receiver could get it as dollars from his own payment gateway over the ecosystem.

THE INTRODUCTION OF RIPPLE (XRP)

The Ripple (XRP) was initially introduced as a coin as far back as 2014 by Ryan Fugger. Ryan was a web developer somewhere in Vancouver, B.C., Canada. In 2005, this foresighted web developer started building Ripplepay as a payment gateway to serve as a means of securely and seamlessly sending and receiving payment across an online community at almost no cost at all.

In May 2011, this idea metamorphosed into a digital currency ecosystem built on this aforementioned protocol. XRP was developed as its own in-built token. Interestingly, this whole idea and concept explains the nitty-gritty of the Ripple blockchain ecosystem operational model.

THE RIPPLE BLOCKCHAIN ECOSYSTEM OPERATIONAL MODEL

The new developed system which conceptualized the Ripple blockchain ecosystem was called Ripple Transaction Protocol (RTXP). This technology was launched in 2012 by Jed McCaleb and Chris Larsen. It had as its goal and aim the provision of a payment system which can function on a global scale while enabling transfers of any size securely in real-time and at almost no cost.

This it would do while accepting any currency at all- dollar, naira, yen, etc.This protocol accepts a variety of payment gateways including even passenger bonus miles, fiat currency, goods, mobile minutes and, of course, cryptos. The RTXP has been accepted and is being used by such institutions as HSBC Bank, the American bank, and even Earthport (which has its presence in over 65 countries of the world).

HOW RIPPLE (XRP) WORKS

Really, the Ripple (XRP) has often been reframed to fit into the operational model of Ripple Incorporated. Hence, it has been variously explained as the fuel which helps provide energy for Ripple transactions that occur on a cross-border basis.

This makes it a token to facilitate more secure and faster international transactions irrespective of which currency is being used.With the XRP transactions can be finished in seconds- much faster than BTC.

Also, as a digital currency it can be transferred across wallets from any country of the world. This speed is very achievable because the Ripple network where XRP is hosted does not make use of the proof-of-work consensus algorithm and is centralised.

IMPORTANCE AND BENEFITS OF RIPPLE (XRP)

Much of the importance and benefits that can be attributed to Ripple (XRP) is its traction as a means of exchange and as a digital asset in holding. Much as the United States dollar acts as a greenback in international markets, the XRP serves to provide quick liquidity in transactions within the Ripple network.

Also, it is used as a bridge asset by the xRapid, a Ripple product, to facilitate transactions between two different fiat currencies since it can function as a mediatory digital asset in value.

BUYING AND STORING OF RIPPLE (XRP)

Buying Ripple (XRP)

Ripple (XRP) can be bought from different sources and markets. This is because the coin has gained a lot of acceptance among different exchanges. Getting the coin will depend on your needs.

In countries like the United States, it may not be purchased directly with an American debit card. Instead you would have to buy Bitcoin or Ethereum and convert to its XRP equivalent. In Nigeria that is also the case.

However, there are a lot of different exchanges from where it can be gotten should you decide to hold some. Some of these exchanges include but not limited to:

- Binance

- CoinMama

- BitPanda

- Bittrex

- Virwox

Storing Ripple (XRP)

Once the coins have been purchased from the exchanges it is not wise to leave them there. This is because of the high risk of being hacked. So, where can the coin be stored safely after purchase. Some of the trusted wallets where Ripple (XRP) can be stored include:

- Ledger Nano S

- Toast Wallet

The Ledger Nano S is a particularly nice place to store if you are looking to invest for a long time. It comes with added security features that makes it very hard to be hacked.

The Toast Wallet is also enabled on desktop, iOS and Android. It is a good place. It is not ideal for long term storage, though.

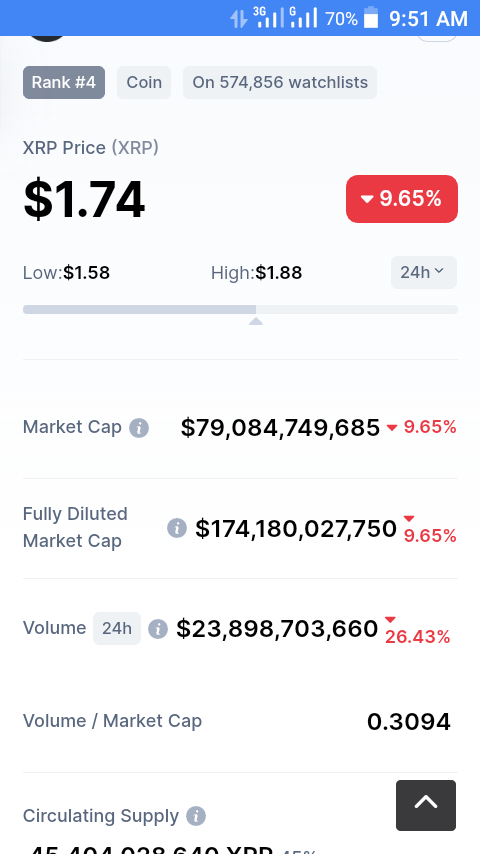

RIPPLE (XRP) MARKET STATISTICS

| METRICS | STATISTICS |

|---|---|

| Market Cap | $79,609,357,476 |

| Fully Diluted Market Cap | $175,335,448,990 |

| Volume 24h | $25,448,204,718 |

| Volume / Market Cap | 0.3197 |

| Circulating Supply | 45,404,028,640 XRP 45% |

| Max Supply | 100,000,000,000 |

| Total Supply | 99,990,831,162 |

| Ledger Number | 62,910,316 |

| Ledger Trade Volume (All Pairs) | $24,410,783.12 |

| Ledger Payment Volume | $3,117,308,998.20 |

| ODL markets | 5 |

| Network transaction fee | $0.0007432 |

| Settlement speed | 3.87 |

These statistics are gotten from coinmarketcap.com and ripple.com as at the time of publishing.

These metrics show that Ripple (XRP) is indeed the third most valuable cryptocurrency as it is often considered. It falls under the large market capitalisation and has a huge daily trading volume.

THE PROS AND CONS OF RIPPLE (XRP)

Should you ever decide to invest in this coin, there are some important pros and cons to consider.

Pros

- LARGE ACCEPTANCE: the over 30 billion coins in supply means there is enough for you to transact any business to any amount. Also, over 100 companies have adopted the coin as a way of moving funds.

- SPEED OF TRANSACTION: transactions are processed in just about 3 seconds. This is only second to the fastest cryptocurrency of 2 seconds transaction rate. Faster rate of transactions confer greater credibility and more trust as funds are very likely not to be lost to hackers.

- DECENTRALIZATION OF REMITTANCES: remittances to be made can be adapted to the individual needs of the end users. Transfers can be made across different varieties like fiat currencies, cryptocurrencies and even other commodities. This has facilitated greater adoption of the coin.

Cons

- LOPSIDED DISTRIBUTION OF THE RIPPLE (XRP) TOKEN: At the onset 100bn XRPs were minted. Ever since then, there has been no addition. The problem with this is that most of those tokens are held by the company. There are fears that these tokens could be cashed out thereby liquidating the market. However, this argument may not hold water but it still generates ripples in some quarters.

- DEGENERATIVE REWARD SYSTEM: arguably since a portion of the tokens are burnt during transactions, it then means that holders get poorer by every transaction. This portrays a degenerative reward system.

- UNHEALTHY HOLDERSHIP: the fact that most of the coins are held by Ripple Incorporated itself portrays a sense of insecurity to a lot of end users. Such end users quickly dismiss the system as a scam crypto.

CONCLUSION

The Ripple ecosystem is majorly recognised for its use as a digital payment processing gateway. Nevertheless, it has its own in-built token- the XRP.

The XRP on its own can be used as a bridge when transacting between two different currencies. This is because it can be transferred without any need for an intermediary.

Hi @bukkyi4u

Thanks for your attendance and participation in the Steemit Crypto Academy.

Feedback

This is good work. Well done with your research on XRP. Though you exceed the maximum number of words. Kindly ensure that you summarise your content in 1000words.

Homework task

9