Steemit Crypto Academy Week 7 Homework Submitted To @gbenga | Decentralized Finance Ecosystem| @bukkyi4u

ABSTRACT

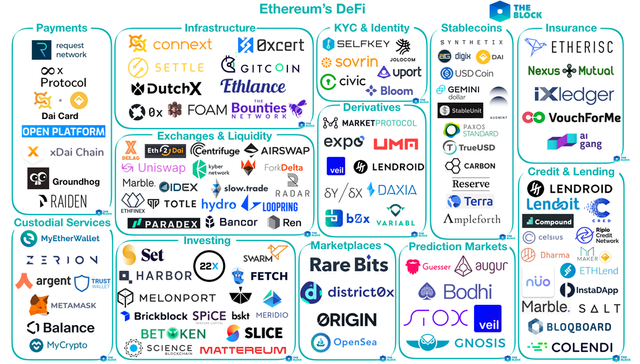

Usually, Decentralized Finance(DeFi, for short) refers to different kinds of applications that are developed on the backbone of the blockchain industry and geared towards achieving specific missions.

These developed peer-to-peer or applications systems function as protocols that promote borrowing, lending and trading activities in a decentralized and, hence, easy format.

We will discuss one of these DeFi ecosystems in this article.

THE WALLET AND ASSET MANAGEMENT DECENTRALIZED FINANCE ECOSYSTEM

Introduction

The concept, wallet and asset management in cryptocurrency refers to the means by which digital resources of economic importance and value are diligently and efficiently invested with the hope of gaining interest and increasing the value in the future.

It refers to the totality of knowing which investable funds are helpful. Equally, it involves putting into consideration what each fund can provide as against what we need.

This ecosystem in the crypto world boasts of robo-advisors that can assess the risk profile, income, goals, profitability, the market and channel digitally-held assets in the form of electronic ledgers in that direction.

HOW THEY WORK

Crypto assets do not only refer to digitally-held cryptocurrencies but also to other digital assets which could be used commercially for other purposes. Learn more

The crypto wallet and asset management initiative deploys on-premise and cloud technologies to connect investors to end users. They do this by creating a navigable atmosphere, especially for new investors, through the muddy and unfathomable waters of crypto trading.

Again, they provide tools for the management of portfolio which makes it possible to manage different holdings from one interface. Hence, eliminating the need for multiple accounts.

With these interfaces trading, buying, accounting and spending of your digital assets could become a lot easier and stress-free.

WHAT ARE THE BENEFITS?

1 They are run in an open and accountable manner

The crypto wallet and assets management DeFi technology somewhat eliminates the ambiguity associated with Traditional or Centralized Finance systems.

In the Traditional or CeFi systems you could only be let in on the quarterly performance of your invested funds as against the real-time statistics of the DeFi crypto assets and wallet management.

On this note some technologies have been initiated to this effect:-

- Set Protocol: developed over the Token Set technology, it has the ability to rebalance token allocation based on technical trading with robo-advisors. Also, the Social Trading technology which channels funds in the direction of favored traders. Wallets can easily be tracked and even moved to other wallets if necessary.

- Melon Protocol: this makes the Private Investment Fund and the Hedge Fund easily accessible to anyone with an ethereum wallet, especially. Trading and investment tools, as well as applicable fees can easily be ascertained while funds can also easily be created.

2. It involves trustlessness

Since this protocol is developed on the blockchain ecosystem, it becomes unnecessary to provide KYC information. Wallets can easily be connected and or funds pulled in or out of any options for asset management at any time.

This is unlike the Traditional or CeFi Finance system. With the DOUGH token- an initiative of the PieDAO)-you can fully participate in the creation and management of your funds.

3. It has a dynamic and composible outlook

This can very readily be seen with the Robo-Advisor for Yield. This platform makes it possible for you to earn higher returns from low-lending investments. This is done by optimally moving funds between lending protocols in order to optimise gain.

Again, you no longer have to work yourself through creating portfolios to monitor hedge, liquidity, growth and income. With initiatives like the Zapper.fi, it is easy to move into multiple yields, positions, layering exposure and take risk management from one transaction.

Some other advantages include:

- Owning portfolios that can be highly customised to personal taste

- Ability to tokenize real-world assets

- Ability to mimic assets that are outside the blockchain

- Ability to host financial experts and architects of all age and race from across the world

THE TOKENY SOLUTIONS DEFI PROJECT/ PROTOCOL

The tokenization of assets-that is, putting assets in formants that could be economically valuable digitally- has its primary goal in the dematerialization of tokenisable assets. Such assets could then publicly have investors subscribed to them.

More and new funds are made available to investors while compliance is equally enforced. Investors and issuers can manage their funds digitally.

The Tokeny Solutions DeFi Protocol is aimed at providing an enabling digital environment to drive liquidity for different markets.

In a recent announcement it was discovered that Tokeny Solutions has teamed up with some banks to explore the possibility of an interbank digital currency.

HOW IT WORKS

The Tokeny Solutions operate under the following codes:

- COMPLIANCE: securities are issued over the blockchain technology. They are issued as security tokens. Hence, applicable security jurisdictions would be followed.

- ISSUANCE: Securities can only be issued to eligible investors. The tokens must also be permissioned. Tiken supply can also be regulated through the process of MINT,BURN and FREEZE.

- ONCHAIN CUSTODY: with this issuers can control the supply of their tokens while investors can never lose ownership of their tokens even in the loss of wallets. Drastically, fees are reduced for issuers and will even be eliminated for investors.

- DISTRIBUTION: issuers will have access to a global network of investors and distributors by having their securities listed over the blockchain infrastructure.

- SERVICING FOR ISSUERS: through operational efficiency enhancement strategies, benefits come post-issuance of securities and investors can be managed on issuer dashboards.

- SERVICING FOR INVESTORS: investor dashboards are provided for easy customization and transfer of tokens with compliance enforced outrightly.

The Tokeny Solutions has a team of over 30 professionals that was founded in 2017. Its membership is spread across Luxembourg, London and even Paris.

They include: Luc Falempin as CEO, Daniel Coheur as Chief Commercial Officer, Philip Van Hecke as Chief Operating Officer and other board members.

CONCLUSION

The wallet and asset management dtecentralized Finance has the ability of revolutionalizing the traditional way and means of managing portfolios, assessing risk profile, keeping track of growth, income and performance of invested funds.

The Tokeny Solutions has brought a new dynamics to the game with their expertise and interesting future plans.

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Rating 8